Daily Market Outlook, September 25, 2023

Munnelly’s Market Commentary…

Asian equity markets traded with a mixed tone, mostly leaning towards the negative side due to a lack of significant catalysts over the weekend and concerns about Chinese developers. The Nikkei 225 outperformed, driven by hopes of stimulus measures in Japan. The government is considering offering tax benefits to firms producing semiconductors and storage batteries, as well as providing support in high-entry-risk areas for private-sector companies. They also plan to boost take-home pay for part-time workers. In contrast, the Hang Seng and Shanghai Composite faced pressure due to concerns related to Chinese developers. Evergrande shares plummeted by more than 20% after cancelling a creditor meeting and scrapping its $35 billion debt restructuring plan. The company cited an investigation into its subsidiary Hengda Real Estate as the reason for being unable to issue new debt. Additionally, China Aoyuan shares dropped over 70% upon resuming trade after a 17-month hiatus.

On the economic front, recent data releases showed both the UK and Eurozone Composite PMIs registering readings below the 50-mark, indicating recessionary conditions in both economies. The Eurozone has experienced this for the fourth consecutive month, and regional reports for France and Germany also paint a bleak picture of their economies. Today's IFO survey for Germany is expected to show a drop in the headline measure to 85.2 in September, primarily due to a fall in the current activity component. In the UK, there are no major data releases today, but the CBI retail sales report for September will be of interest. The report will provide insights into whether the weak underlying retail trends observed in August continued into the final month of the quarter.

Statside, the Chicago Fed activity index for August and the Dallas Fed manufacturing survey for September will offer insights into local economic trends. Market participants will also pay attention to speeches by the US Fed's Kashkari and the ECB's Villeroy, as they may provide confirmation that interest rates in both economies have either peaked or are very close to their peak. ECB's Villeroy indicated over the weekend that the recent rise in oil prices would not impact the underlying disinflation, suggesting that euro rates had peaked. Investors are closely monitoring the situation regarding a potential government shutdown in the United States. GOP Representative Graves has indicated that Republicans are contemplating a stopgap government funding measure that could span anywhere from 14 to 60 days. Graves emphasised the importance of avoiding a funding lapse, characterising it as a mistake. In addition, Graves mentioned that House Republicans are advancing with four appropriations bills in the coming week. However, with just seven days remaining until government funding expires, lawmakers may need to pass a short-term measure to prevent a shutdown. Lawmakers have cautioned that the likelihood of a government shutdown is increasing as hopes for a last-minute compromise diminish.

