Daily Market Outlook, January 24, 2024

Munnelly’s Market Minute…“China Restricts Short Selling & PBoC Cut RRR BY 0.5%”

Asian markets traded with mixed results, influenced by the performance of Wall St, corporate earnings, and recent statements from the Bank of Japan. The Nikkei 225 was under pressure due to rising Japanese bond yields and a more assertive stance from BoJ Governor Ueda. The Hang Seng and Shanghai Composite indices also had mixed performance, with Hong Kong outperforming due to support measures from Chinese authorities, while the mainland market was volatile and briefly erased earlier gains after the People's Bank of China continued to reduce liquidity through open market operations, but later recovered slightly. According to sources, Chinese authorities have requested certain hedge funds to limit their short selling activities in the stock index futures market. PBoC will reduce its RRR by 0.5 percentage points starting from Feb 5th and will keep using liquidity injection tools. PBoC Governor mentioned that RRR levels are still relatively high and the cut is intended to release CNY 1 trillion into the economy.

Recent PMI data in the UK has shown a relatively positive outlook on economic activity. The composite index indicated expansion for the second consecutive month in December, staying above the key 50 level. This was driven by a rapid increase in the services measure, reaching its highest level since June, and lifting the composite measure to its highest since June as well. Conversely, the manufacturing index declined in December and remains below the expansion/contraction threshold. For January, expect a slight decrease in the services index to 51.7 from 53.4, while the manufacturing index is predicted to rise to 47.8 from 46.2. This would crucially mean that the composite indicator once again signals overall expanding activity. The January CBI industrial survey, expected soon, is likely to echo recent trends, indicating ongoing pressure on the manufacturing sector.

Ahead of the European Central Bank's monetary policy update on Thursday, the January Eurozone PMIs will provide timely insights into economic conditions. Unlike the UK, the Eurozone composite index remained below 50 in December for the seventh consecutive month. Although we expect both the manufacturing and services indices to show improvement in January, they are still projected to be below 50. However, the survey's forward-looking components may provide optimism for improvement throughout the year.

Stateside, PMIs usually receive less attention, but given the current focus on clues regarding the timing of interest rate cuts, this might not be the case this time. The US composite index remained above 50 in December for the eleventh straight month, reaching a five-month high. We anticipate another reading above 50 in January.

Overnight Newswire Updates of Note

Trump Defeats Haley; Biden Sweeps Democrats In New Hampshire Primary

Japanese Exports Hit Record In 2023 On Weak Yen

New Zealand Inflation Slows More Than RBNZ Expected

Japan Keidanren Biz Lobby Head Aiming For Wage Hikes To Outpace Infl

China Says EU’s ‘Unfair’ EV Subsidies Probe Risks Damaging Ties

US Stages Retaliatory Airstrikes Against Iran-Backed Militias In Iraq, Officials Say

One-Month Gaza Truce Focus Of Intensive Talks, Sources Say

Senior Tory Calls On Sunak To Resign To 'Give Party A Fighting Chance'

Japan Bonds Fall On Growing View BoJ Is Step Closer To Rate Hike

Japanese Banks Climb On Bets The BoJ Will Lift Rates This Year

Texas Instruments Gives Weak Forecast as Chip Slump Persists

Netflix Is Preparing Investors And Users For More Price Hikes In 2024

Boeing Woes Reach A New Low As Two Airlines Consider Abandoning 737 Plans

FAA May Expand Boeing Probe Beyond Max 9, Agency Chief Says

eBay To Cut 1,000 Jobs, Reduce Contractors To Sharpen Focus

Apple Dials Back Car’s Self-Driving Features And Delays Launch To 2028

China Regulators Ask Funds To Restrict Short Selling Of Stock Index Futures

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0810 (379M), 1.0865 (446M), 1.0900 (2.1BLN), 1.0950 (487M)

GBP/USD: 1.2500 (225M), 1.2525-35 (301M)

AUD/USD: 0.6565 (1.4BLN), 0.6575-80 (3BLN), 0.6610-20 (1.7BLN)

0.6625-30 (1.1BLN)

AUD/NZD: 1.0775 (461M), 1.0850 (405M)

USD/JPY: 147.50 (554M), 149.00 (554M), 149.50 (275M), 150.00 (600M)

AUD/JPY: 95.00 (210M), 95.50 (225M), 97.50 (252M)

One month expiry implied volatility is trading near two year lows in major G10 currency pairs due to lower realised volatility. This makes current levels more attractive before upcoming key events such as central bank meetings and potential policy outlook clues. Implied volatility for JPY fell after the Bank of Japan left policy unchanged, but the risk of a policy tweak on April 26 has increased. There is more demand and premium for options thereafter. Additionally, USD/CHF has seen more realised volatility than EUR/USD, lifting the implied volatility differential in 1-month to 0.75 for USD/CHF since December.

