“Phase one” deal is unlikely. But perhaps the tariffs hike is too.

As the deadline for the December tariffs is approaching and there is growing appeal to “trade the event”, let’s review again the reasons why the “Phase One" deal will likely be delayed:

- Absolute intransigence in the matter of who will make the first step in the “quid pro quo” scheme. US farmers sponge on the government (read my yesterday article for more details), while China suffers hyperinflation on pork waiting for more supplies from Brazil. The annual increase in pork prices, by the way, reached 110% in November with signs of slight easing in December. To make it clear, the two nations can’t agree because of the following: China insists on a gradual increase in purchases (of agricultural products) for the immediate removal of tariffs while US wants gradual tariffs removal for an immediate increase in purchases. Each nation wants to retain its own lever.

- Trump administration is currently focused on the NAFTA 2.0 deal (only final touches left). Putting the end to one of the tariff fronts is a clear negotiating advantage for the Trump administration.

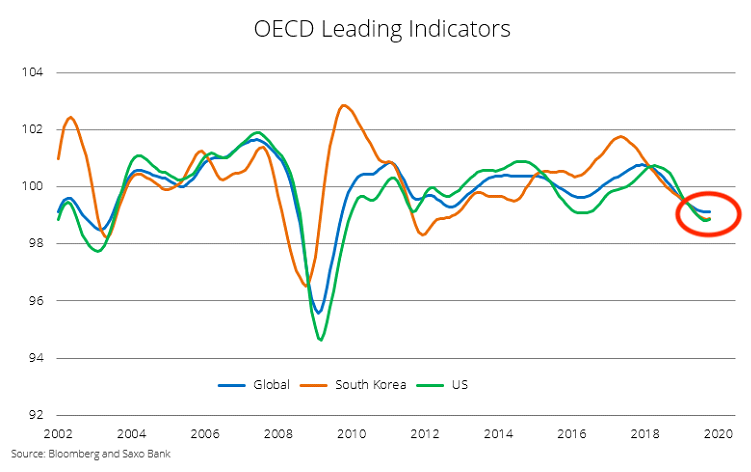

- The global economy may soon pass an inflection point. OECD forecasts a transition to expansion, thanks to preemptive Central Banks’ policies and the “fiscal stimulus year” in 2020 thanks to the Japanese government spending and the EU’s “green” investments.

So, the trade deal does not seem to be “the only savior” of positive market sentiments.

Nevertheless, both sides are likely to try to steer clear from the escalation making a “mini-deal”. It can be argued with the following:

- New tariffs will likely provoke a countermeasure — the release by the Chinese government of the so-called “unreliable entities list” that it has long been threatening to do.

- There are irreversible effects of a long trade war. The US hostile stance towards China may backfire with strengthening of the US farm rivals – namely Brazil and Argentina, at the risk of dooming itself to long-term subsidies to the farm industry. If negotiations drag on until February, American farmers will miss the chance to sell their goods, as the Latin American crop pours onto the market. According to the agency Gro Intelligence, the Brazilian crop this season may exceed the American by 27%, which clearly indicates the size of Brazilian "stake" in the game. Back in 2015, the US crop exceeded the Brazilian by 10%.

- According to Agricensus, China increased tariff-free quotas for US soybeans by $2 million metric tons last Friday for local and international companies, which may be one of those subtle signs that China is making small concessions before the deadline. However, temporary quotas certainly do not mean permanent purchase commitments, therefore, with this measure, China may have just solved the internal problems of the market.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.