Daily Market Outlook, July 06, 2023

Munnelly’s Market Commentary…

Asian equity markets mostly traded lower, influenced by weak global data releases, a rising yield environment, and limited guidance from the FOMC Minutes regarding future rate increases. The Nikkei 225 faced selling pressure after falling below the 33K handle. The Hang Seng and Shanghai Comp also declined, with Hong Kong-listed Chinese banks experiencing notable pressure. Mainland losses were mitigated ahead of US Treasury Secretary Yellen's arrival in Beijing for meetings with senior officials.

In the UK, the Decision Maker Panel (DMP) survey of businesses will be released, which is closely monitored by policymakers. The report's findings on firms' pricing behaviour, inflation expectations, and wage growth will be particularly scrutinised. The survey suggests that firms' price and wage growth expectations are moderating but remain high compared to historical averages. Additionally, the UK construction PMI for June will be published, with solid growth expected in the commercial and civil engineering sectors but contraction in housebuilding activity.

Retail sales figures for May in the Eurozone were expected to show modest month-on-month growth. German factory orders for May showed a significant increase but remained lower compared to a year ago. Tomorrow's German industrial production report will be closely watched for signs of further deceleration in activity, following recent weaker-than-expected outcomes and survey evidence.

Stateside the upcoming employment and ISM services data are of note on today's data docket The ADP gauge of private payrolls is expected to show a decrease to 228,000 from the previous reading of 278,000. Challenger layoffs data will also be released. The JOLTs data for May, which provides insights into job openings, is anticipated to moderate to 9.9 million from 10.1 million in April. Weekly initial jobless claims and continuing claims data are expected to show a slight increase. S&P Global will release its final composite and services PMI data shortly before the release of the ISM services index for June. The ISM headline index is forecasted to rise to 51.0 from 50.3, indicating growth in the services sector. The business activity index is also expected to improve slightly to 51.9 from 51.5. The services sector has shown more resilience compared to the manufacturing sector, and analysts will be monitoring how long this resilience can be sustained, considering the manufacturing decline and the lagged impact of previous interest rate hikes by the Federal Reserve.

CFTC Data As Of 30-06-23

USD IMM net spec short in the Jun 21-27 reporting period; $IDX -0.02%

EUR$ +0.38% in period, specs stayed on sidelines +379 contracts now +145,028

$JPY rose 1.91%, specs -5,214 contracts now -112,870 as BoJ remains steady

Recent test of 145, tipped intervention area may stir long profit-taking

GBP$ -0.1%, specs +5,386 contracts now +51,994 on rising UK rate view

BTC rose 8.86%, specs sold 2,491 contracts into strength, flip to -2,094

$CAD -0.31% in period, specs +30,696 contracts short pared to -2,847

AUD$ -1.49% in period, specs +10,192 contracts now -39,424

BoC, RBA had been considering further rate hikes amid persistent inflation

Inflation stalling has weakened CAD and AUD since Jun 21, may see recent longs lighten(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (450M), 1.0820 (300M), 1.0840-50 (1BLN)

1.0890 (775M), 1.0950 (785M)

USD/CHF: 0.8875 (255M). GBP/USD: 1.2850 (490M)

EUR/GBP: 0.8550 (180M), 0.8600 (220M), 0.8625 (188M)

AUD/USD: 0.6655 (273M), 0.6675-80 (261M)

USD/JPY: 144.00 (2.4BLN), 144.40-50 (369M), 145.00 (1.1BLN)

