Daily Market Outlook, August 14, 2023

Munnelly’s Market Commentary…

Asian equity markets encountered downward pressure driven by ongoing economic concerns in China and apprehensions over developer defaults. This backdrop of risk aversion loomed over the region, especially with significant upcoming events such as key global data releases and the imminent release of the latest Federal Open Market Committee (FOMC) minutes.

The Nikkei 225 index (-1.3%) in Japan experienced initial fluctuations between gains and losses. Early advances, attributed to a weaker currency, were eventually nullified as the index succumbed to the prevailing risk-off sentiment. In contrast, the Hang Seng index (-2.5%) and the Shanghai Composite index (-1.0%) recorded declines. Among these, the Hang Seng index took the hardest hit, largely due to substantial losses in the technology and property sectors. These losses were amplified by concerns surrounding defaults, as evidenced by Country Garden Holdings' suspension of trading for 11 onshore bonds and Sino-Ocean Group's announcement regarding the suspension of trading for 6% guaranteed notes due in 2024. Adding to the concerns, China's recent lending data revealed a significant drop of nearly 90% in New Yuan Loans, marking the lowest figure since 2009. Participants are also bracing themselves for the release of Chinese activity data scheduled for the following day, as well as the upcoming earnings reports from major tech giants Tencent and JD.com later in the week.

The start of the week is expected to be relatively quiet, with a data docket devoid of any significant data releases. However, the data calendar for the rest of the week is quite active, particularly in the UK. The labour market report on Tuesday will be followed by inflation data on Wednesday and retail sales data on Friday. Anticipated mixed outcomes in these reports may underscore the Bank of England's delicate position as it contemplates the possibility of another interest rate hike. Forecasts suggest that the labour market report will reignite domestic inflationary concerns. Despite the BoE acknowledging tentative signs of easing labour market pressures in its August Monetary Policy Report, a further decline in reported unfilled job vacancies might be seen as another indication of this trend. Nevertheless, employment is projected to have risen by 155,000 in the three months leading to June, with the unemployment rate likely remaining stable at 4.0%. Furthermore, annual average earnings growth is expected to accelerate, reaching a new multi-year high of 7.4%. These forecasts are expected to intensify the challenges faced by the Bank of England.

CFTC Data As Of 11-08-23

USD net spec short cut significantly in Aug 2-8 period; $IDX +0.52%

EUR$ -0.31% in period; specs -22,251 contracts now +149,811

$JPY +0.1% in period; specs -3,964 contracts as pair rises to key 145 lvl

GBP$ -0.22% in period; specs -2,542 contracts, long cut to +47,020

AUD$ -1.13% in period; specs +8,600 contracts, specs bottom-fish

$CAD +1.05%; specs -6,988, position flips to -623

BTC +2.64% specs -610 contracts into strength, now short 1,149 (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0975-80 (865M), 1.1000 (1.9B), 1.1050 (535M), 1.1065 (555M)

USD/JPY: 142.00 (1.8B). GBP/USD: 1.2510 (310M), 1.2885 (305M)

AUD/JPY: 0.9000 (915M). AUD/USD: 0.6505 (950M). USD/CAD: 1.3350 (580M)

USD/ZAR: 19.3800 (540M)

FX Options Positioning

Implied volatility for near-term contracts in the G10 foreign exchange market continues to decline and has further decreased following the release of the CPI data, as was anticipated. The 1-month benchmark contracts are now approaching the possibility of revisiting their lows from June, indicating a resurgence of the typical FX market conditions during the traditional quieter period of August.

