Daily Market Outlook, October 18, 2023

Munnelly’s Market Minute…

Asia - Asian stocks displayed a mixed performance, influenced by escalating tensions in the Middle East ahead of US President Biden's visit to Israel. The cancellation of scheduled meetings with the Palestinian President and Arab countries added to the geopolitical uncertainty. In economic news, China reported a robust 1.3% quarter-on-quarter increase in Q3 GDP, surpassing expectations and resulting in a 4.9% year-on-year growth rate, which exceeded the consensus forecast of 4.5%. Oil prices experienced an upward trajectory during this period, while Treasury bond yields remained relatively stable overnight. This stability followed a previous uptick in yields, which had been driven by strong US data, including encouraging figures from the retail sales sector..

Europe - The UK's Consumer Price Index (CPI) inflation, which was released earlier, remained unchanged in September at 6.7%. This figure exceeded the consensus forecast, which had anticipated a slight dip to 6.6%. Core inflation, which excludes energy and food components, saw a modest decline from 6.2% to 6.1%, albeit smaller than expected.Several factors influenced this outcome, with lower prices for food and furniture contributing to a decrease in overall inflation. However, this reduction was offset primarily by higher petrol prices. Looking ahead to next month, the October figures are expected to reflect lower Ofgem utility prices, potentially causing the headline CPI to drop below 5%.

In the Eurozone, the Consumer Price Index (CPI) inflation, scheduled for release this morning, is anticipated to confirm preliminary 'flash' estimates, indicating a decline in the headline rate from 5.2% in August to 4.3% in September. This would mark the lowest rate in nearly two years, with core inflation also reaching a 13-month low of 4.5%. There is a possibility of a slight upward revision to either or both the headline and core rates due to rounding, but European Central Bank (ECB) policymakers are likely to take comfort from the overall downtrend this year. As a result, the ECB is expected to keep interest rates unchanged during their upcoming meeting next week.

US - Stateside, this afternoon, the US will release data on housing starts and building permits, which could prompt analysts to refine their forecasts for third-quarter GDP growth. The indicators are expected to provide further insight into what is likely to be a robust economic performance during that period. Additionally, market watchers will closely monitor various Federal Reserve speakers scheduled for today and the rest of the week, with particular attention on Fed Chair Powell's remarks set for Thursday. This comes as we approach the onset of the 'blackout' period just before the Federal Reserve's policy decision scheduled for November 1st. Fed Governor Michelle Bowman and Fed Governor Christopher Waller are both scheduled to speak today on different topics related to the economic outlook and monetary policy. Bowman will speak at the Harvard Law School Program on International Financial Systems, where she will discuss responsible innovation in money and payments. Waller will speak at the Rocky Mountain Economic Summit, where he will share his views on the conflicting data from the labour market and the real economy. He will explain why he thinks the labour market is very tight and inflation is far too high, and why he supports reducing inflation and achieving the Fed's price stability goal. He will also discuss the implications for monetary policy and the economic outlook. Equity investors are looking for good news from Netflix tonight, as its crackdown on account sharing could boost its subscriber growth. Tesla also reports tonight, investors are alert for information on its profit margins, which could suffer from price cuts.

FX Positioning & Sentiment

Implied volatility of near-dated FX options serves as a predictor of future realized volatility and risk. Currently, it is notably lower than recent highs, and call premiums for USD, CHF, and JPY have softened. This comes as the Israel/Hamas conflict remains contained. Resilient U.S. economic data and ongoing geopolitical concerns keep the U.S. dollar at risk of strengthening against various currencies. However, for those looking to hedge against this scenario, USD call options with reverse-knock-out triggers can provide a cost-effective solution. Specifically, the implied volatility for USD/JPY appears significant, with one-week and one-month expiries trading at their lowest levels in 18 months, approximately 5.75 and 7.6, respectively, during the early London session. Despite this, a brief and sharp drop/recovery in the exchange rate from 149.75 to 148.75 corresponded to the 1-week option break-even point and has sparked renewed interest from buyers at these lower levels.

CFTC Data As Of 4-10-23

The US Dollar Index ($IDX) declined by 1.2% in this period.

The Euro (EUR/$) appreciated by 1.36% during the same period, leading to a reduction of -3,411 contracts in speculative positions. The total net long positions now amount to +75,532.

