Repo Market Liquidity Shortage – How the Fed will Explain it?

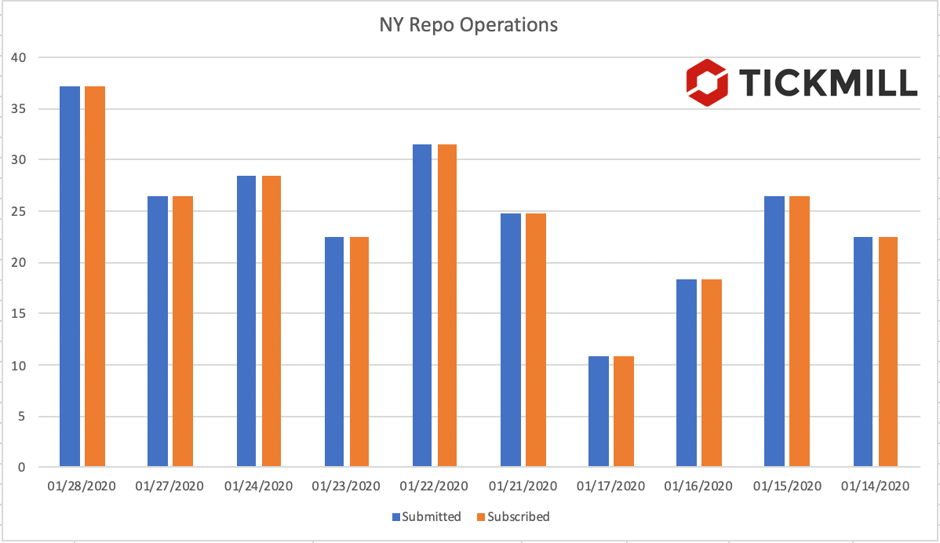

The Federal Reserve is going to hold its first monetary policy meeting in 2020 today. The focus is on the Central Bank’s assessment of how the three rate cuts made last year have worked out, updated economic forecasts and the “sore point” with Repo market. Recall that the whole November and December the Central Bank explained their aggressive easing through Repo operations with “seasonal lack of liquidity” and “liquidity bottlenecks”. These were the reasons why the repo operations of the New York Fed, which quickly “became norm” (and differ from QE in only a known and relatively short reverse operation period), took place. But the holidays have passed, but the Federal Reserve Bank of New York looks like it is not going to stop soon. To show that I’ve collected data for the last two weeks on Repo operations with a maturity of 1 business day, with Treasuries as a collateral. Let’s put this data on the chart:

Two important conclusions can be drawn from this graph:

- in the last two weeks, the Federal Reserve Bank of New York conducted 10 repurchase transactions with a maturity of 1 day (this, apart from operations with a two-week maturity), and after a slight decline in volume by January 17, the volumes of liquidity offered have begun to grow again.

- Market participants bought out the entire volume of liquidity (submitted are equal to subscribed in every case). The same can be said about two-week Repo operations, and even if we include operations with MBS collateral, all has been bought out.

From this we can conclude the market continues to suffer from a shortage of liquidity (bottlenecks?). But the assets on the Fed balance sheet have already risen from a local low of $3.76 trillion to $4.14 trillion in five months. Have those money helped to solve liquidity problem? How long it will last? I suppose these questions worry markets the most and the Fed needs to answer them.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.