FOMC Minutes: Markets Don’t Believe Powell Despite the Promises

Cautious optimism – this is the position of the Fed policymakers regarding their ability to keep last year’s promise and keep the rate in the current range (1.50 - 1.75%) until the end of the year, showed the Minutes of January meeting. Nevertheless, the policymakers recognized that the risks associated with an outbreak of coronavirus pose considerable threat to the outlook skewing it to the downside.

The minutes also showed that officials who decided unanimously to stand pat on policy settings expressed doubts that the inflation target of the central bank could be revised. In other words, the good old tools and methods of monetary policy remain in play, which have already gained some predictability among investors in terms of effects. Namely, the Fed “controls” the stock market because it keeps borrowing costs low. This is basically the tool to keep consumer spending decisions positive what outweighs the side effects of low rates. Trying to park capital in another place becomes less and less feasible because it’s basically nowhere to go.

The meeting participants generally believe that the distribution function of negative outcomes (risks) has changed in a positive direction since the last meeting. Then the phrase followed that the monetary policy settings will be in line with the demands of the economy “for a time”.

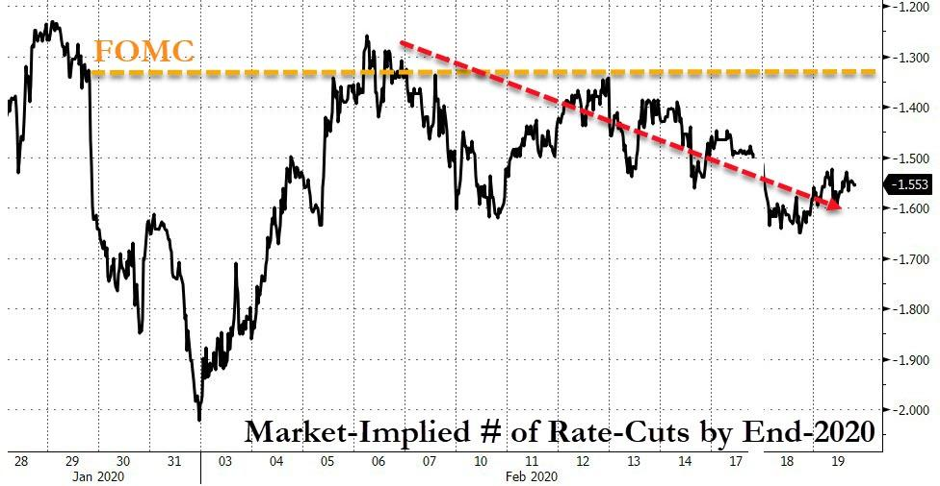

After lowering rates three times in a row last year, the Fed made it clear that it was no longer going to make concessions this year. However, the market does not think so:

The market prices in rate cuts by the end of 2020

On Monday, Apple announced a possible decrease in revenue due to the outbreak of the coronavirus disrupting its supply chain. China is in a hurry to lift restrictions in order to revive production activity as soon as possible, however, the recovery rate remains low, which in itself is destructive for the global economy due to the high level of globalization.

Fed Chairman Powell said last week that it’s too early to talk about how much a coronavirus outbreak will affect the US economy and whether it can affect the rate path.

This contradicts some economic data released after the Fed meeting. The Commerce Department said last week it saw consumer spending cuts in January. Business investment is also experiencing a deepening slowdown, and the US manufacturing sector, not having time to recover from a trade war, may again be hit.

Also, in the minutes of the meeting, Fed policymakers discussed how to deal with the growing balance sheet. Since last October, the Federal Reserve has been buying US treasury bills by about $ 60 billion per month to increase reserves in the banking system in response to a liquidity crisis in the REPO market.

Powell said the Fed will seek to begin cutting this amount sometime between April and June, when the level of reserves will be enough to keep borrowing costs stable.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.