The Japanese Yen (JPY/$) saw a minor decrease of -0.22%, resulting in an increase of +14,512 contracts in speculative positions. The total net short positions now stand at -99,476, and the pair is close to the key 150 level.

The British Pound (GBP/$) strengthened by 1.75%, but speculative positions reduced by -3,368 contracts, mainly due to a dovish Bank of England.

The Australian Dollar (AUD/$) gained 2% in the same period, with speculative positions increasing by +5,410 contracts, totaling -76,577. The AUD has been lower since Tuesday.

Bitcoin (BTC) saw a modest increase of 0.04%, and speculative positions grew by +95 contracts, reaching +1,151. The expectation of ETF approval supports BTC.

It's worth noting that the USD has rallied on a more hawkish Federal Reserve outlook since the period ended, and SOFR red contracts suggest an expectation of higher rates for a longer duration. (Source Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0500 (1.3BLN), 1.0525 (807M), 1.0600 (8090M), 1.0665-80 (1.5BLN)

USD/CHF: 0.8965 (690M), 0.9055 (493M). AUD/USD: 0.6325 (222M)

GBP/USD: 1.2040 (932M), 1.2250-65 (550M), 1.2400 (1BLN), 1.2430-40 (935M)

NZD/USD: 0.5910 (282M), 0.6000 (409M). USD/CAD: 1.3505 (1.BLN)

USD/JPY: 148.00-10 (1.5BLN), 148.40 (320M), 148.65 (520M)

150.00 (1BLN), 150.25 (505M)

Overnight Newswire Updates of Note

China Exceeds Growth Expectations as Consumer Spending Strengthens

Jordan Cancels Biden Summit Following Deadly Explosion at Gaza Hospital

Hezbollah Declares a 'Day of Unprecedented Anger' Against Israel During Biden's Visit

Oil Prices Surge Amid Escalating Regional Tensions Triggered by Gaza Hospital Blast

IMF Warns that China's Property Slowdown Will Impact Asia's Economic Growth

Japan's Prime Minister Kishida Plans Temporary Tax Measures

RBA's Bullock Expresses Concern About Persistent Geopolitical 'Shocks' Fueling Inflation

Fed's Kashkari Stresses Inflation Remains Uncomfortably High

ECB's Stournaras Highlights Middle East Crisis as a Shadow Over Upcoming ECB Meeting

Country Garden Teeters on the Brink of Its First Default as Silence Surrounds Bond Situation

BoJ Intervenes in Market to Stem Soaring Bond Yields

Japan's 10-Year Yield Climbs to a Ten-Year High, Testing the BoJ

Nvidia and Other Chip Stocks Dip Due to New US Export Restrictions on China

Fed to Propose Reducing Debit Card Swipe Fees

United Airlines Anticipates Lower Profits Due to Rising Fuel Costs and Middle East Conflict

