Daily Market Outlook, April 15, 2024

Munnelly’s Macro Minute…

“Middle East Tensions Recede As Iran Retaliation Considered Proportionate ”

On Monday, Asian investors initially focused on reducing risk and playing it safe before buyers emerged as relief around middle east tensions increased risk appetite. With the yen reaching a 34-year low against the dollar, traders are wary of intervention from the Bank of Japan. Japanese authorities have not intervened despite warnings, possibly because the yen's decline is justified by U.S. growth and inflation rates outpacing Japan's. The strong dollar and rising U.S. bond yields may pose problems for Asia by tightening financial conditions and increasing the cost of servicing dollar-denominated debt. Geopolitical tensions may not provide much comfort as investors seek to reduce risk in their portfolios.

Last week's release of US CPI inflation for March brought about an unexpected twist, triggering a significant reassessment in global interest rate projections. Presently, markets are factoring in just one Fed rate cut for the year. This outcome underscores the resilience of US CPI throughout Q1, heightening the possibility that US policymakers might exercise greater patience before implementing interest rate reductions. Consequently, the likelihood of a mid-year initial Fed rate cut has diminished. Investors await cues from Fed officials regarding the prospect of a June rate cut, with speculation lingering until after the May 1 update. The market has shifted its fully priced first cut expectation to September.

Today's market attention rests on the US retail sales report, expected to reveal a 0.6% increase in headline activity for March, indicating only a marginal slowdown in Q1 consumption growth. Next week's release of the advance estimate of Q1 GDP growth is projected to exhibit moderation but still maintain a pace above trend, contributing to the Fed's cautious stance on policy easing. Overnight, Fed member Daly is set to affirm that there's no immediate need to adjust interest rates.

In the UK, the upcoming week is brimming with significant data releases, including labor market updates, CPI inflation, and retail sales figures. These releases are crucial for gauging inflationary trends, which could influence the Bank of England's decision to potentially implement rate cuts starting in the summer. Commentary from MPC member Sarah Breeden might offer insights into the timing of the first Bank Rate cut. Early tomorrow, the UK labor market report is anticipated to demonstrate further signs of softening, aligning with survey data and indicating a blend of reduced labor demand and enhanced supply. The central projection suggests a consecutive increase in the unemployment rate, reaching 4.0% in the three months to February. Additionally, a continued softening in annual wage growth across headline and underlying measures, reaching 5.5% and 5.8%, respectively.

Elsewhere, Eurozone industrial production data for February is on the agenda, alongside a speech by ECB Chief Economist Lane. Following last week's policy meeting, the ECB maintains its stance signaling a probable cut in June.

Overnight Newswire Updates of Note

Israel Vows To 'Exact A Price' After Drone And Missile Attack By Iran

White House: US Will Not Join Any Retaliatory Action Against Iran

US House Speaker: Will Try To Pass Israel Aid This Week

Yellen Says Nothing Off Table In Response To China Overcapacity

ECB Set To Cut Interest Rates In June, Villeroy De Galhau Says

China Drains Cash Via MLF For Second Month Amid Yuan Concern

Japan's Machinery Orders Rise Sharply, May Ease Concerns On Demand

New Zealand PSI Release Shows Service Sector Dropping Into Contraction

Oil Shrugs Off Iranian Assault On Israel As Brent Turns Lower

Metals Spike On LME After Russian Metal Hit By US, UK Sanctions

Apple’s iPhone Shipments Plunge 10% As Android Rivals Rise

Tesla Is Rumoured To Be Preparing A Massive Round Of Layoffs

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0575 (761M), 1.0640-50 (407M), 1.0700 (420M)

1.0740-50 (2.5BLN), 1.0770 (610M)

AUD/USD: 0.6500 (711M), 0.6600 (1.3BLN)

USD/CAD: 1.3665-75 (300M), 1.3750-55 (631M)

USD/JPY: 153.10 (375M), 155.00 (400M)

EUR/JPY: 161.00 (225M). AUD/JPY: 99.00 (225M)

CFTC Data As Of 29/03/24

Equity fund managers raise S&P 500 CME net long position by 9,236 contracts to 939,368

Equity fund speculators trim S&P 500 CME net short position by 32,395 contracts to 333,288

