Daily Market Outlook, August 15, 2023

Munnelly’s Market Commentary…

Asian equity markets traded with mixed outcomes as market participants processed key releases, including disappointing Chinese activity data and the People's Bank of China's (PBoC) unexpected reductions in its 7-day Reverse Repo and 1-year Medium-term Lending Facility (MLF) rates. The Nikkei 225 index in Japan experienced an upswing following a robust Gross Domestic Product (GDP) report. The report indicated a 6.0% expansion in Japan's economy, surpassing the projected 3.1% growth. This growth rate marked the fastest annualised pace since the fourth quarter of 2020. The expansion was primarily driven by exports, while private consumption contracted for the first time in three quarters. Conversely, the Hang Seng index and the Shanghai Composite index displayed subdued performance. The underwhelming Chinese Industrial Production and Retail Sales figures overshadowed the surprise rate cuts made by the central bank. The People's Bank of China made a surprising reduction of 10 basis points in its 7-day Reverse Repo rate and a 15bps cut in its 1-year MLF rate. These rates now stand at 1.80% and 2.50%, respectively.

The latest UK labour market data, released earlier today, offers further indications that domestic inflationary pressures are likely to remain a concern for the Bank of England. Particularly noteworthy is the acceleration in headline wage growth, which reached a new high of 8.2% in June, up from a revised 7.2% in May. This increase was partly driven by one-off bonus payments within the National Health Service (NHS). When excluding bonuses, regular wage growth also rose to 7.8% from 7.5%. The report also revealed unexpected developments, including a rise in the unemployment rate from 4.0% to 4.2%, and a decrease of 66,000 in employment over the past three months. Despite the decline in job vacancies, their numbers still remain relatively high compared to pre-pandemic levels.

In the Eurozone investors will focus on the August German ZEW survey, released this morning, holds significance, particularly considering the bulk of data for the third quarter so far indicating a slowdown in growth.

Stateside, retail sales data will take centre stage later today. An expected monthly increase of 0.4% for July would signal ongoing economic growth in the third quarter.

FX Positioning & Sentiment

On Monday, the MSCI Emerging Markets (EM) Foreign Exchange (FX) index declined to a level of 1667, and it maintained a trading range of 1667 to 1670 on Tuesday. The index has fluctuated between 1659 and 1717 in 2023. A significant retracement level of the major rise that occurred from October to February is at 1661. If the index drops below 1659, it might signal the conclusion of this year's consolidation phase. Bearish signals emerged from the fact that the index closed below the 200-day moving average (DMA) and both the 55-DMA and 100-DMA dropped below the 100-DMA. Despite modest bets against Asian currencies, there appears to be limited restraint preventing a potential drop. Traders have taken long positions on Mexican peso (MXN), Brazilian real (BRL), and many investors have allocated significant amounts of capital to other carry trades.If the index experiences a decline, it could lead to a notable shift in market positioning and investment strategies.

CFTC Data As Of 11-08-23

USD net spec short cut significantly in Aug 2-8 period; $IDX +0.52%

EUR$ -0.31% in period; specs -22,251 contracts now +149,811

$JPY +0.1% in period; specs -3,964 contracts as pair rises to key 145 lvl

GBP$ -0.22% in period; specs -2,542 contracts, long cut to +47,020

AUD$ -1.13% in period; specs +8,600 contracts, specs bottom-fish

$CAD +1.05%; specs -6,988, position flips to -623

BTC +2.64% specs -610 contracts into strength, now short 1,149 (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800-05 (1.5B), 1.0810 (685M), 1.0850 (1.2B), 1.0900 (1.3B)

EUR/USD: 1.0930-35 (1.1B), 1.0940 (2.3B), 1.0990 (2.1B), 1.1000 (2.1B)

USD/JPY: 143.50 (1.0B), 145.00 (1.3B), 145.25 (595M), 146.00 (900M)

GBP/USD: 1.2650 (570M), 1.2700 (585M). USD/CAD: 1.3100 (830M), 1.3400 (620M)