Strike Deadline Set for October 29 in Stellantis-Unifor Negotiations

Chesapeake Contemplates Acquisition of Southwestern Energy

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

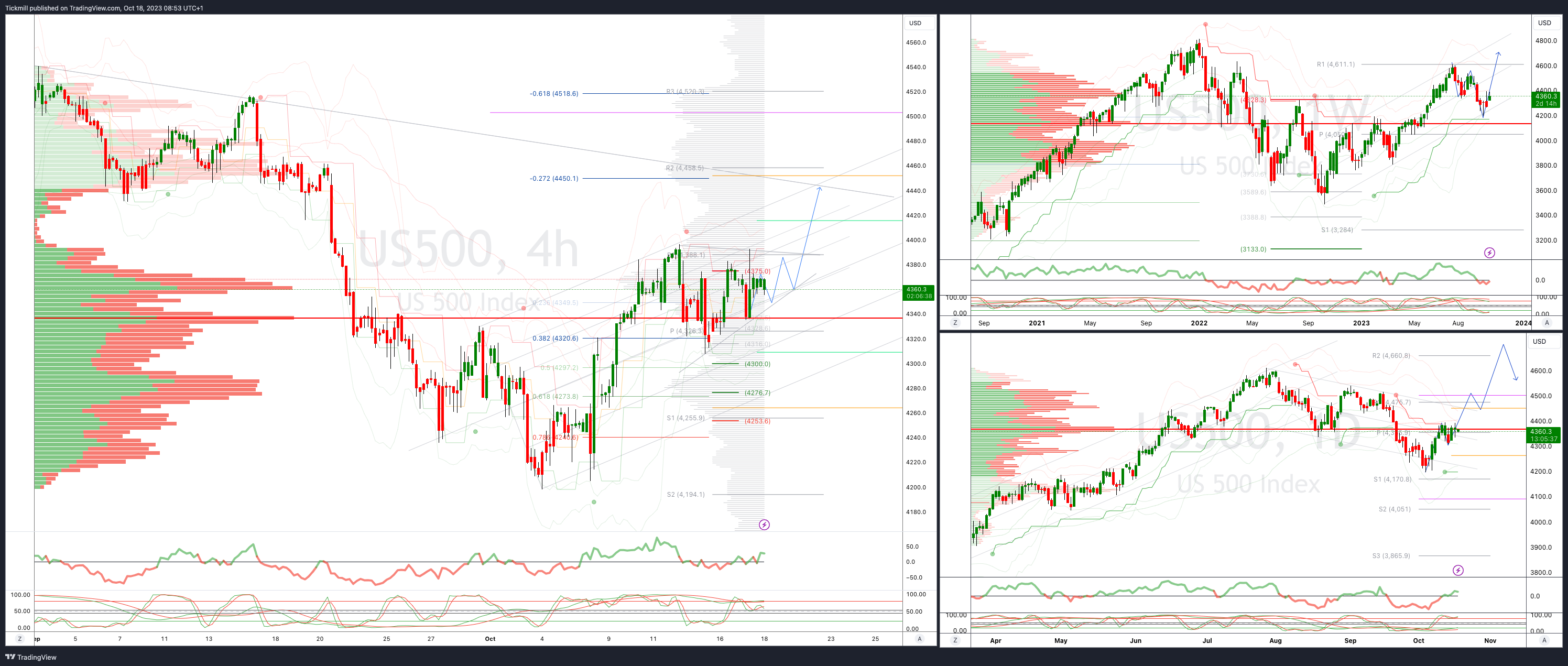

SP500 Bias: Bullish Above Bearish Below 4350

Below 4300 opens 4270

Primary resistance is 4450

Primary objective is 4446