CFTC Data As Of 12/01/24

USD bearish decreasing -9,298

CAD bearish increasing -992

EUR bullish decreasing 14,150

GBP bullish increasing 2,443

AUD bearish increasing -3,151

NZD neutral neutral -177

MXN bullish neutral 2,370

CHF bearish neutral -542

JPY bearish neutral -4,803

Technical & Trade Views

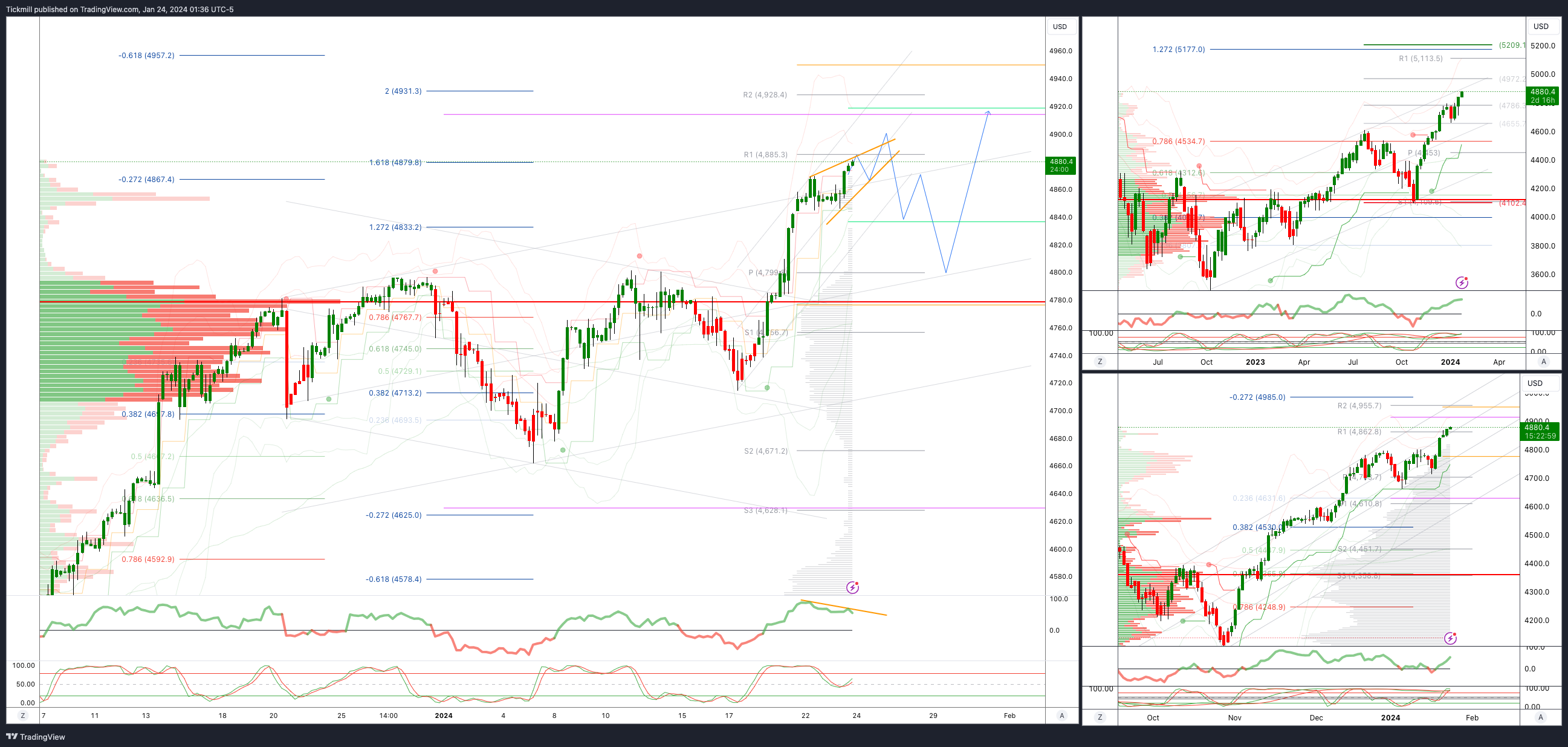

SP500 Bullish Above Bearish Below 4850

Daily VWAP bullish

Weekly VWAP bullish

Below 4800 opens 4780

Primary support 4700

Primary objective is 4880 Target Hit, New Pattern Emerging

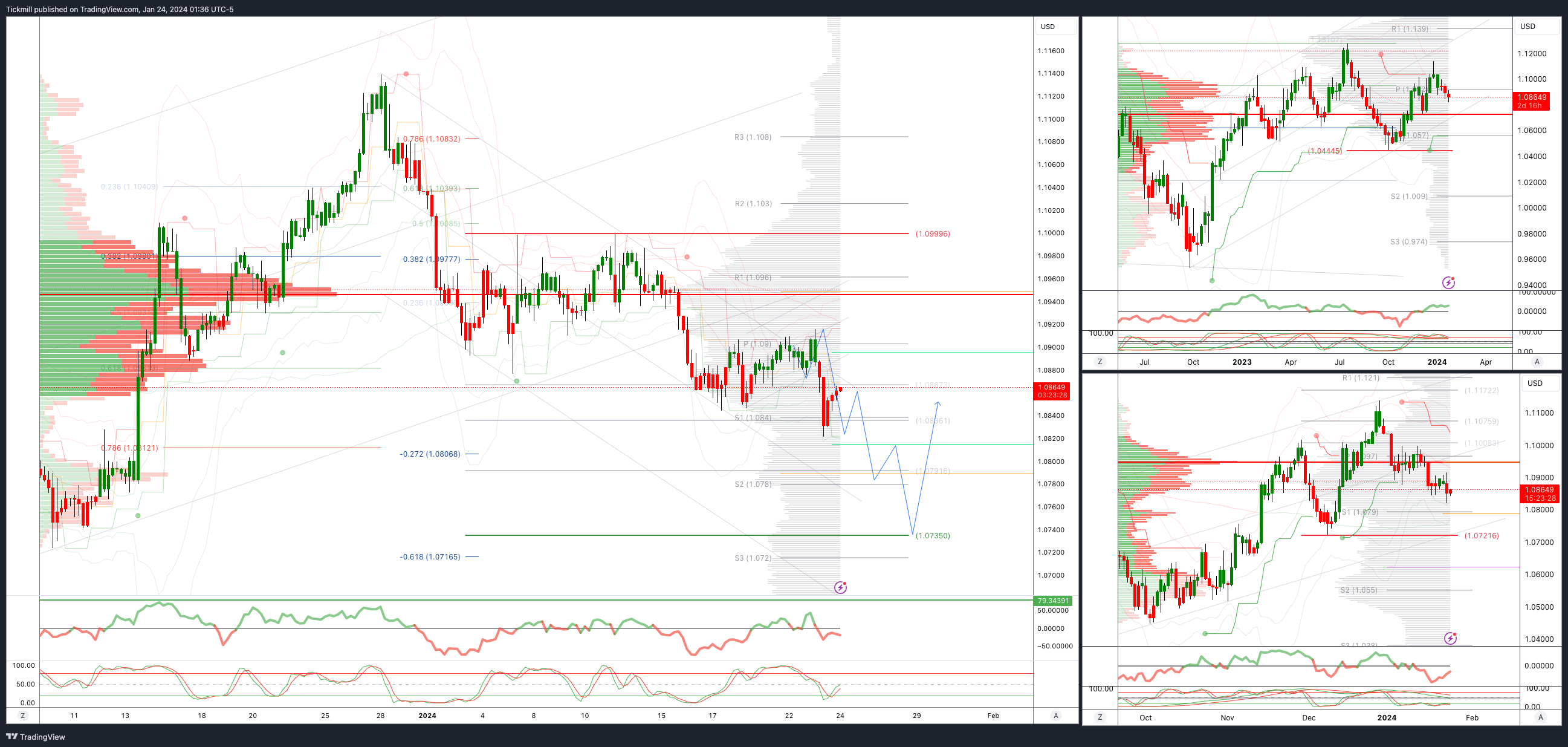

EURUSD Bullish Above Bearish Below 1.0930

Daily VWAP bullish

