Soybeans: Hard Choice for China Between the US and Brazil

We continue to scrutinise the “Phase one” trade deal between the US and China, in particular the feasibility some of its aspects, in order to understand whether trade deal optimism was premature or not. I would like to delve into the problem of zero-sum game in international trade, which I started here and draw your attention to the Trump’s sore spot - China agricultural purchases.

Recall that White House trade adviser Robert Lighthizer said that Beijing agreed to boost purchases of farm goods by $16 billion next year, in excess of $24 billion (before trade tensions increased in 2018) and potentially buy $50 billion. Beijing, in turn, continues to repeat the mantra "depending on market conditions ...".

The ability of China to swiftly bring American farmers back to the game will obviously depend on how much China relies on alternative suppliers (Brazil and Argentina) and how profitable it is to rely on them. Boosting agro purchases significantly from the US, China risks destroying Brazilian agro sector.

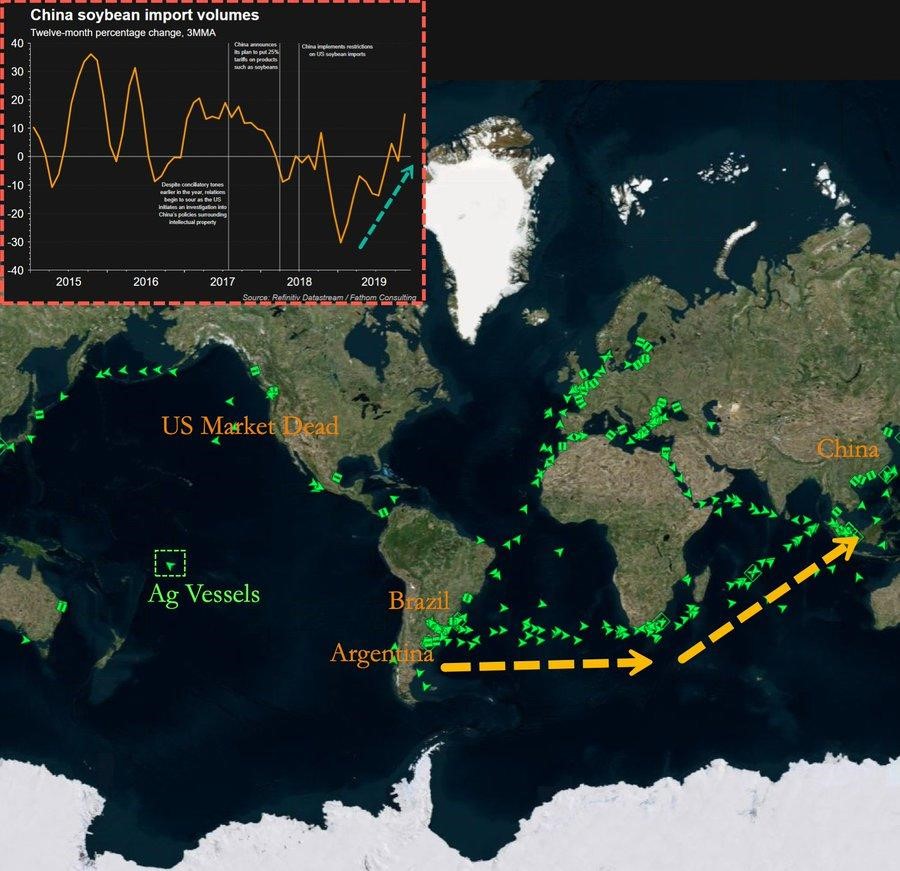

Based on the latest data on transportation of vessels with agricultural goods, trade with Brazil has flourished, and depressed with the US:

Vessels with agricultural goods are marked in green

Since the beginning of 2018, the Brazilian real has depreciated by 25% against the dollar (not to mention how much the Argentine peso has depreciated), and it is unclear why Chinese firms should suddenly “start to want” to fork more for US soybeans which are roughly the same in quality.

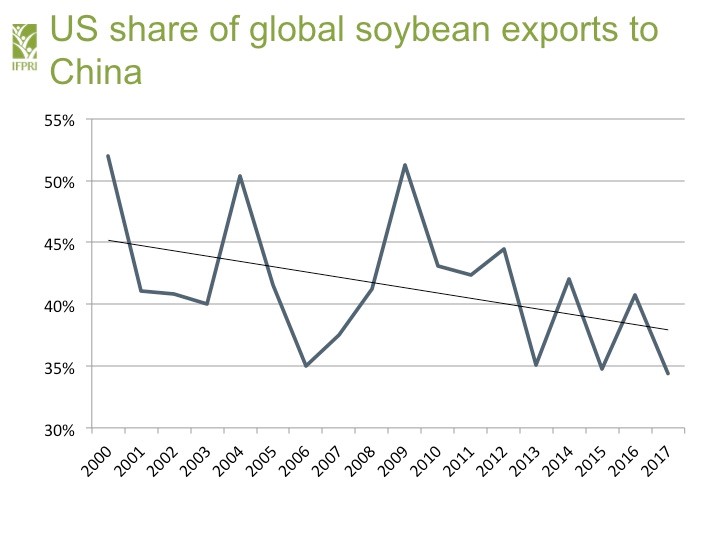

The share of Brazilian soybeans in China's imports of this product increased from 20% in 2000 to 50% in 2017. The trade war only supported this trend. The US share fell to 35% in 2017:

Apparently, any sharp increase in supplies from the United States should come at the expense of Brazil.

Consumption of soybeans in China has declined significantly due to the outbreaks of African swine fever, which has reduced the hogs count. According to forecasts by the USDA, the demand for soybeans will grow next year, but still will be 10% less than the peak in 2017:

Therefore, Brazilian and American suppliers will have to "share even smaller cake" what complicates China potential to make a U-turn in the soybean supplier choice.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.