FX Positioning & Sentiment

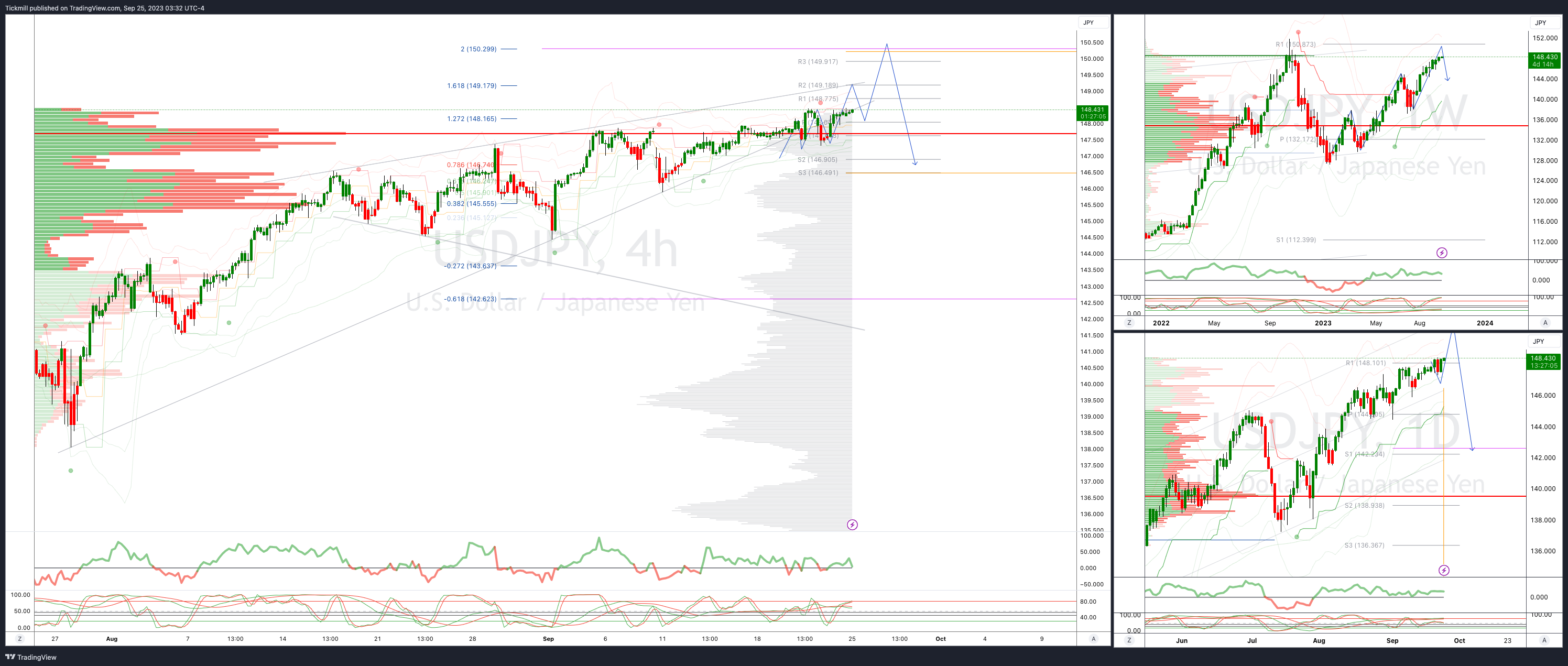

The week begins with a cautious tone in the USD/JPY market as traders remain watchful for potential intervention by Japan. The pair had experienced a 0.55% increase on Friday following a dovish Bank of Japan (BOJ) statement. USD/JPY is expected to stay bid on dips due to the BOJ's commitment to maintaining an ultra-loose monetary policy and its dovish guidance. This is in contrast to the higher-for-longer interest rate stance of the Federal Reserve, which has resulted in a widening interest rate differential between the U.S. and Japan. Traders are closely monitoring the situation for any signs of verbal or actual intervention by Japan in the currency market. This vigilance is driven by the desire to prevent excessive yen strength, which can negatively impact Japanese exports and economic growth.

