What Does High Inflation in the UK Tell us?

In the “club” of developed countries, an inflation rate which is persistently higher above the target level and, all the more, high inflationary expectations, are a rather unusual phenomenon. Structural changes that explain the long-term decline in inflation are nearly the same everywhere — an aging population, a decrease in long-term GDP growth rates, more even distribution of price power, a lack of “high inflation experience” among the young population (and, therefore, persistently low inflation expectations), etc. So, is it possible to consider that deviations from the norm are temporary?

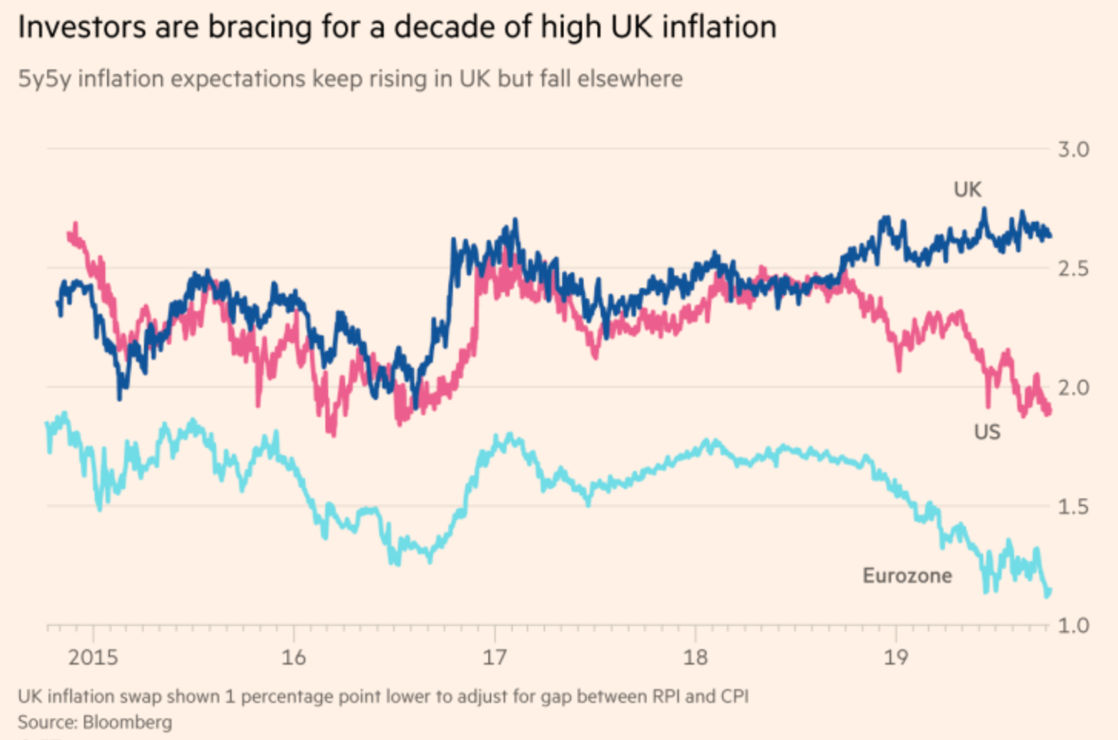

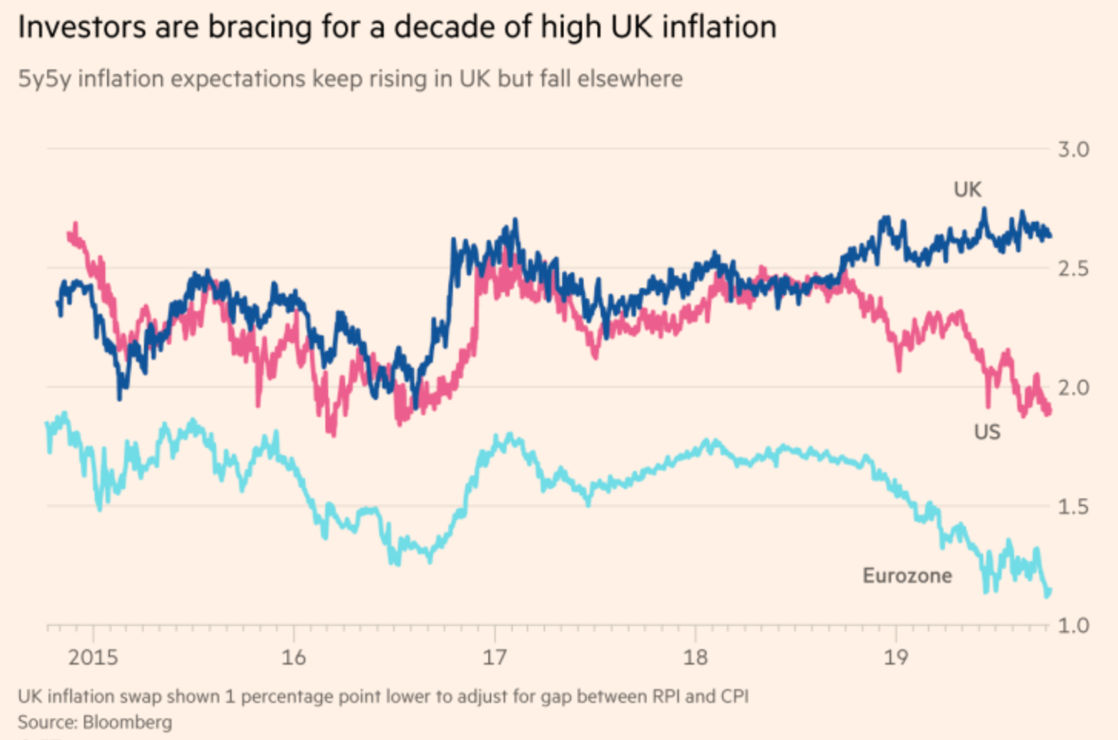

Market expectations for inflation in the US and the Eurozone have fallen sharply in recent months, contributing to a record rally in bonds. However, the landscape of the fixed income market in the UK is fundamentally different from other developed countries: investors price in inflation, significantly exceeding the Bank of England target value of 2% over the next decade and even later. This puts the Central Bank in an unusual position, where despite the slowdown in economic growth, the policy should instead focus on containing inflation rather than boosting it. The problem can be attributed to possible trade implications of Brexit (expectations of more expensive imports from the main trading partner), but there are other factors, for example, the unique needs of England pension funds.

