January NFP: ADP Hiring Surprise Finds Little Support in ISM Data

World stock markets extended recovery on Thursday, buoyed by a positive Wall Street performance on Wednesday and positive economic updates in the US. China announced tariff cuts on a number of US products in an attempt to spur economic activity. This reinforced expectations that both sides will stick to their commitments and implement the trade deal despite the shock from coronavirus outbreak on Chinese demand.

MSCI, the broad index of Asian stocks, which exclude Japan, jumped 1.66%, while the Japanese Nikkei was also in green gaining 2.38%. Chinese stocks cheered the government’s step towards free trading, rising 1.97%.

European stocks extended their relief, the main Eurozone indices and US stock futures indices are trading in the green zone, thus increasing the odds that market optimism seen on Wednesday was not a merely technical correction, but the beginning of full-blown reversal that will drive weekly gains in the green zone.

China announced on Thursday that it would reduce tariffs on a number of US goods. The move should obviously boost imports and tame inflation/make cheaper some imported goods for end consumers and theoretically give a boost to consumption. Actually, China kills two birds with one stone as besides of strong economic rationale of the move, it is also a direct effort to implement the trade deal and pave the way for second phase negotiations.

January NFP

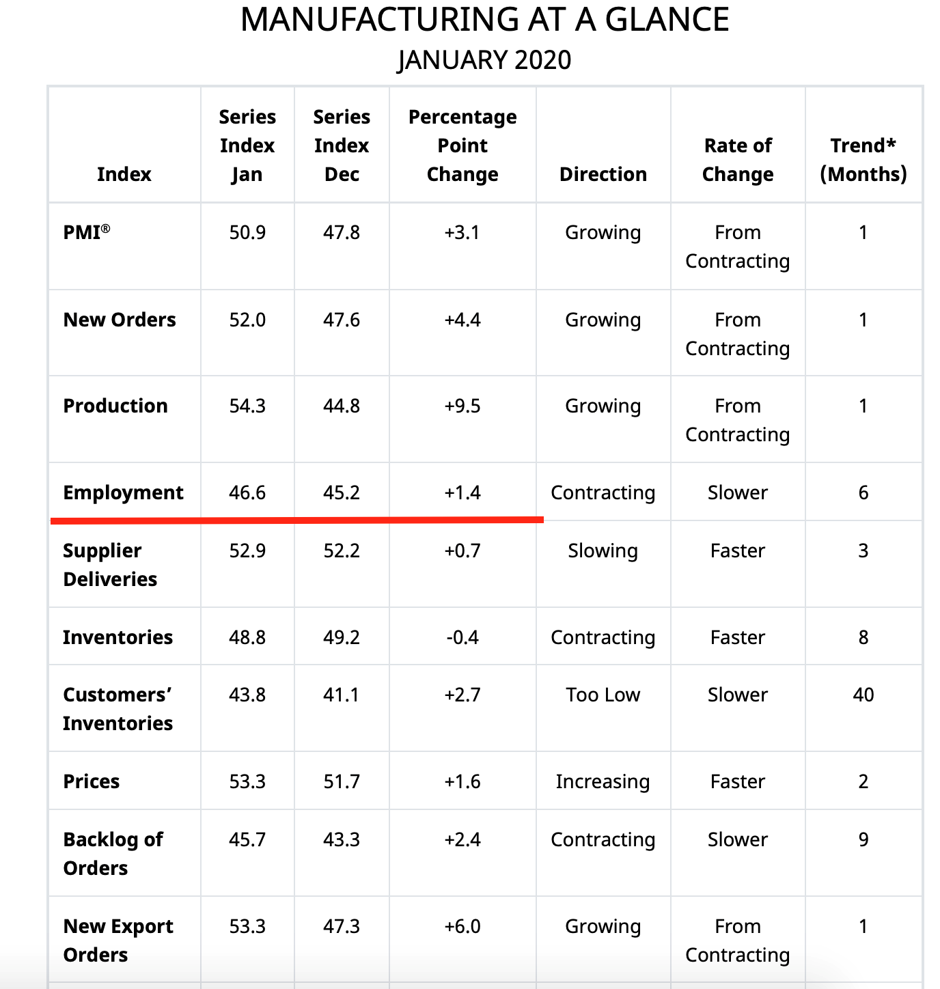

The report of private agency ADP was a big surprise on Wednesday. It showed that the number of new jobs in January could rise by whopping 291K. This is the biggest monthly gain since May 2015. The ISM report showed that activity in the US non-Mfg sector rose at faster pace last month, however, the employment component fell 1.7 points indicating a slowdown in the pace of hiring. Activity in the manufacturing sector expanded slightly in January beating the forecast (50.9 points against the forecast of 48.5 points), which was also an unexpected change in the US economic performance. The employment component made a positive input to the broad index, gaining 1.4 points.

The data on Wednesday showed that retail sales in the Eurozone grew significantly less than the forecast in December (1.3% against the forecast of 2.3%). Weak consumption growth and bleak prospects of the export sector due to the trade deal reduce the odds of the Eurozone economic recovery in the first quarter, while the number of positive economic surprises in the United States is growing, what possibly forms an advantage of the greenback in EURUSD. I would expect a bearish momentum on the NFP report on Friday with pair dropping below 1.10 and continuing to trade in the new range in the next week.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.