Japanese yen net short position is -162,151 contracts

Euro net long position is 32,723 contracts

British pound net long position is 28,252 contracts

Swiss franc posts net short position of -31,764 contracts

Bitcoin net short position is -153 contracts

Gold NC Net Positions climbed from previous $199.3K to $207.3K

Technical & Trade Views

SP500 Bullish Above Bearish Below 5160

Daily VWAP bearish

Weekly VWAP bullish

Above 5160 opens 5200

Primary resistance 5258

Primary objective is 5118 TARGET HIT NEW PATTERN EMERGING

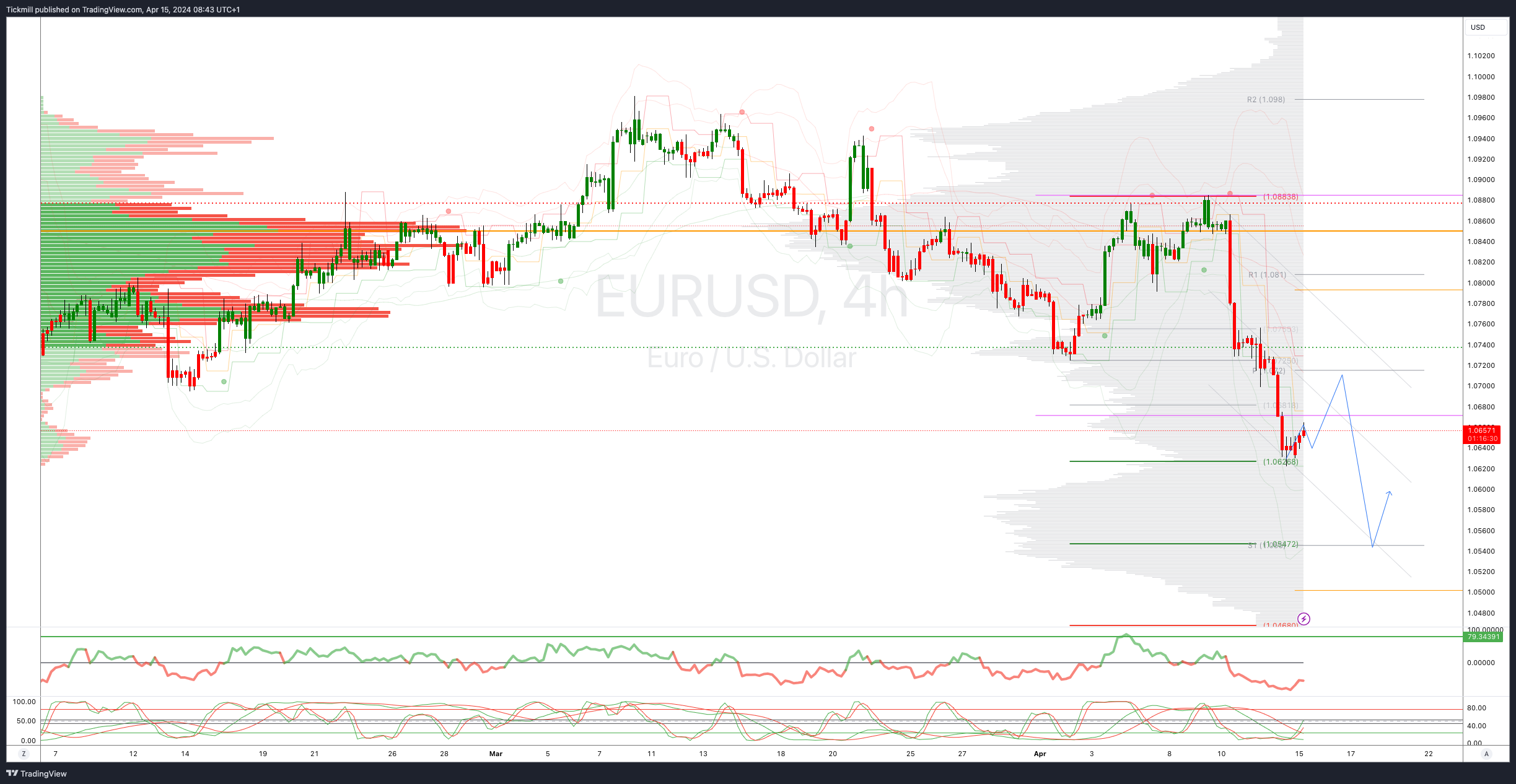

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bearish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

