Pay Attention to Capital Investments in the US – Early Sign of Cheaper Gold

European bonds fell on Monday reacting to the positive noise related to the US-Sino trade talks and temporary reprieve in the US economic background.

Stock markets rose, which was accompanied by an increase in outflow from the “safe havens” and welcomed tide in risk assets. Representatives of China and the United States supported market sentiment on Friday, claiming about one more step ahead in the talks. Senior White House officials once again said that agreement can be signed in this month.

Gold price flattened near $1,510 per troy ounce. Expectations on the five core demand factors - the path of the US interest rate, consumer inflation, volatility, demand for defensive assets and demand in the consumer market have subsided. Nevertheless, it is necessary to monitor “event risks” such as sudden exacerbation of the trade spat between the US and China or an increase in the uncertainty relating to December early elections in the UK.

The rise in Payrolls in the United States more than met expectations, amounting to 128K. It is substantially higher than expected value of 85K. Nevertheless, wage inflation in October missed projections, amounting to 0.2% against expectations of 0.3%, which, of course, keeps in check expectations of real yield erosion in the US. Real yield negatively correlates with gold demand.

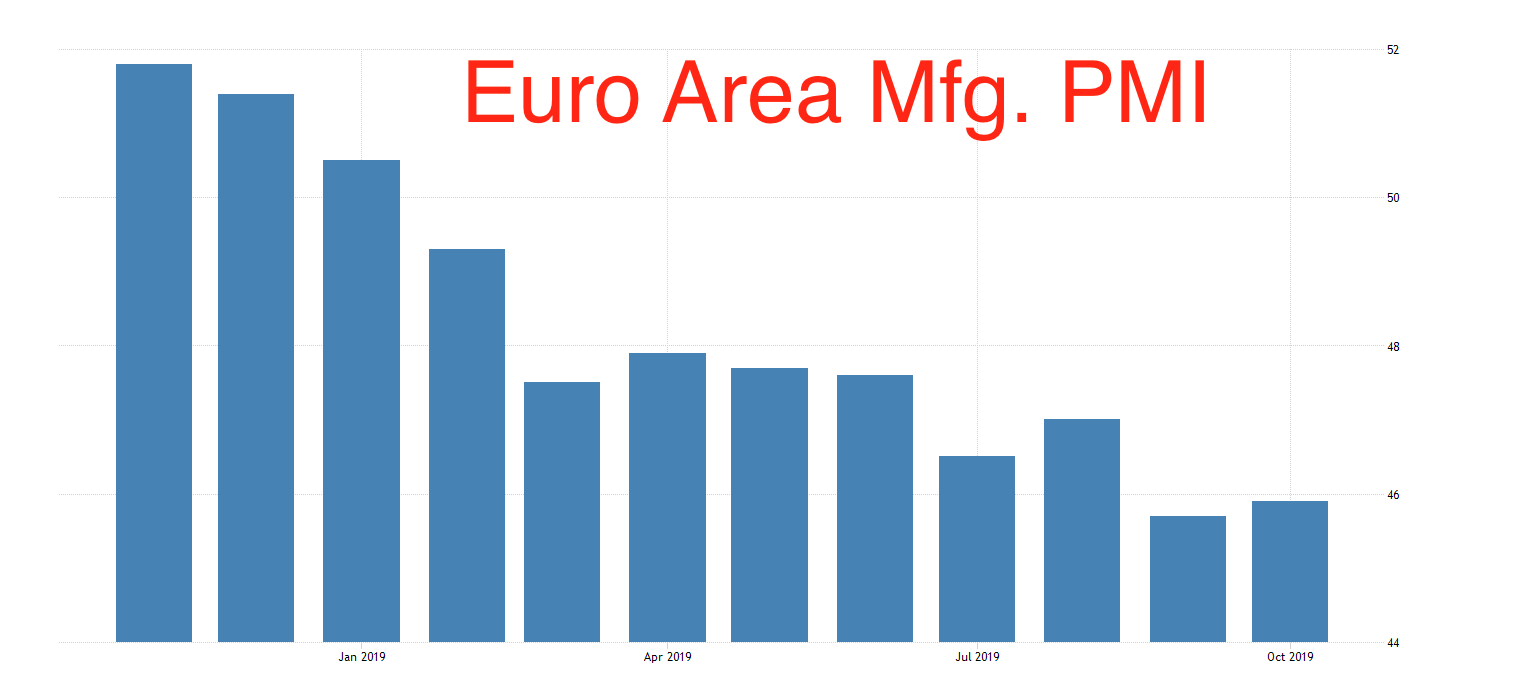

Activity in the manufacturing sector of the Eurozone and Germany and France levelled off in October, which undoubtedly supported the positive mood. The manufacturing sector is regarded as the main “source of contagion” of weakness, as it is most vulnerable to frayed trade ties due to heavy orientation to export. The corresponding indices rose slightly last month compared to September but still remain in the zone of contraction:

It is also worth paying attention to the data on capital investment in the US, which release is due later today. According to the latest FOMC statement and Powell’s comments, the Fed is worried about weak exports, production and investments. The dynamics are such that capital investments are contracting and slowdown in the decline or increase (i.e. positive surprise) may become the welcomed sign of working “insurance” rate cuts or firming positive expectations about the trade deal. The key question of a “switch” in expectations from recession to extended expansion in the corporate sector has the answer precisely in such “low-impact” data as capital investments.

The speech planned for today by the new head of the ECB, Christine Lagarde, will be interesting in the sense of what position she takes between opponents and supporters of QE. The terms and volumes of fiscal stimulus, which are gradually interspersed on the ECB agenda, will directly affect the expectations for the date of QE end.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.