Daily Market Outlook, October 9, 2023

Munnelly’s Market Commentary…

Asian equity markets mostly traded lower in quiet markets, with concerns about geopolitical tensions and a surprise multi-front attack by Hamas on Israel weighing on sentiment. The conflict led to a flight to safety, boosting T-note futures and gold prices. Oil prices also surged amid heightened geopolitical risks, with reports suggesting Iranian security officials were involved in planning Hamas's attack on Israel. However, trading activity was subdued due to holiday closures in Japan, South Korea, Taiwan, and disruptions caused by a typhoon in Hong Kong.

On the economic front, the release of the monthly US labor market report on Friday showed a robust increase in nonfarm payrolls in September, driving the yield on the benchmark US 10-year Treasury back towards a 16-year high of 4.90%. This led to speculation about whether the Federal Reserve would proceed with further tightening of monetary policy at their next update in November. Some debate emerged about whether the sharp rise in Treasury yields might make policymakers more cautious about additional rate hikes.

Looking ahead, the focus is on this week's US Consumer Price Index (CPI) report, which is expected to play a crucial role in the Fed's decision-making process in November. Comments from Federal Reserve officials Barr, Logan, and Jefferson, all voting members this year, could influence market expectations regarding a November rate hike. Note it is a public holiday Stateside for Columbus day celebrations so expect reduced volumes and participation which may exacerbate near term market movements adding to volatility.

In terms of the economic data docket, the Eurozone Sentix investor confidence survey for October is the primary release scheduled for the day. Additionally, several ECB members, including Guindos, Centeno, de Cos, and in-coming member Cipollone, are scheduled to speak. In the UK, Catherine Mann, known for her hawkish stance on the Bank of England's MPC, will participate in a panel discussion at the National Association for Business Economics annual meeting, where her comments on the necessity of further rate hikes in the UK will be closely watched. Mann dissented from the majority decision to leave rates unchanged at the September meeting, advocating for another quarter-point increase.

