Daily Market Outlook, June 16, 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

Munnelly’s Macro Minute…

Despite ongoing missile exchanges between Israel and Iran, markets have demonstrated resilience, with most Asian indexes closing in positive territory on Monday. Chinese retail sales surpassed expectations, although the markets showed little reaction to the news. Oil prices initially surged by 4% but have since stabilised, now trading about 1% higher. While conflicts in the Middle East are not uncommon, this particular situation does not appear to be escalating further. Investors seem confident that Iran will avoid attempting to shut down the Strait of Hormuz, as such an action could provoke U.S. involvement. Furthermore, Saudi Arabia and other OPEC members have the capacity to increase oil supplies if needed to stabilise prices. This regional tension adds complexity to the upcoming G7 meeting in Canada, already strained by disputes over President Trump's tariffs on allied nations. Progress on trade agreements remains limited, and last week's temporary U.S.-China tariff resolution has not fully addressed restrictions on critical minerals tied to national security concerns.

China's May credit data shows RMB2.287 trillion added to total social financing (TSF), up from RMB2.062 trillion last year, driven by government borrowing rather than broad lending. Year-to-date TSF has risen 25% (+RMB18.63 trillion) due to fiscal initiatives, while private sector demand remains weak, with households favouring savings. SOEs bear most of the burden, despite interest rate cuts and RRR reductions. Challenges like declining housing prices, unfinished developments, tariff uncertainties, and overcapacity persist, pressuring corporate margins, profits, and confidence, while fuelling deflationary trends. The trade data from May indicated strong demand for non-US exports; however, risks continue to exist due to domestic challenges.

The escalating conflict in the Middle East has led to a sharp rise in oil prices. While it's premature to make definitive statements, this situation highlights the significant uncertainty present. The various central bank meetings scheduled for the week ahead, particularly the Federal Reserve's, are expected to maintain mostly stable rates as they await more information. Nevertheless, it will continue to be difficult to gauge activity in the US. The Federal Reserve is expected to maintain its current stance during the upcoming Wednesday meeting, which will be accompanied by the latest Summary of Economic Projections and the DOT plot. The target range for federal funds is widely anticipated to remain unchanged. A downward revision in the GDP forecast is expected, along with a slight increase in unemployment rates, higher inflation, and potential upward adjustments to long-term rate projections. Furthermore, weak auto sales and prices are likely to negatively affect May's retail sales figures, although core sales may have experienced slight growth. Overall, retail sales appear to be gradually losing momentum.

On Friday, the money and credit figures for May in the euro area are expected to demonstrate continued growth. The strong rate of credit is a crucial indication that monetary policy is appropriately set. In France, the Insee business survey for June is anticipated to reflect confidence slightly below the historical average, yet close to it. The discussions among unions regarding pensions are slated to conclude on Tuesday. Attention will then shift to the Socialist Party, which has conditioned its implicit backing of PM Bayrou on the outcomes of these discussions.

The Bank of England meeting will be the main focus next week. Recent data since the May meeting has been positive, but it has not been sufficient to persuade the Monetary Policy Committee (MPC) to lower rates again. Thus, we anticipate that the MPC will maintain the Bank Rate at 4.25%. A day before the BoE meeting, the Consumer Price Index (CPI) is projected to show a decrease in services inflation by 0.6 percentage points to 4.8% year-on-year, as the Easter effect dissipates and the Office for National Statistics (ONS) rectifies the previous overestimation of the Vehicle Excise Duty increase. On Friday, we expect retail sales to disappoint, with a 1.5% month-on-month decline in May. Lastly, Trump may approve portions of the UK-US trade agreement during the G7 meeting.

In Asia, the Bank of Japan (BoJ) are scheduled to convene this week. The BoJ is expected to maintain its current stance and may reduce the pace of quantitative tightening starting in April next year, in light of the recent decline in ultra-long-term Japanese Government Bonds (JGBs).

Overnight Headlines

Israel And Iran Trade Missile Strikes As Conflict Escalates

Fed Hold Leaves Wall Street Asking What It Will Take To Cut

China Retail Sales Beat, But Industrial Output And Investment Lag

RBA To Decide On Publishing Votes; PBoC Plans More June Liquidity

AMD Targets Nvidia’s AI Dominance With MI500 Launch

UK Rightmove House Prices Post Rare June Drop

NZ Services PMI Slides Further Into Contraction

BoJ To Reassess Bond-Buying Strategy Amid Market Volatility

Macron Offers Greenland Security Aid Amid US Loan Talks

Taiwan Imposes Tech Export Controls On Huawei, SMIC

Oil Holds Gains On Israel-Iran Crisis; Gold Edges Higher

Dollar Inches Up, Yen Softens On Rising Crude Prices

Economist Predict Germany Will Return To Growth This Year

FX Options Expiris For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.1700 (EU4.57b), 1.2000 (EU2.04b), 1.0600 (EU1.97b)

USD/JPY: 145.00 ($4.87b), 139.00 ($776.2m), 135.00 ($700m)

AUD/USD: 0.6560 (AUD549m), 0.6455 (AUD476.2m), 0.6333 (AUD402.2m)

USD/CNY: 7.4000 ($664.3m), 7.6000 ($415.4m)

USD/CAD: 1.5100 ($414.7m), 1.4305 ($332m)

GBP/USD: 1.3505 (GBP339.1m)

USD/BRL: 6.8400 ($300.4m)

CFTC Positions as of the Week Ending June 13th

Speculators have reduced their net short position in CBOT US Treasury bonds futures by 22,628 contracts, bringing it down to 79,745.

They have also decreased their net short position in CBOT US Ultrabond Treasury futures by 24,696 contracts, now totaling 203,747.