CFTC Data As Of 22-09-23

USD net spec short flips to long $4.567 in Sept 13-19 period; $IDX +0.51%

EUR$ -0.67% in Sep 13-19 period, specs -11,099 contract, now +101,981

Hawkish Fed posturing at Fed hold Wednesday pushed EUR lower in current period

$JPY +0.55%, specs -2,906 contract as pair hovers near 2023 highs

Dogfight b/w bulls & bears as longs profit, new longs eye US-JY yield diffs

GBP$ -0.87% in period, specs -12,491 contracts on less-hawkish BoE rate view

Weak BoE data, recent hold hints at further GBP weakness

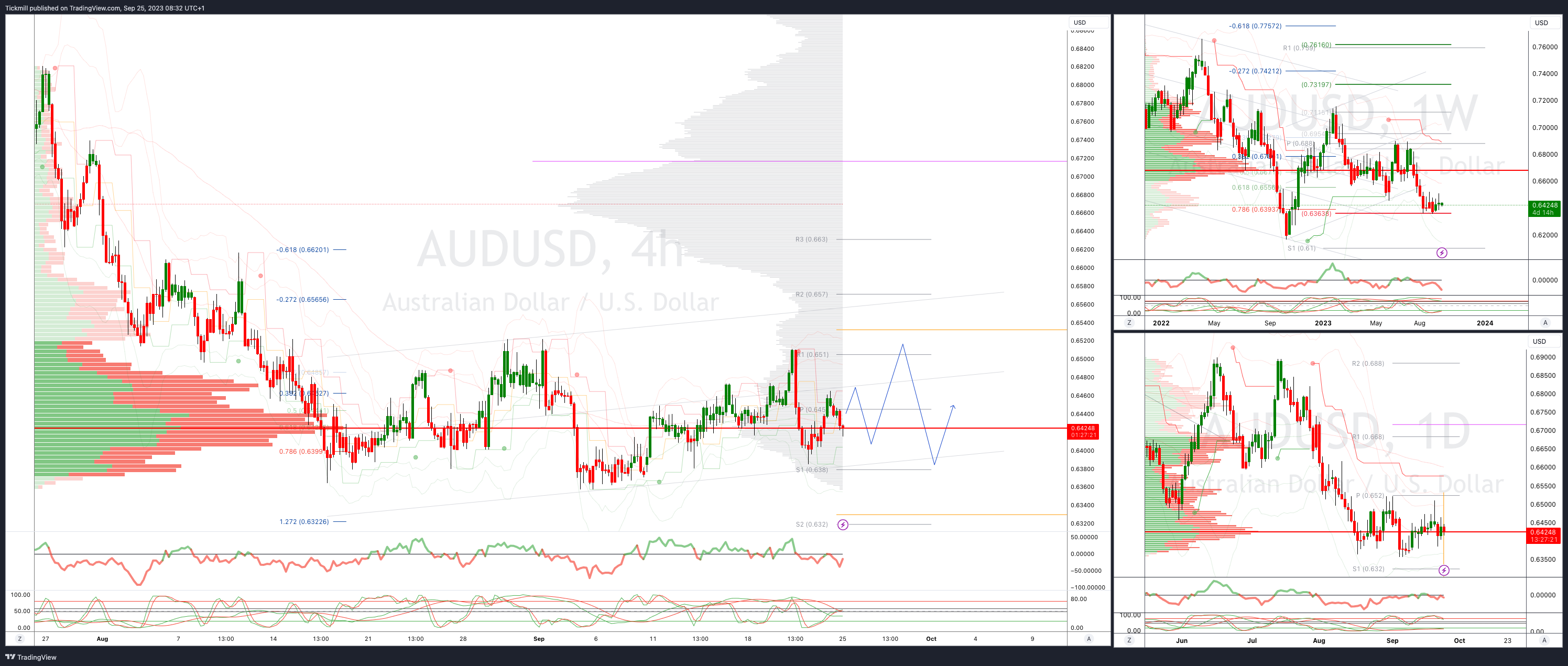

AUD$ (+0.54%), $CAD (-0.9%) sold aggressively despite higher commodity prices