FX Positioning & Sentiment

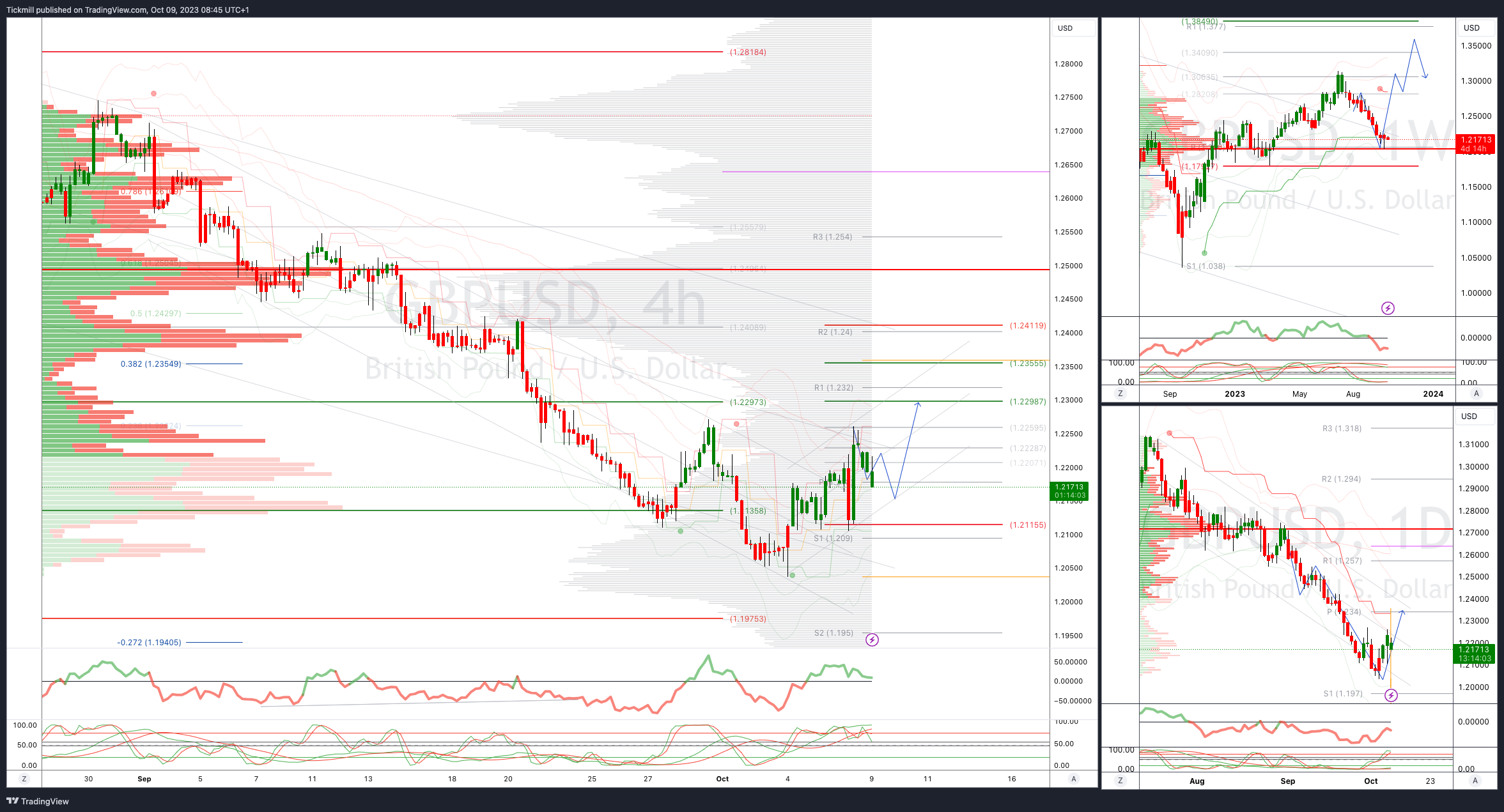

Speculators have shifted to a net short position on the British Pound (GBP) for the first time since April, according to data from the Commodity Futures Trading Commission (CFTC) for the week ending October 3. This change in sentiment follows a sharp contraction in net long GBP positions in the week ending September 26, which coincided with the Bank of England's (BoE) decision to hold interest rates. The GBP hit a 29-week low of 1.2039 on October 4 before recovering slightly as UK services PMI data was revised upward. Some analysts suggest that the GBP may regain strength once speculators are short, potentially leading to a short squeeze and a rebound in the currency's value.

CFTC Data As Of 3-10-23

EUR net spec long falls to 78,943 in week to Tues from 98,399

Smallest EUR long since October

JPY short increases to 113,988 contracts from 109,512

AUD short 81,987 versus 86,815 previous week

GBP flips to short 6,680 from long of 15,669

First sterling short since April

CHF short jumps to 16,742 -- biggest since November -- from 9,115. (Source Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0500 (679M), 1.0550 (1.4BLN), 1.0585 (892M), 1.0600 (1.8BLN)

USD/CHF: 0.9200 (250M). EUR/GBP: 0.8550 (200M), 0.8755 (280M), 0.8800 (893M)

EUR/SEK: 11.50 (258M)

GBP/USD: 1.2100 (1.1BLN), 1.2150 (613M), 1.2215-25 (686M) , 1.2375 (558M)

AUD/USD: 0.6350 (200M), 0.6415-25 (360M). AUD/NZD: 1.0860 (522M)

USD/JPY: 148.00-10 (550M), 148.25 (735M), 148.50 (350M), 149.00 (280M)

149.15 (355M), 149.55 (274M), 149.75 (309M), 150.00 (745M)

Overnight Newswire Updates of Note

Israel has retaliated after Hamas attacks, and the death toll in the conflict has passed 1,100.

The Middle East conflict is adding new risks to the global economic outlook.

Oil prices jumped more than $4 as violence in the Middle East rattled markets.

Federal Reserve's Bowman says it will likely be appropriate to raise rates again.

The Federal Reserve's Mester states that strong jobs data do not change the underlying view on hiring.

