Soybeans and Pork: The Trade War Intricacies you Need to Know

China said on Friday that it will abolish part of import tariffs on US soybeans and pork. Despite a series of controversial statements and decisions that set back progress, the fundamental trend toward the “disarmament” of the parties seems to remain valid.

The exemption from tariffs will be based on the relevant applications of individual firms, the Ministry of Finance said. However, the agency did not provide exact figures, making it difficult to assess the scale of the concessions.

China introduced 25% tariffs on US soybeans and pork in 2018 as countermeasures to US punitive duties, which were designed to force China to treat foreign companies fairly.

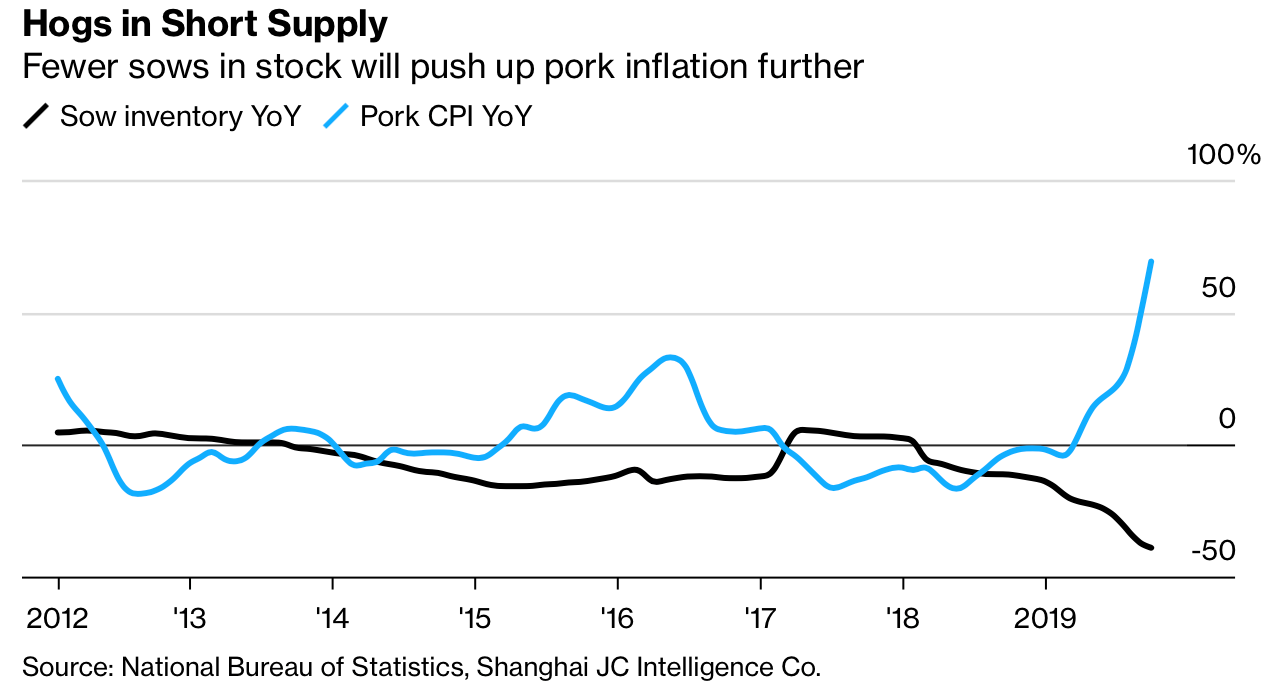

However, the significance of China’s “goodwill gestures” for negotiations is highly questioned if we consider the situation with stocks and inflation of pork prices in China:

The graph shows that pork price inflation since the beginning of the year was more than 70% in annual terms, and stocks fell by almost half. Additional China constraints on supplier diversification (capable of supplying the necessary volume) and low potential for the realignment of supply chains indicate that China is somewhat forced to cancel tariffs in order to stabilize the domestic market.

Earlier, I also wrote that the difference in the harvest season in the Northern and Southern Hemisphere makes it difficult for Chinese firms to refocus on Brazilian agricultural supplies, which is a negotiating advantage for the United States (but only for the summer-autumn period, when Brazil cannot supply).

The second important point regarding the import of pork is the celebration of the Lunar New Year (it happens in February). This is the period when pork consumption reaches a peak. Therefore, both demand for tariff exemption and government desire to grant waivers are growing as we are approaching this period.

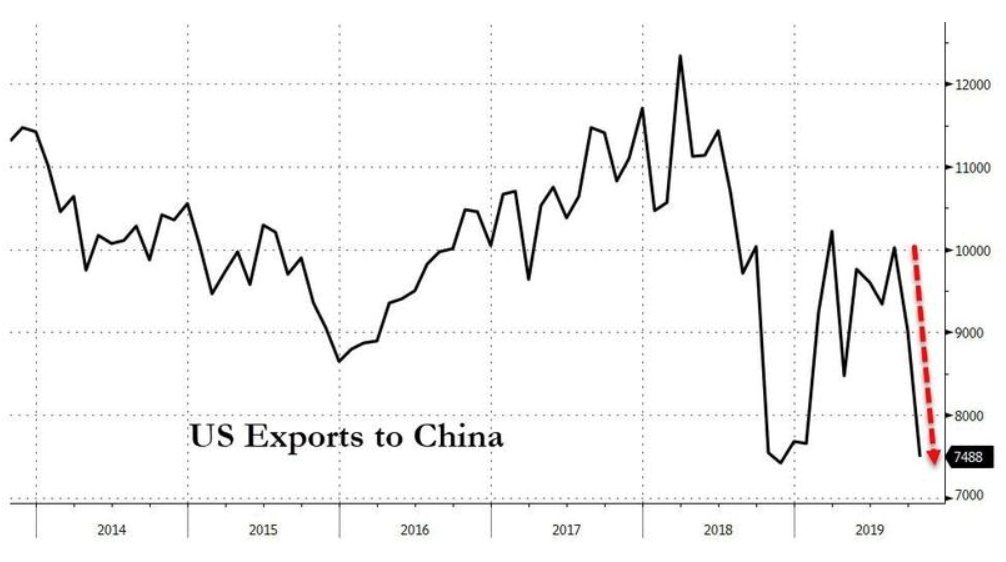

Recent US imports, including sub-component imports in manufacturing / non-manufacturing PMI from ISM, have indicated a decline in imports mainly from China. The U.S. trade deficit narrowed to -47.2 billion dollars, the highest since June 2018. Imports from China fell to a three-year low in October. In turn, exports to China fell to their lowest level in a year.

The monthly change in US soybeans export to China of -42% to $ 1.1 billion in October speaks loudly of the level of escalation. It is not difficult to understand the reason for the fall, if we take into account that the ripening period of the Brazilian crop is approaching (February-May), therefore, China has less desire now (if any at all) to exempt from tariffs on soybeans.

Less obvious points regarding the trade in soybeans that you should pay attention to are the protein content, which has decreased in the last Brazilian crop (as a result, the smaller proportion of “useful” contents used in the production of feed), as well as the classic “transshipment” of US soybeans through Brazil to China, what Trump might pay attention to at one point (as was the case with Vietnam).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.