Will the Fed Cut Rates in September?

All hot debates about the “strange” lack of inflationary effects on US CPI from tariffs on Chinese goods usually generate two satisfactory explanations:

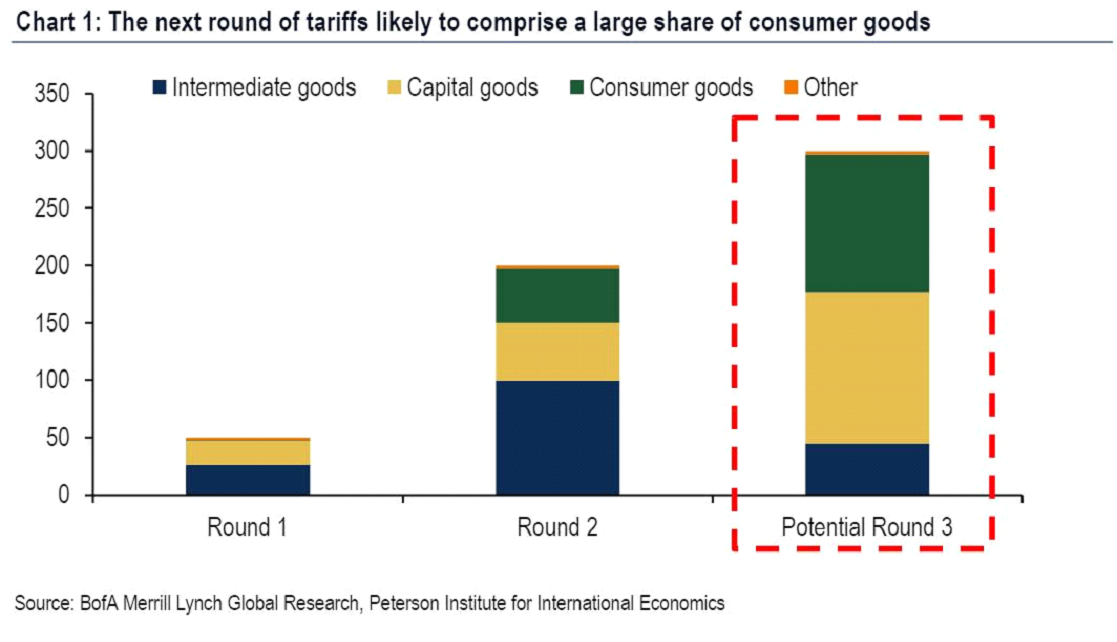

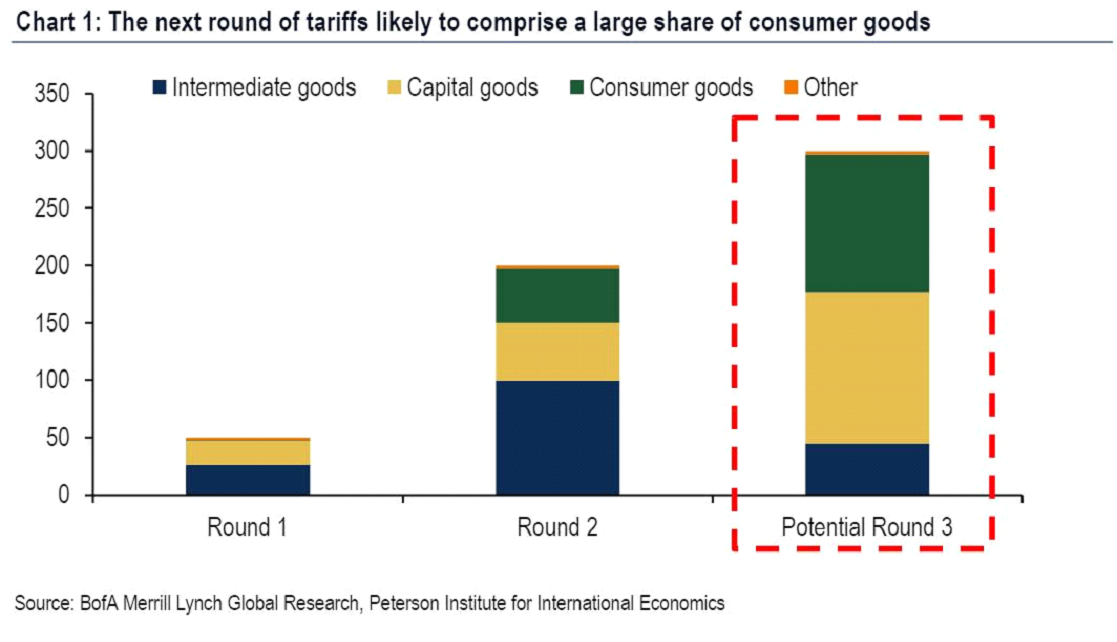

- The share of consumer goods touched by the tariffs is low (hence low consumer inflation).