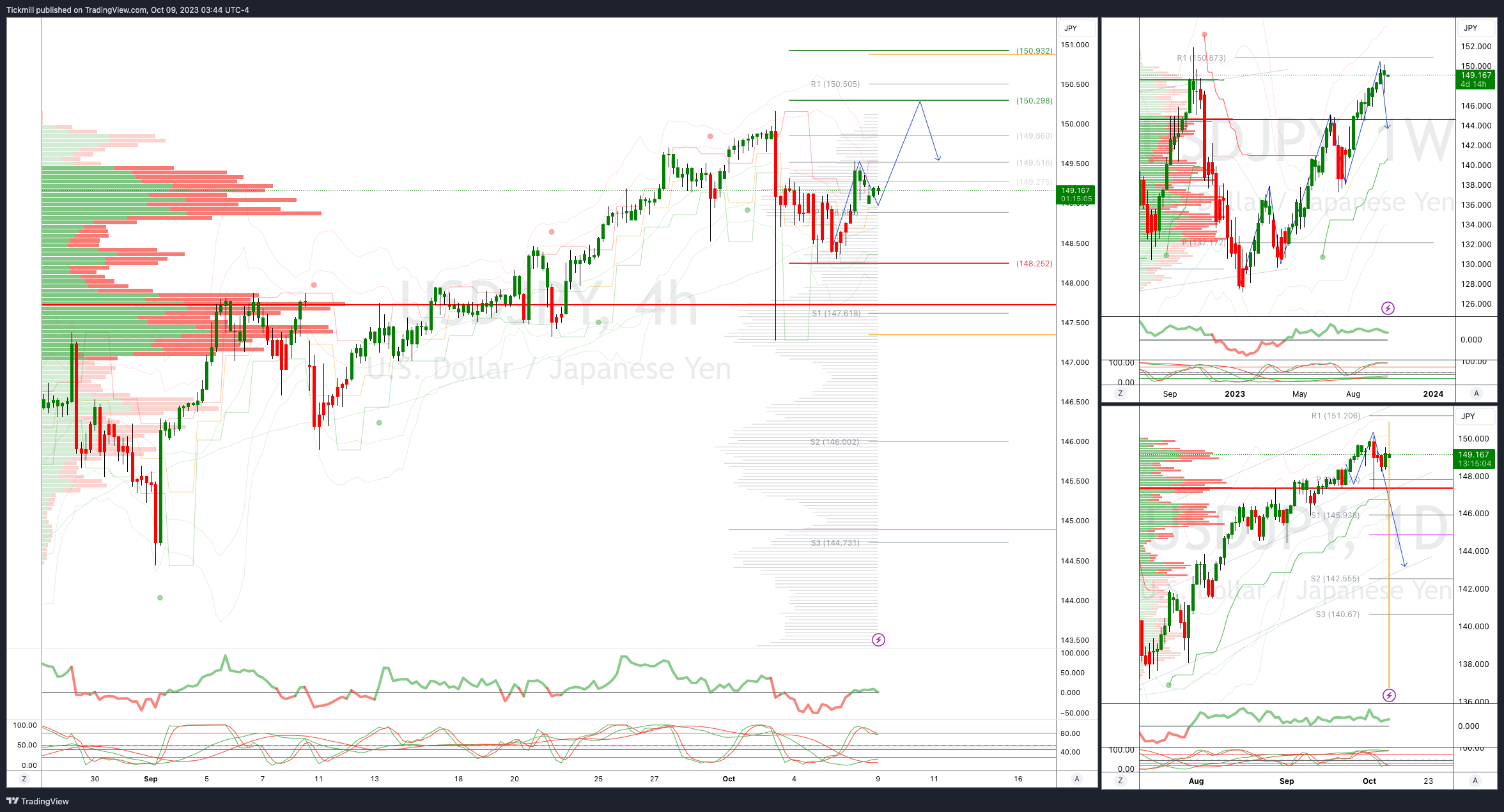

Japan is unlikely to intervene to reverse the yen's downtrend, according to a former top FX diplomat.

Chinese developer Country Garden faces a fresh offshore payments deadline.

US senators have met with China's top diplomat, Wang Yi, according to state media.

ECB's Lagarde expresses confidence over the 2% inflation target and Europe's winter gas situation.

Far-right and conservative parties have gained ground in German votes, dealing a blow to Scholz's government.

