Greenback Strengthens Amid Surprising Producer Price Index Data

The US Dollar demonstrated resilience in Thursday's trading session, bolstered by a wave of positive economic data releases. Notably, the Producer Price Index (PPI) for February exceeded expectations, injecting fresh momentum into the Greenback. This unexpected surge in PPI figures has ignited speculation among traders regarding the Federal Reserve's interest rate policy, particularly regarding the timing of a potential rate cut.

The monthly Headline PPI surged from 0.3% to 0.6%, surpassing the forecast of 0.3% and catching many analysts off guard. Both the Headline and Core measures outpaced expectations, prompting a bullish sentiment towards the USD. Market participants are now reassessing the likelihood of an initial rate cut by the Federal Reserve, with concerns emerging that June may not witness such a move as previously anticipated.

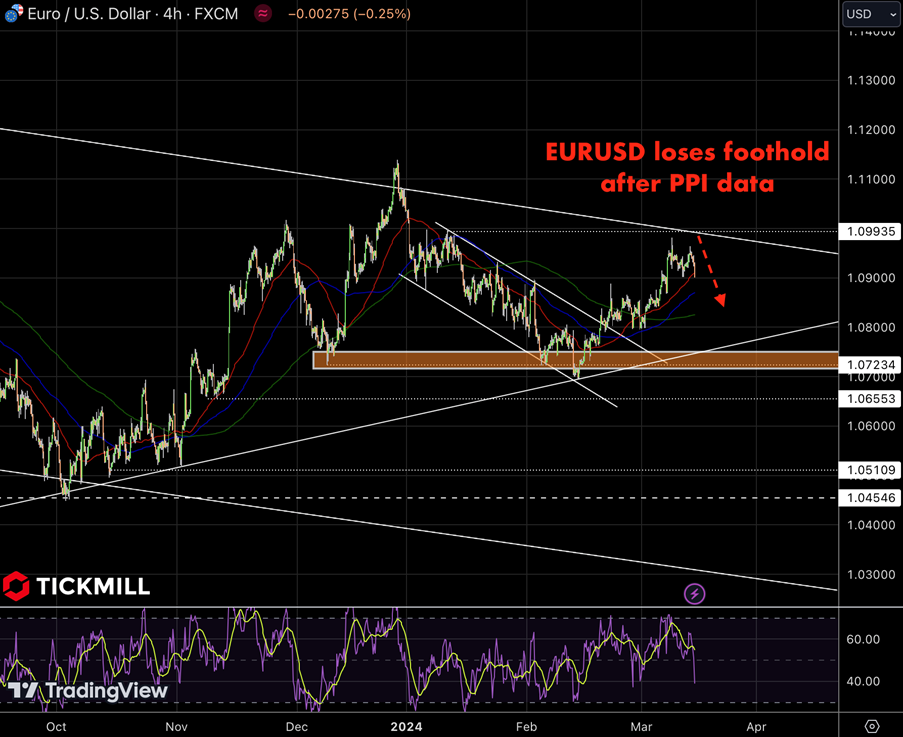

EURUSD went into decline on the news and taking into consideration that the recent high has been formed near the upper bound of the bearish corridor there is a risk that technical traders may interpret this as a signal that the price starts to pullback from the resistance and on the failed breakout attempt. This in turn may help EURUSD to gather bearish momentum:

Amidst the flurry of economic data releases, market participants eagerly await the Business Inventories for January, though expectations for significant market movements remain tempered. The US Dollar Index is currently on an upward trajectory, flirting with a breakthrough above 103.00, buoyed by the unexpected strength in PPI data. Attention now shifts towards key indicators such as Industrial Production and the University of Michigan numbers, slated for release on Friday, which are poised to influence market sentiment moving forward.

The Pound Sterling encountered downward pressure against the US Dollar during Thursday's early New York session, with the release of the United States Producer Price Index data exacerbating the decline. Investor risk appetite waned amidst concerns that persistent US PPI strength could delay anticipated interest rate reductions by the Federal Reserve. Currently, market sentiment leans towards a potential rate cut by the Fed in June, though evolving economic data dynamics may challenge this consensus in the coming months.

In contrast to the robust economic data emanating from the United States, the UK economy is exhibiting signs of recovery following a technical recession in the second half of 2023. While recent data indicates a return to growth, it remains premature to ascertain the depth of the recession and the extent of the economic rebound. The Office for Budget Responsibility forecasts a modest growth rate of 0.8% for the UK economy in 2024, underscoring the need for vigilance amidst ongoing economic uncertainties.

Technical perspective in GBPUSD is similar to the EURUSD one, PPI was a catalyst that triggered the wave of sell-off. The near-term target for the pair remains unchanged from the previous analysis - confluence of support and resistance lines near the 1.27 level:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.