What You Need to Know Before Thursday’s ECB Meeting

The dollar has risen to a monthly high on Monday while the common currency is patiently waiting for Lagarde's comments due on Thursday. Gold, with varying success, is trying to gain a foothold above the $1,560 level, but subsiding Middle East and tariff risk factors, Fed comments and the ECB policymakers, filled with hope, have been suppressing the move.

The Chinese yuan kept rising on Monday, also pulling up the Australian and New Zealand “commodity dollars” reflecting expectations of a firmer Chinese economy and thus renewed growth of the demand for raw materials.

The macro data from the last week indicated continued recovery of the manufacturing sector affected by the trade wars. Retail sales grew at a faster pace than expected, describing a rather favorable picture of consumer spending in the shopping season. Housing starts surprisingly jumped 16.9% in December, but the number of building permits issued (which is the leading indicator for housing starts in January) lost momentum, suggesting that the surge in private home construction is likely unsustainable.

Key things to note before the ECB meeting on Thursday.

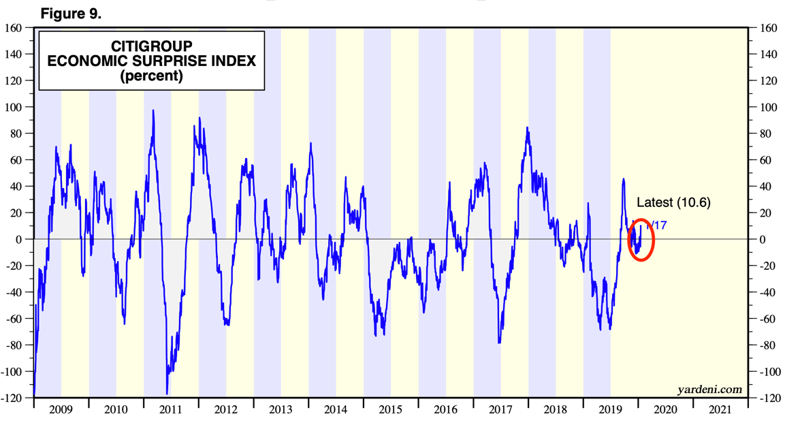

- “Incoming data” has retrieved the main role in the analysis of monetary policy as major risk factors such as the trade war have subsided. “Surprises” in the economic data (i.e. deviation from consensus) is what drives the changes of market expectations about the monetary policy. It is convenient to judge about overall level of surprises happened in the given period looking at indices of economic surprises and the most famous of them is probably the Citi Economic Surprise Index. At the end of Q4 2019, the number of positive economic surprises in the United States increased, which, for example, can be seen from the latest rebound into positive territory:

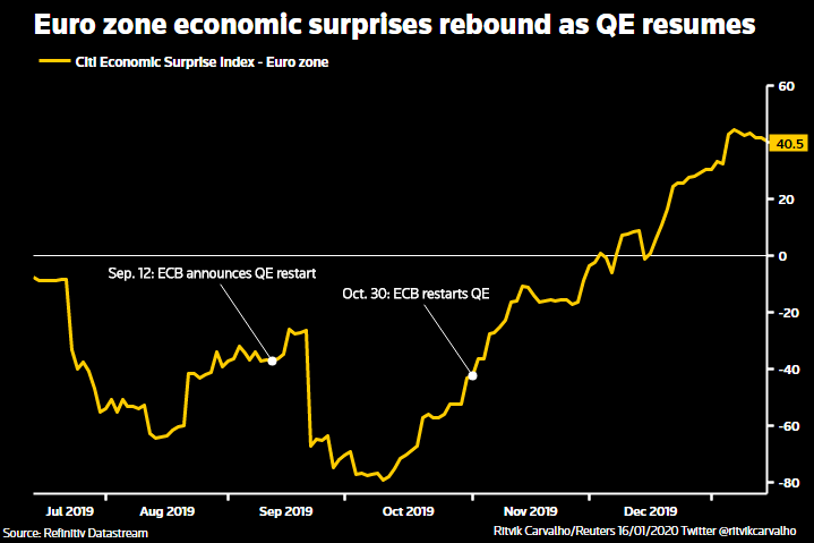

But the EU’s surprising economic performance didn’t lag behind. The number of positive surprises also rose, which is shown in the index rising to the highest level in two years:

So, judging by the economic performance positively deviating from consensus, the economies of both the New and the Old World have entered into a relatively solid recovery path.

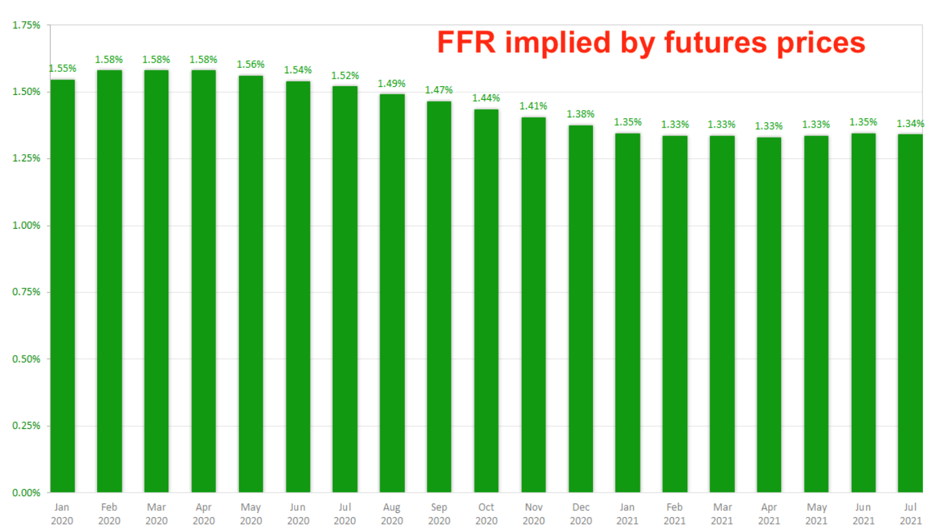

- Futures on the Federal Funds rate have been ruling out the outcome of policy easing in January, which is quite expected since officials previously signaled a pause till the end of 2020, provided there would be no significant negative shocks. Nevertheless, futures have been pricing lower interest rate in 2021:

On the contrary, since the last ECB meeting, European money markets have increased their bet on the ECB hawkish bias in 2021, which is seen from the EONIA swaps. The expectations of convergence of interest rate paths of the ECB and the Fed in 2021 will likely act as a bullish factor for the EURUSD.

- The January meeting of the ECB will probably be more dedicated to the discussion of the so-called policy review. In short, this is a search for an “improved” definition of price stability and ways to achieve it. Lagarde said in December that the research and consultations will likely take the whole year, and against this backdrop, it is difficult to believe that sharp maneuvers in politics may occur at the very beginning of this “revision”. The policy will likely to be steered "away" from the QE which is a bullish factor itself. It is possible that the ECB will follow the example of Denmark and generally decide to abandon negative interest rates. But this will not happen immediately.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.