US PMI: More Disappointment as Business Activity Fades

The number of downside surprises in the US economic data continues to increase, what cannot be said about European economic data. The activity index in the US non-manufacturing sector fell to 53.9 points against the forecast of 54.5 points in November, sparking concerns about the impact of recent Fed rate cuts, which in theory should have already started to feed into the data.

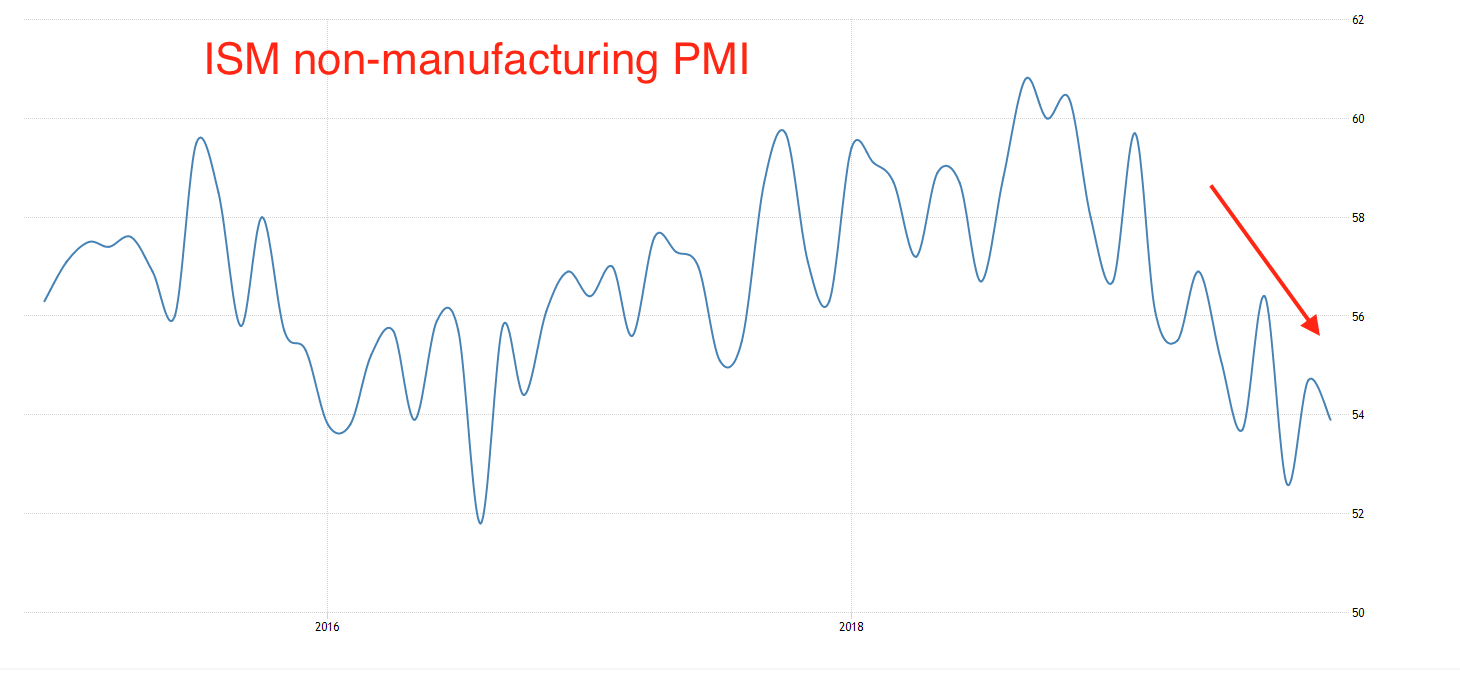

Looking “under the hood”, we can see that the sub-components of production/business activity (-5.4 points to 51.6 points) and imports (-3.5 points to 45 points) posted the biggest decline, pointing primarily to the severity of the impact of trade frictions between the US and China. The employment component, by contrast, increased by 1.5 points to 55.5 points, and the component of export orders increased by 2 points to 52 points. A broad activity index has been in a downtrend since around the end of 2018:

The non-manufacturing sector employs 80% of the US population, and in this regard, it speaks a lot about employment gains in the near future and therefore consumer spending.

An employment estimate from private agency ADP, which release precedes the release of official gauge on the first Friday of the month, indicated a sharp slowdown in the number of new jobs. According to the agency’s calculations, the number of jobs in November grew by only 67 thousand, significantly lagging behind the forecast of 121 thousand.