Overnight News of Note

Minutes Revealed Some Fed Officials Supported Raising Rates In June

Fed's Williams Says Data Supports More Action On Interest Rates

BoE’s Dovish Talk May Have Worsened UK Inflation, Economists Say

UK Edges Closer To Re-joining EU’s £85Bln Horizon Science Programme

SNB’s Maechler: SNB Doesn't Rule Out Further Rate Hikes

China Analysts: China To Prefer Near Term Structural Policy Support

China Has Ample Tools Even In ‘Panic’ Yuan Drop, PBoC Paper Says

Australia's Trade Surplus Swells To $11.8 Billion, Beating Forecasts

Dollar Firms On Rate Hike Views After Fed Minutes, Yen Gains

BlackRock Wants To Make It Cheaper To Trade Bitcoin, Larry Fink Says

Oil Prices Steady As China Demand Fears Offset Tighter Supply Forecasts

Stocks Slide, US Yields Climb Amid Hawkish Fed, China Tensions

Bank Of America Increases Dividend By 9% After Fed Stress Test

As Twitter Falters, Threads Surpasses 5 Million Sign Ups On Day One

ExxonMobil Sees $4 Billion Earnings Hit From Gas Prices, Refining

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

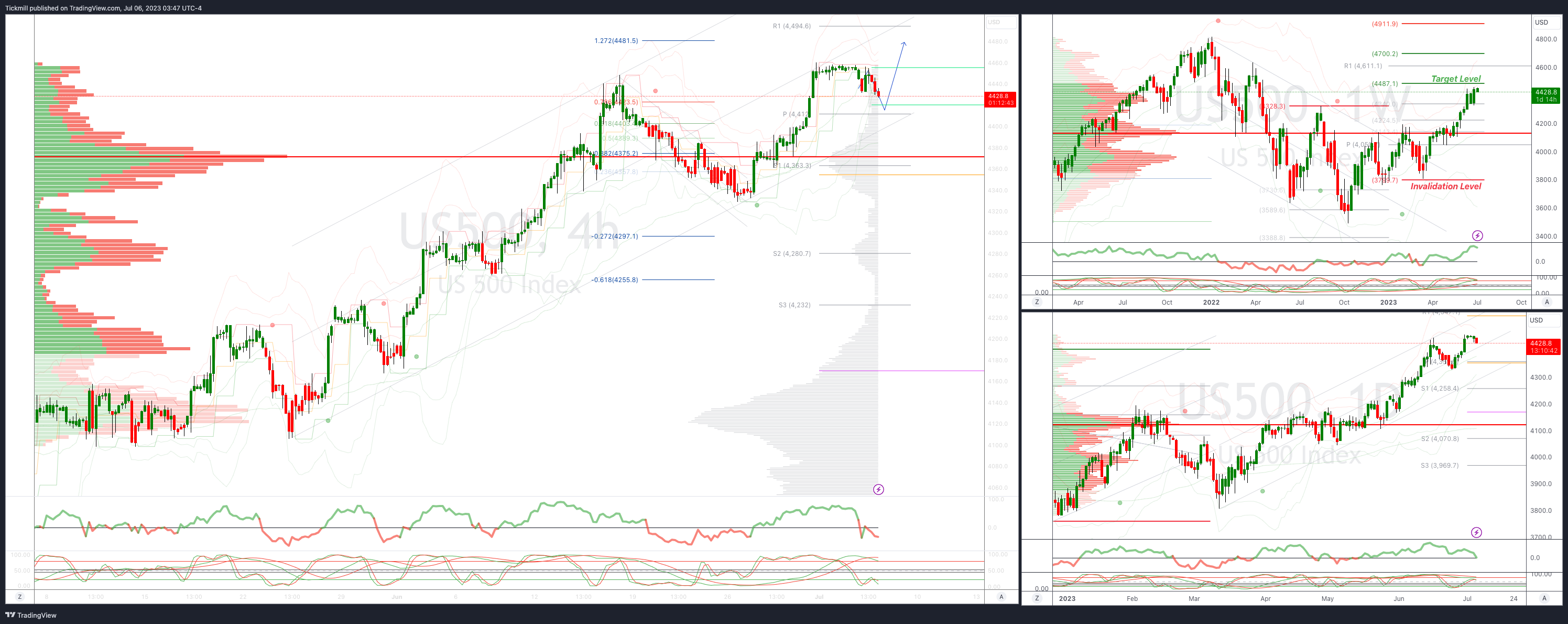

SP500 Bias: Intraday Bullish Above Bearish Below 4412

Below 4400 opens 4370

Primary support is 4300

Primary objective is 4540

20 Day VWAP bullish, 5 Day VWAP bullish

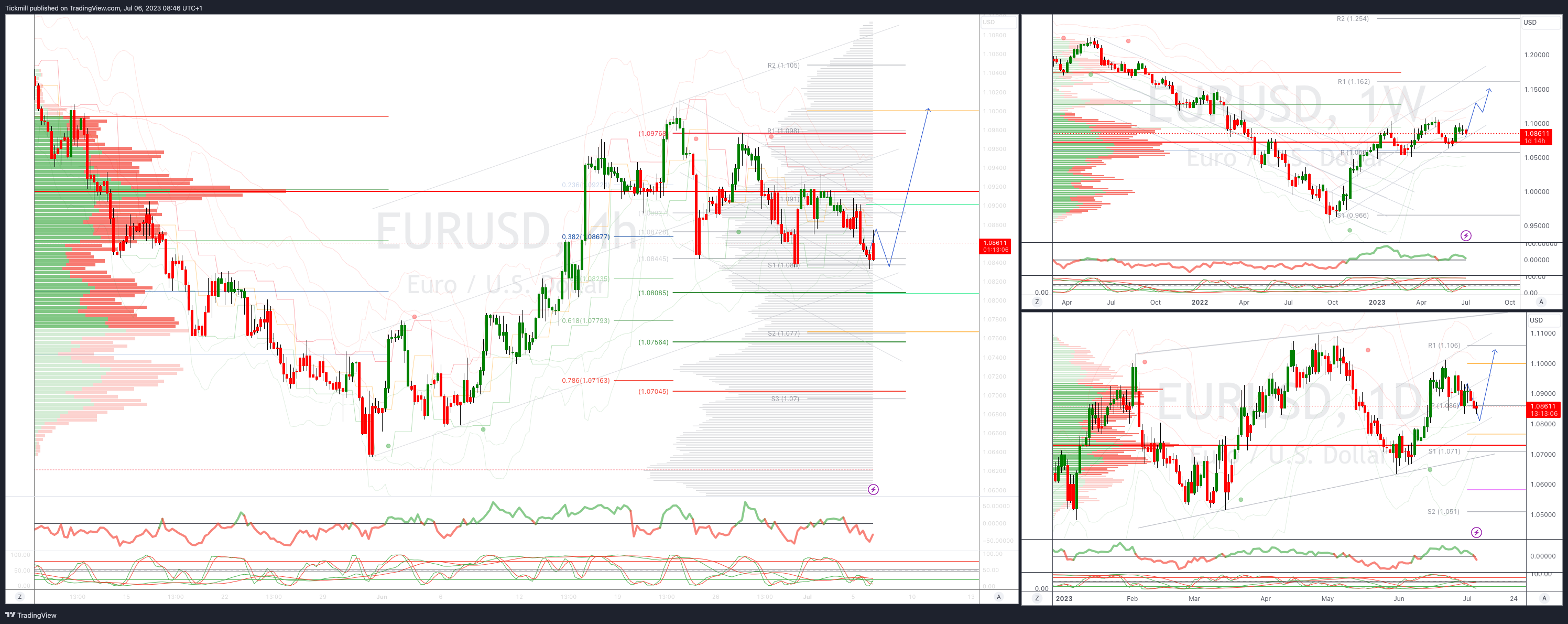

EURUSD Intraday Bullish Above Bearsih Below 1.0840

Below 1.0840 opens 1.08

Primary support is 1.07

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bearish

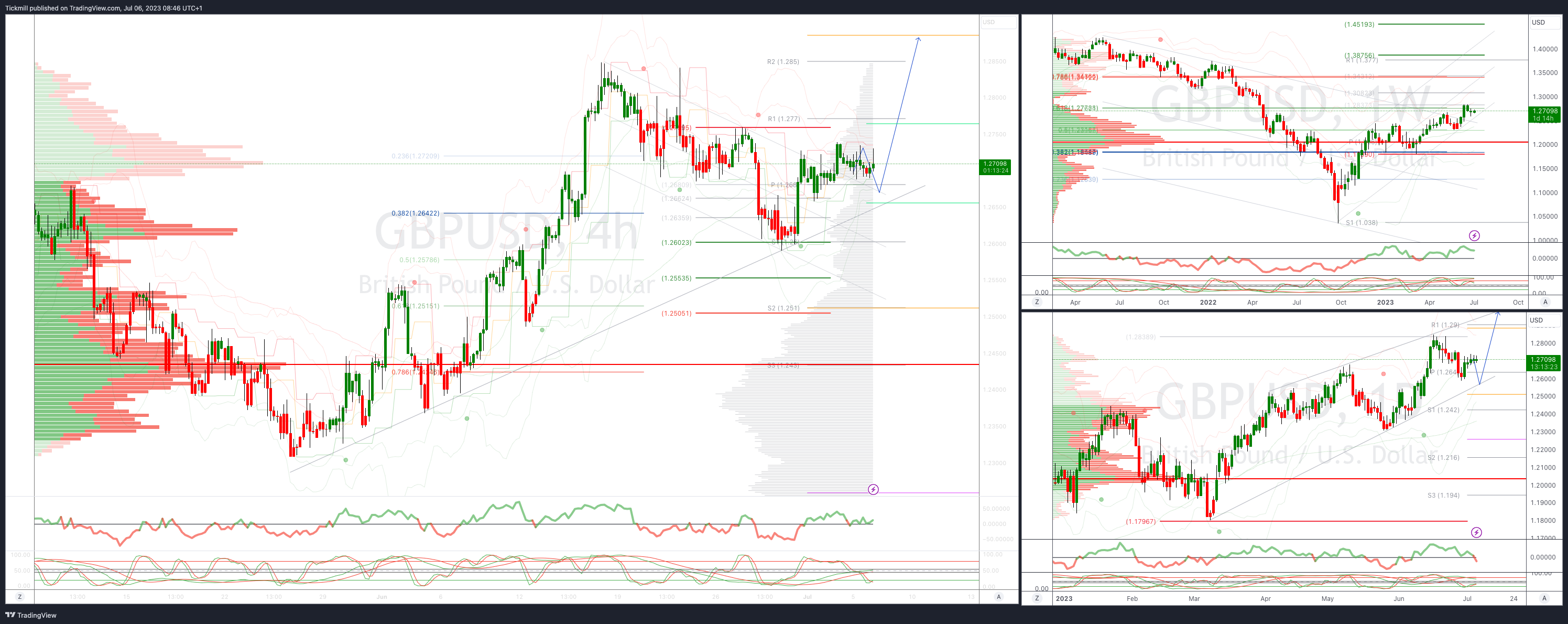

GBPUSD Bias: Intraday Bullish Above Bearish Below 1.2650

Below 1.26 opens 1.2550

Primary support is 1.26