20 Day VWAP bullish, 5 Day VWAP bullish

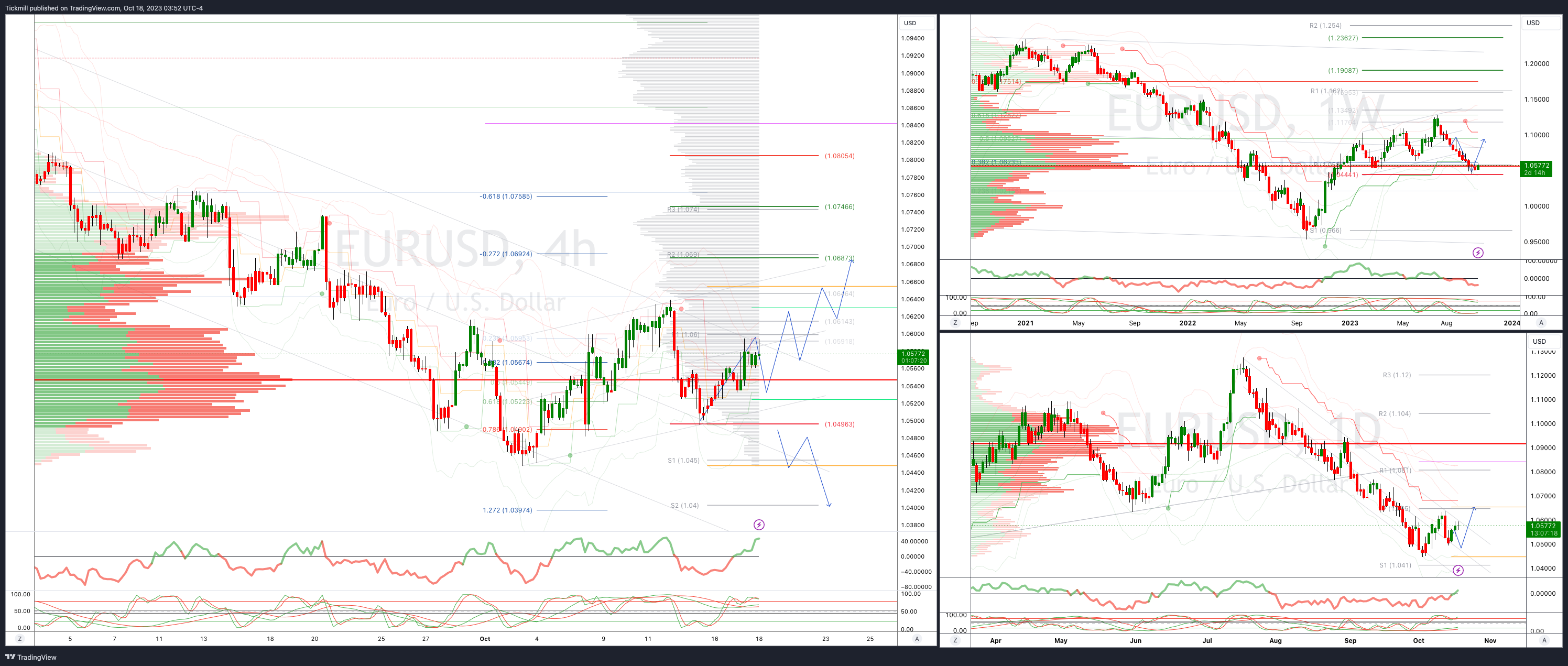

EURUSD Bias: Bullish Above Bearish Below 1.06

Below 1.0520 opens 1.0480

Primary support is 1.05

Primary objective is 1.0680

20 Day VWAP bearish, 5 Day VWAP bullish

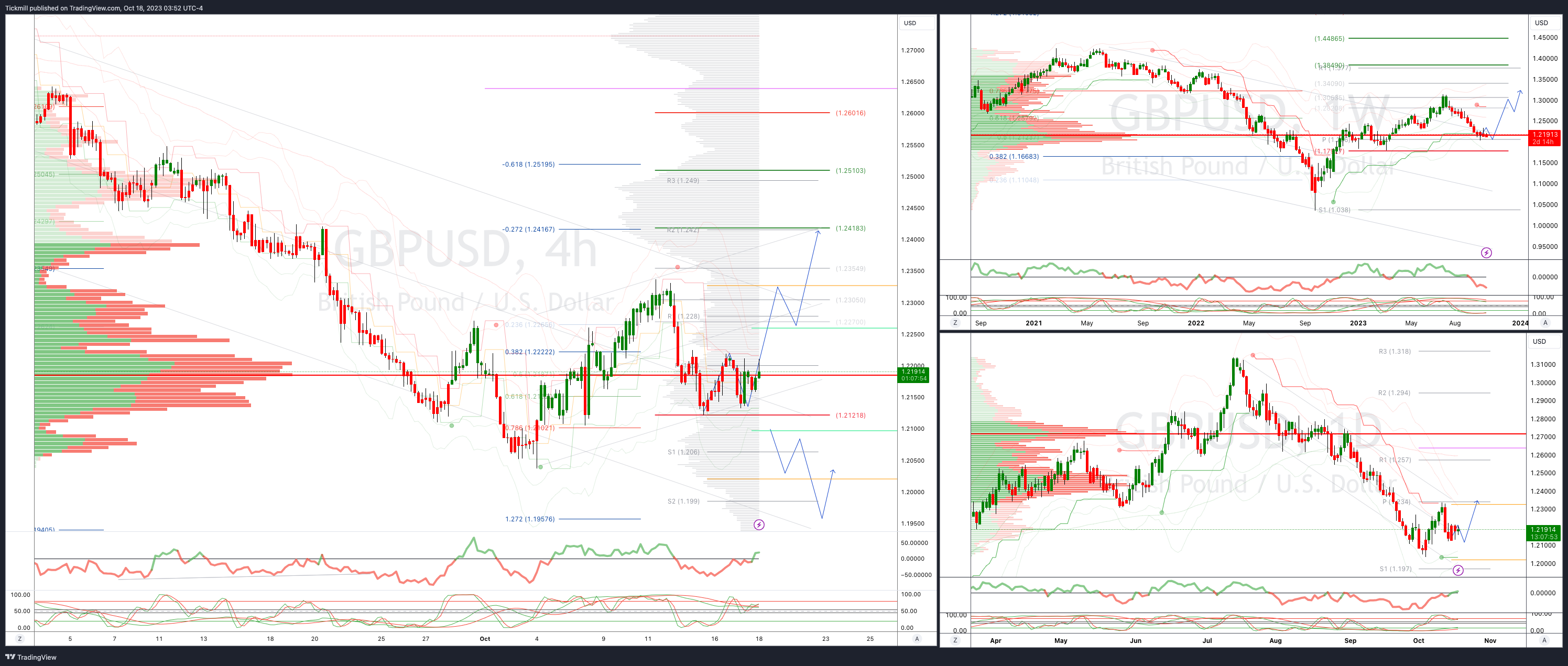

GBPUSD Bias: Bullish Above Bearish Below 1.22

Below 1.2120 opens 1.1960