Overnight Newswire Updates of Note

Goldman Pencils In First Fed Rate Cut For Second Quarter Of 2024

Britain’s Landlord Selloff May Be Much Bigger Than First Thought

NZIER Recommends The RBNZ’s OCR Should Remain At 5.5% In August

Yen Slides To Weakest Since November On Wide Japan-US Yield Gap

Yuan Drops Toward This Year’s Low As Chinese Economy Sputters

Oil Edges Lower After Seven-Week Rally Driven By Tighter Market

Gas Market Ructions Fuel Concerns About Energy Bills This Winter

China Stocks Close To Erasing Politburo Gains Amid Economic Woes

Tesla Cuts China Price Of Top-End Model Ys In Latest Salvo

SoftBank In Talks To Buy Vision Fund's 25% Stake In Arm

China Country Garden To Suspend Onshore Bond Trading From Monday

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

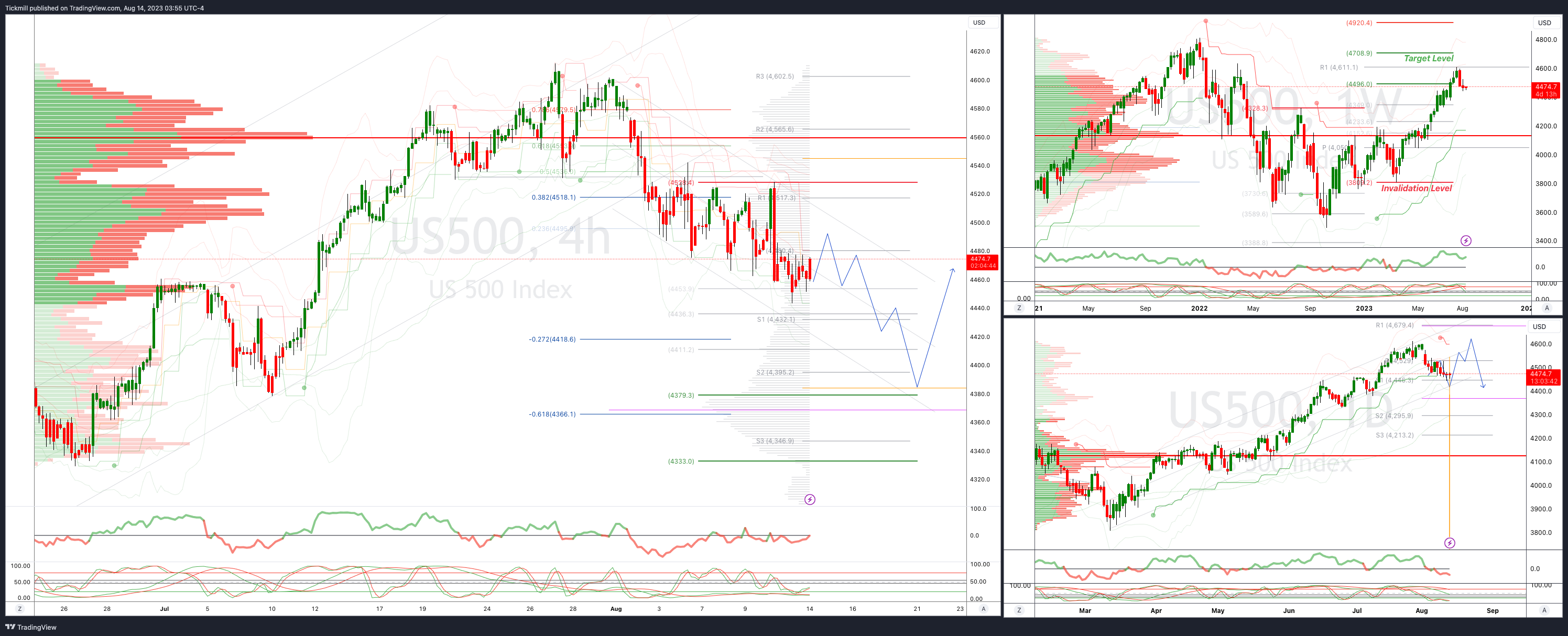

SP500 Intraday Bullish Above Bearish Below 4500

Above 4530 opens 4560