Overnight Newswire Updates of Note

China’s Central Bank Unexpectedly Cuts Two Key Policy Rates

China Industrial Output, Retail Sales Growth Miss Forecasts

Japan’s Huge GDP Beat Driven By Exports As Domestic Demand Falls

RBA Sees 'Credible Path' To Inflation Target At 4.1% Cash Rate

Australia Q2 Wage Growth Softer Than Expected, Adds To Rate Pause Case

Yellen Says China’s Slowdown Is A ‘Risk Factor’ For US Economy

US Regulators Try To Consign Emergency Bank Fire Sales To History

Yen Weakens Toward Level That Prompted September Intervention

Chinese State Banks Sold Dollars To Support Yuan, Traders Say

US Real Yield Climbs To 14-Year High, Stoking Demand For Dollar

Oil’s Push Toward $90 Gets Lift From Physical Markets Everywhere

Saudi Arabia And UAE Race To Buy Nvidia Chips To Power AI Ambitions

Tesla Adds Lower Spec Model S, X EVs That Are $10,000 Cheaper

US FDA Approves Pfizer’s Blood Cancer Therapy

Esmark Becomes Second US Steel Suitor With $10Bln Offer

NAB Flags Higher Loan Losses, Unveils A$1.5Bln Buyback

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

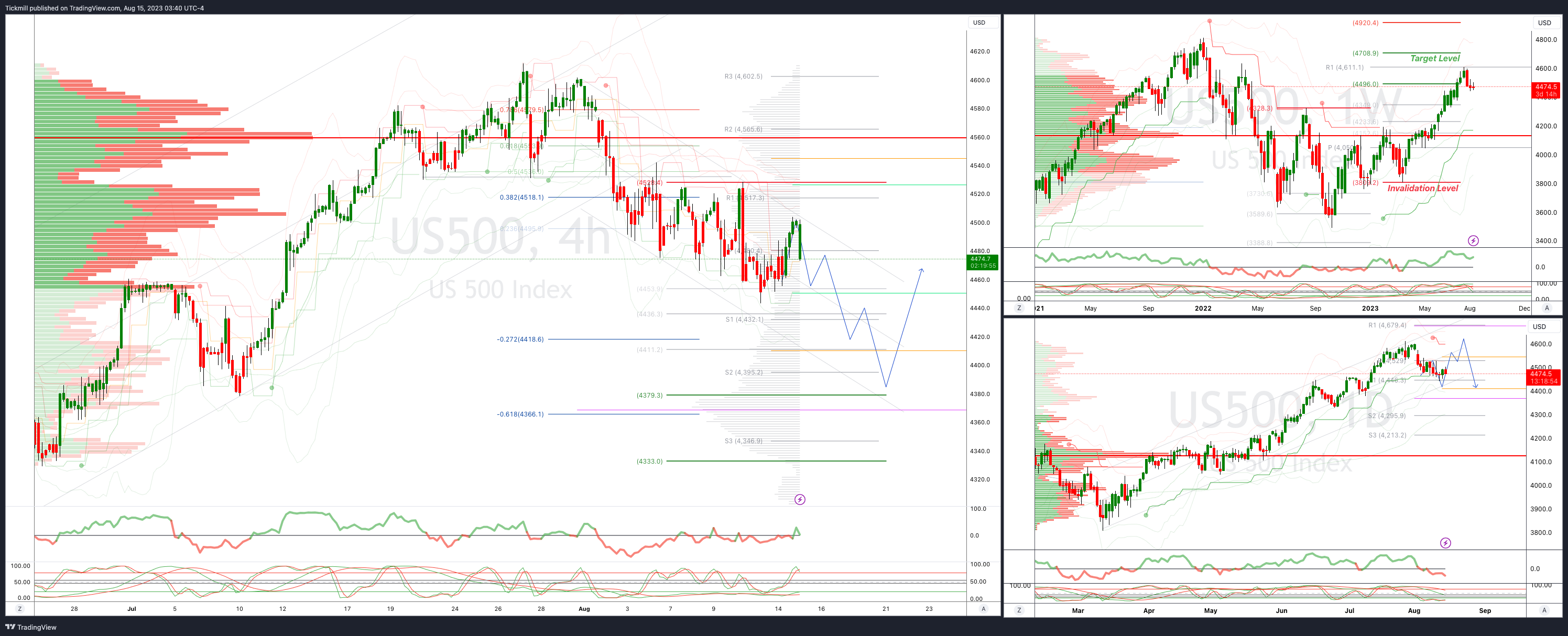

SP500 Intraday Bullish Above Bearish Below 4500

Above 4530 opens 4560

Primary resistance is 4560

Primary objective is 4380

20 Day VWAP bearish, 5 Day VWAP bearish

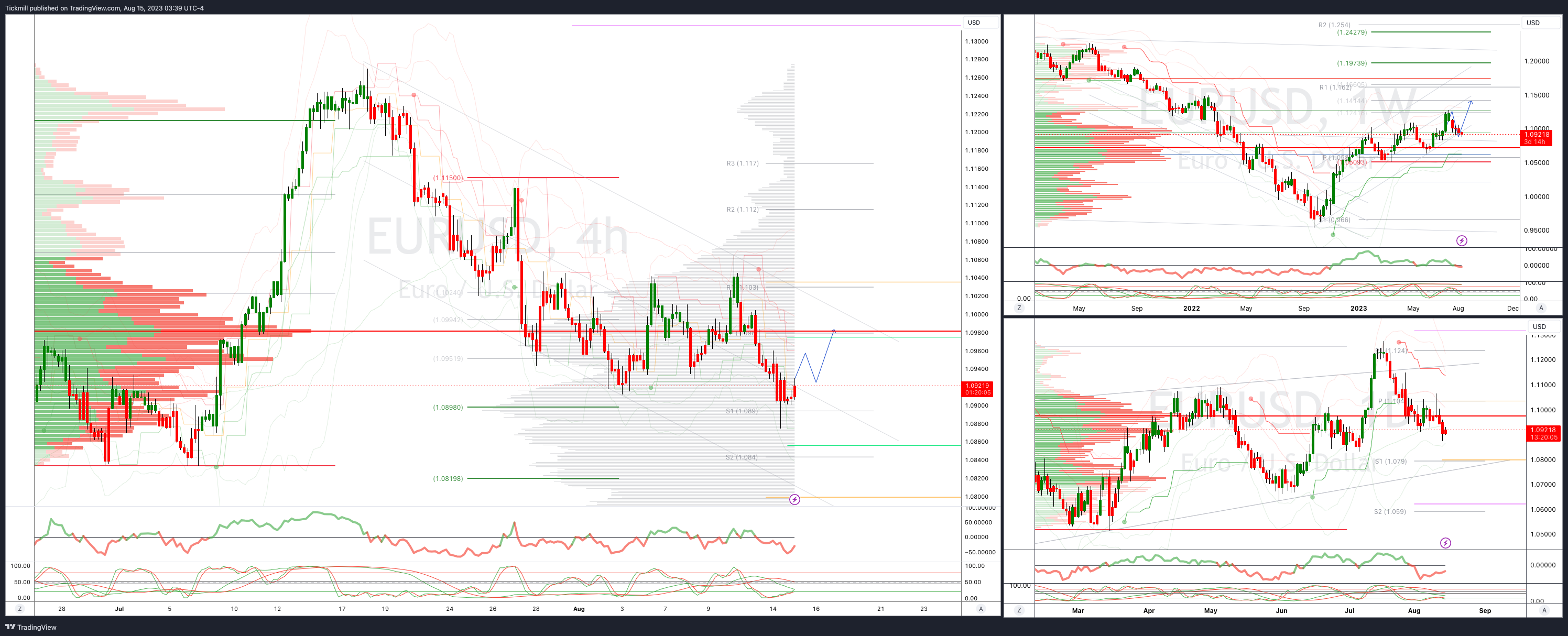