Speculators have increased their net short position in CBOT US 10-year Treasury futures by 18,845 contracts, reaching 724,101.

Similarly, the net short position in CBOT US 5-year Treasury futures has risen by 74,384 contracts to 2,470,920.

The net short position in CBOT US 2-year Treasury futures has gone up by 36,591 contracts, now at 1,180,516.

Equity fund managers have raised their net long position in S&P 500 CME by 10,532 contracts, reaching 825,013.

Equity fund speculators have increased their net short position in S&P 500 CME by 31,419 contracts, now at 316,744.

The net long position for the Japanese yen stands at 144,595 contracts.

The euro's net long position is 93,025 contracts.

For the British pound, the net long position is 51,634 contracts.

The Swiss franc shows a net short position of -21,268 contracts.

Bitcoin has a net short position of -2,009 contract

Technical & Trade Views

SP500 Pivot 5900

Daily VWAP bearish

Weekly VWAP bullish

Above 5900 target 6100

Below 5800 target 5650

EURUSD Pivot 1.12

Daily VWAP bullish

Weekly VWAP bullish

Above 1.11 target 1.19

Below 1.11 target 1.0950

GBPUSD Pivot 1.34

Daily VWAP bullish

Weekly VWAP bullish

Above 1.34 target 1.38

Below 1.3350 target 1.32

USDJPY Pivot 147

Daily VWAP bearish

Weekly VWAP bearish

Above 147.10 target 148.26

Below 146.53 target 139

XAUUSD Pivot 3365

Daily VWAP bullish

Weekly VWAP bullish

Above 3410 target 3600

Below 3240 target 3000

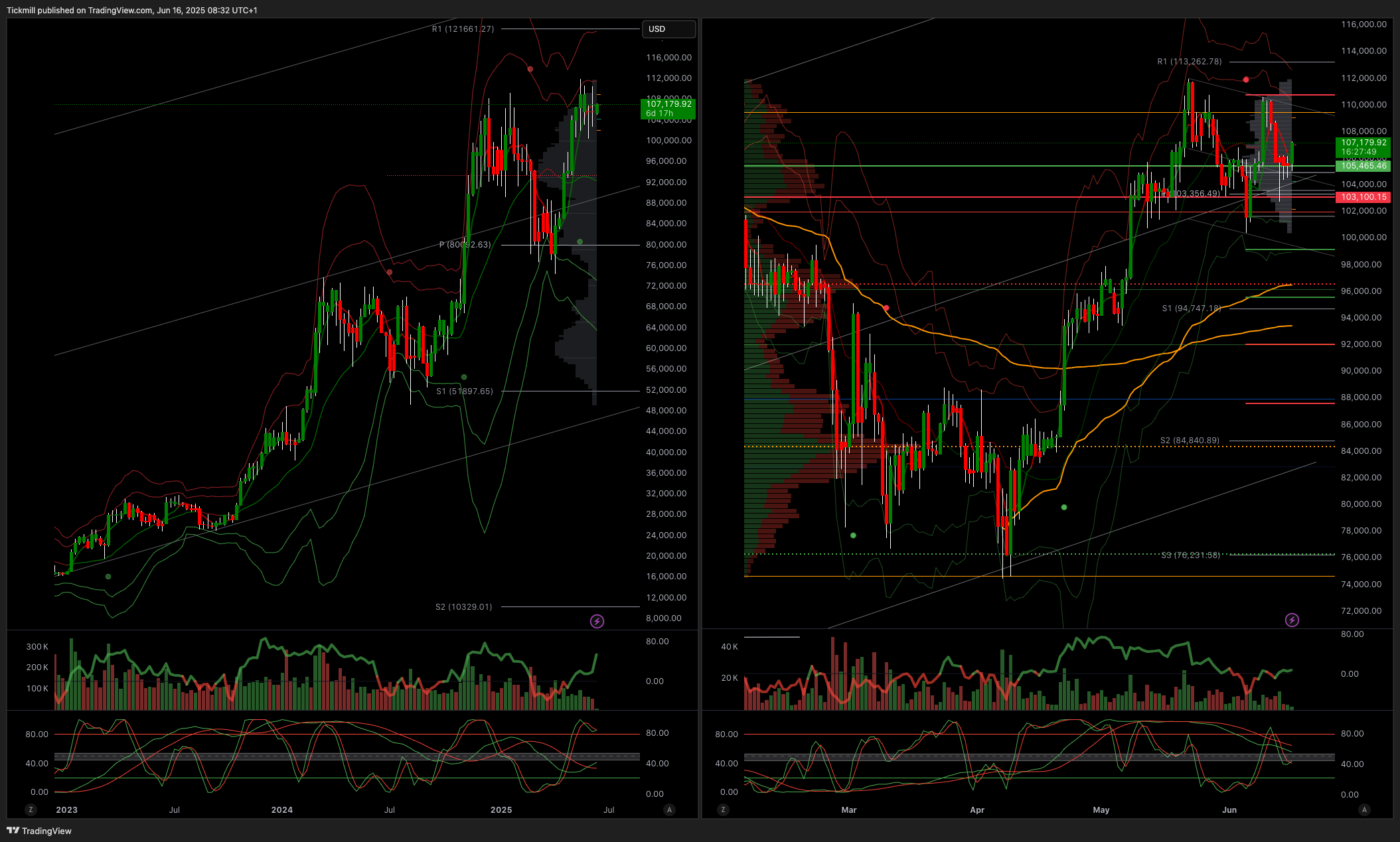

BTCUSD Pivot 105k

Daily VWAP bearish

Weekly VWAP bearish

Above 105k target 118k

Below 103k target 100k

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!