Primary support is 1.21

Primary objective 1.24

20 Day VWAP bearish, 5 Day VWAP bearish

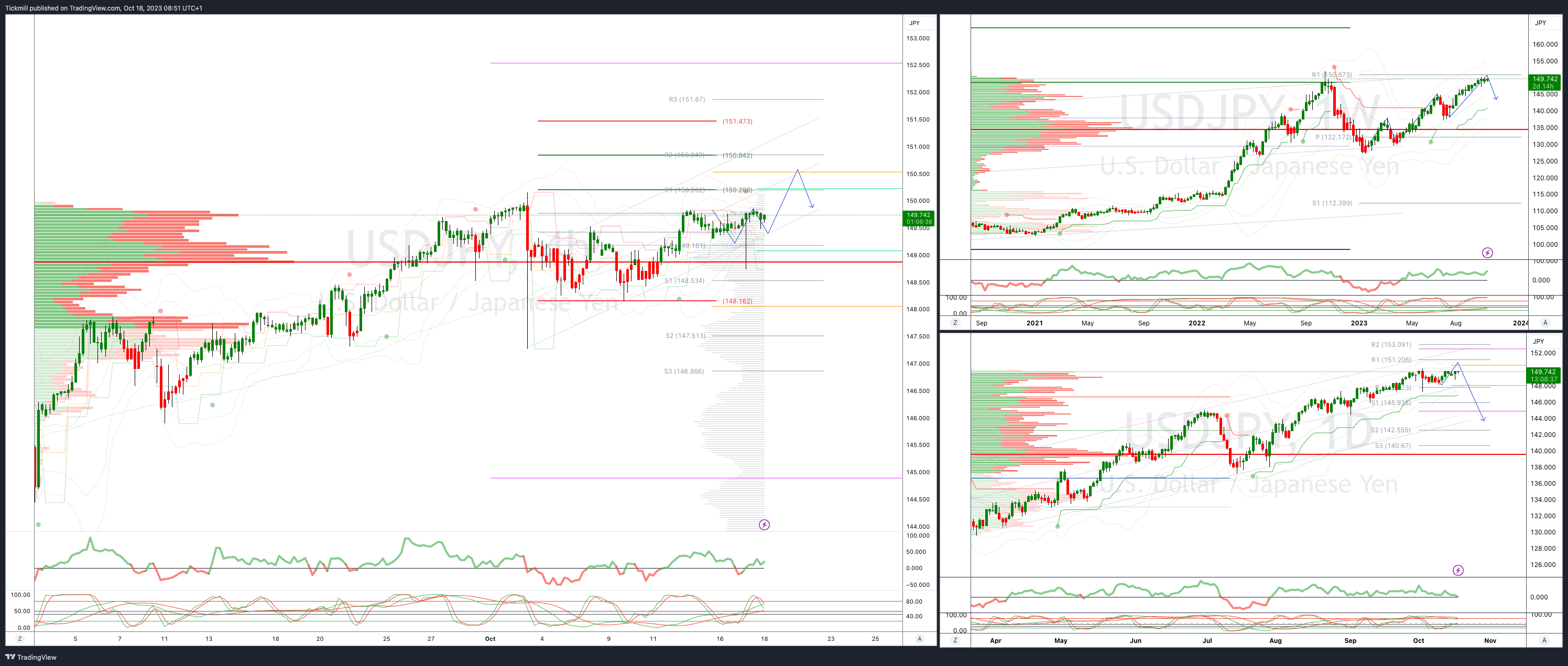

USDJPY Bias: Bullish Above Bearish Below 149.25

Below 149 opens 148.50

Primary support 144.50

Primary objective is 150.20

20 Day VWAP bullish, 5 Day VWAP bullish

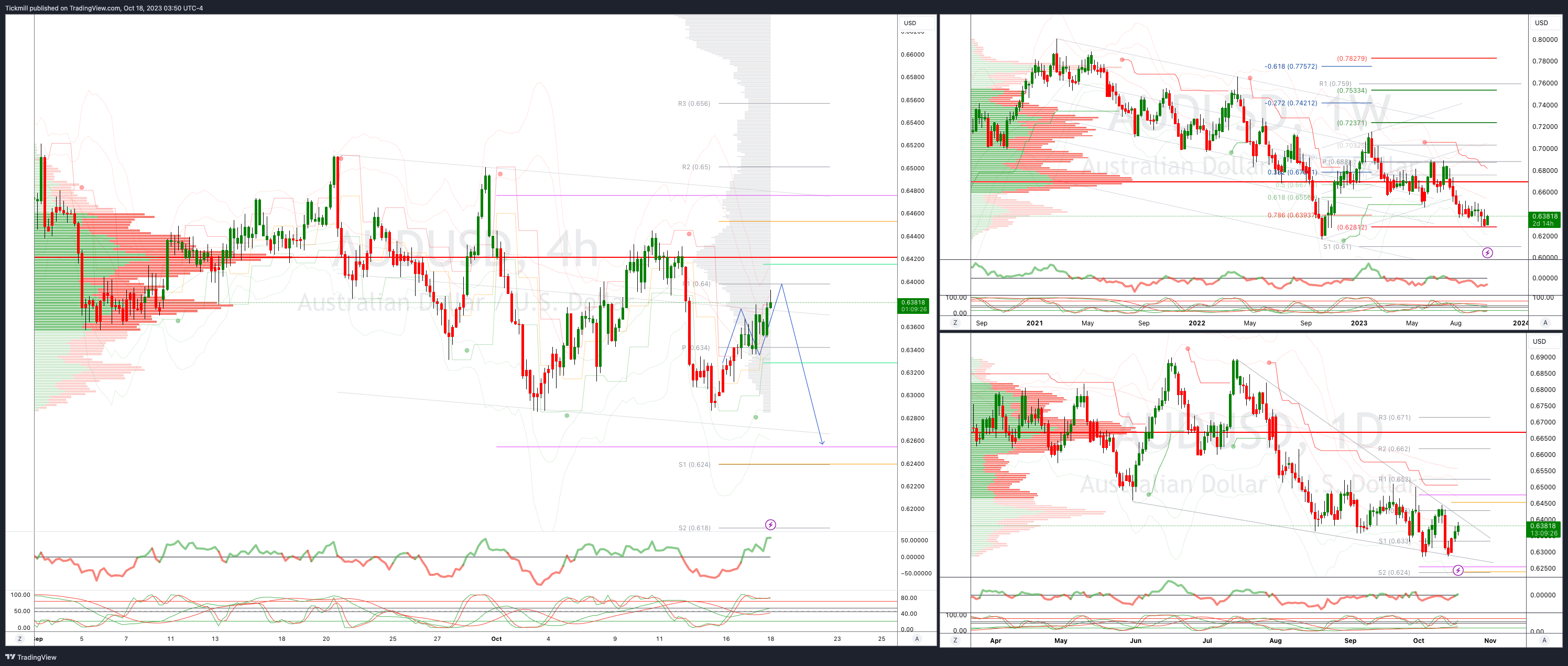

AUDUSD Bias: Bullish Above Bearish Below .6400

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6270

20 Day VWAP bearish, 5 Day VWAP bullish

BTCUSD Bias: Bullish Above Bearish below 27500 - 30k Target Hit New Pattern In Play

Below 27100 opens 26500

Primary support is 26500

Primary objective is 31200

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!