- Consumer goods that were affected by tariffs have substitutes produced somewhere else, that is, transformation of the supply chain is relatively painless (in terms of inflation) for them.

However, with the threat of new round of tariffs targeting 300 billion dollars of previously unaffected imports, both of these conditions could be violated! The share of consumer goods in the tariff list will surge and more goods that cannot be replaced with the same cheap alternatives from other countries will be affected. Of this amount, consumer goods account for $120 billion, and Chinese suppliers have critical importance in US imports of some of them, like computers, mobile phones, sports equipment, garments, shoes, toys, etc. For example, garments and shoes which were not affected by tariffs in the previous legs make up 20% of the total consumer goods from the proposed tariff list, mobile phones - 17%, toys - 10%.

With Trump raising the stakes to unprecedented levels, we are likely to see old but familiar “rush effects”. These include an increased US-China trade deficit, boosted import & export volumes and prices and marked pickup in production and export activity in China in August. However, it is reasonable to treat future incoming Chinese data with a grain of salt, since tapping short-living economic potential from tariffs will likely give way to decline in Q4 of 2019.

In the US, part of the new tariffs will be paid by the thinning corporate margin of the firms included in supply chains of consumer goods. However, retailers are likely to share the trouble with consumers, that is, they will begin to raise prices. This means that US consumers, which have been feeling little pain from external shocks so far, which sentiments are on the cycle peak, will face the threat of inflation and may respond by cutting consumption. We can confidently say that with the introduction of new tariffs on a schedule or with a delay, data on consumer spending, sentiments and inflation expectations will come to the fore.

One thing is unclear: how on earth the market expectations can now embrace both glaring inflationary risks from the new tariffs and hopes for a September rate cut (which bears inflationary risks too)? Not only will the inflationary effects of July’s “pre-emptive” rate cut fully manifest in a few months, the mix of tariffs on consumer goods + rate cuts contain an even bigger enigma in terms of inflation response. The current position of US economy in economic cycle (moderate expansion) implies precisely the positive response of inflation to rate cuts. I’ve shown above that new tariffs will touch consumer goods and firms are likely to pass on tariffs costs on consumers, raising prices.

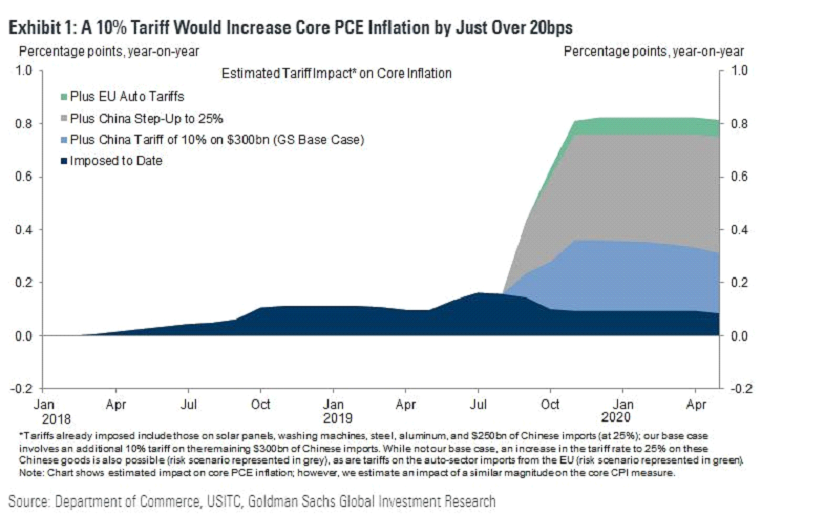

I think that the Fed not only does not want to know the answer to this mystery, but even to face such dilemmas. According to Goldman Sachs, the introduction of 10% tariffs will cause Core PCE to accelerate by 20 basis points, and an increase of tariffs to 25% - already by 35 basis points:

However, there are scenarios with no acceleration of inflation, and this is the depreciation of the yuan or the strengthening of the dollar. Both FX movements will offset tariffs, holding back inflation acceleration. Since the announcement of the threat of new tariffs by Trump, the yuan has fallen in price by 1.9%.

In my opinion, the chances of a Fed rate cut in September are subject to correction, at least for the following reasons:

- There is still a month left before the introduction of tariffs, they can be either delayed or cancelled if China bends under pressure or new risks will emerge for political reputation of Trump (falling stock market?).

- The Fed will not take the risk of letting go of inflation in a free float working in tandem (forced or not) with Trump. Stable economic data will strengthen this assumption, as the response of inflation to lower rates is likely to be positive.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.