The ECB meeting triggers EURUSD correction, focus remains on dovish Fed stance

After hitting a four-month peak near 1.0950 on Wednesday, EURUSD experienced a downward correction during Thursday's American session. This move came on the heels of the ECB’s latest policy announcement, where key interest rates remained unchanged. The Main Refinancing Operations Rate stands at 4.25%, while the Deposit Facility Rate stands at 3.75%:

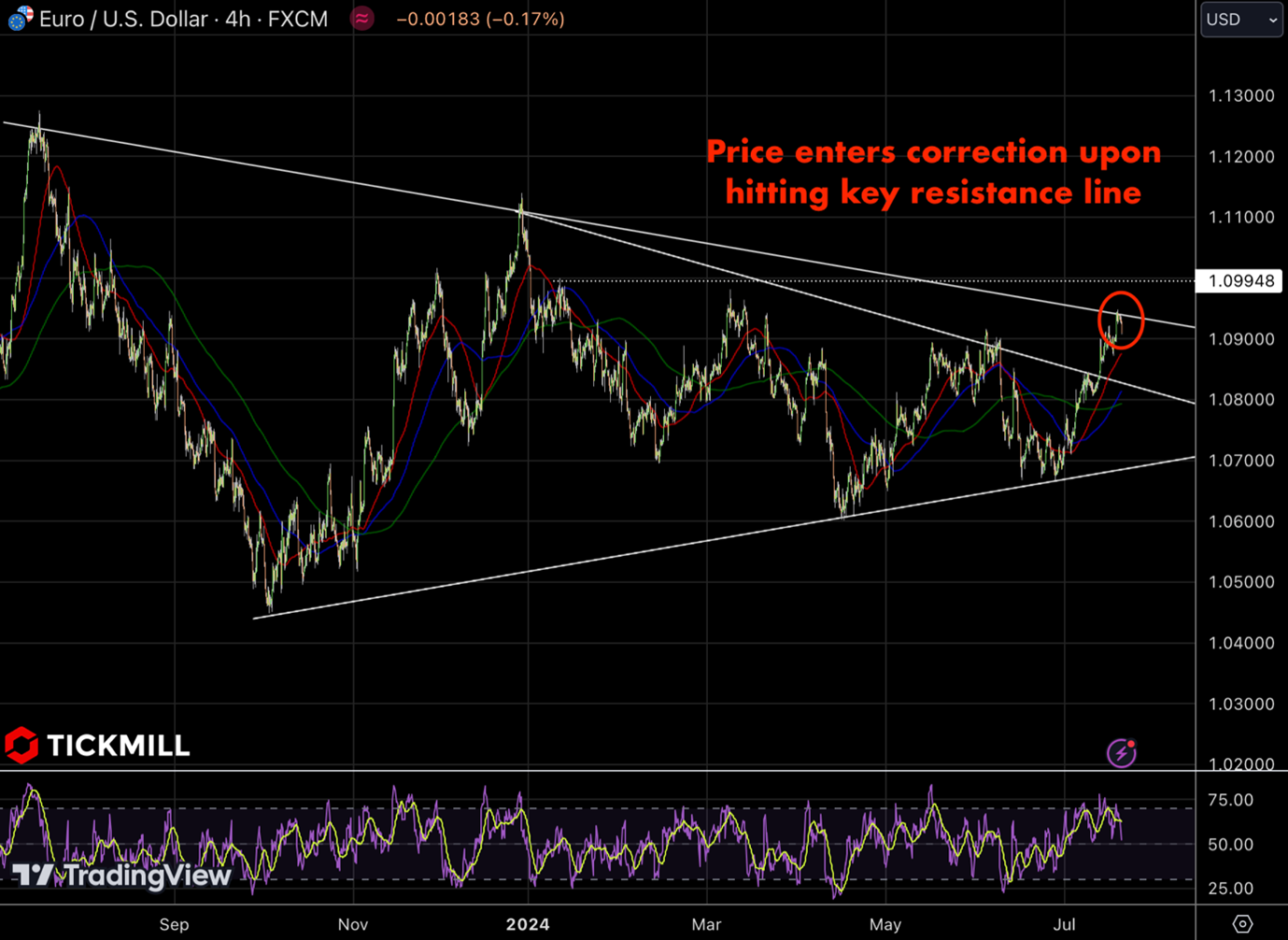

A glance at the EUR/USD chart reveals that the recent pullback appears to be a technical correction rather than the onset of a prolonged downtrend. The decline was precipitated by technical selling pressure near the resistance level of 1.0950. As the immediate volatility linked to the ECB decision dissipates, market participants are likely to shift their focus towards the Fed dovish stance. This shift in focus could underpin the EUR/USD pair, potentially resuming its upward trajectory. Consequently, the medium-term outlook for the pair retains a mildly hawkish bias.

The ECB's decision to maintain the status quo on interest rates aligns with market expectations. This cautious approach is influenced by persistent inflation in the service sector, which poses a threat to the ongoing disinflation process. Notably, the ECB initiated its first rate cut in June after a two-year period of restrictive monetary policy aimed at curbing pandemic-induced inflationary pressures. The rationale for easing the policy stance lies in the ECB's confidence that inflation risks are balanced and that price pressures will return to the 2% target.

Market participants are now anticipating two more rate cuts from the ECB this year, with the next move expected in September. However, ECB President Christine Lagarde emphasized a data-dependent approach, stating, "The governing council is not pre-committing to a particular rate path." She also highlighted that headline inflation is projected to remain above the desired level into the next year, reinforcing the ECB's cautious and responsive policy framework.

However, the US Dollar will likely continue to face downward pressure amid growing expectations that the Fed will commence rate cuts starting in September:

This sentiment is bolstered by recent economic data indicating easing inflation and a cooling labor market. June’s CPI report showed a sharper-than-expected deceleration in both headline and core inflation. Additionally, the Fed’s Beige Book pointed to moderate growth and slower labor demand from late May through early July.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.