Daily Market Outlook, September 28, 2023

Munnelly’s Market Commentary…

Asian equity markets with a mixed tone as traders evaluated the performance in the US leading into the end of the month and quarter. Global yields and oil prices saw further upside, impacting market sentiment. The Nikkei 225 underperformed, slipping below the 32k handle and facing headwinds from a mass ex-dividend day involving over 1,400 companies in Japan. Meanwhile, the Hang Seng and Shanghai Composite indices diverged, with the property sector facing challenges following the suspension of Evergrande shares and some of its units. However, the mainland market was buoyed by the People's Bank of China's liquidity injections and China's support pledges.

In Europe, attention turns to the release of September inflation estimates for Spain (3.2% vs 3.3% Exp) and Germany, with the Eurozone flash CPI estimate scheduled for Friday. Expectations pointed to a sharp decline in Eurozone headline CPI to 4.5%, the lowest in nearly two years, from 5.2% in August, driven by lower inflation in food, energy, and services. The data reinforced expectations that the European Central Bank's interest rates had likely peaked. The Eurozone economic confidence index for September was also on the agenda, with forecasts suggesting a drop to 92.0 from August's 93.3, marking the weakest level in nearly three years. Consumer confidence had already fallen for two consecutive months, and the decline was expected to extend to industrial and services confidence.

Stateside, the focus shifted to indicators for Q3 growth, with Q2 GDP growth expected to be revised slightly higher to 2.2% (annualised) from 2.1%. Attention was also on releases such as weekly jobless claims and pending home sales.

Central bank appearances included Fed Chair Powell and some ECB speakers, with BoE MPC member Greene participating in a panel discussion in Sweden. Greene had voted for a rate hike in the recent BoE meeting. Additionally, there will be several notable speeches from Fed voters Austan Goolsbee and Charles Cook, and 2024 voter Thomas Barkin. These speeches may provide insights into the Fed's economic outlook and monetary policy stance.

FX Positioning & Sentiment

Institutional FX month-end rebalancing models are anticipating an increased demand for USD as month-end flows come into play. Credit Agricole's model suggests that the strongest USD buy signal is against CAD. However, their corporate flow model points to EUR buying at the end of the month. Barclays' model indicates strong USD buying against all major FX pairs. The USD has been on the front foot against all major currencies throughout the week, and FX options have seen raised risk premiums due to concerns of further USD gains and increased volatility. Morgan Stanley's outlook includes a projection of the DXY eventually reaching 1.0800 and EUR/USD dropping to 1.0300. These models and analyses reflect the ongoing dynamics in the foreign exchange market as traders assess various factors influencing currency movements.

CFTC Data As Of 26-09-23

During September 20-26, the USD index saw a gain of 1.01%, indicating the potential growth of USD long positions. In contrast, the EUR/USD pair declined by 1.01% during the same period, suggesting a likely further unwinding of EUR long positions, with Friday's data expected to provide more insights into this trend.

The market's view of the Federal Reserve keeping interest rates higher for longer has put the 2023 low for EUR/USD at 1.0482 in focus. The USD/JPY pair saw a gain of 0.81% in the reporting period, indicating a potential growth in yen short positions. Traders were closely watching the key level of 150, with the continued dovish stance of the Bank of Japan (BoJ) keeping the USD bid. Bullish traders have their sights set on 150, with the 2022 high at 151.94 serving as a potential target.

GBP/USD pair declined by 1.92% in the reporting period, weighed down by the Bank of England's dovish lean after the recent 5-4 rate hold. The interest rate profile (IRPR) indicated the possibility of just one more BoE rate hike in 2024, signalling a decrease from the previously expected peak rate of 6.5%.