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

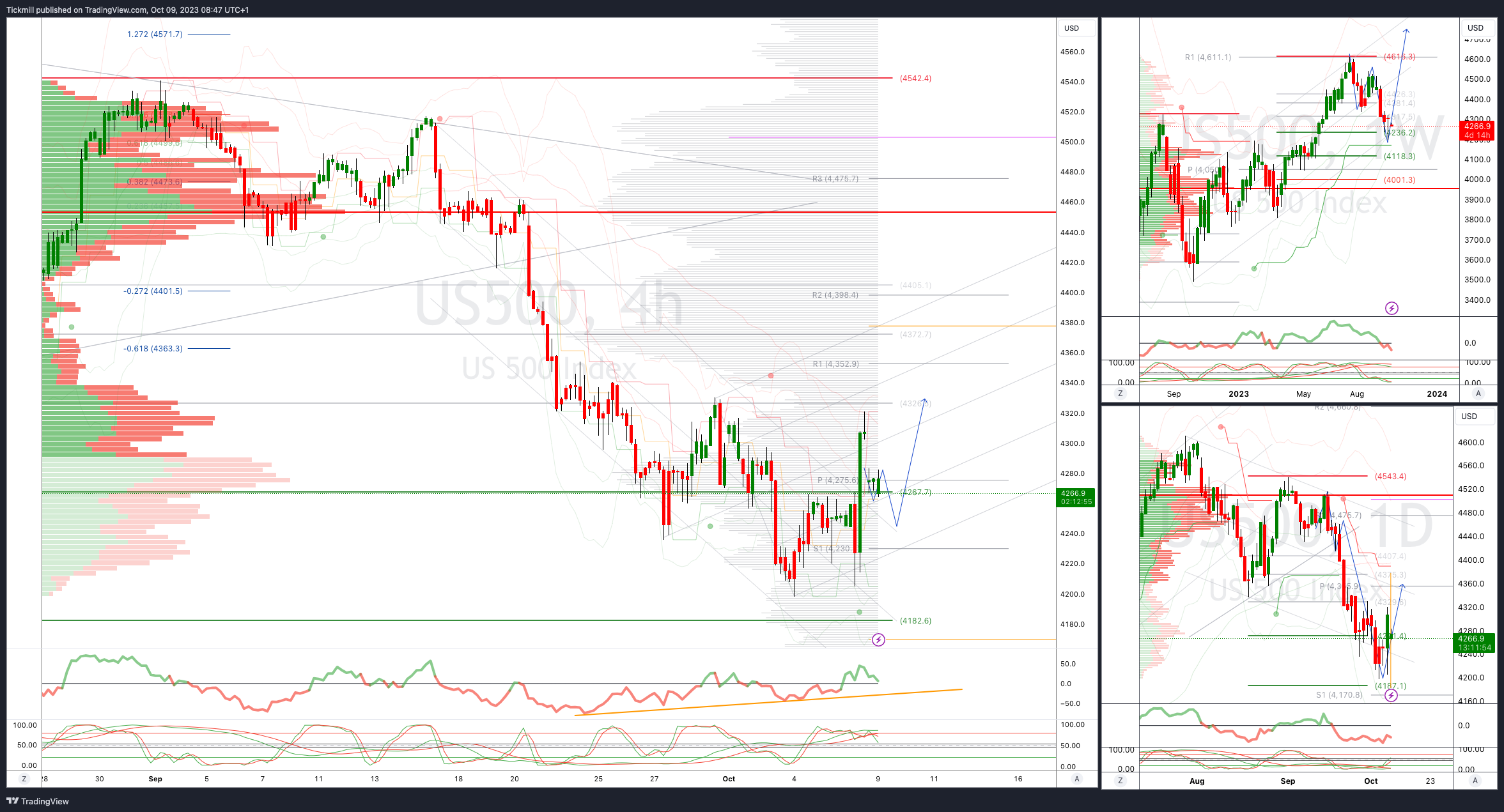

SP500 Bias: Bullish Above Bearish Below 4250

Above 4280 opens 4330

Primary resistance is 4400

Primary objective is 4380

20 Day VWAP bearish, 5 Day VWAP bullish

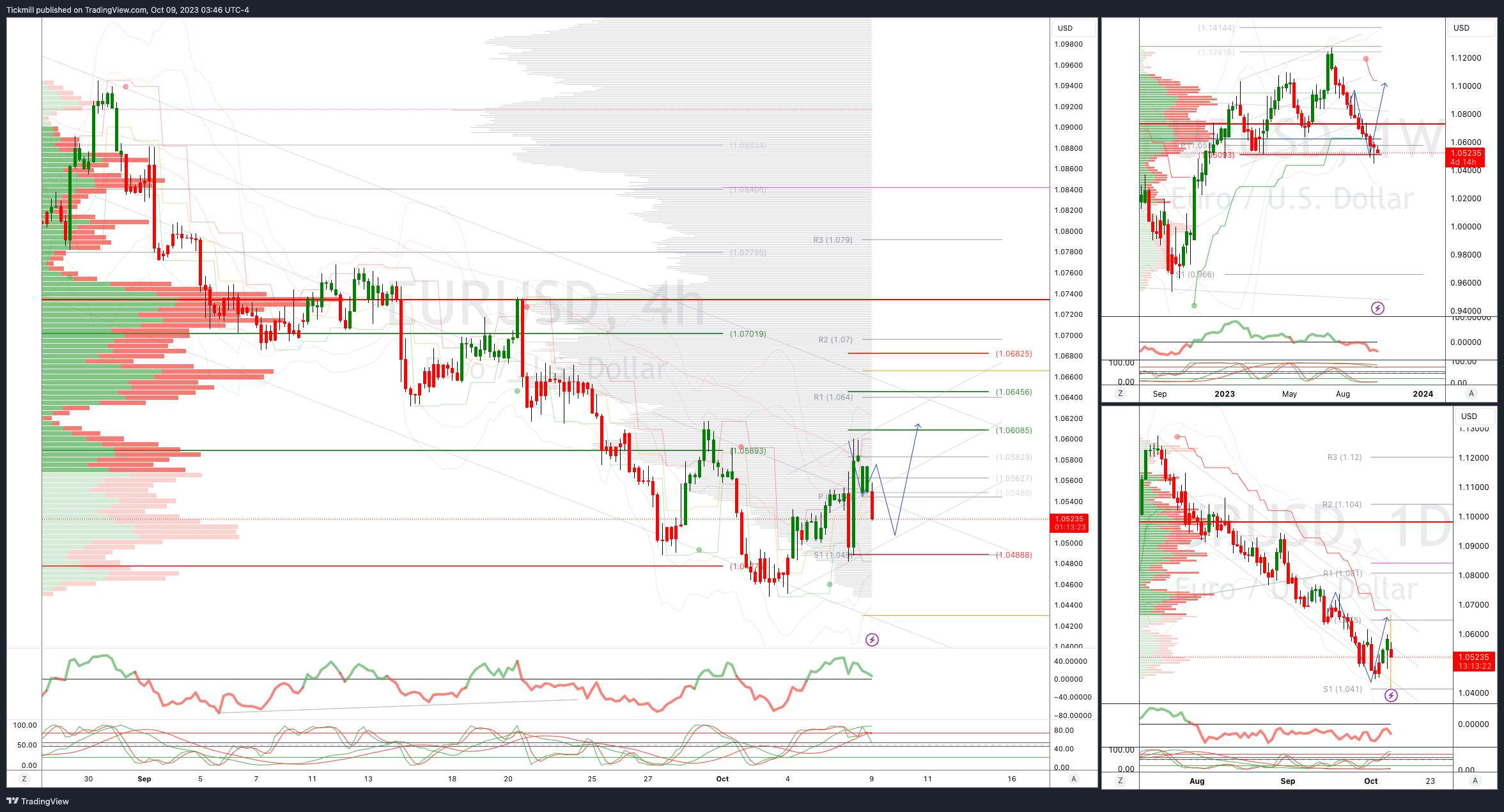

EURUSD Bias: Bullish Above Bearish Below 1.0488

Above 1.0610 opens 1.0650

