Preview of the Fed Meeting: Focus on the “Favourite Charts” of the Board Members

The bar for changing or adjusting the course of the Fed’s monetary policy has been set quite high this year. This is not a surprise, since the Fed believes that it was “ahead of the curve” after cutting the rate three times in a row last year. But it takes time for the changes made in “upstream” of the interest rate channel to reach the “downstream” – firms and consumers. Jeremy Powell put it this way: only material reassessment can urge the Central Bank to take action this year. But what does this “material reassessment” actually mean?

The phrase looks simple but at the same time extremely vague, because the Fed policymakers now have no consensus on what should worry the Central Bank and what shouldn’t. In the context of disappearance of relatively stable in time economic links such as between inflation and unemployment, officials hit into active research and look for alarming bells in sometimes completely different indicators of the economy.

Of course, no one will argue that common shocks like the outbreak of coronavirus shifts the balance of risks down for the US economy, which the Fed will take into account. The futures market prices in a 30% chance of a rate cut at the meeting in June, although a week ago it was only 18%.

As the innovative research continues officials form their own bias towards preferred economic signals. I will consider them below:

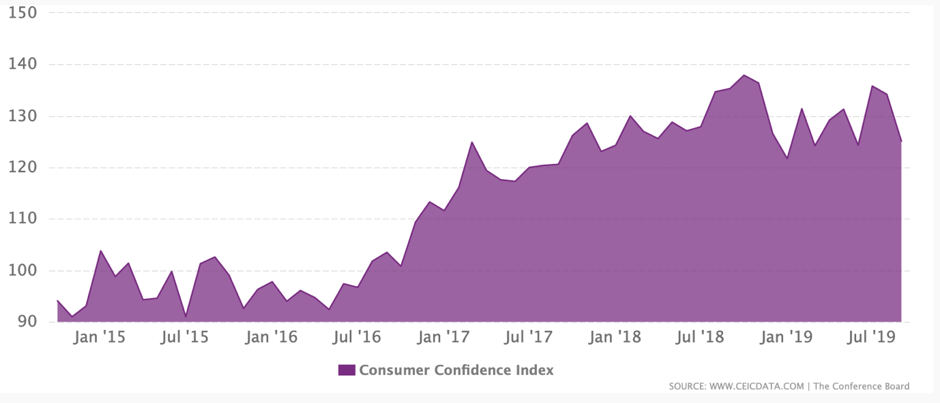

Rafael Bostic, Atlanta Fed: The main focus should remain on consumer confidence and consumer spending.

Neil Kashkari, Federal Reserve Bank of Minneapolis: Wake-up calls should be expected in wages dynamics.

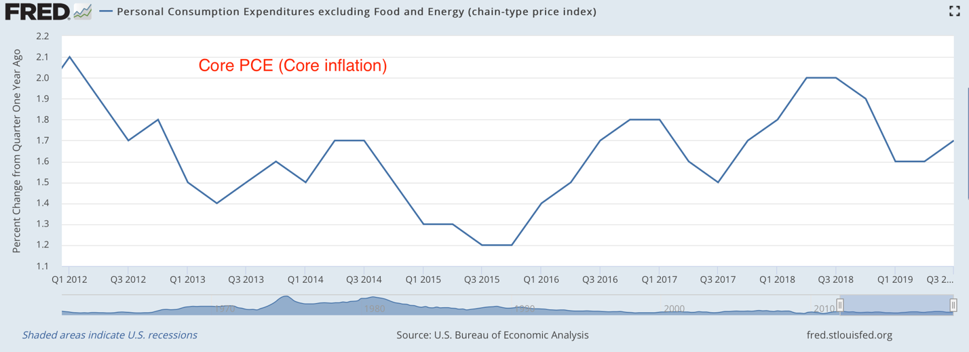

James Bullard, vice president of the Fed: the main task of the Fed is to stimulate inflation, if there is no positive dynamics, it will be necessary to act.

Robert Kaplan: GDP growth below 1.75% by the beginning of the second quarter of 2020 may be worrying.

Loretta Mester, Cleveland Federal Reserve Bank: At the moment, I would not have made a focused effort to stimulate inflation. In a recent interview, Mester noted that positive data on wages and retail sales and a decrease in production activity for the fifth month in a row are essentially a combination early pickup and downturn signals, which seriously complicates the interpretation of aggregate effect.

To understand what to expect from the Fed meeting on Thursday, you need to keep in mind the following two points:

- The "clear action plan" of the policymakers is now limited to a wait-and-see attitude.

- The clues about more policy easing can only be expected if unpleasant dynamics start / continue on the “favorite charts” of the majority of the policymakers. At the same time, the weakness of separate indicators is now uninformative, since the opinions on what is important differ. Take at least the same issues of stubbornly low inflation - someone speaks of deanchoring inflationary expectations and undermining Fed’s credibility as a grave consequence, but for others this is not so critical.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.