Daily Market Outlook, November 27, 2023

Munnelly’s Market Commentary…

Asia - At the beginning of the week, equity markets in the Asia-Pacific region were subdued due to geopolitical headlines dominating newsflow over the weekend. There was uncertainty over whether the Israel-Hamas truce would be extended beyond the initial four-day agreement. The Nikkei 225 wiped out its opening gains and participants digested Japanese Services PPI, which showed a slight acceleration. The Hang Seng and Shanghai Comp. declined due to soft Chinese Industrial Profits and concerns over shadow banking after Chinese authorities opened a probe into struggling shadow bank Zhongzhi. The PBoC's notice to strengthen financial support for private companies did little to spur risk sentiment. Overall, a quiet calendar added to the humdrum mood in the markets as the month-end approached.

Europe - The week begins with relatively subdued activity, with a focus on the CBI's November UK retail sector report providing insights into the sector's performance leading up to the festive season. The 'volume of sales' measure has consistently shown negative figures since May, likely continuing this month, resulting in high inventory levels for businesses. In the US, the October new home sales report is anticipated to reflect a decline in activity after a surprising surge in September, attributed to increased mortgage rates.

Later today, ECB President Christine Lagarde will address the European Parliament, emphasising the ECB's current stance of pausing to assess the impact of recent interest rate hikes, indicating a neutral position without a bias toward hiking or cutting in the near term. Overnight, ECB member de Cos and the BoE’s Ramsden will participate in a panel discussion hosted by the Hong Kong Monetary Authority (HKMA) and The Bank of International Settlements on 'Inflation, Financial Stability, and Employment'. On the domestic front, the British Retail Consortium (BRC) is set to release its November shop price index, with an expected decrease in the annual rate, further fueling expectations of ongoing declines in the broader UK CPI inflation measure in the coming months.

US - Stateside, after a period of quiet, the U.S. economic calendar is becoming more active. The release of the core PCE price index, which is the Federal Reserve's preferred measure of inflation, will be the most important event. The G10 central bank calendar will be dominated by the Reserve Bank of New Zealand's rate decision. The market is anticipating a 0.2% increase in the U.S. core PCE for October, which is a slight decrease from the previous month's 0.3%. Any deviation from this expectation could impact the Fed's projections. Additionally, the second estimate of Q3 GDP is expected to show a healthy 5.0% growth. Other data to be released includes ISM manufacturing PMI, final S&P Global manufacturing PMI, Chicago PMI, and a variety of housing data. Fed Chair Jerome Powell will also be speaking at a college event on Friday.

FX Positioning & Sentiment

The foreign exchange and options markets have experienced a period of tranquillity following the recent decline of the US dollar. However, the upcoming week, filled with various data releases, may usher in heightened volatility in realised FX rates, consequently supporting implied FX option volatility. The focal point will be Thursday's PCE data, crucial for confirming perspectives on moderating US inflation and potential rate adjustments. Key releases throughout the week include jobless claims on Thursday, new home sales on Monday, consumer confidence on Tuesday, GDP on Wednesday, and ISM data on Friday. Additionally, Europe's data releases and New Zealand's central bank policy announcement on Wednesday will contribute to local currency risk. Despite the relatively stagnant FX rates this week, the exceptionally low 1-week realised volatility measures do not align with the diminished implied volatility in very short-dated options. Conversely, benchmark 1-month expiry implied volatility is unlikely to rebound from its prolonged lows, primarily influenced by its post-Christmas expiry, rendering this date less appealing.

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0845-50 (2.6BN), 1.0860-65 (440M), 1.0950 (935M), 1.1005 (787M)

USD/CHF: 0.8860 (419M), 0.8935 (247M)

GBP/USD: 1.2600 (338M)

EUR/GBP: 0.8700 (528M)

AUD/USD: 0.6480 (530M), 0.6600 (200M)

NZD/USD: 0.6050 (280M)

USD/JPY: 148.00-15 (800M)

Overnight Newswire Updates of Note

China Industrial Profit Growth Eases As Deflation Persists

Chinese Authorities Move On Asset Manager Zhongzhi After Defaults

China Says Multiple Pathogens Are Behind Spike In Respiratory Illnesses

Japan's Corp Service Inflation Climbs In Sign Of Broadening Price Pressures

Japan To Expand Tax Breaks On Stock Options - Nikkei

NZIER Shadow Board Recommends RBNZ Keeps OCR At 5.5% This Week

Australia To Introduce Legislation To Reform, Modernise RBA

Sunak Says Claims UK Heading For Austerity ‘Simply Unfounded’