GBPUSD Bullish Above Bearish Below 1.2620

Daily VWAP bearish

Weekly VWAP bearish

Above 1.2560 opens 1.2650

Primary resistance is 1.2650

Primary objective 1.2350

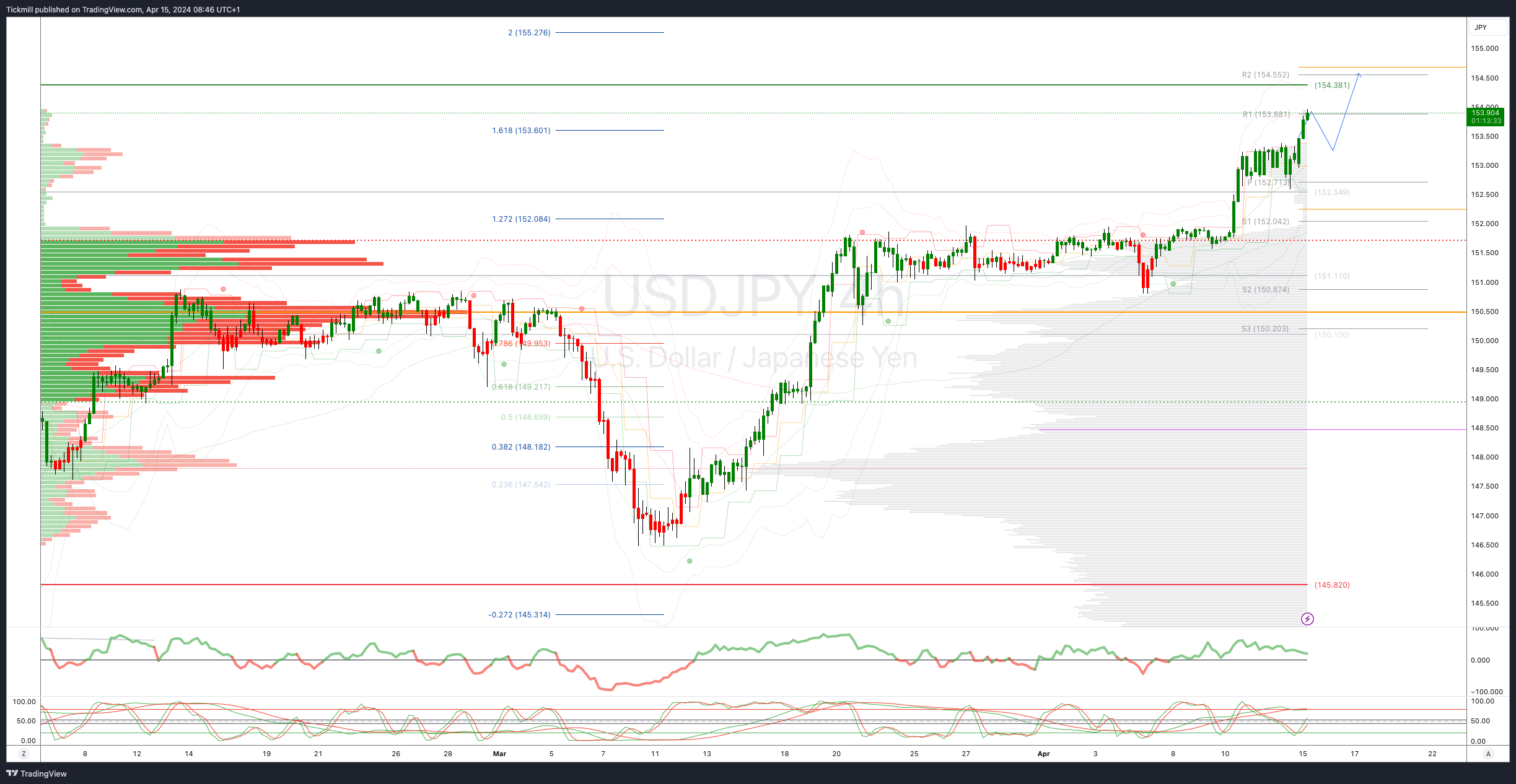

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bullish

Above 154 opens 154.50

Primary support 152

Primary objective is 153.50 TARGET HIT NEW PATTERN EMERGING

