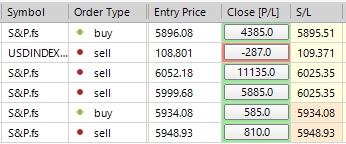

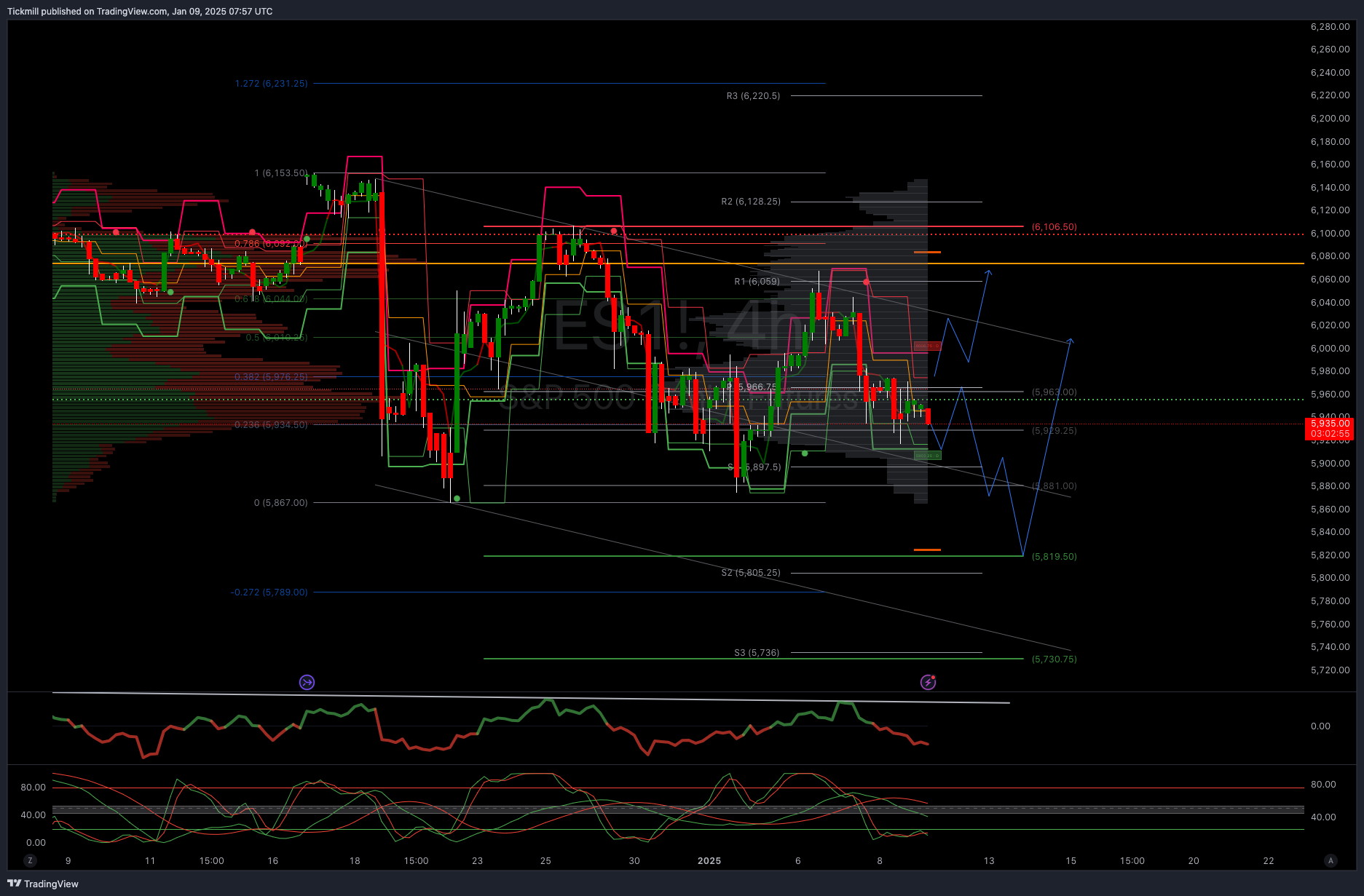

#SP500 LDN TRADING UPDATE 09/01/25

WEEKLY BULL BEAR ZONE 6050/60

WEEKLY RANGE RES 6077 SUP 5911

DAILY BULL BEAR ZONE 5965/70

DAILY RANGE RES 5996 RANGE SUP 5913

BUYER ON TEST/REJECT WEEKLY/DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

BUYER ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SELLER BELOW 5900 TARGET 5865> *5820* CORRECTIVE OBJECTIVE AGAINST 6107 SWING HIGH

YOU CAN REVIEW THE WEEKLY ACTION AREAS AND PRICE OBJECTIVES HERE

Goldman Sachs US Equities Trading Desk View

The U.S. stock market will be closed today, while fixed income markets remain open, which feels unprecedented. This situation is creating a rather uneasy environment. Throughout this week, stock traders have not shown much activity ahead of the jobs report. Recent economic data, including JOLTS and ISM, has been hawkish, and with 10-year yields now at 4.7%, this is putting pressure on stocks. Currently, the market is only anticipating 40 basis points of Fed rate cuts this year. According to Ryan Hammond in GIR, U.S. equities generally manage to adjust to gradual increases in bond yields. However, when bond yields spike sharply—specifically by more than 2 standard deviations in a month—equities usually decline (with 2SD today equating to 60bps). This is particularly the case when the increase is driven by real yields.

Moreover, U.S. equities often continue to rise if the market's outlook on economic growth improves alongside rising bond yields. Conversely, if yields increase due to factors like high inflation or a hawkish Fed stance, equities tend to drop. Over the past month, both real and nominal yields have surged sharply, while the market's expectations for economic growth have remained relatively stable (cyclicals vs. defensives). We surpassed the 2 standard deviation mark on both a 5-day and 10-day basis in December and are currently at the 2 standard deviation threshold on a 1-month basis. The S&P 500 is 3% below its all-time high, but until yesterday, it was buoyed by large-cap tech stocks. The SPW is 6% off its peak, and the RUT is 8% below its all-time high.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!