Dollar Soars as Fed Announcement Looms; Pound Falters on Soft CPI Data

The US Dollar surged past the 104.00 threshold on Wednesday, exhibiting resilience after a brief setback following the Bank of Japan's deliberations on Tuesday. As market participants eagerly anticipate the forthcoming monetary policy statement from the US Federal Reserve, coupled with a speech by Fed Chairman Jerome Powell, all eyes are trained on the pivotal dot plot, poised to offer insights into the trajectory of potential interest rate adjustments for the year.

The spotlight on the US economy intensified as the Mortgage Bankers Association unveiled a dip of -1.6% in its weekly Applications Index, contrasting with the previous week's robust 7.1% surge. Notably, futures on the federal funds rate price in a staggering 99% expectation for a Fed pause in today's meeting, with merely a 1% chance of a rate cut.

Against this backdrop, the benchmark 10-year US Treasury Note witnessed marginal softness, trading around 4.30%, subtly lower than on Tuesday. The market sentiment remains cautiously optimistic, albeit braced for potential shifts based on the Fed's pronouncements later in the day.

The Dollar index (DXY) approached a key resistance area, which has been formed by the descending medium-term line where the price has seen multiple pullbacks since autumn last year. Both a bullish breakout and a bearish pullback will likely gain some momentum and ignite a short-term trend in their respective directions, presenting an opportunity for retail traders looking for solid technical signals:

In contrast, the Pound Sterling faced a notable downturn during Wednesday's London session, following the release of subdued CPI data for February. Both headline and core inflation figures decelerated, reaching 3.4% and 4.5% annually, respectively. This softer-than-expected inflationary outlook is anticipated to prompt BoE policymakers to contemplate interest rate cuts sooner than previously envisaged.

Traditionally, BoE policymakers accord greater significance to core inflation metrics in shaping their interest rate decisions. The underwhelming CPI data could embolden policymakers in their conviction that inflation will gradually converge towards the targeted 2% rate, thus warranting preemptive measures to stimulate economic momentum.

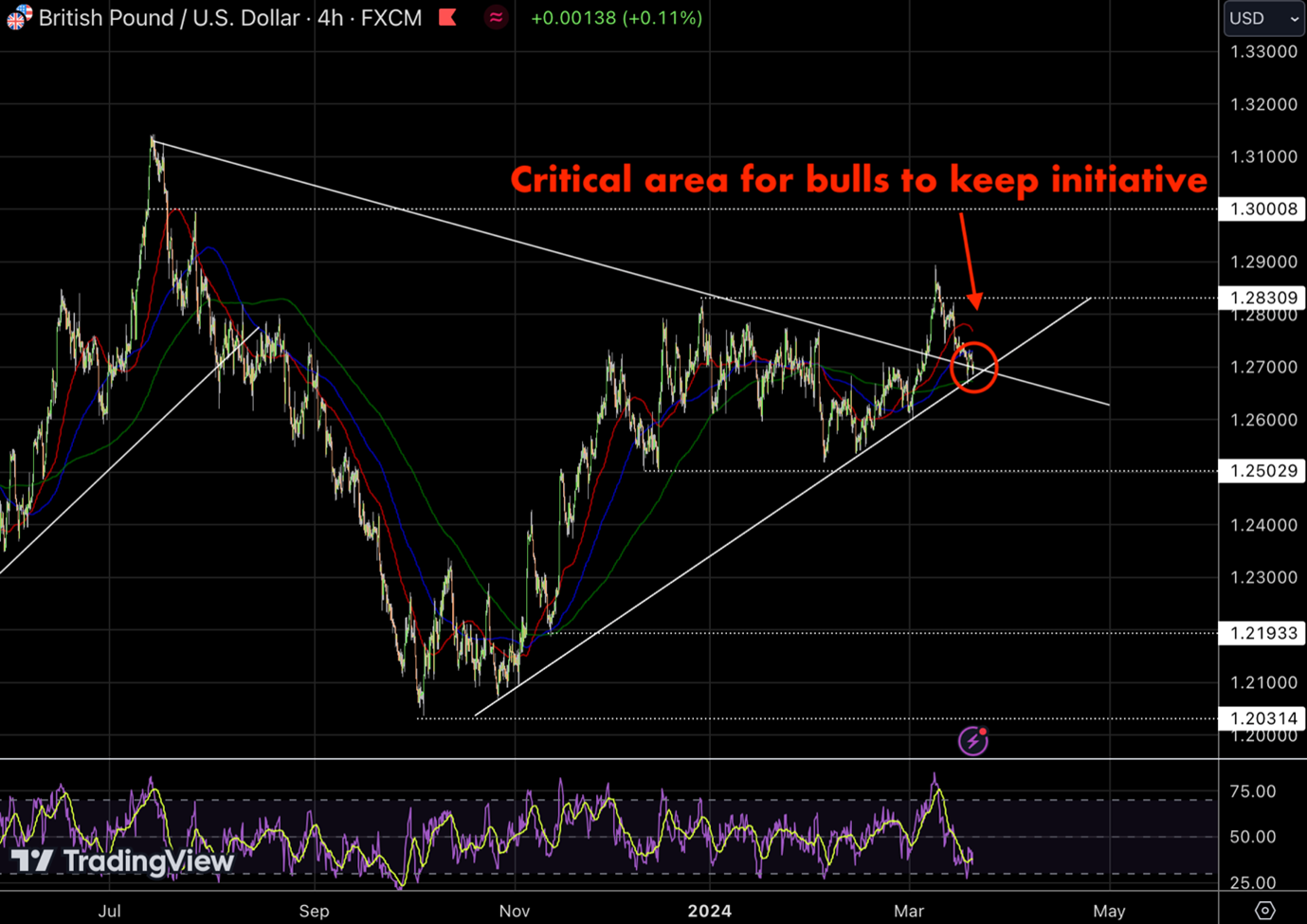

GBPUSD saw choppy price action near the critical demand line that defined a medium-term bullish trend in the pair. As in the case with the DXY price, GBPUSD appears to be at a crossroads too; both a breakdown and a bounce up will signal both sides of the market that they should double down in their activity on a strong technical signal that will clear some short-term uncertainty in the market:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.