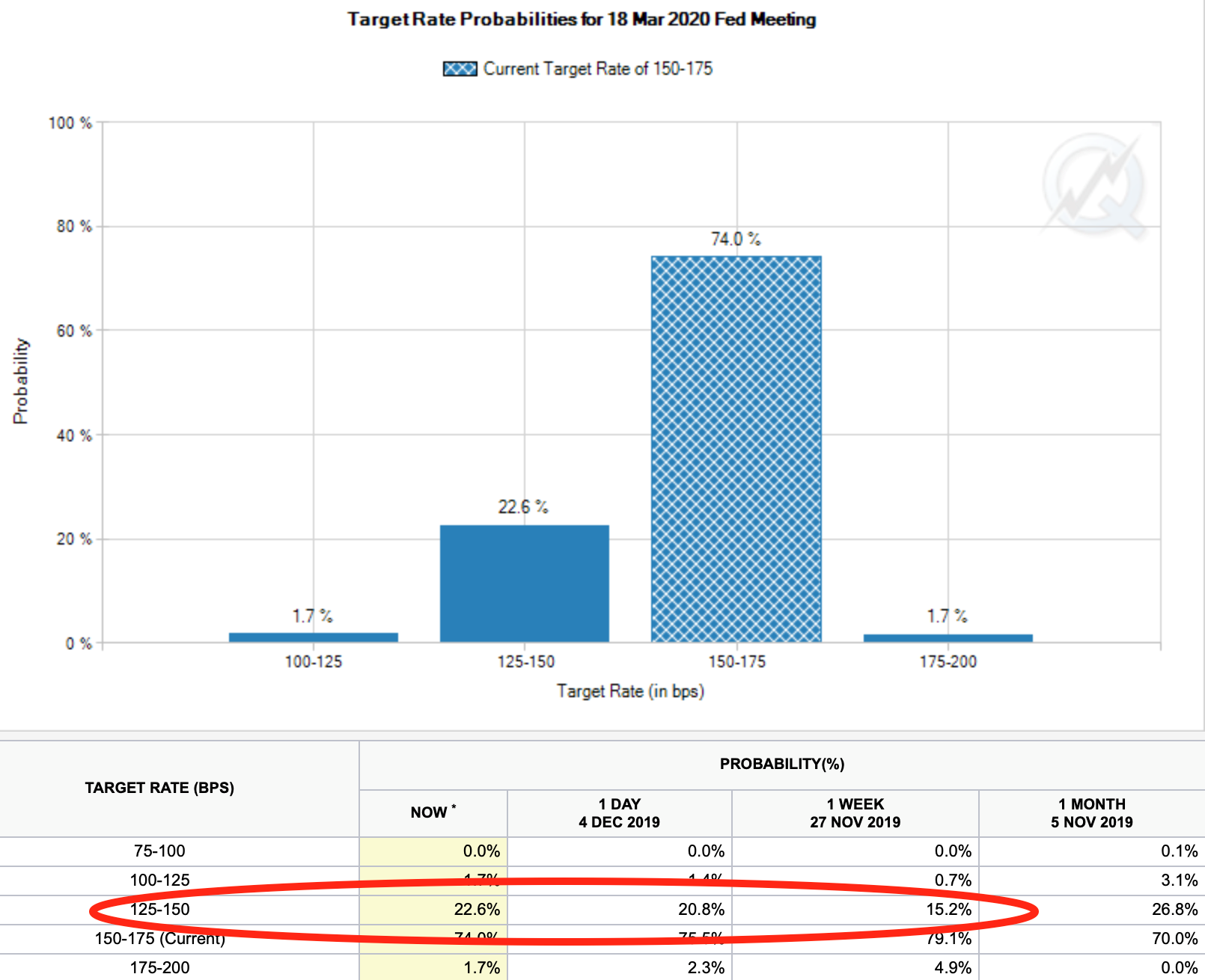

Activity indices in the manufacturing / non-manufacturing sector of the Eurozone and separately for the key countries of the union rose in November. Only France did not live up to expectations. The business climate in Germany continues to improve, Markit reported, confirming official data released earlier that manufacturing output in Germany have stabilized and employment growth continues to be in an uptrend. Due to the preponderance of optimism in European data, we can expect further weakening of the dollar in the near future. Note that the gain in the odds of the fourth consecutive Fed rate cut is gaining momentum, and currently stands at 22.6% for March 2020:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.