Primary resistance is 4560

Primary objective is 4380

20 Day VWAP bearish, 5 Day VWAP bearish

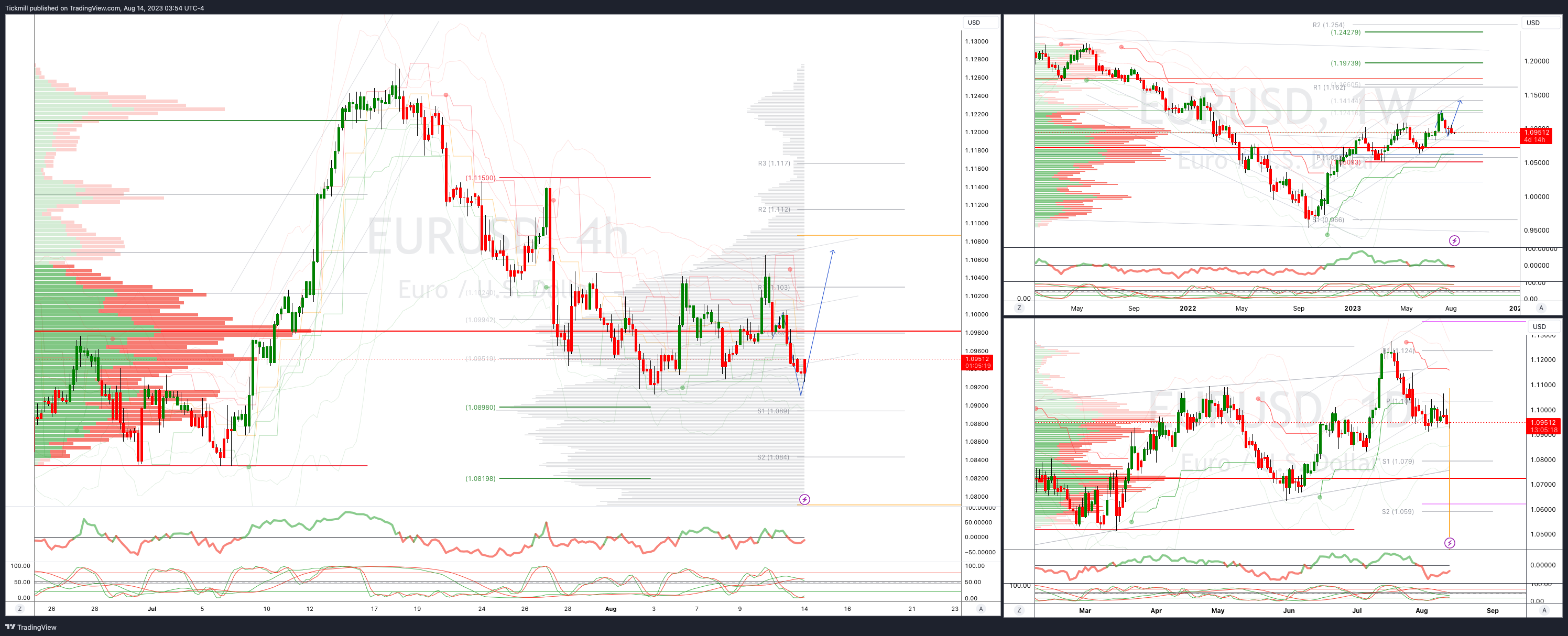

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bearish, 5 Day VWAP bearish

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bearish, 5 Day VWAP bearish

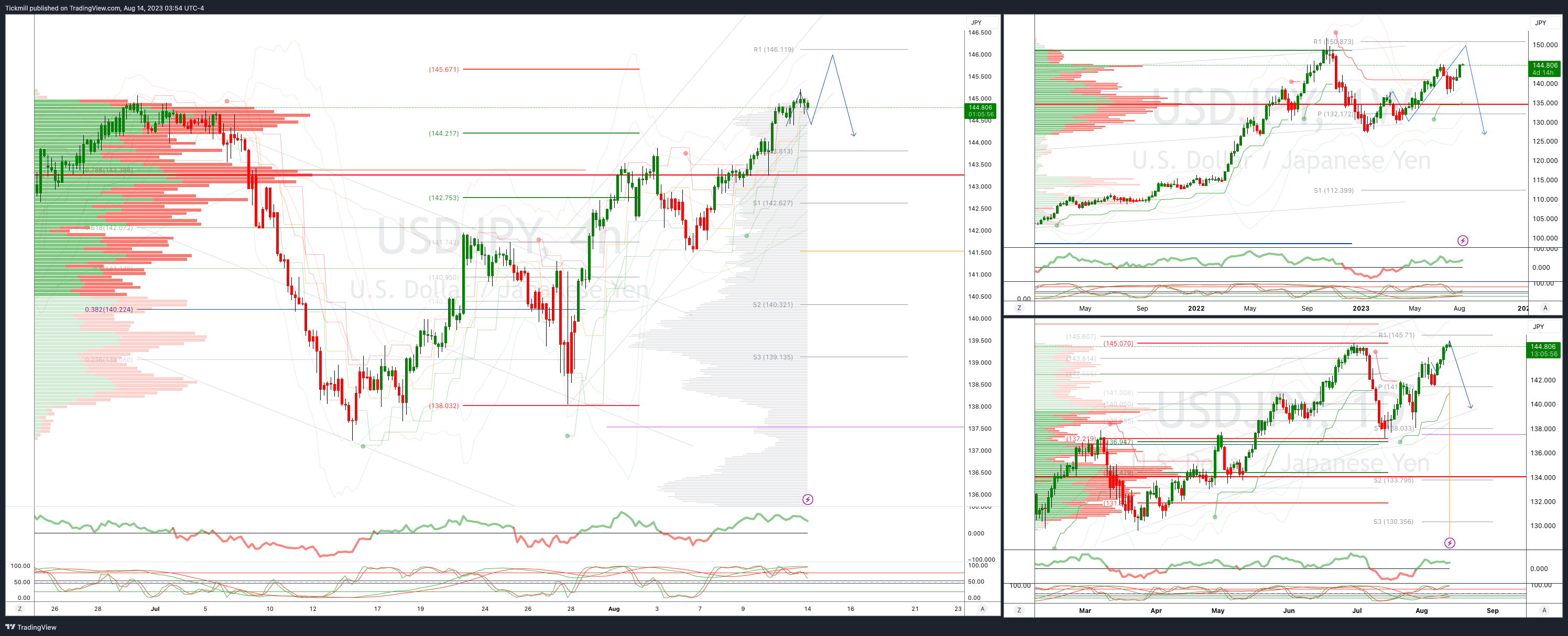

USDJPY Bullish Above Bearish Below 143

Below 143 opens 142

Primary support 140.50

Primary objective is 147.20