Sterling Steady, Dollar Wobbles As Markets Brace For Post-Thanksgiving Buzz

JGB Yields Track US Peers Higher Ahead Of Bond Auctions, US Inflation Data

Oil Steadies After Three-Day Drop Ahead Of Postponed OPEC+ Meet

Gold Steadies As US Bond Auctions Set To Give Clues On Yields

China Stocks Fall, Leading Losses In Asia On Fragile Sentiment

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

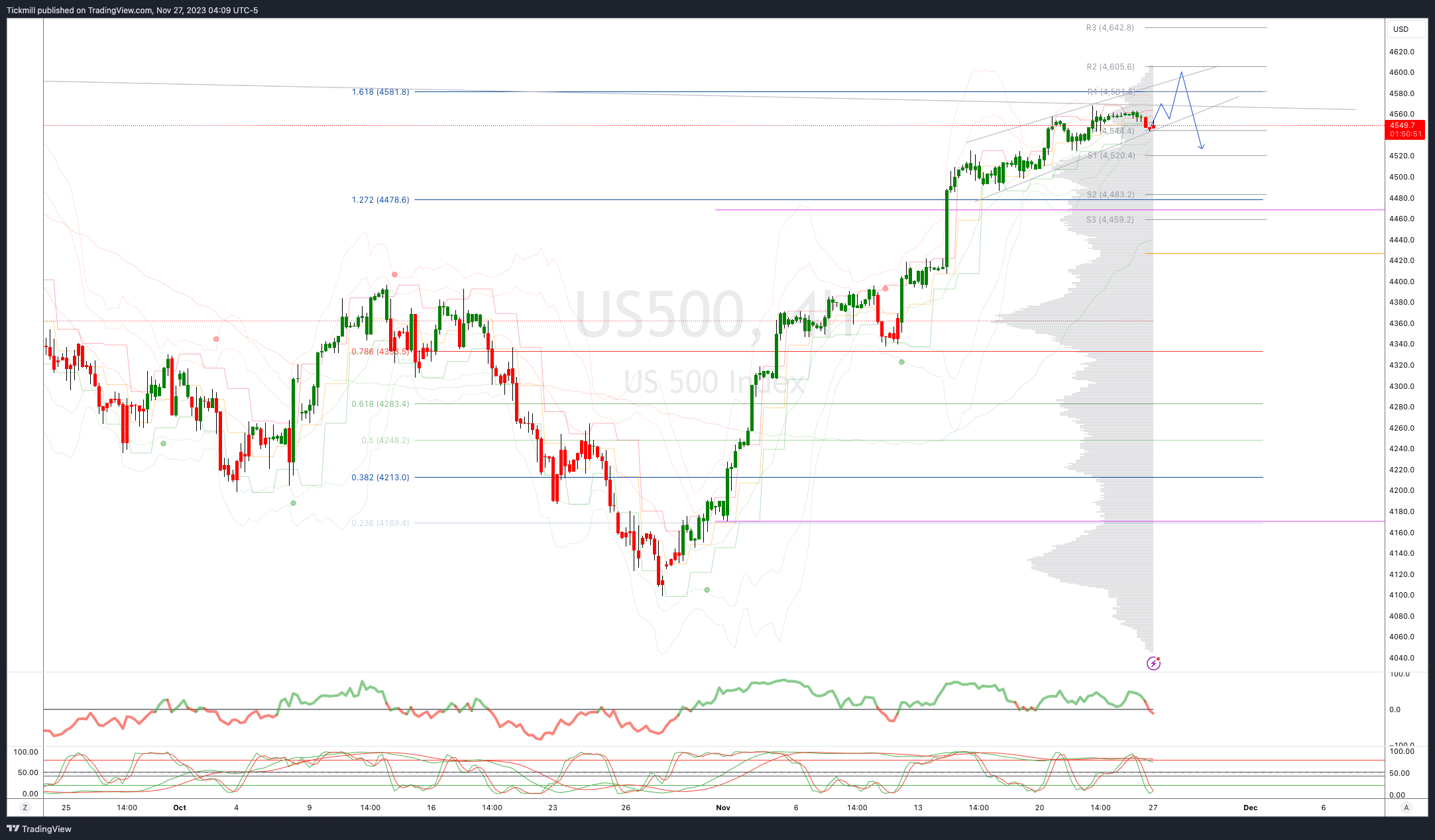

SP500 Bias: Bullish Above Bearish Below 4540

Below 4519 opens 4485

Primary support 4420

Primary objective is 4600

20 Day VWAP bullish, 5 Day VWAP bullish

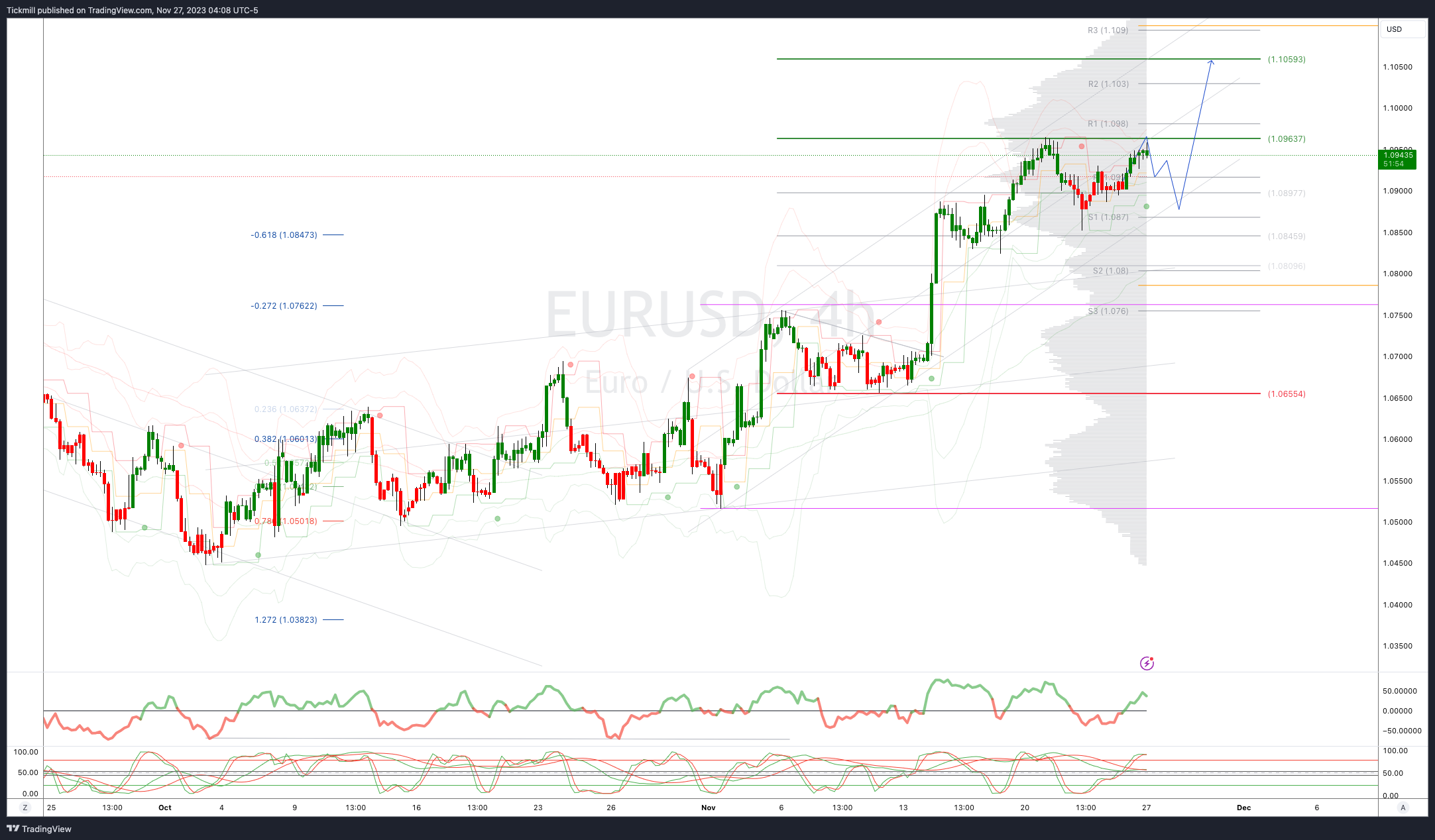

EURUSD Bias: Bullish Above Bearish Below 1.09

Below 1.08 opens 1.0750

Primary support 1.0650

Primary objective is 1.10