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bearish, 5 Day VWAP bearish

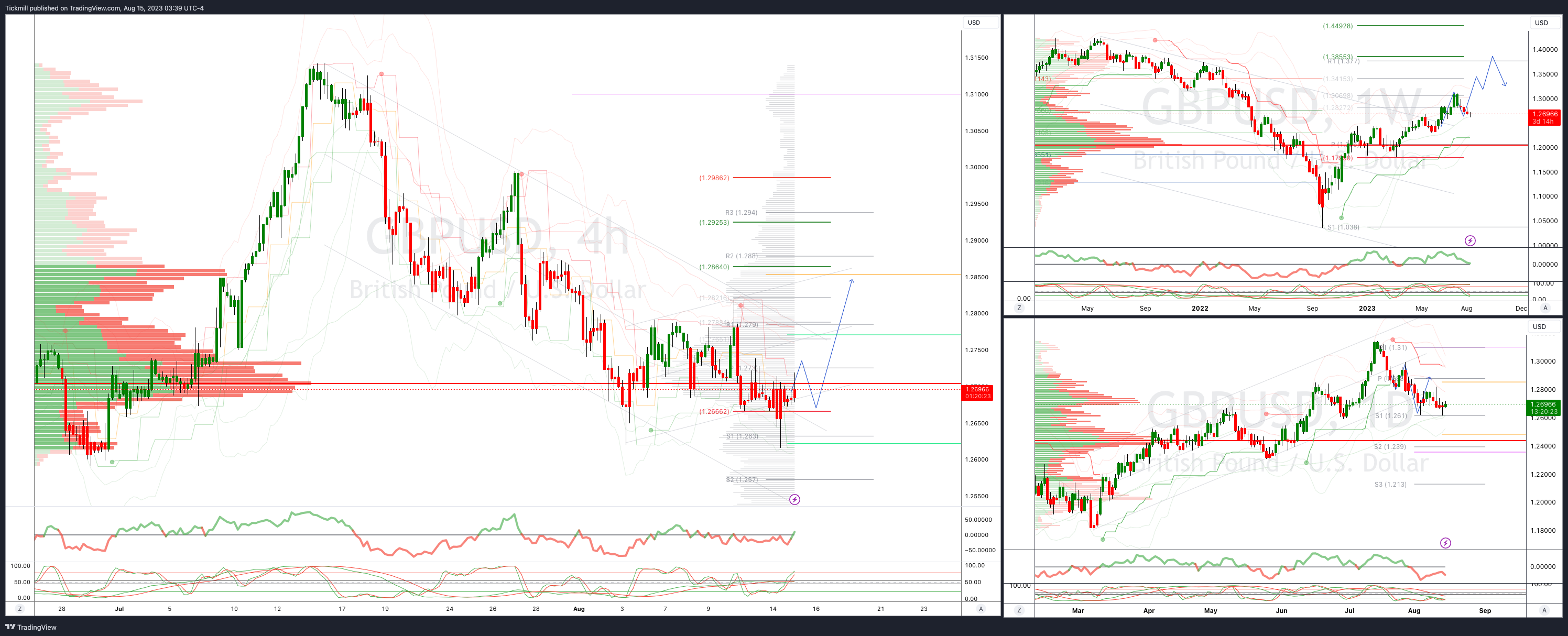

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.2590

Primary objective 1.3850

20 Day VWAP bearish, 5 Day VWAP bearish

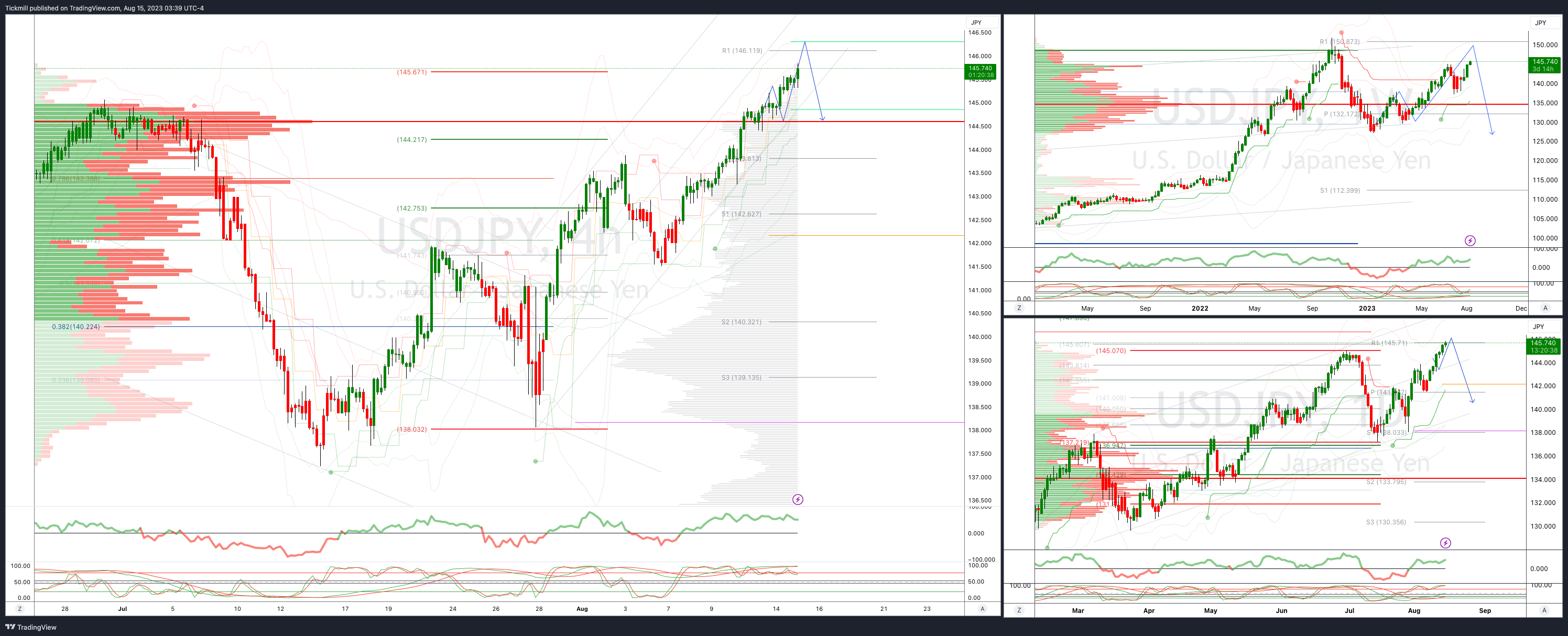

USDJPY Bullish Above Bearish Below 144.50

Below 143 opens 142

Primary support 140.50

Primary objective is 147.20

20 Day VWAP bullish, 5 Day VWAP bullish