Primary objective 1.2880

20 Day VWAP bullish, 5 Day VWAP bullish

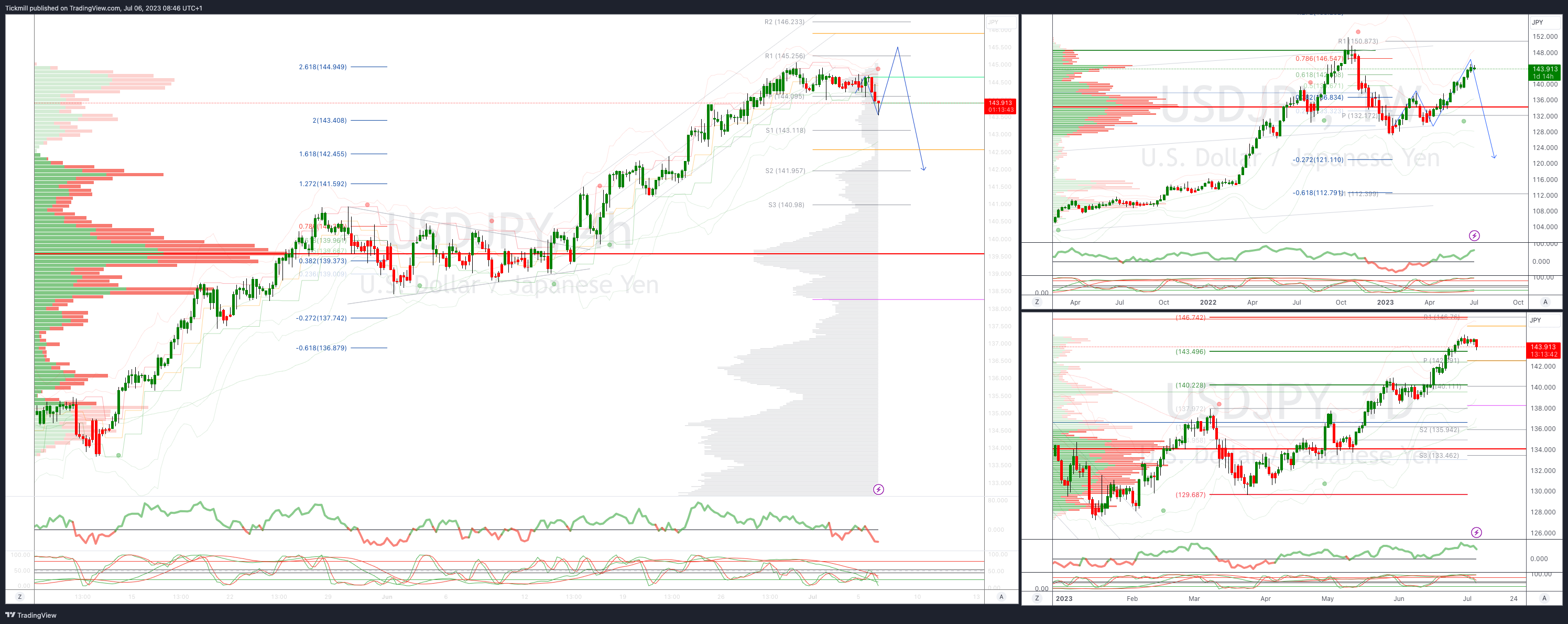

USDJPY Bullish Above Bearish Below 143.50

Below 143 opens 142.30

Primary support is 141

Primary objective is 145.50

20 Day VWAP bullish, 5 Day VWAP bullish

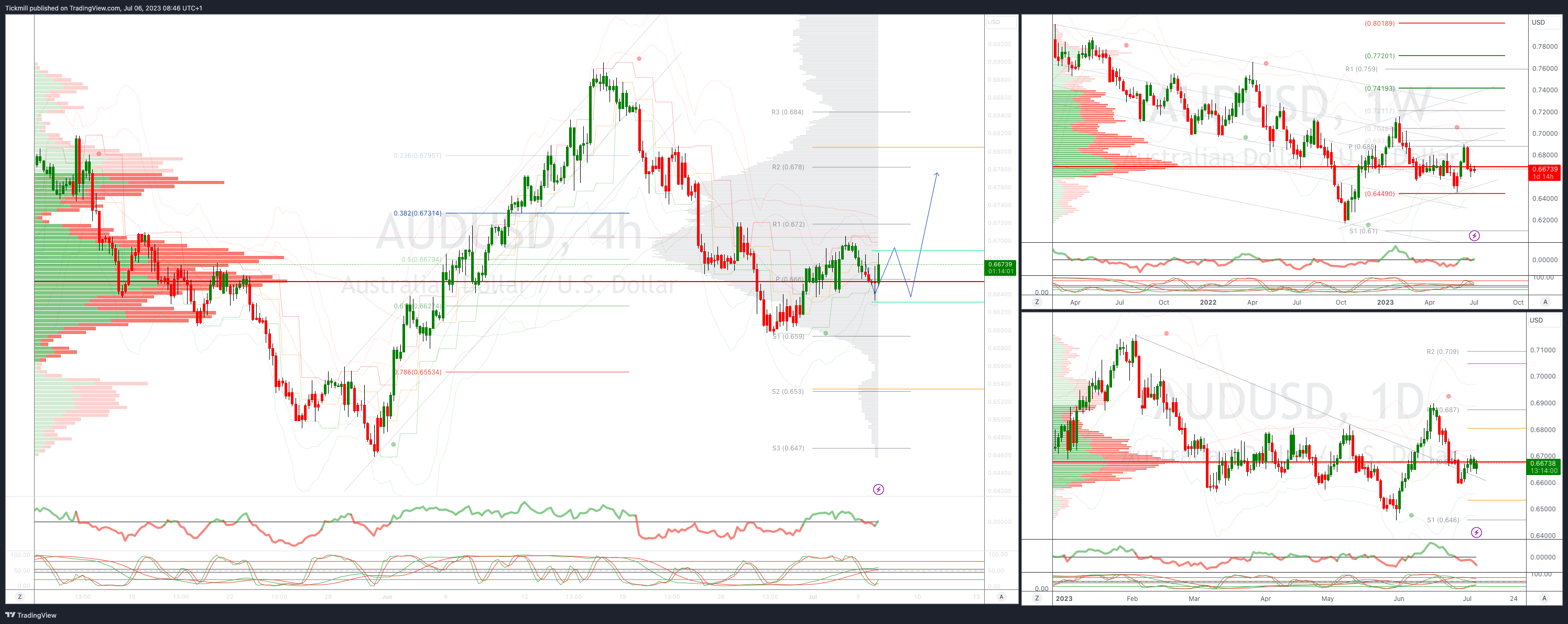

AUDUSD Bias:Intraday Bullish Above Bearish Below .6660

Below .6600 opens .6550

Primary support is .6448

Primary objective is .6917

20 Day VWAP bearish, 5 Day VWAP bullish

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!