In the commodity-centric currency space, the AUD/USD pair was down by 0.91%, while the USD/CAD pair gained 0.52%. The less dovish stance of the Federal Reserve and concerns related to China weighed on these currencies. (Source Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0530-35 (424M), 1.0585 (468M), 1.0600 (593M), 1.0665-75 (1.1BLN)

USD/CHF: 0.8990 (759M) . EUR/GBP: 0.8650 (431M)

GBP/USD: 1.2000 (1.1BLN), 1.2100 (235M), 1.2200 (1.5BLN)

AUD/USD: 0.6350 (337M), 0.6475 (360M), 0.6500 (450M)

NZD/USD: 0.5940 (258M)

USD/CAD: 1.3450 (741M), 1.3465 (250M), 1.3530-35 (620M)

USD/JPY: 146.60 (2BLN), 147.00 (516M), 147.70 (974M), 148.00 (424M)

148.80 (517M), 149.70 (427M), 150.00-05 (594M)

Overnight Newswire Updates of Note

JPMorgan ‘Options Whale’ Worries Resurface As Stocks Extend Drop

WH: US Economy Facing Headwinds From Possible Government Shutdown

Australian Retail Sales Cool, Boosting Case To Extend Rate Pause

China Risk Growing, Say 60% Of Japan's Corporate Heads - Nikkei Poll

Property Fallout To Continue In China Despite Modest Policy Easing - Fitch

Italy’s Fiscal Deficit Predicted To Hit 5.3% Of GDP This Year

Dollar Sticks Near 10-Month High, Keeping Heat On Yen

Japan 20-Year Bond Yield Rises To Highest Since 2014

Bitcoin Refuge Appeal Touted Again As US Shutdown Prospects Rise

WTI Oil Hits $95/Bbl For The First Time Since Aug. 2022

Japan's Nikkei Hits One-Month Low On Fed's Higher-For-Longer Rate Woes

