BTC Still Below $100k… For Now

Bitcoin prices are on watch this week with the market still yet to print at the historic $100k mark. BTC futures rallied as high as mid 99s last week before softening. However, dips remain well bid for now with price sitting just below those highs and now trading back in the green for the day, keeping the focus on a fresh push higher. Given the significance of the $100k mark, volatility is expected with profit taking and scalping likely to play a factor. However, the broader outlook remains firmly bullish with many crypto watchers expecting BTC to start the new year above the $100k mark.

Trump Trade Continues

Expectations of a pro-crypto market environment under Trump next year are keeping bullish sentiment firmly intact in Bitcoin. News over the weekend that Trump’s pick for commerce secretary, Howard Lutnick, is involved in a deal with Tether to launch a $2 billion bitcoin lending business has bene seen as a sign of things to come. With Trump promising a much more relaxed regulatory environment and greater access for institutional capital, there is a strong case for BTC to continue rallying hard into next year.

Institutional Demand

Looking ahead, traders should keep an eye on headlines around ETF flows and options market movements. The launch of BTC ETF options last week on the Nasdaq provides further insight into how institutional traders are viewing the market with current put/call skews firmly bullish, suggesting more upside is expected near-term.

Technical Views

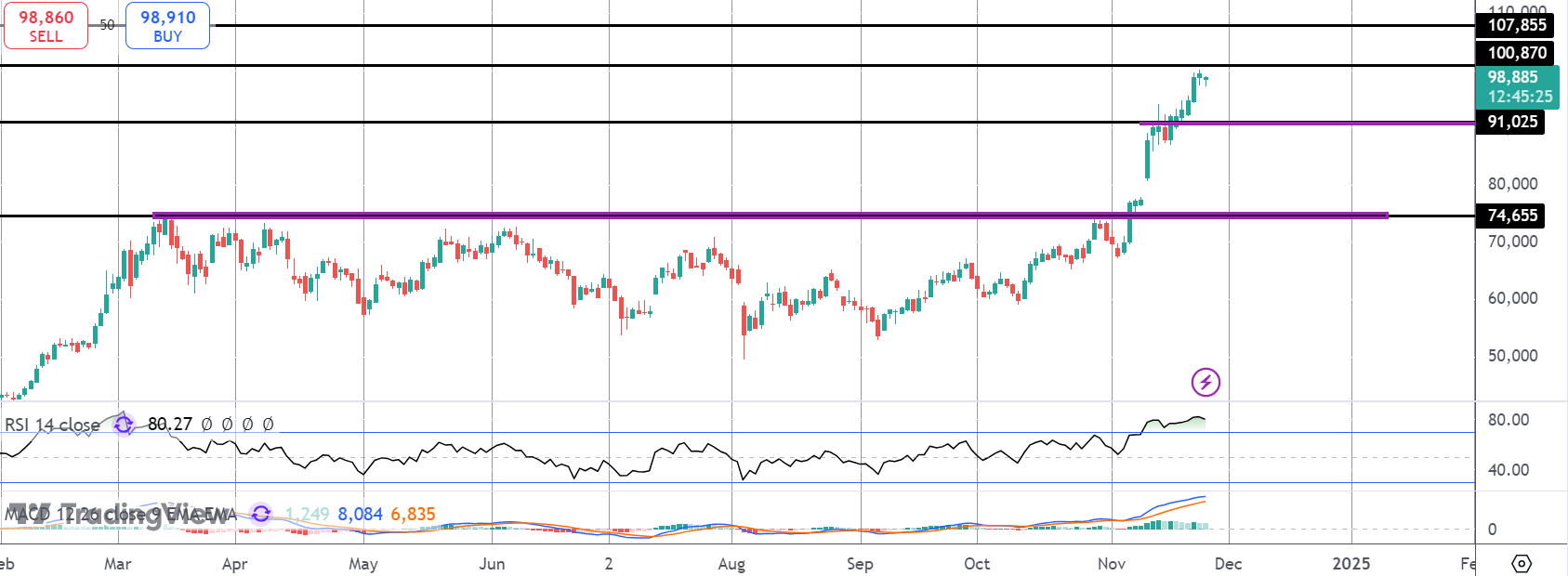

BTC

The rally in BTC has stalled for now ahead of the 2% extension of the March-September retracement, coming in around the 100k mark. Momentum studies are softening, showing room for a correction. However, while price holds above the 91,025 level, focus is on a continued push higher with 107,85 the next target for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.