Yield Curve Receives Positive Slope – Is this a Sign for Continued Expansion?

The Bond’s market response to the series of recent Fed rate cuts has “bullish” signs for the US economy, said the head of FRB St. Louis James Bullard on Thursday, adding that he is ready to take a wait-and-see stance to estimate impact from the move.

“The Fed made major policy changes in 2019 and it makes sense to wait and analyze how the economy will respond to them in the fourth quarter and in 2020,” Bullard said, echoing Powell’s words that without a “material” change in economic outlook there is not chance that the Fed will cut rates further. GDP growth, in his opinion, could exceed 2% in 2020 thanks to the sharp shift to accommodative policy.

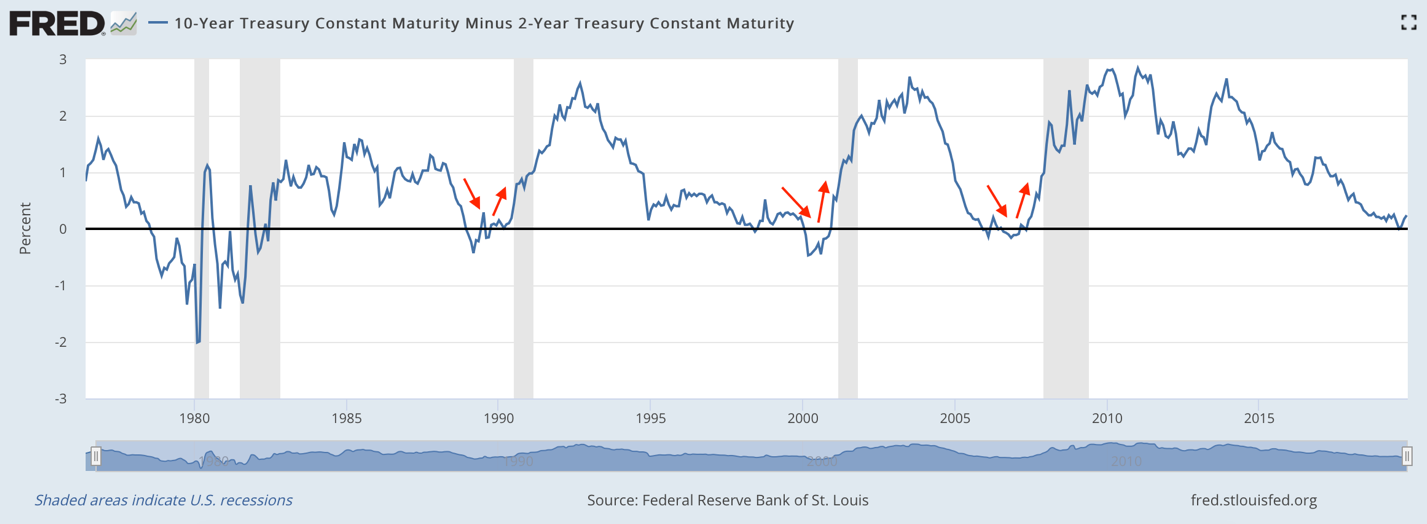

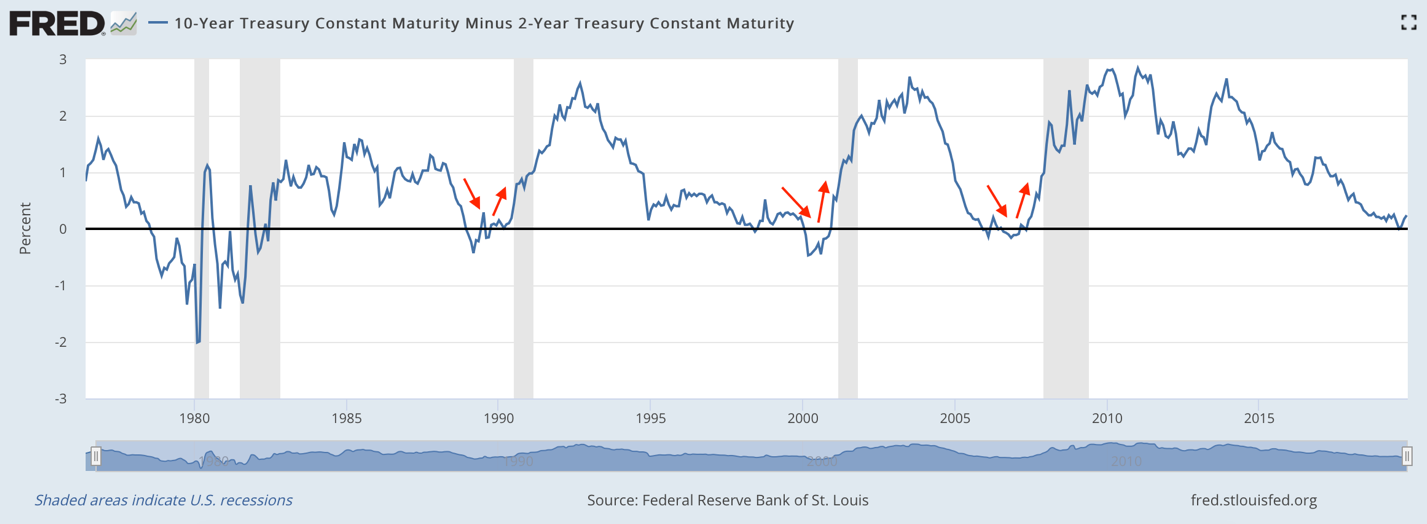

The series of three rate cuts led to a positive redistribution of demand between short and long bonds - demand for short ones increased, while for long ones fell. In accordance with the theory of expectations, which partially explains the preferences of investors in the bond market, such shift indicates that the markets start to expect an increase in the short-term market interest rate in the economy, which is a sign the expansion. For the sake of completeness, I have to note that three past recessions were preceded by a decrease in the spread between long and short bonds, and subsequent increase, same as we currently observe:

Every recession is unique and the pattern in the spread is not a law but inability to acknowledge the lessons of history could have grave consequences.

Since firms have shifted to new supply chains to work in a tough environment of high tariffs, albeit less efficiently, a favorable outcome in trade negotiations could be a positive shock to the growth, Bullard said.

The US yield curve is again gaining a positive slope, and this indicates a narrowing gap in “misunderstanding” between the market and the Fed decisions. We could observe that in late 2018 when the Fed projected three more rate hikes in 2019 but this were perceived as a policy mistake by the markets which expected rate cuts instead. The Fed had eventually to cave in, taking pause and then starting to cut the rate. According to Bullard, the market begins to foresee the same rate path as the Fed, and this will provide correct policy response to the Fed decisions.

Along with Neil Kashkari, Bullard is a traditional dove in the Fed management. Blatant statements from the left bound of the “spectrum of opinions” that the interest rate should remain at the current level until at least 2020 do indeed mean that there is simply nowhere to get ideas for the Fed to deliver more easing.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.