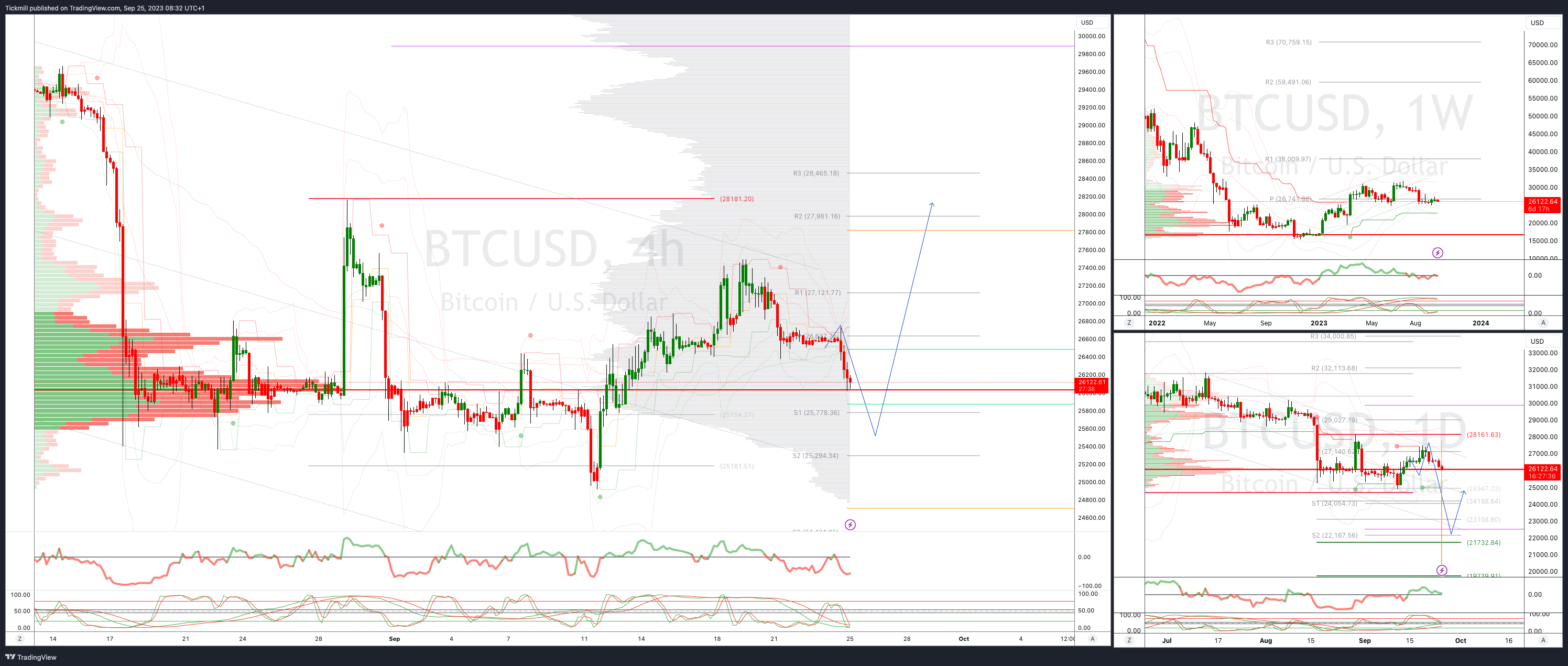

BTC +4.29% in period, specs -635 contracts; higher Fed rate musing stir long unwind (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0540-45 (1BLN), 1.0600 (375M), 1.0650 (250M), 1.0670 (307M)

1.0690-1.0700 (744M), 1.0710 (321M), 1.0725 (919M), 1.0750 (487M)

1.0790 (2.1-BLN).

GBP/USD: 1.2170 (360M), 1.2275 (545M), 1.2300 (203M), 1.2335 (462M)

AUD/USD: 0.6400 (881M), 0.6485 (417M). AUD/NZD: 1.0860 (556M)

USD/CAD: 1.3400-05 (784M), 1.3425 (565M), 1.3470 (556M)

USD/JPY: 147.00 (1.3BLN), 148.50 (236M), 149.00 (642M), 150.00 (680M)

USD/CHF: 0.9050 (618M). EUR/NOK: 11.40 (591M)