20 Day VWAP bullish, 5 Day VWAP bullish

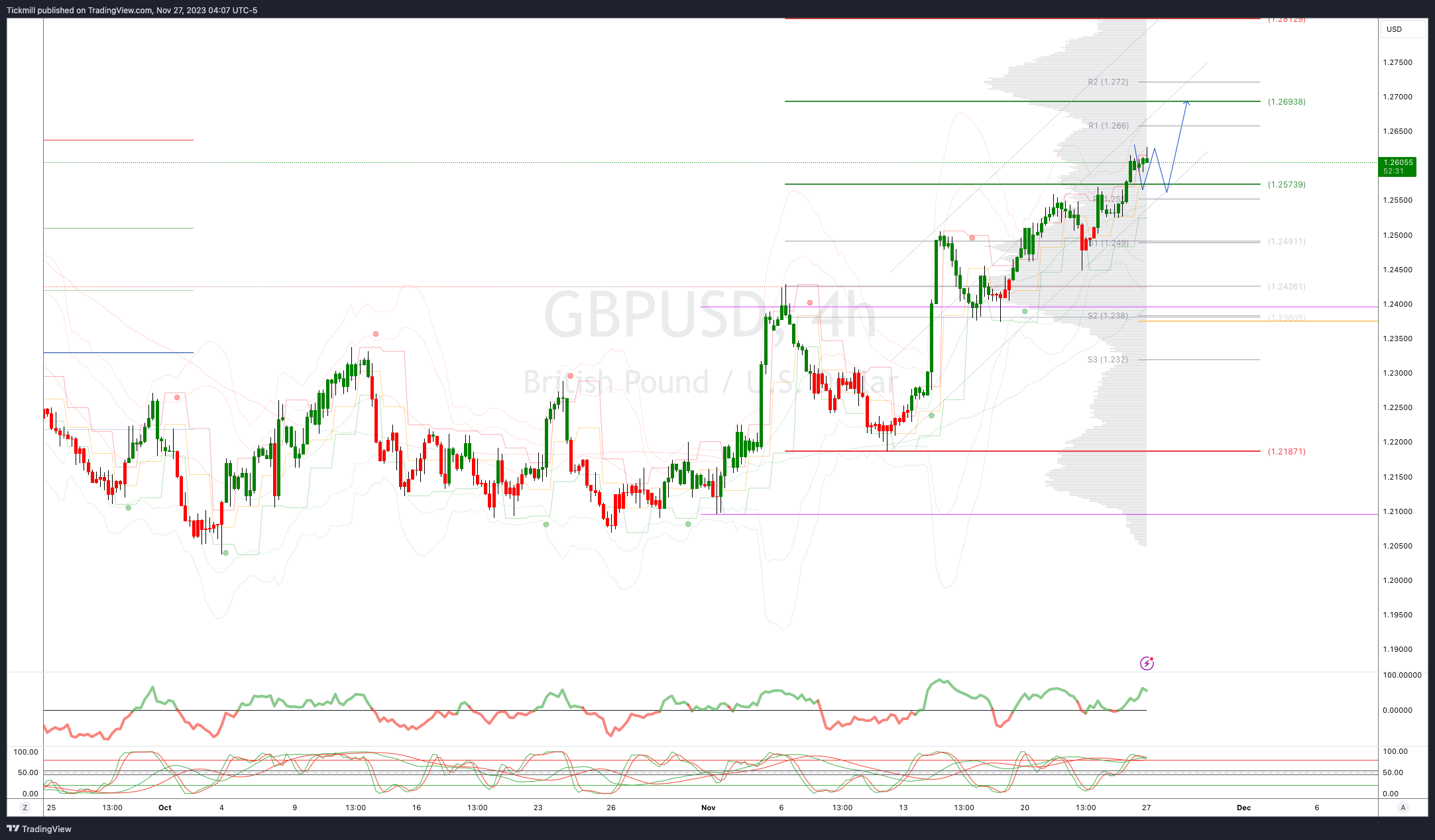

GBPUSD Bias: Bullish Above Bearish Below 1.2550

Below 1.24 opens 1.2350

Primary support is 1.2185

Primary objective 1.2690

20 Day VWAP bearish, 5 Day VWAP bullish

USDJPY Bias: Bullish Above Bearish Below 149

Above 149 opens 149.80

Primary resistance 147.30

Primary objective is 147

20 Day VWAP bearish, 5 Day VWAP bearish

