USDJPY: Fundamental Analysis and Expectations for the Currency Pair

USDJPY broke the 112 mark on Wednesday, the first time since the end of April 2019. Concerns about recession in Japan, the long-term impact of the Covid-19 outbreak on regional economies, the anticipation of capital outflows from Japan before the end of financial year and strong greenback all contributed to the rapid decline of Yen. Nevertheless, in the short term, USDJPY is more likely to pull back, which should offer more attractive buy entry opportunities.

As I wrote earlier, the Japanese economy unwound economic momentum even before the virus outbreak after the authorities took unpopular step in October, raising the sales tax. At the same time, households cut spending by as much as 11% in the fourth quarter (compared with the 4th quarter of 2018), while GDP in quarterly terms fell by 6.3%. In February, it became clear that Chinese lockdowns would severely undermine consumer demand and thus import too (don’t forget China also has import commitments with the US), so China will reduce demand for Japanese goods. The share of Japan's exports to China is 23.5%, and due to the fact that the government risked sacrificing consumption driver (for a while) in order to strengthen fiscal discipline by raising the sales tax, the hope was only for exporters. But they, in turn, basically has lost their main customer.

The blow to two main points of pain as a result had negative synergistic effect, which now clearly requires a response from the Bank of Japan. This forms bearish expectations for the yen.

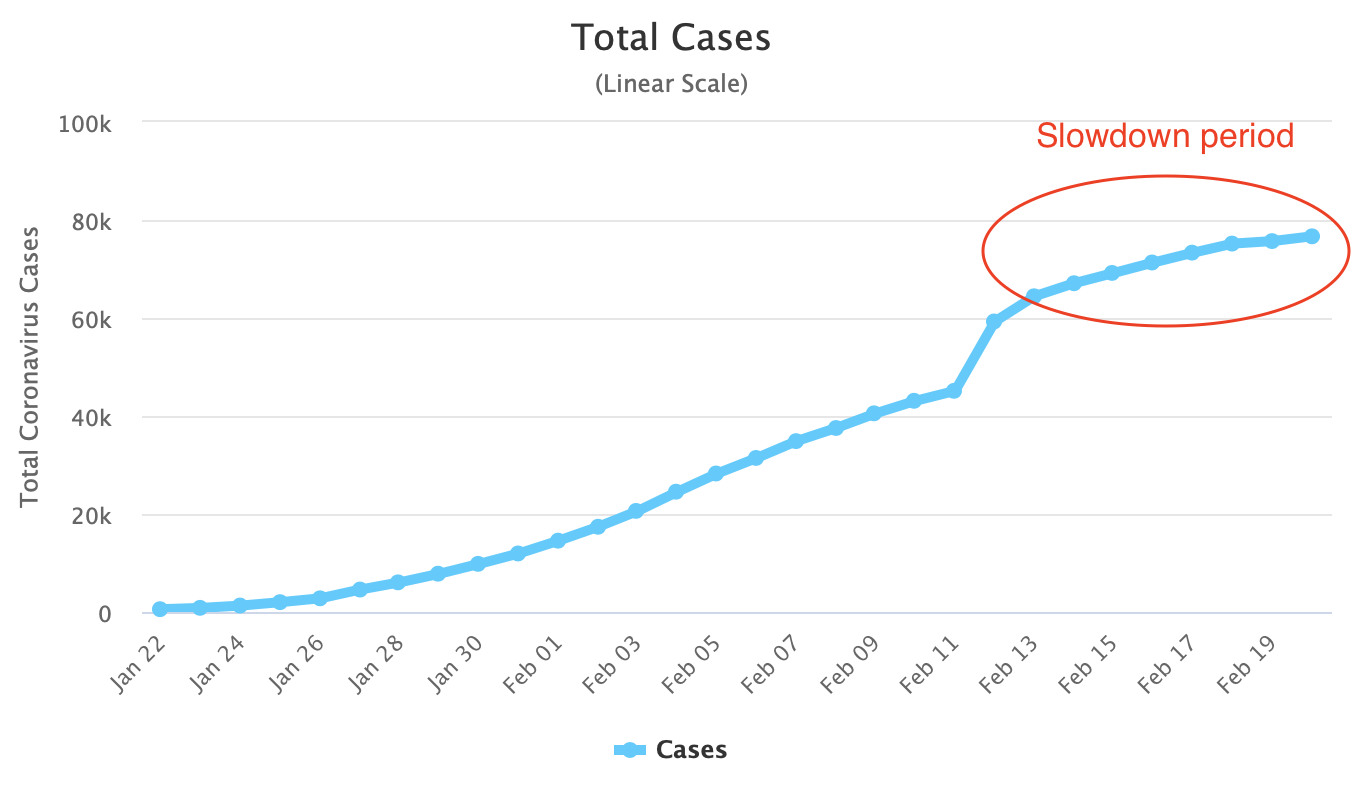

With the slowdown in the growth of clinically confirmed cases and deaths, market attention has shifted to long-term economic effects, i.e. the effects of Chinese quarantine:

It is reasonable to assume that countries which exports are oriented to China will suffer more than others, which will be reflected in the weakening of the currencies of those countries. You may notice that this is basically the case with AUD, JPY, NZD, which are losing support for support. The share of exports to China of these countries is 39%, 23.5% and 27%, respectively, which is somewhat higher than the of countries with other major currencies. At the same time, the currencies such as CAD or NOK turned out to be more resistant to the factor of destabilization of trade with China, however, they’ve been more sensitive to the indirect factor of the slowdown of Chinese activity - oil prices. Therefore, provided that the positive trend in oil prices continues, the corresponding cross rates (AUDCAD, NZDCAD, JPYCAD) will continue to decline.

Another driver of the yen decline was growing speculation that Japanese investment funds are giving more weight to foreign assets in their asset portfolios with the approach of the end of the fiscal year (March). As the yield of Japanese assets is becoming less and less attractive, it is not surprising that risk-taking behavior of Japanese investors deepens. The search for yield should weaken the Japanese yen because of outflows. Such expectations in the FX market further contribute to speculative pressure on the yen.

Weekly data on the purchase of foreign bonds by Japanese investors suggests that the process of adjusting the portfolio could already begin:

Source: ING

Nevertheless, the growth of USDJPY from the zone below 110 to 112 yen per dollar in just a couple of days suggests that it is likely that investors will consider further purchases only after a local correction to levels 111.00 - 111.50 and a certain stabilization period around this mark.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.