Preview of January NFP: Slowing Services Sector and Boeing Could Slow Job Creation

Sustained job growth, record low unemployment, and stable wage growth are a perfect recipe for the Fed's stable interest rates but the economic impact from the coronavirus outbreak has shifted risks toward monetary easing.

The number of jobs grew unevenly in the second half of 2019, and the strike of General Motors employees rocked down and up payrolls by 43 thousand in November and December. The story with GM ended, but a new one came in its place - Boeing has put off plans for the production of 737 MAX on the back-burner, so both the company itself and its 600 suppliers are likely to find in themselves with surplus of labor that they will get rid of. In this regard, the manufacturing sector is likely to pull the labor market down for some time.

Services sector

The service sector, in which 80% of US workers are employed, should generate fewer and fewer jobs, reflecting the general slowdown in the economy. Recall that at the last Fed meeting, consumer spending growth was rated as "moderate", although in December the growth was rated as "strong." Over the past 18 months, the leisure industry and the hotel industry have been the most active employer, where wages have been growing very reluctantly due to the low negotiating power of workers. A slight acceleration in recruitment can happen due to the United States Census in 2020.

Manufacturing

Weakness in the manufacturing sector was reflected in ISM “soft data” for January. A survey of the agency showed that in January activity in the manufacturing sector continued to decline, but at a slower pace than in December, and the employment component also slowed down. Nevertheless, it is expected that jobs count in the manufacturing sector will continue its downward trend.

Construction

Construction sector, in contrast, is expected to offset the negative impact from manufacturing on jobs, where low mortgage rates have propelled activity of mortgage borrowers and developers. The NAHB Real Estate Developers Index is now at a 20-year high. Warmer than usual weather probably kept seasonal layoffs in the construction sector, which is obviously a positive contribution to the jobs count.

Gathering all the arguments together, I suppose that the payrolls could rise on par with the forecast (160K) at best.

Unemployment

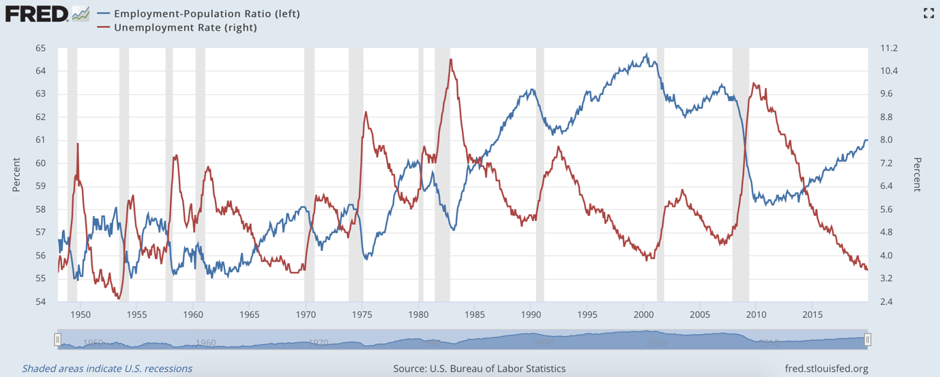

Unemployment is expected to remain at 3.5%, but it is losing its importance as the gauge of the health of the labor market. If you look at the joint dynamics of unemployment and % of employed people from the working-age population, you can see that the second indicator is recovering sluggishly despite the rapid decline in unemployment, which distinguishes the present economic expansion from the previous ones:

In addition, new jobs in low-skill sectors does not cause wage pressure, as workers can be easily replaced. This limits the importance of low unemployment in determining the Fed's policy, since without connection with other variables, including aggregate wage growth, it is uninformative. Consequently, the market will pay the main attention to new jobs and salaries, which are likely to disappoint due to an unimportant picture of consumption, the situation with Boeing and coronavirus outbreak.

Impact for interest rates?

Despite the fact that the number of jobs is generated enough to keep unemployment stably low, inflationary pressure in wages remains strikingly low. And since the Fed is pleased with how the policy affects the economy, its change in the short term is unlikely. The main threat now remains the impact of coronavirus on consumption in the United States, as happened in China - people reduced the cost of eating out, entertainment, transportation, hotels, etc. In the US economy, the share of these services is 15% of consumer spending. Signs of a virus outbreak outside of China will almost unambiguously mean the Fed reaction.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.