Japan is Likely to Start Borrowing Again. What to Expect from the Yen?

Federal Reserve’s endeavours revived risk appetite in late summer - early September and the negative-yield bond market lost its scary size. At its peak the size was $17 trillion, now it has dropped to $11.5 trillion. There is a promising driver that can send this figure even lower and if it is realized, the growth of the Yen will be under big question.

The driver is new powerful spree of government spending in Japan. Earlier, I wrote that the IMF recommended BoJ to buy more short-dated bonds, which should make the yield curve more convex what seen as essential feature for Japanese banks to make money from lending operations. In response, the head of the Japanese Central Bank complained about the "lack of coordination of fiscal and monetary policies," gently hinting at the limited supply in the JGB market, where the Central Bank has been almost the only player for a long time. Despite the fact that Haruhiko Kuroda assured that there are no limits in deploying its monetary tools (including unconventional ones, like QE), its effective use encounters certain barriers, the biggest of which is a constraint in choosing right composition (not volume) of asset-purchases.

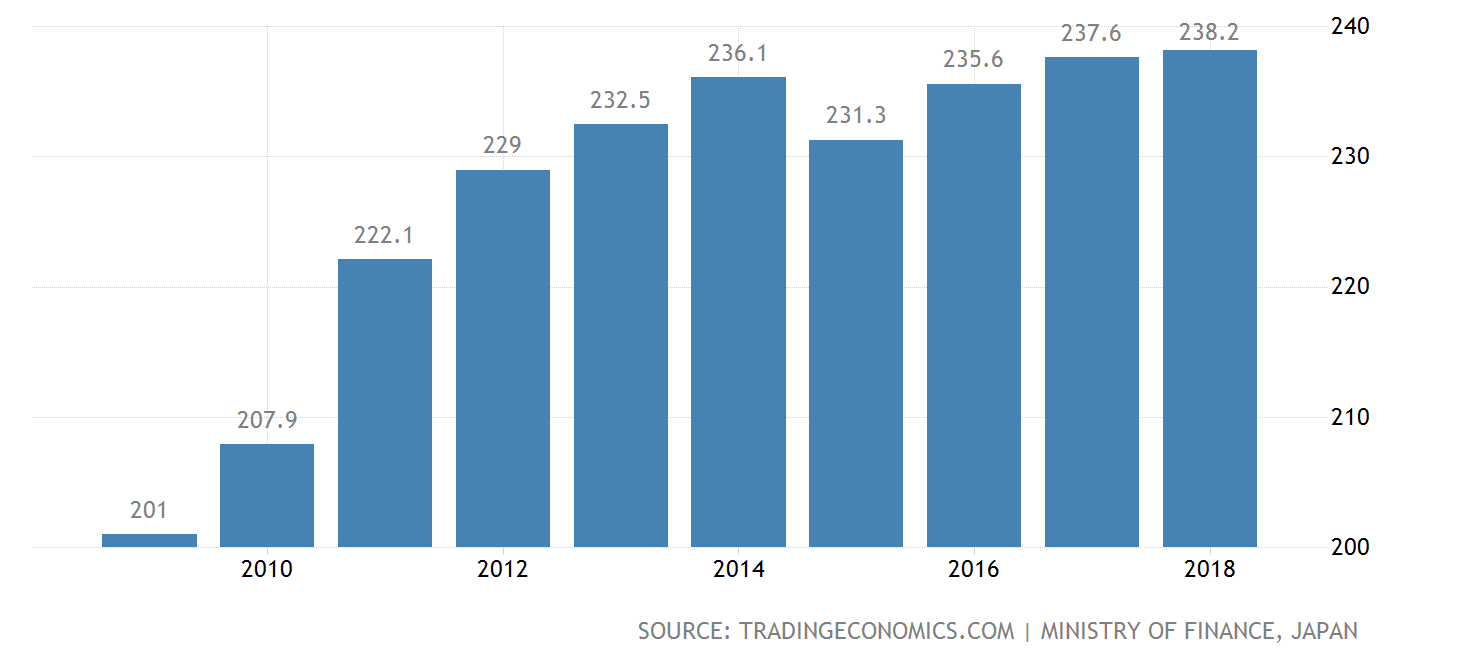

As a result, there were expectations that the government would finally bend as breaking fiscal rules was not only tempting option due to negative rates, but also necessary to revive the economy and avert the threat of depletion of primary tool of the Central Bank - open market operations. The Japanese public debt ceiling stabilized in 2014, floating at about 236% of GDP.

Nikkei and Reuters reported the government is preparing a $ 120 billion spending package, which could increase to $230 billion if we include subsequent private sector spending. For comparison: In the US, a fiscal push of this size would be equal to $1 trillion.

The bids to cover ratio, which indicates demand for bonds, at the last JGB auction fell to its lowest level since 2016 on expectations that the price of bonds would decline - i.e. supply will rise.

The main conclusion from this news is more aggressive rhetoric of the Central Bank at the upcoming meetings, in particular in mid-December. If there is no surge in demand for defensive assets in the near future, we can expect USDJPY to go up.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.