Global Market Cap Drops Under $100tn On China Jitters, Rising Rates

China’s Top Developers Lost Close To $3bn Due To Weakened Renminbi

Evergrande Suspends Trading In Hong Kong, Along With Units

Micron Widens Loss Forecast, Shares Drop; Chipmaker Hopes To Supply Nvidia

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4300

Above 4310 opens 4330

Primary resistance is 4400

Primary objective is 4225

20 Day VWAP bearish, 5 Day VWAP bearish

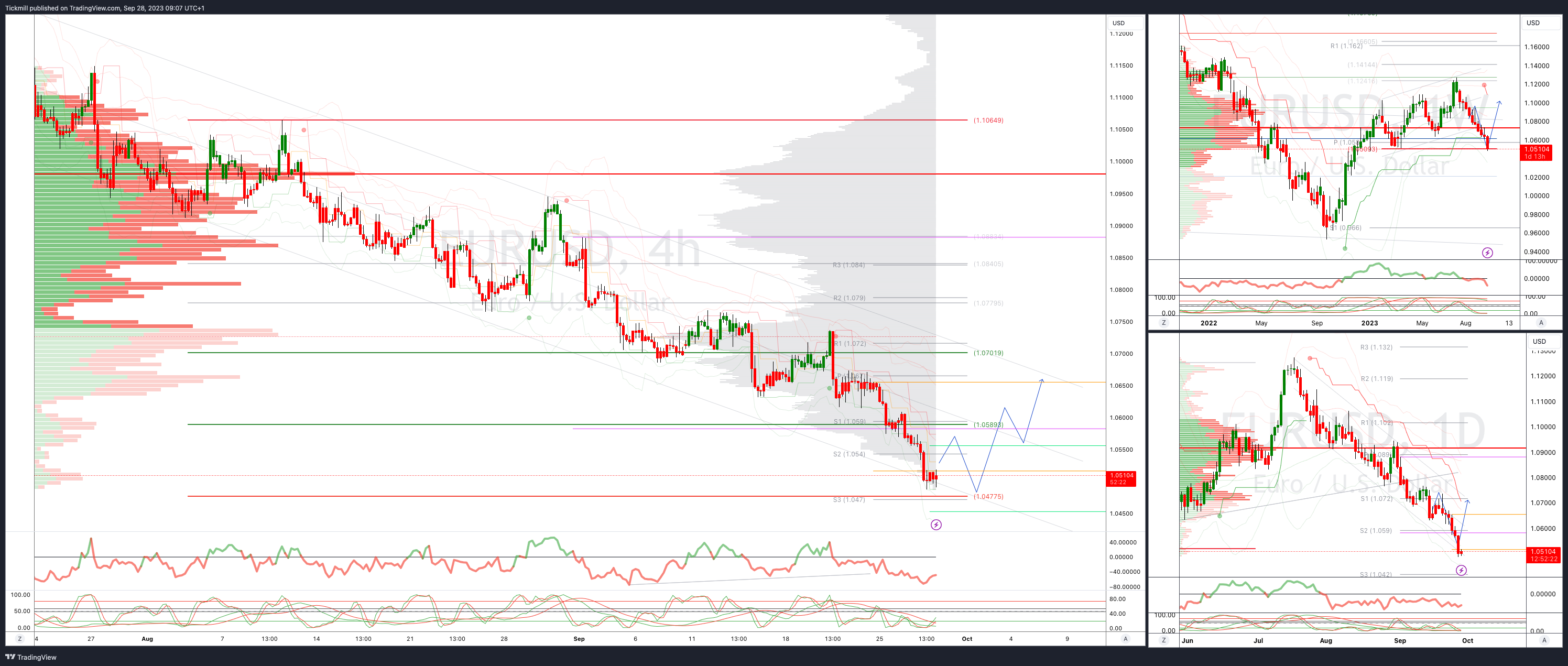

EURUSD Bias: Bullish Above Bearish Below 1.0610

Above 1.06opens 1.0650

Primary resistance is 1.0760

Primary objective is 1.0477

20 Day VWAP bearish, 5 Day VWAP bearish

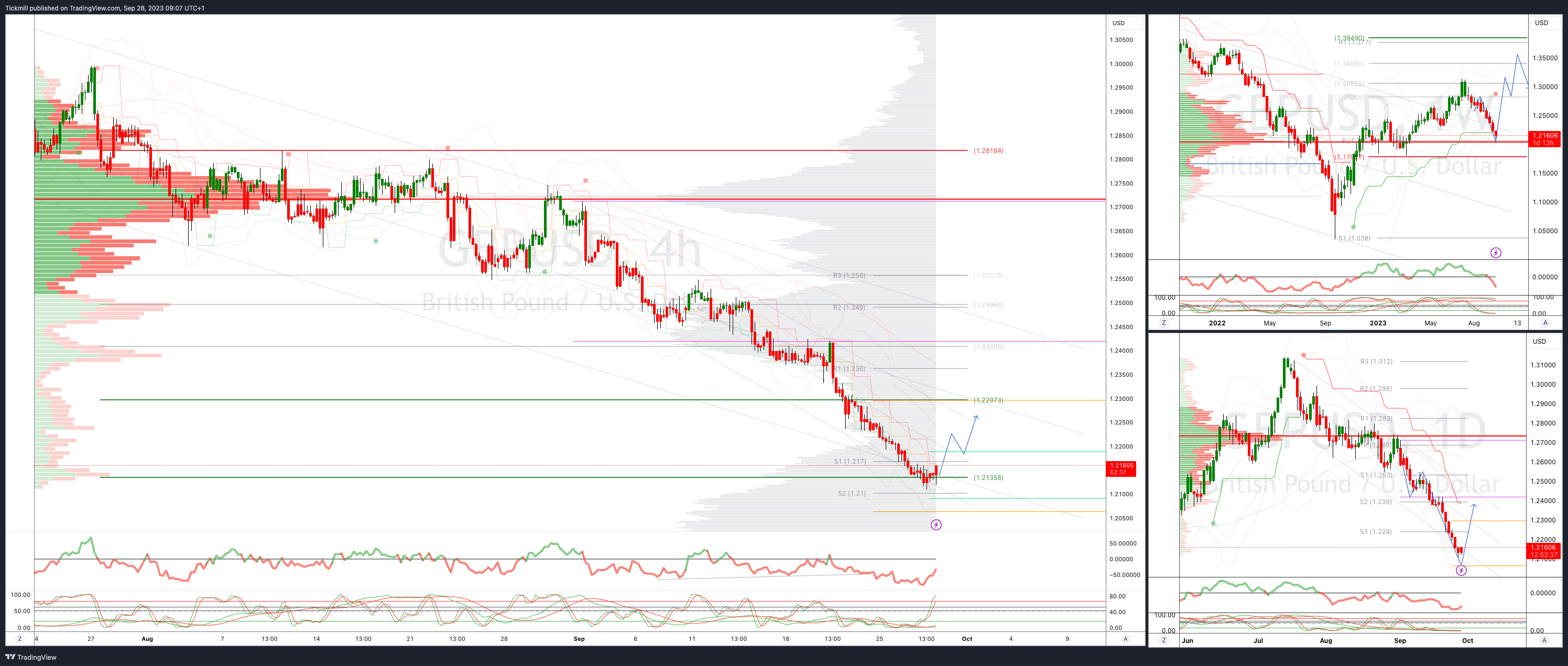

