Baltic Dry Index Tumbled 10% - What’s Wrong with sea Freight Traffic?

While gold and other defensive assets are responding to short-term disturbances in the news background, whether it is the killing of a senior Iranian general in Iraq or North Korean leader preparing to unveil new weapon, it’s important to keep focus on the medium term as well, so let’s consider one of the most important freight traffic gauges – the Baltic Dry Index. The input data for calculating this index is time charters average for Capesize, Panamax and Supramax cargo vessels what serves as a good proxy of the demand for sea freight transportation.

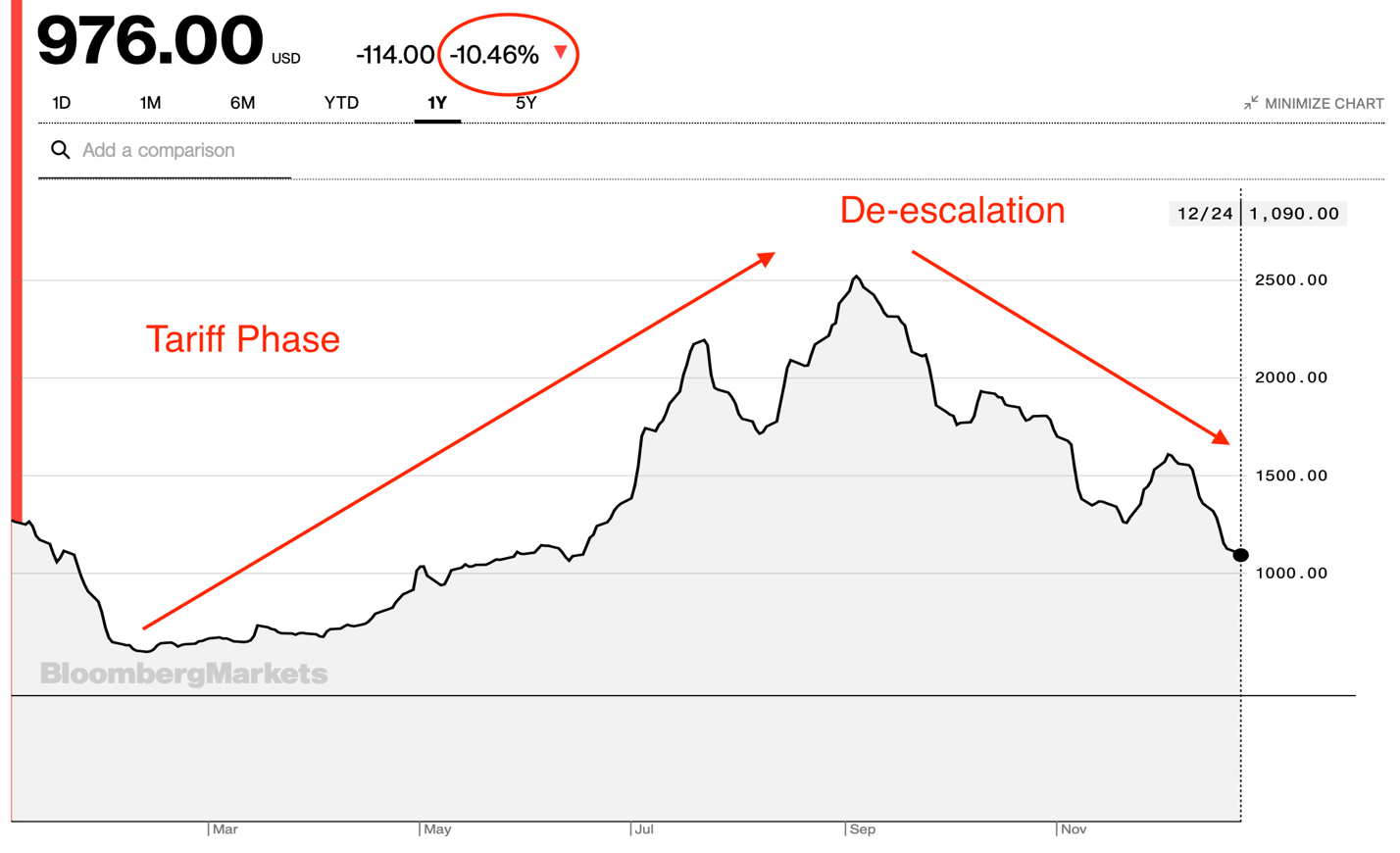

The volume of sea freight transportation is probably the most basic indicator of the presence and pace of global economic expansion. Being a common feature of completely different sectors of the economy and countries, it helps to view export-import activity at a different perspective and with much less lag than government trade data. What is noteworthy, on Thursday, the index recorded the strongest one-day drop in 6 years - -10.5%, primarily due to worsening demand for dry cargo vessels.