20 Day VWAP bullish, 5 Day VWAP bullish

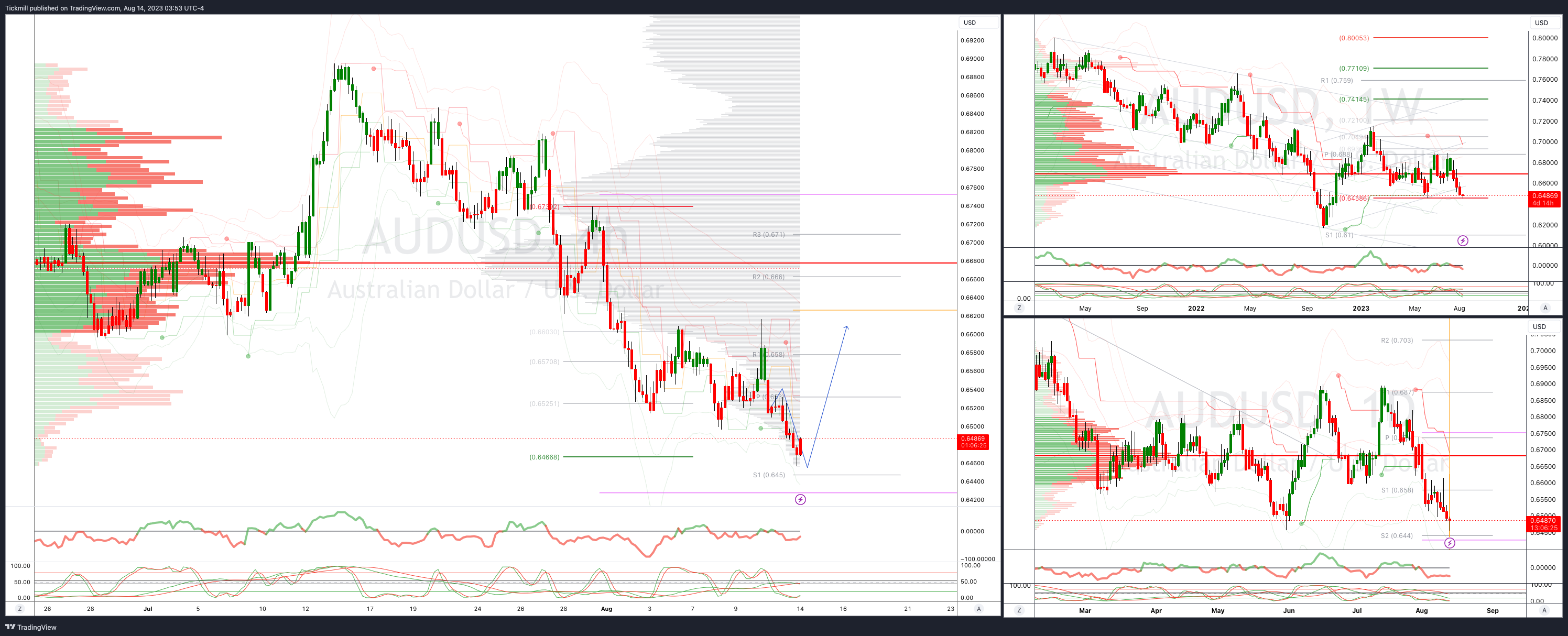

AUDUSD Intraday Bullish Above Bearish Below .6660

Above .6750 opens .6820

Primary resistance is .6730

Primary objective is .6466

20 Day VWAP bearish, 5 Day VWAP bearsih

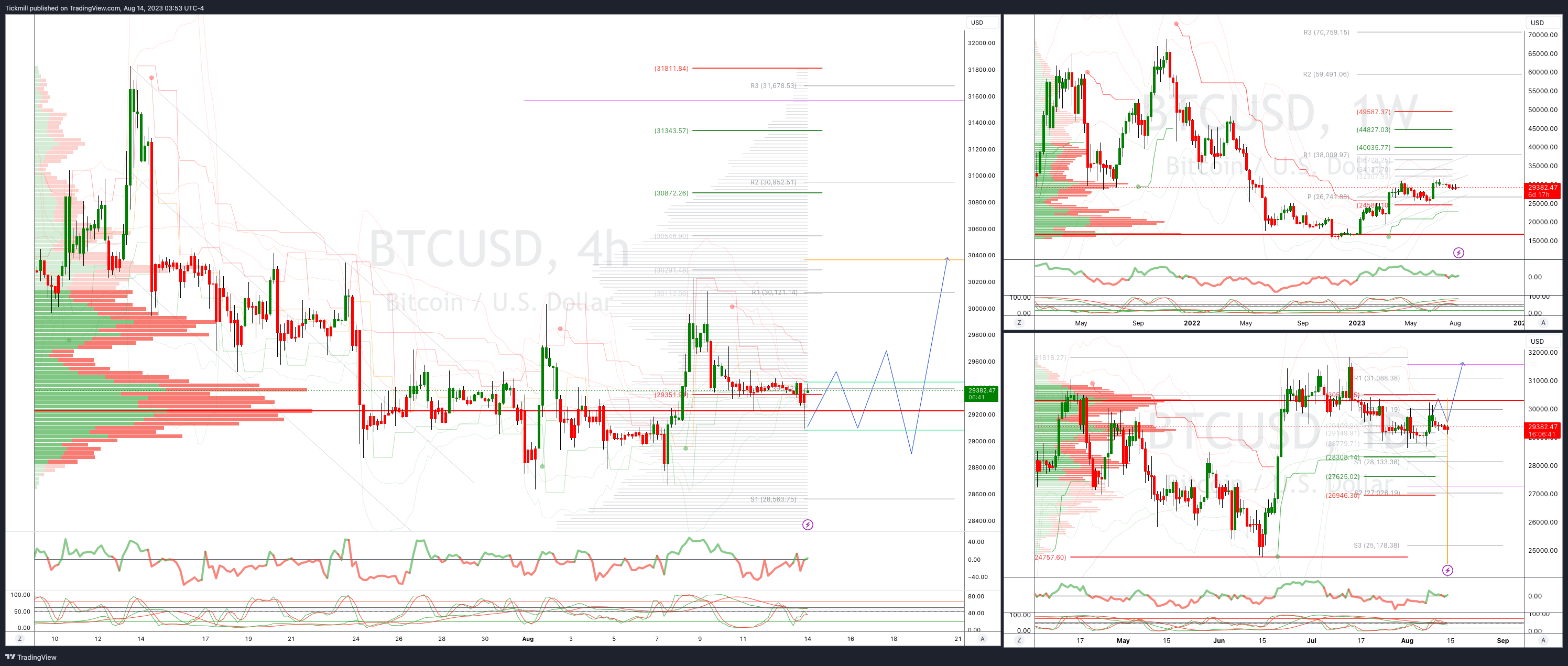

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28300

Primary support is 28300

Primary objective is 32750

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!