GBPUSD Bias: Bullish Above Bearish Below 1.22

Above 1.22opens 1.2250

Primary resistance is 1.2450

Primary objective 1.2060

20 Day VWAP bearish, 5 Day VWAP bearish

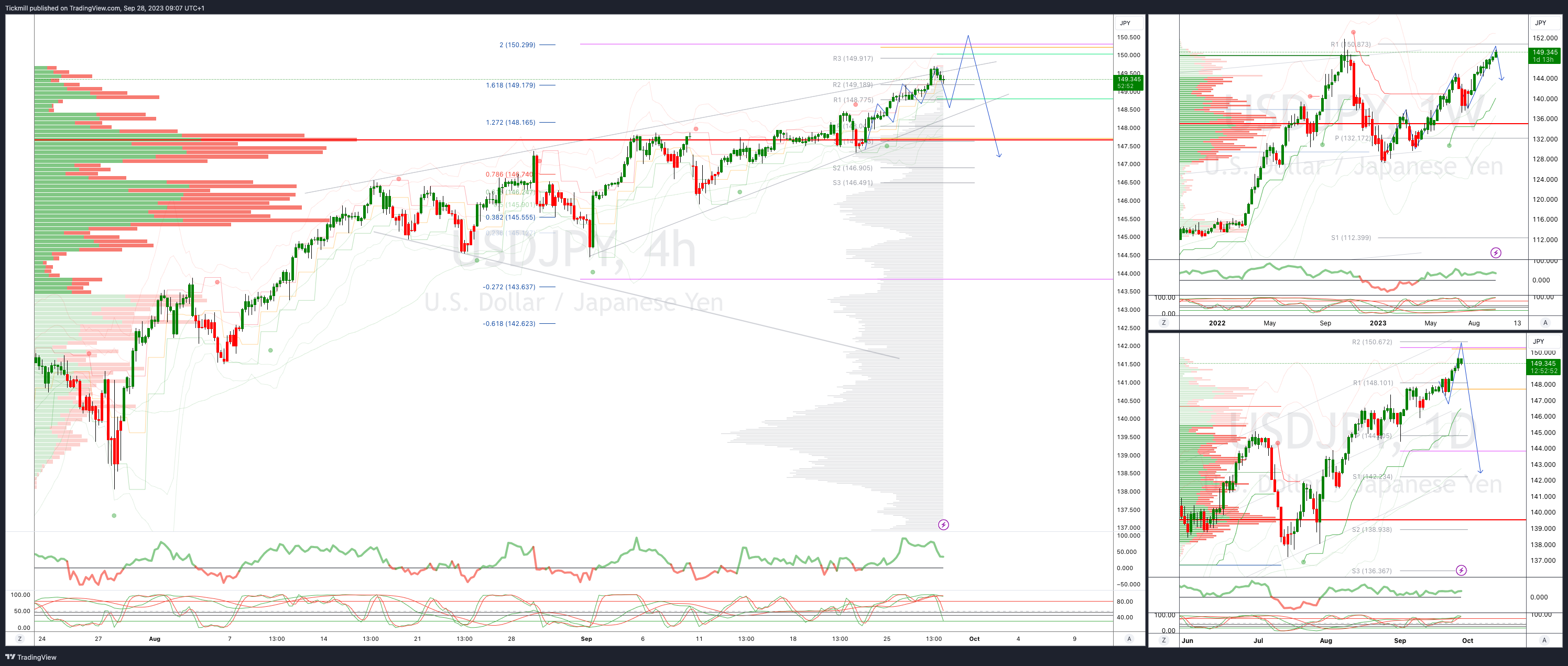

USDJPY Bias: Bullish Above Bearish Below 148.50

Below 148 opens 147.50

Primary support 144.50

Primary objective is 150

20 Day VWAP bullish, 5 Day VWAP bullish

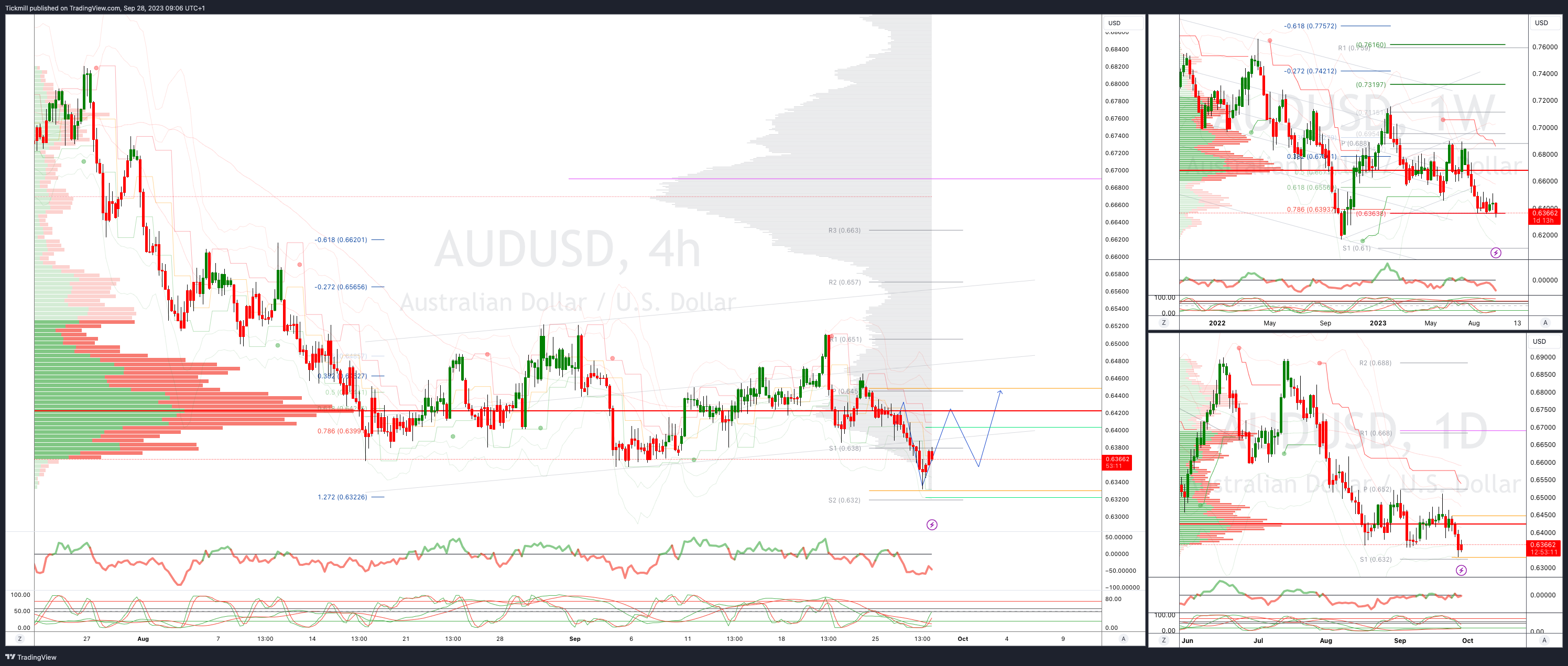

AUDUSD Bias: Bullish Above Bearish Below .6450

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6320

20 Day VWAP bearish, 5 Day VWAP bearish

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28200 opens 30000

Primary resistance is 28175

Primary objective is 23300

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!