Eurozone, UK PMIs: Weakness will feed into Q1 2020

Eurozone manufacturing sector reiterated that it is not ready yet to render support to the broad economy in the first quarter of 2020 - including December, activity fell for 11 consecutive months, and leading indicators indicated lingering weakness in early 2020, Markit showed on Thursday.

The index of production activity fell from 46.9 to 46.3 points in December, which nevertheless turned out to be better than the forecast of 45.9 points. The subcomponent of production, which has the largest weight in the broad indicator, fell from 47.4 to 46.1 points. The pace of the slump was the highest since 2012.

Although firms' expectations have changed in a positive direction, the hopes for a quick reversal in production wane as new orders continued to fall at one of the fastest rates in seven years. Raw material purchases declined, as did the demand for labor, showed the report.

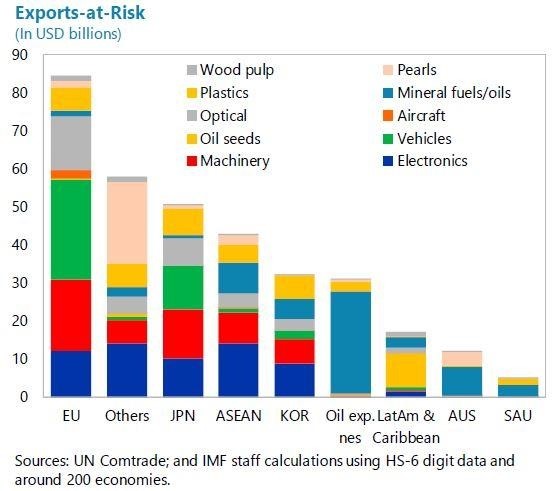

According to the “Phase One” trade agreement, China will have to gradually ramp up import of goods from the United States to reduce trade imbalance. That increase in imports, according to officials from the Trump administration, will amount to $100 billion a year, and will restore the market not only to American farmers, but will breathe a new life to the US manufacturing sector, which is a direct rival to European one. The loss of the European Union from the trade deal is estimated at about $90 billion:

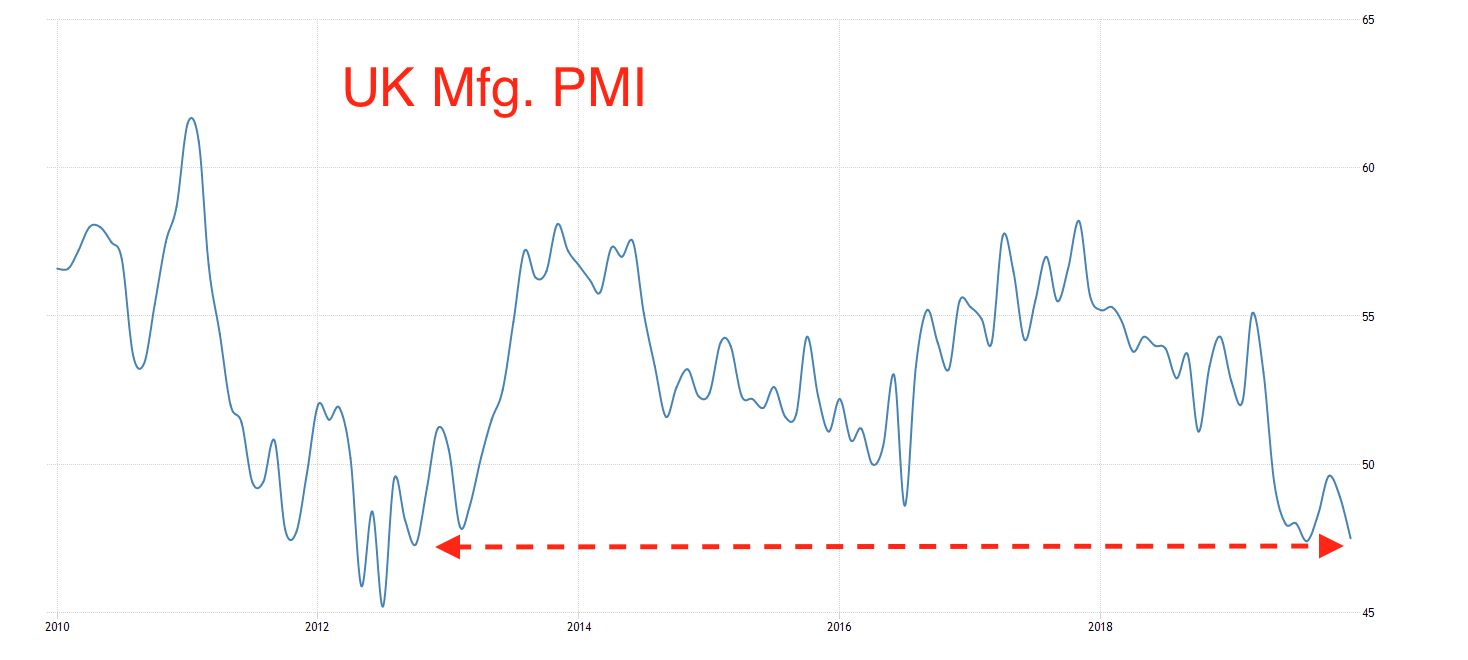

Factories in Britain also reduced output at the fastest pace since 2012. One of the main reasons (of a transitory nature) was a decrease in the demand of firms for inventories, as the risk of a disorderly exit of Britain from the EU decreased with Johnson's landslide victory. Until that moment, firms, in response to uncertainty, were increasing stocks, which gave rise to an unusual boost in UK production activity.

The output component fell from 49.1 in November to 45.6 in December, a record for the previous seven years. The broad index fell from 48.9 to 47.5 points, which is just above the preliminary value of 47.4 and marks a fall for the fourth consecutive month.

The survey was conducted from December 5 to 18, which covers the date of the December elections. Now, apparently, the risks of a no-deal exit have substantially decreased, and the political “tug of war” has come to naught. The country should leave the EU before January 31, and a transitional deal will help to avoid tariffs by the end of 2020 and give Johnson time to discuss the terms of a long-term deal with the EU.

It is safe to say that the macroeconomic background in the near future will take the biggest weight in Pound’s “exchange rate formula”. Today the British currency clearly showed that it is already less indifferent to production data than it was before - GBPUSD fell 20 pips after the release of the report.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.