Weekly VWAP bearish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bearish

Above 1.28 opens 1.2870

Primary resistance is 1.2785

Primary objective 1.2570

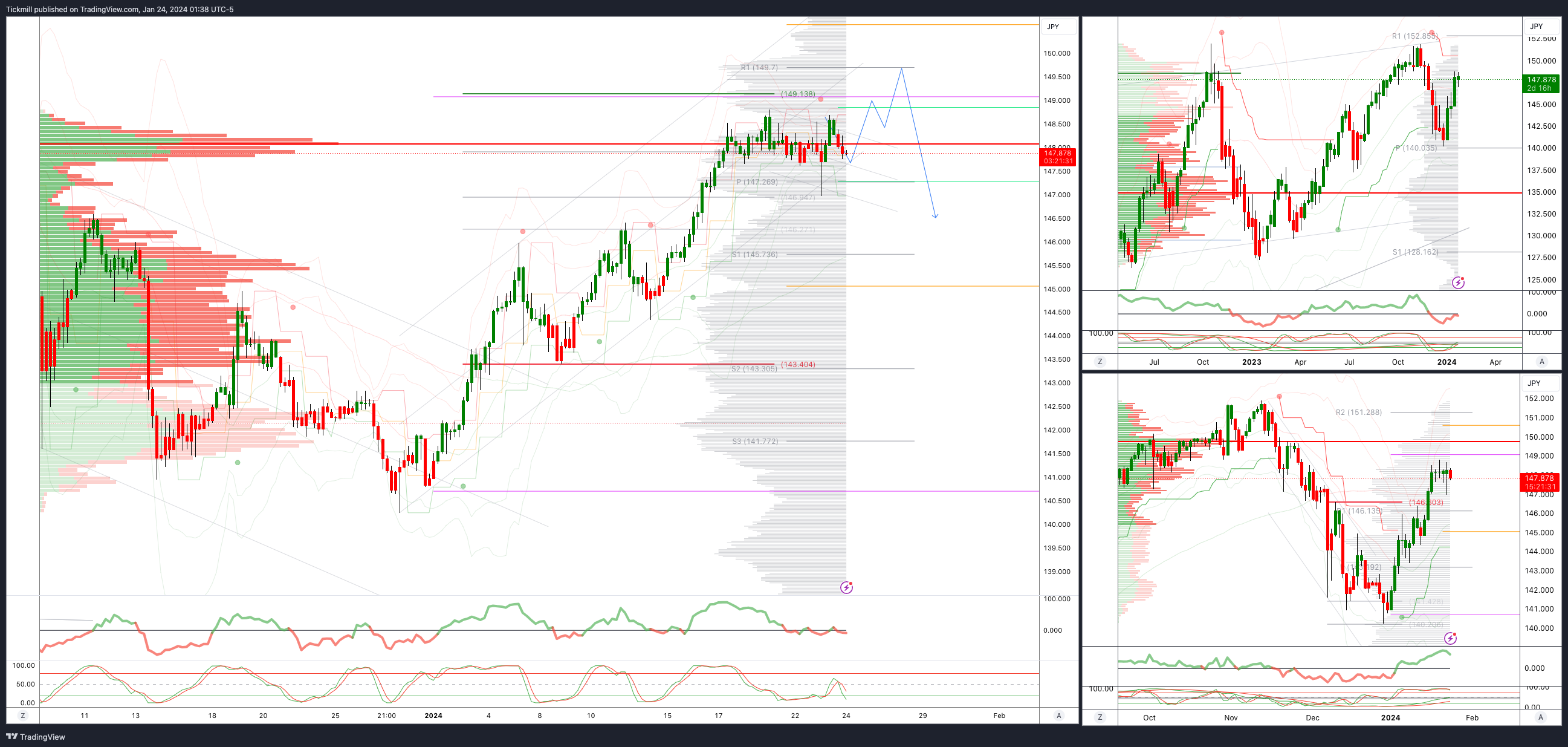

USDJPY Bullish Above Bearish Below 146.40

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bullish

Weekly VWAP bearish