Primary resistance is 1.0760

Primary objective is 1.0605

20 Day VWAP bearish, 5 Day VWAP bullish

GBPUSD Bias: Bullish Above Bearish Below 1.2115

Below 1.21 opens 1.2037

Primary resistance is 1.2410

Primary objective 1.2298

20 Day VWAP bearish, 5 Day VWAP bullish

USDJPY Bias: Bullish Above Bearish Below 148.25

Below 148 opens 147.50

Primary support 144.50

Primary objective is 150.30

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish Below .6312

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6270

20 Day VWAP bearish, 5 Day VWAP bullish

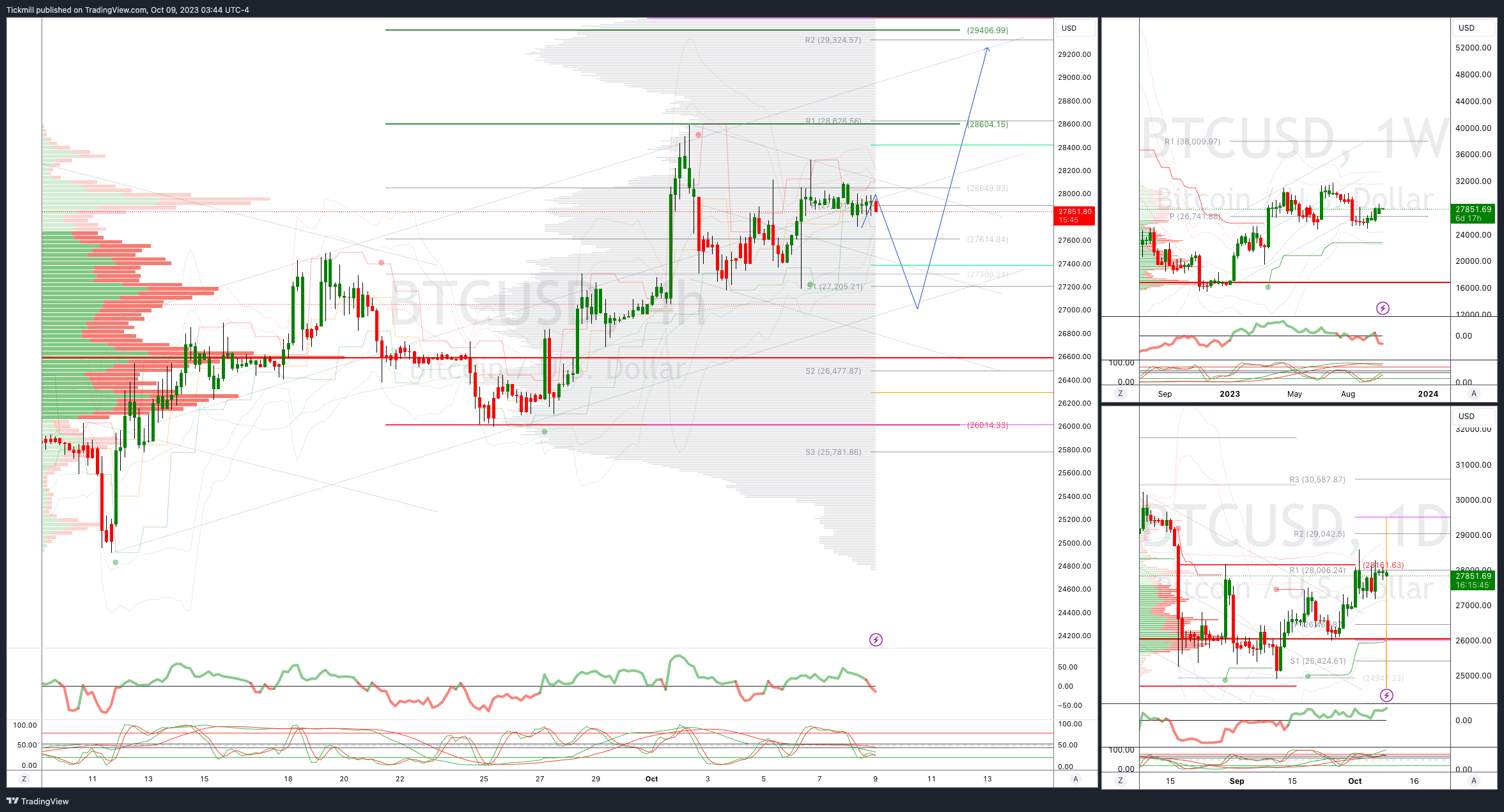

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28600 opens 30000

Primary resistance is 28175

Primary objective is 30000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!