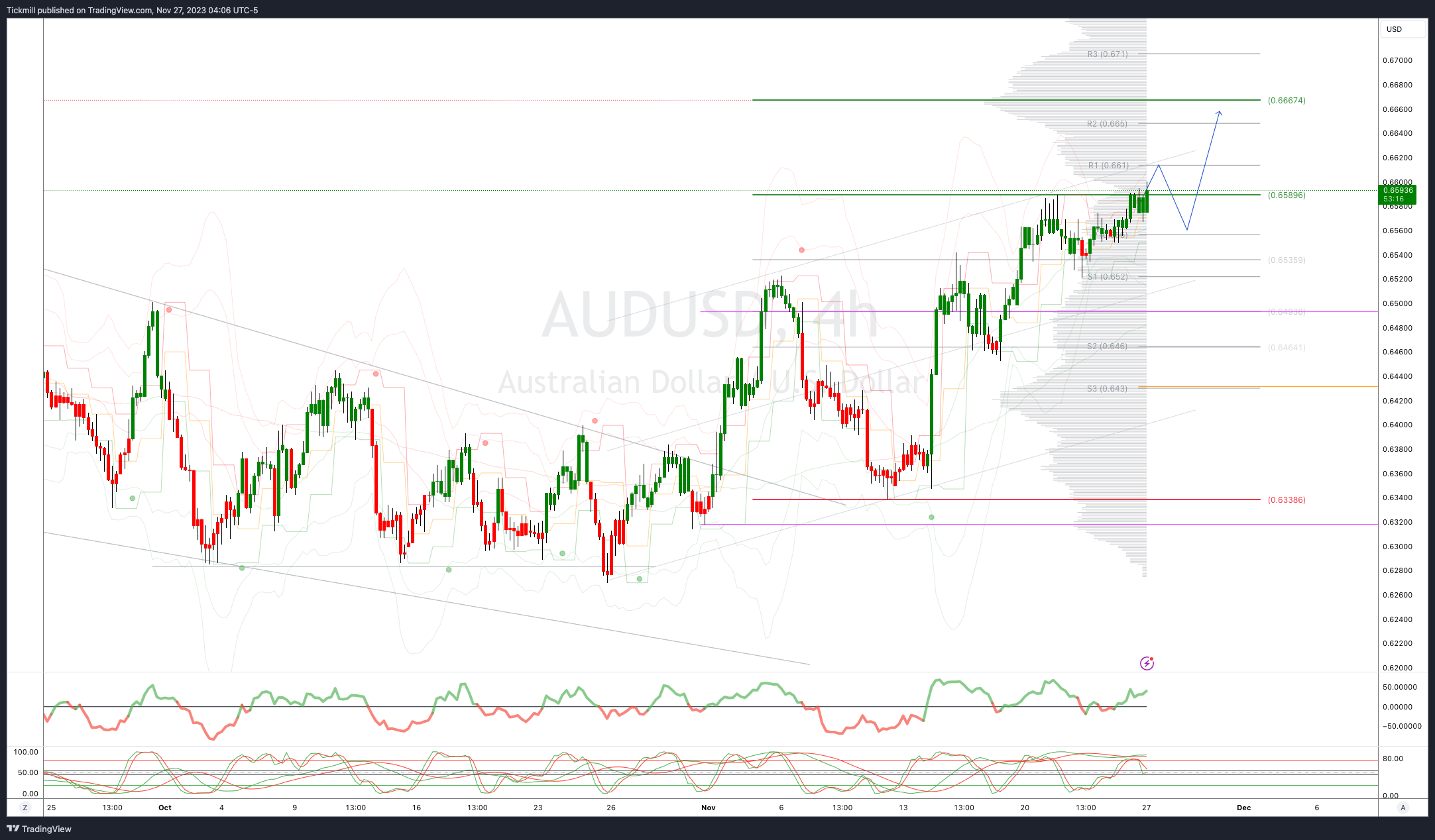

AUDUSD Bias: Bullish Above Bearish Below .6520

Below .6500 opens .6420

Primary support .6330

Primary objective is .6620

20 Day VWAP bullish, 5 Day VWAP bullish

BTCUSD Bias: Bullish Above Bearish below 34000

Below 33600 opens 32400

Primary support is 30000

Primary objective is 37000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!