Short-Term Dollar Outlook: Are The Odds Of A Fed Rate Cut Rising?

The US dollar has ceded ground to some other majors as the threat of the coronavirus spreading in the United States rises. The CDC made a number of important statements which basically hint at impending local transmission. This, in turn, prompted markets to review the odds of lockdowns in the US and potential economic damage.

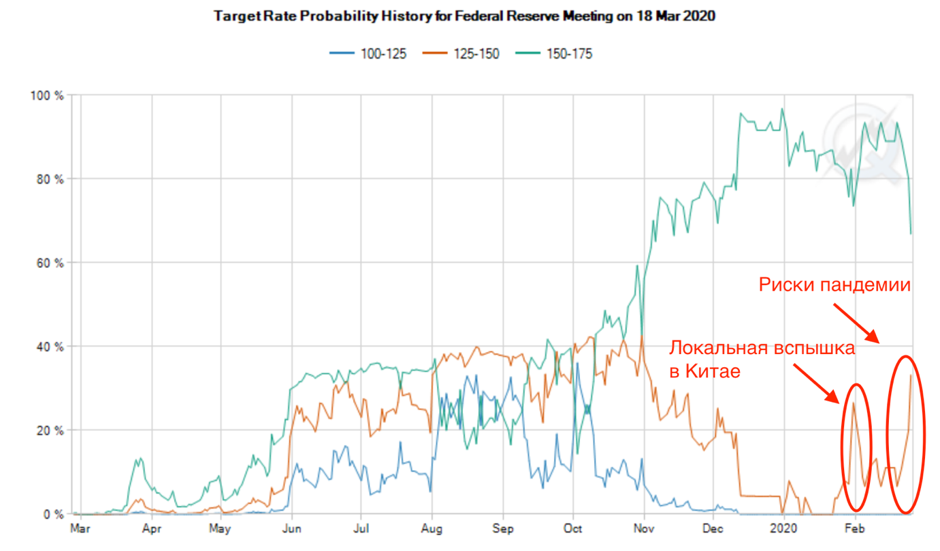

The greenback fell against the euro, pound and Swiss franc as investors increased demand for risk-free securities ditching cash. Yields on 10-year Treasury bonds fell to record lows of 1.29%. However, as the short-term equilibrium in gold suggests, the rally of risk-free papers doesn’t come solely from the flight to safe heavens. It is actually driven by the expectations of a new policy easing by the Fed. The chance of an interest rate cut has risen from 7.9% a month ago to 41% on Thursday. They are set to rise further since the range of possible outcomes remains very wide as the virus is in the early stages of spread outside of China. Markets hate uncertainty and the wider it is, the more risk aversion they will price in.

Other currencies oscillate in a narrow range as investors continue to assess the prospect of a pandemic and try to determine the least affected place for their investments. The number of cases outside of China has increased by 569, but WHO refused to classify the outbreak as a pandemic, noting that careless use of the term spreads unnecessary panic and unjustified economic costs due to often irrational public response.

The only straw in the current situation to get out of the swamp of panic and fear is the dynamics of epidemic in China. The number of new confirmed cases is growing mainly in the epicenter, while other provinces are gradually weakening quarantine. This can mean one of the following two outcomes:

- The risk of exacerbation/re-outbreak is lower than the risks of economic collapse from prolonged lockdowns.

- The authorities really took control of the spread of infection and there is no need for tight quarantine anymore.

Traces of the virus have already been detected in 50 countries, and the most worrying are confirmed cases that do not have a history of travel to high-risk countries. This does not allow tracing the chain of infection, which in turn makes it difficult to identify new cases as it is not clear who to look for and test.

The number of infected in South Korea increased by 505 people, thus surpassing China for the first time (+405). In Japan, the number of confirmed cases increased by 34.

At least 5 confirmed cases from Croatia, Germany, France, Spain and Finland (i.e. completely different cases) returned from Italy which probably indicates that the virus has gained a solid footing there, forcing a revision the odds of contamination to the downside.

Another test of the dollar is expected today after the release of the report on orders for durable goods and a preliminary estimate of GDP for January, if the numbers disappoint expectations. In the short term, a further weakening of the dollar is expected, subject to development of the trend with local spread of the virus in the US, which, as the CDC emphasized, will almost certainly happen.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.