Overnight Newswire Updates of Note

Asian Shares Subdued After Brutal Central Bank Week

Lawmakers Warn That US Is Heading For Shutdown As Budget Talks Stall

Hollywood Writers Reach Agreement With Studios, Streamers To End Strike

ECB’s Villeroy Says Fuel Jolt Won’t Affect 2% Inflation In 2025

S&P: APAC Showing Resilient Growth Amid Slowdown In China

Australia Warns Of Impact If China Suffers Sharper Slowdown

Japan To Boost Take-Home Pay For Part Time Workers, Yomiuri Says

Italy Offers Banks Get-Out Clause To Controversial Windfall Tax

Sliding Yen Stokes Intervention Threat; Dollar Reigns

Yen Intervention Watch Redoubles After Fed, BoJ Meetings

China’s Economic Rebound Will Support The Yuan - CSJ

Hedge Funds Rush To Unwind Bets Against Gilts

Oil Holds Rally As Hedge Funds Join Increasingly Bullish Bets

Asian Shares Subdued Monday After Brutal Central Bank Week

China Developer Slump Deepens To $55 Billion As Debt Woes Mount

Qantas Travel Demand Remains Strong, Fuel Price Up 30% Since May

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4355

Above 4360 opens 4385

Primary resistance is 4465

Primary objective is 4266

20 Day VWAP bullish, 5 Day VWAP bearish

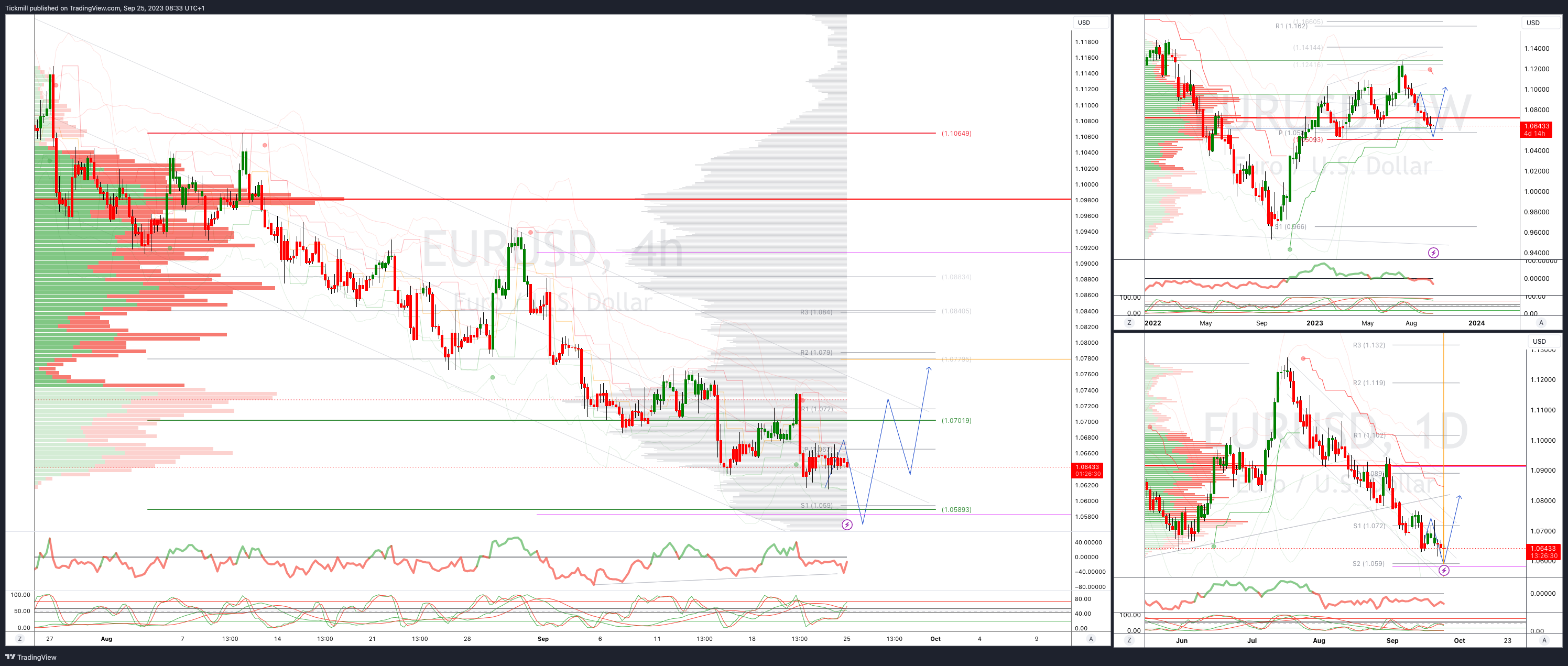

EURUSD Bias: Bullish Above Bearish Below 1.0730

Above 1.08 opens 1.0910

Primary resistance is 1.1066

Primary objective is 1.06

20 Day VWAP bearish, 5 Day VWAP bearish

GBPUSD Bias: Bullish Above Bearish Below 1.2300

Above 1.2350 opens 1.2450

Primary resistance is 1.2750

Primary objective 1.22

20 Day VWAP bearish, 5 Day VWAP bearish

USDJPY Bias: Bullish Above Bearish Below 147.50

Below 147 opens 146.40

Primary support 144.50

Primary objective is 150

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish Below .6450

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6320

20 Day VWAP bearish, 5 Day VWAP bullish

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28200 opens 30000

Primary resistance is 28175

Primary objective is 23300

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!