BoJ will Abandon Stimulus soon, the Latest Reuters Survey Shows

The Japanese Central Bank will soon be forced to abandon unconventional easing measures as it will soon hit a “speed bump” which is basically the limited size of JGB market in Japan. This is the main conclusion from the latest Reuters poll about the outlook on BoJ’s monetary policy.

Withdrawal of stimulus will not happen immediately and is expected to start in 2021. Therefore, next year the Bank of Japan will probably devote its meetings to preparing investors for the policy reversal. This should be accompanied by recovery of the world economy, which should lend a helping hand to the Japanese economy in 2020.

The Japanese yen has been relatively stable lately, and local stock indices held at peaks, which helps BoJ to initiate debates about gradual halt of massive QE it currently conducts.

The survey conducted in November showed that only 44% of the respondents considered it appropriate for BoJ to halt QE. In December, this opinion was already shared by 61% of the economists surveyed.

Core inflation in Japan, which takes into account fuel prices but does not take into account fresh food prices, is expected to grow by 0.6% this year and next. This is well below the target of 2%.

Earlier, the IMF recommended that the Bank of Japan replace the inflation target with the target band. This will allow shaping the policy in such a way as to allow inflation to overshoot above the target without an urgent need to suppress it. Fears of high inflation in the past century have been forgotten, so there is a growing conviction among central bankers that suppressing inflation will be easier than igniting its proper growth.

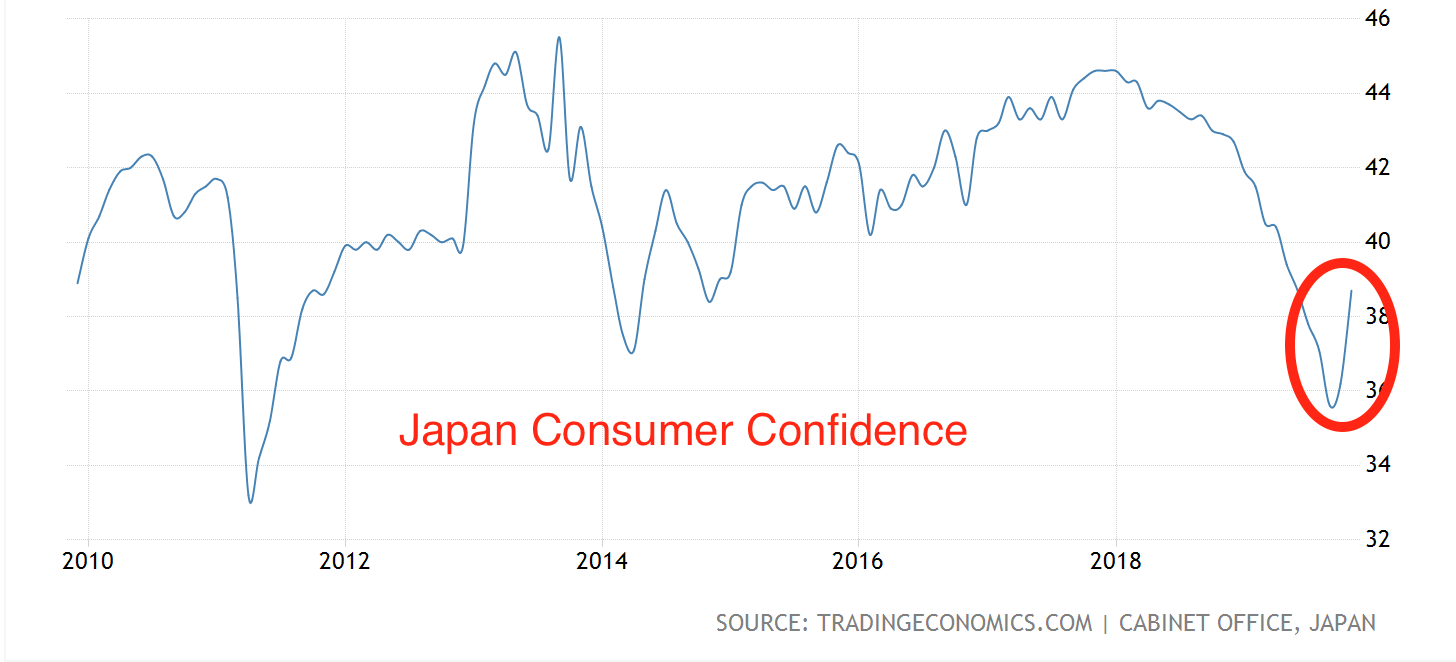

The third largest economy in the world is expected to decrease by 3.2% in the 4th quarter on an annualized basis, which will be the highest pace of contraction since the second quarter of 2014. The market blames the increase in sales tax on the downturn, but it seems to have transitory effect on the consumer confidence:

In the first and second quarter of 2020, the economy should turn into growth, which is expected to be at 0.9% in the first quarter and 1.2% in the second quarter.

In the context of exclusively monetary policy, the Bank of Japan’s bias towards normalization is a bullish signal for the Yen, but we also have a strengthening factor of “coordination of monetary and fiscal policy”, which was recently raised by the head of Kuroda Bank in his speech. In simple words, the government will increase debt supply on the market by borrowing more so that the Central Bank can fulfill its goals of controlling the yield curve (by buying JGB from the market). If the Bank of Japan insists on this, which can be concluded from the future meetings, then the yen will likely resume decline.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.