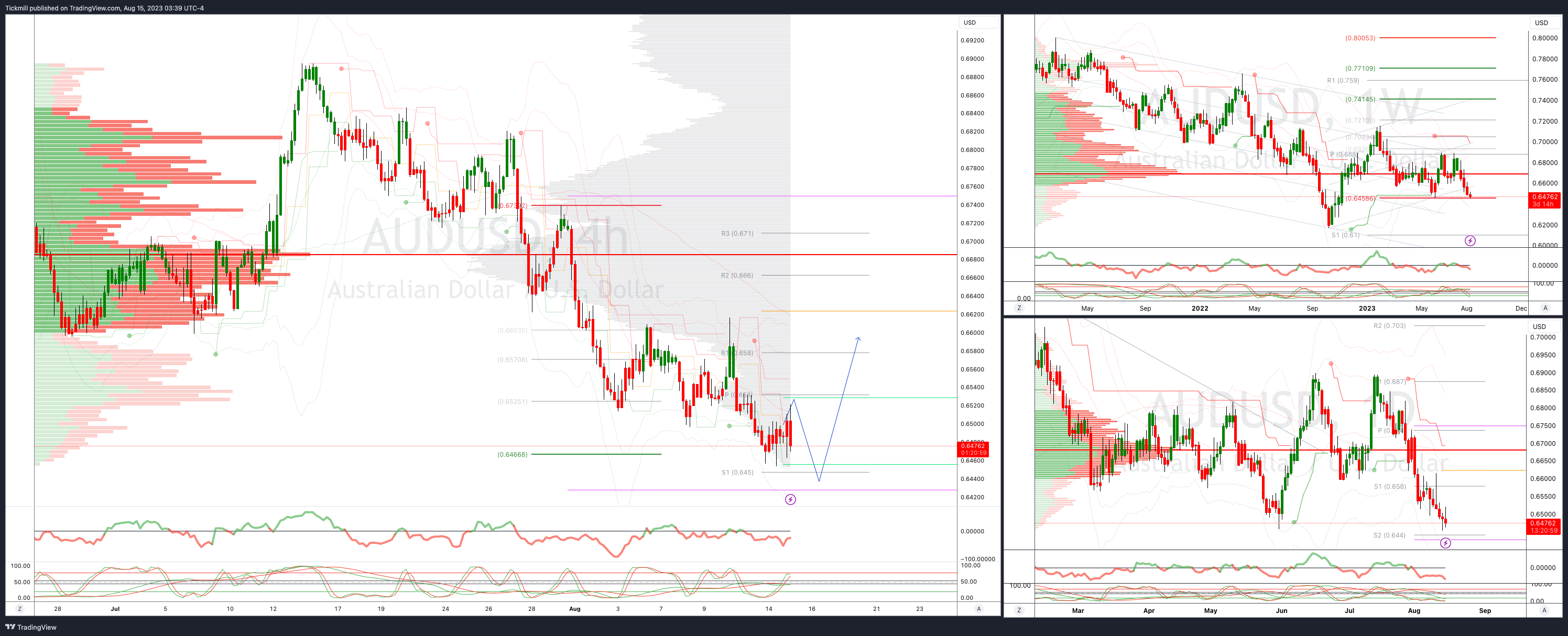

AUDUSD Intraday Bullish Above Bearish Below .6660

Above .6750 opens .6820

Primary resistance is .6730

Primary objective is .6466

20 Day VWAP bearish, 5 Day VWAP bearsih

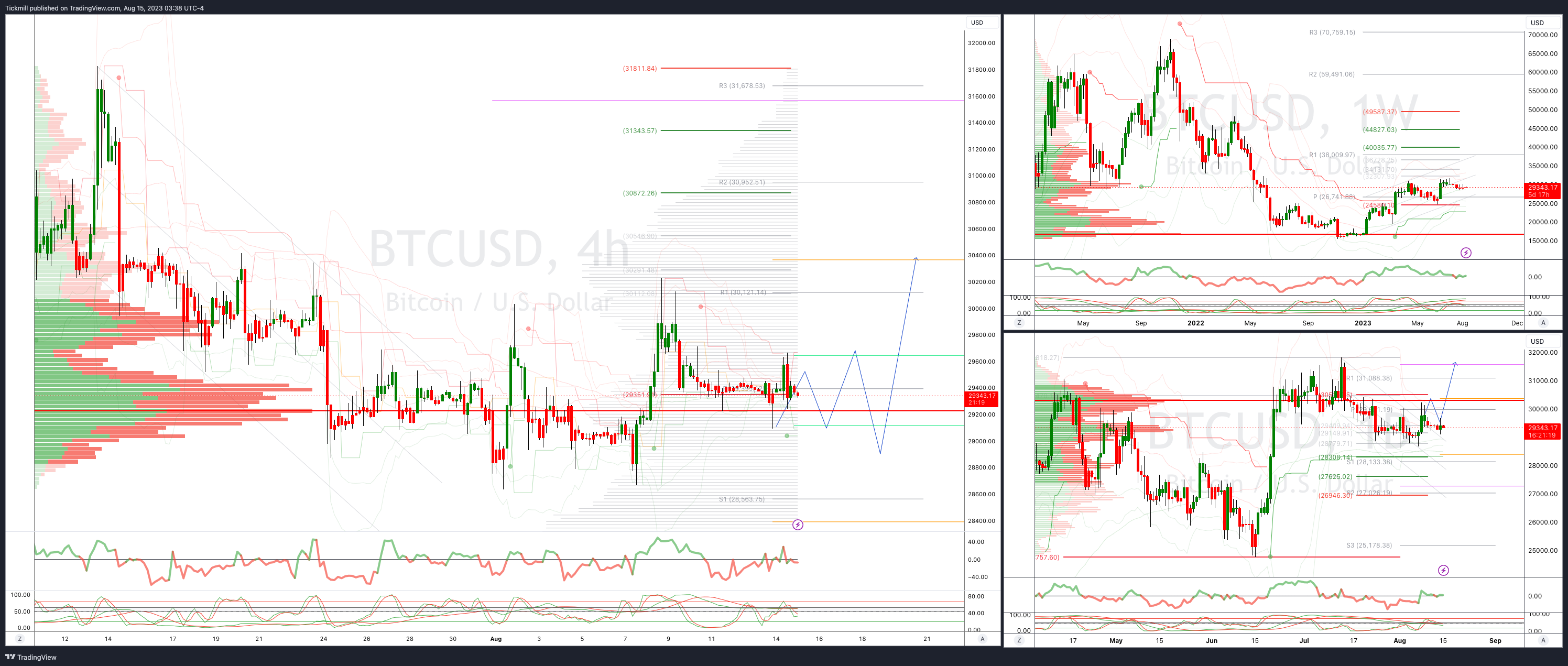

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28300

Primary support is 28300

Primary objective is 32750

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!