Market Overview: Looming Japanese Recession, US Economic Data and The Trade Deal

Japanese GDP has taken a huge hit, falling by 1.6% on a quarterly basis and by 6.3% year-over-year in the fourth quarter of 2019 – the worst performance since the financial crisis. Even the economic damage from the Fukushima disaster was less. The output of the economy was expected to contract by 3.8% but even this modest target turned out to be impossible to achieve.

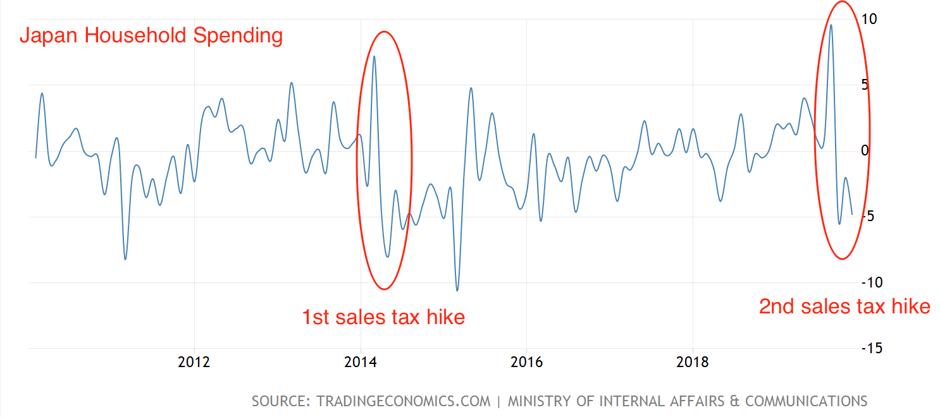

The sales tax hike conducted in October accounted for the decline in output in a similar manner as in 2014 when the government applied similar austerity measures. Japanese households which had been already demotivated to increase spending because of the long stay of the economy on a near-zero inflation path retrenched further in the 4Q:

Firms’ capex also shrank, construction and machinery production sectors led declines. The fall in exports due to lower foreign car sales and the shock in consumer demand in China (China accounts for 20% of Japanese exports) was the final touch on Japan’s gloomy economic picture for the fourth quarter.

Downside surprise in the data shifts risks for the economy to the downside in 1Q of 2020, because given the fallout of the virus outbreak on the manufacturing sector in Japan, a recession is only a matter of time. This is basically a signal for a weaker Yen, as the rising of risk of recession means more stimulus.

Retail sales in the US

The broad index rose by 0.3% (in line with the forecast), core sales rose by 0.4% MoM, which is higher than expected, however, sales of the control group (used to calculate GDP) posted zero growth. In general, the report is likely to fuel risk appetite across the Pond while U. of Michigan consumer sentiment index came above 100 points which is in line with recent Powell’s bold statement that “there is no reason to expect that economic expansion won’t continue”.

Trade deal

An important update in the US economic data was export prices for January. In January, export price inflation amounted to 0.7% compared to December, which is way higher than market projection (0.0%). Rising export prices basically tell us that US exports more (which likely suggests that China is increasing purchases), which supports positive outlook for the US economy and negative for other China partners which have been forced to share their “China export quota” with the US. EURUSD held up the defense at 1.08 but is expected to resume decline after completed bullish pullback.

Coronavirus

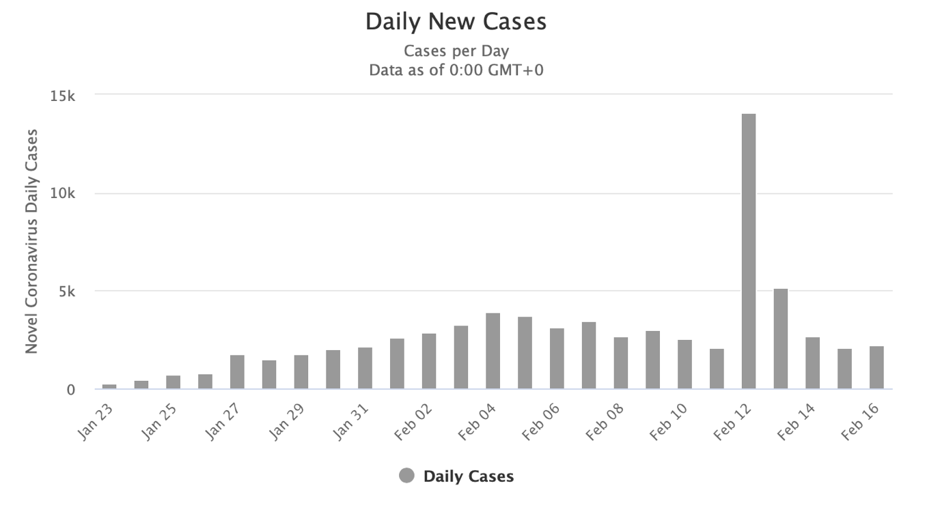

As expected, the number of people infected in China after an explosive daily growth of 15K started to decline and in the last two days amounted to a little more than 2K people easing fears about low impact of containment measures:

Nevertheless, Gold failed to unwind Friday gains staying elevated despite loosened credit access from PBOC which is unusual as Asian stock market cheered decision with a notable risk-on rally. The further gold is under question though, since taking into account the latest stimulus measures and the development of the epidemic, damage to the economies will be likely revised to the better.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.