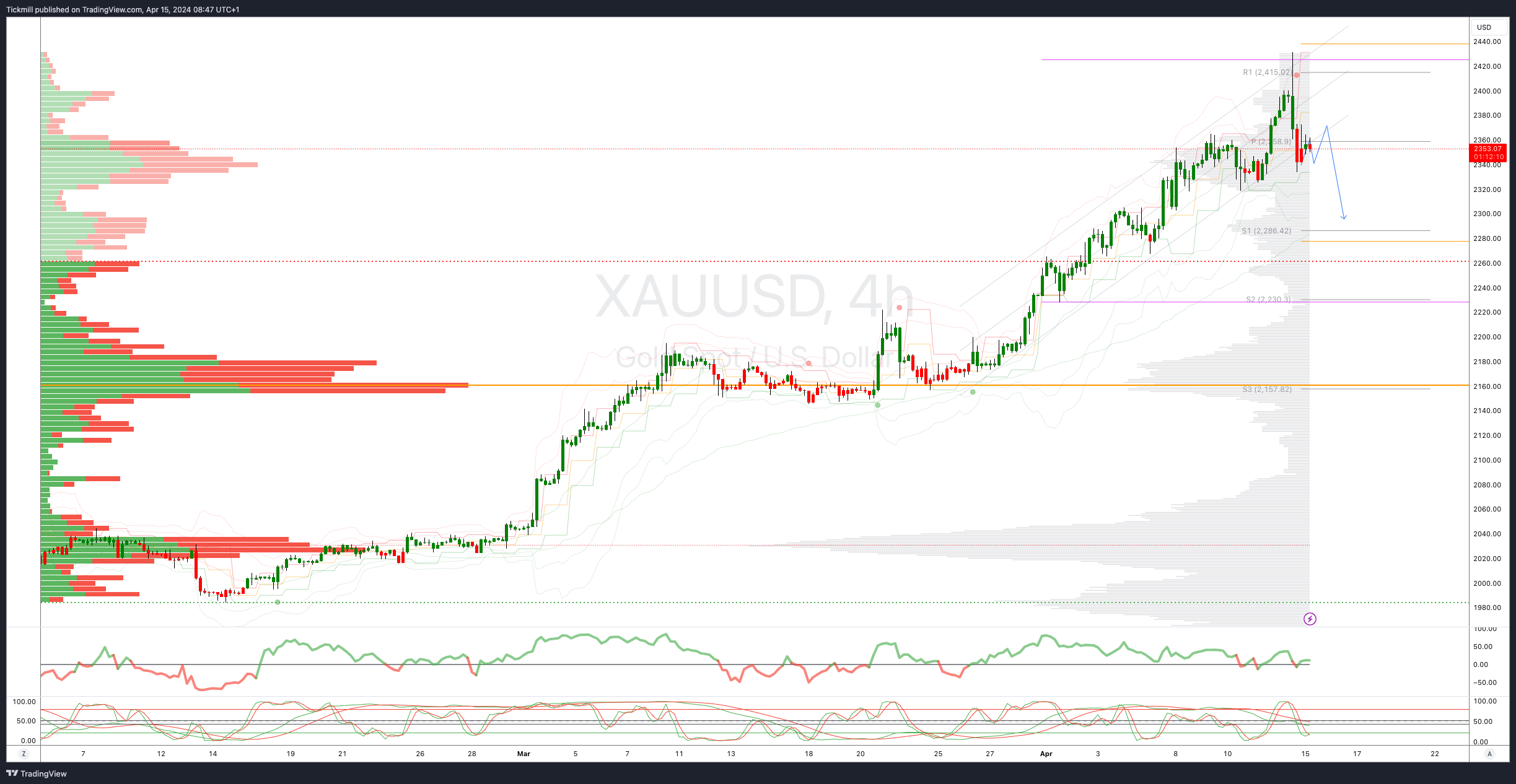

XAUUSD Bullish Above Bearish Below 2380

Daily VWAP bullish

Weekly VWAP bullish

Below 2380 opens 2330

Primary support 2300

Primary objective is 2430 TARGET HIT NEW PATTERN EMERGING

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bearish

Weekly VWAP bullish

Below 60000 opens 57250

Primary support is 60000

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!