The index fell 114 points to 976, the lowest level since May 2019.

One of the most likely causes for the weakening demand was the decrease in so-called front-loading shipments. Their volume rose sharply during the escalation of the trade war because manufacturers and importers rushed to move goods before tariffs deadlines. Since the US and China managed to establish an acceptable definition of fair trade (aka Phase One deal), importers could finally relax.

As you can see on the chart, “rush” shipments rose exactly in the period when trade relations between China and the United States deteriorated – 1Q of 2019 – September 2019. In that period, the index rose by 318% but in the next three months it reversed gains sharply, falling 61%. As importers have to drain good inventories before ordering more, the trade war boost basically backlashed with the slowdown in the freight transport sector which now complicates deciphering the true trend in the demand for transportation and hence prospects for global economic rebound in 1Q.

The pre-tariff surge in export-import activity gave an additional boost to the US economy in 2019. In 2020, it will not happen again, and this should be taken into account.

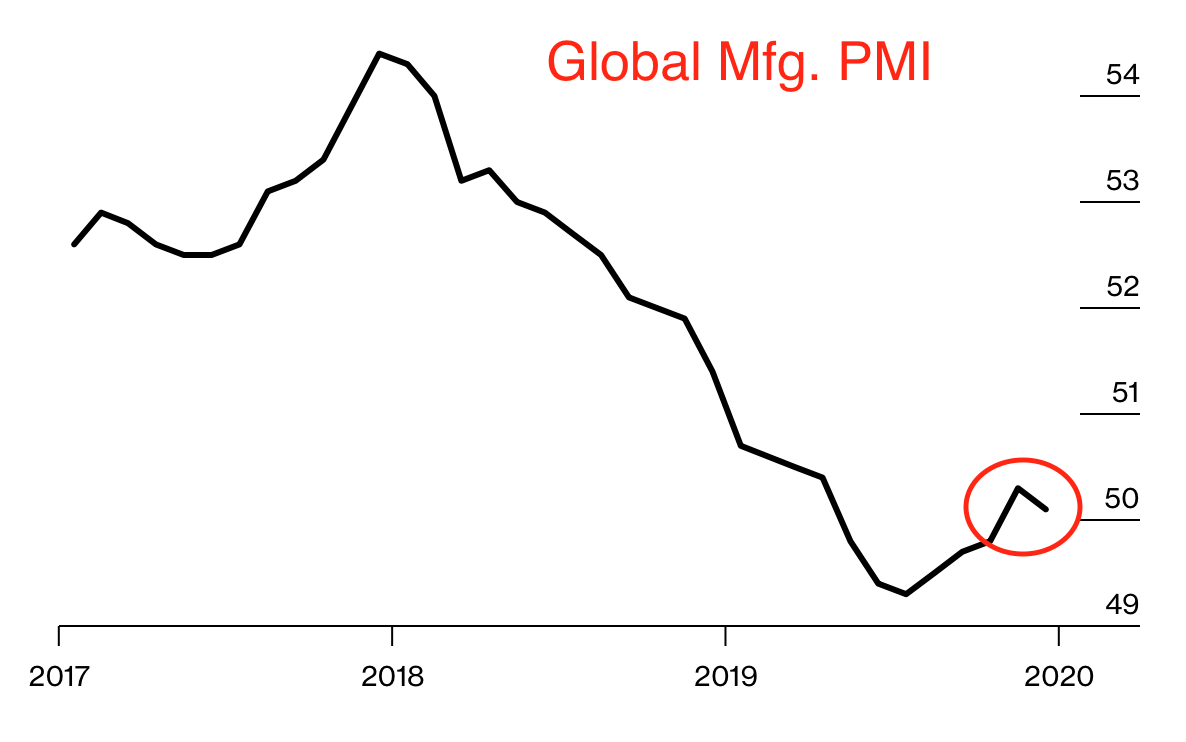

JP Morgan's global manufacturing PMI fell from 50.3 to 50.1 in December, urging caution about the expansion of the global economy.

So given some inertia, the slowdown is likely to continue in the first quarter of 2020.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.