Above .6680 opens .6550

Primary support .6525

Primary objective is .6933

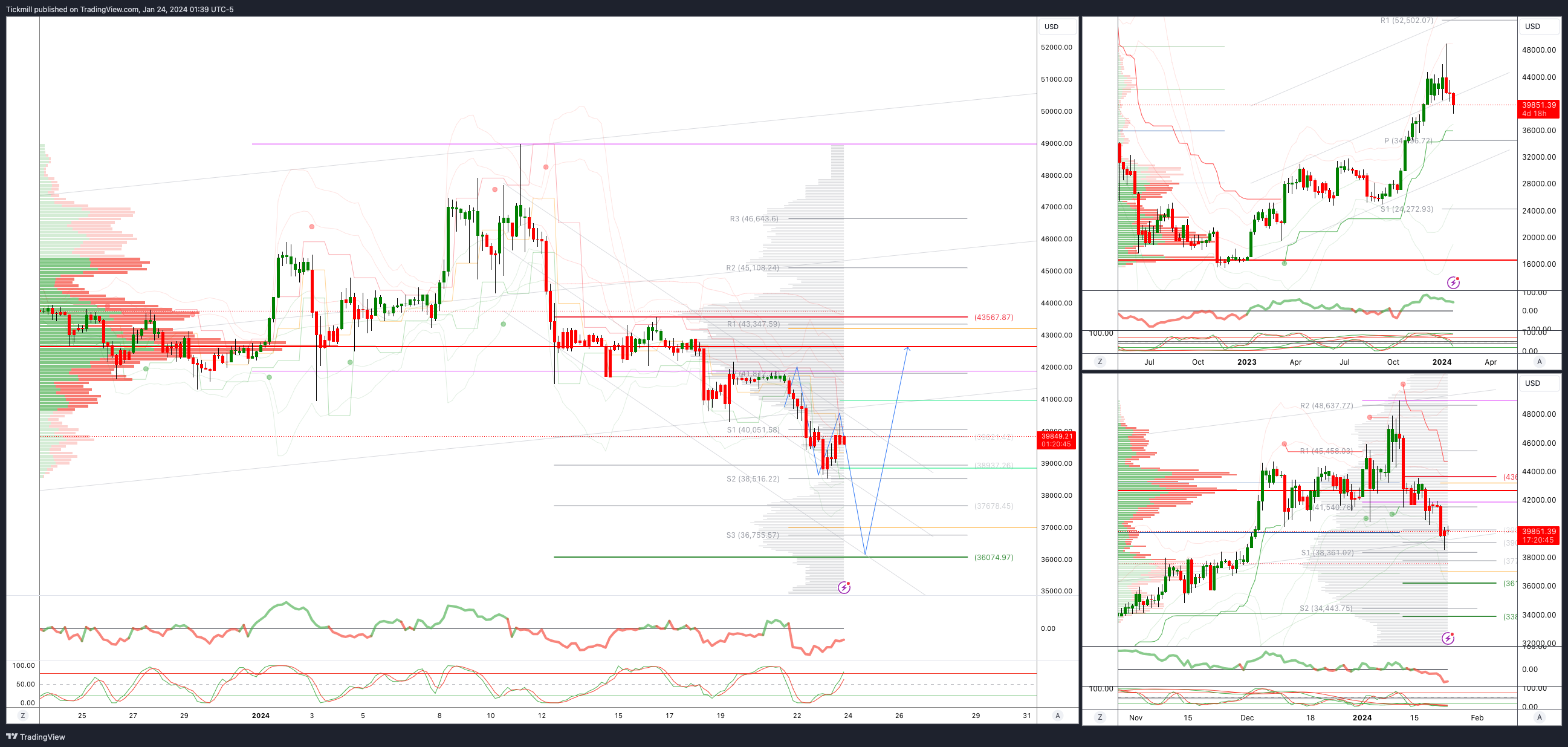

BTCUSD Bullish Above Bearish below 43600

Daily VWAP bearish

Weekly VWAP bearish

Above 43590 opens 46000

Primary support is 40000

Primary objective is 36097

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!