Short-term inflation expectations can really be explained by the fears of Pound collapse in case of a hard Brexit, similar to one that happened after the referendum in 2016. This should lead to higher prices for imports and acceleration of inflation. However, it is clear that sharp exchange rate fluctuations can no longer be extended to long-term inflation expectations as the only factor of impact. “Hard divorce” with the EU implies weakening economic growth, and for a developed country this will inevitably lead to weak inflation in the long run. If we look at one of the popular metrics of long-term inflation expectations - “delayed” 5-year inflation expectations (5y5y swap rate), you can see that it is at 3.6% in UK - the highest level for 11 years. In other words, the market believes that after 5 years, 5-year inflation expectation will run at 3.6%.

Recall that the market estimate of inflation in the UK is based on the retail price index, and not on the CPI, which, as you know, is consistently higher than the latter. But even after adjustment, long-term inflation expectations are 2.7%. For comparison, in the Eurozone they recently fell to 1.1%.

A much more interesting explanation can be obtained by questioning the connection between inflation markets and true inflation expectations. The thing is that such instruments as inflationary swaps and inflation-indexed bonds are in great demand among many pension funds in the UK, which are required to index payments to pensioners in accordance with rising prices. With a short-term jump in inflation after the referendum, a “self-reinforcing” demand for hedging inflation risk could arise. As a result, a constant premium on protection against inflation could be formed in the market, and the true inflationary expectations have been probably distorted.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above article are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.