A "Christmas Tale" About A Trade Deal

December is a very awkward time for new tariffs. Why, you ask? Because December is a time of gifts and Christmas tales. What Christmas gift could be better than the stock market at a record peak for America? Trump knows how to make people happy. And, he is also an excellent Christmas storyteller. One of his best is the "Phase One" trade deal.

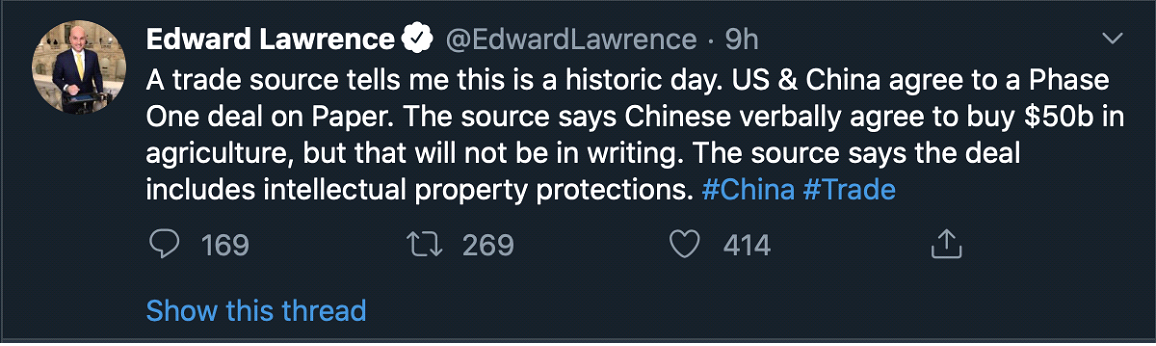

Where does such skepticism come from? Out of all the trade buzz and buoyant news filled with optimism, I would like to bring to your attention the “source” info posted by Edward Lawrence, Fox Business correspondent (the media outlet loyal to Trump). Until the official announcement, this should be regarded as rumors, but anyway, this helps us to assess the real state of things (hint: you may need to start worrying):

- There will be a paper version of the “Phase One” deal;

- US side will cancel only a small part of tariffs as a goodwill gesture;

- China agreed to purchase products at $50 billion/year, but only in words. There won’t be any specific commitments in the document!

- The second phase of negotiations will begin only after the presidential election in 2020. Attention to Trump's twitter will probably fade a little bit as what will be the new ground for China attacks?

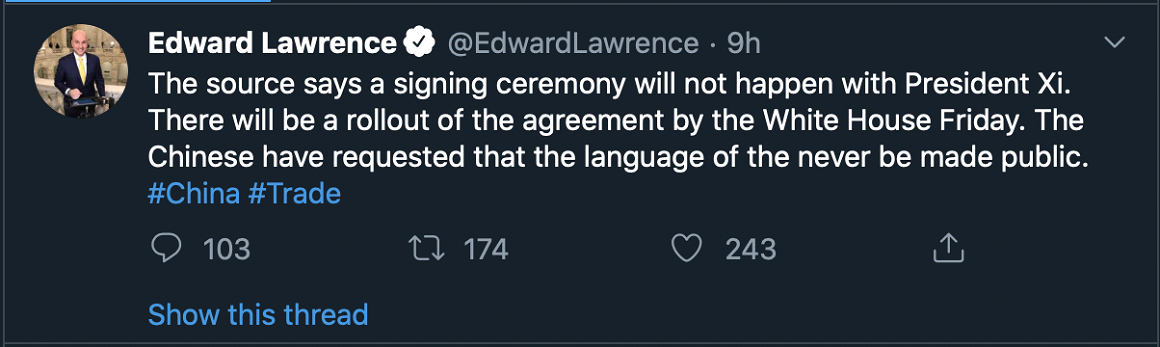

And now the most interesting part:

- The Chinese side asked to not make public the language of the agreement (to not look weak before Chinese people? Or to avoid public pressure because of deviation from commitments?);

- There won’t be a ceremony of signing the document by Trump and Xi.

Isn't that a Christmas tale?

In short: the most “tangible” fact and an important result in a practical meaning is that December tariffs are canceled. If Lawrence’s source info is confirmed, the impact of the deal will be restrained by the concrete fact of cancelled December tariffs, but the general level of trade tension will likely remain approximately unchanged.

So, don’t be in a hurry to sell Gold or buy US stocks. The Christmas rally may be under threat.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.