BTC Under Pressure

Bitcoin prices have come under heavy selling pressure this week with the futures market reversing sharply from the week’s highs at the 65,000 level. The market is now down around 10% from that level testing support at the 57,215 mark. Given the better tone to risk markets on the back of dovish comments from Fed’s Powell last week, the move is somewhat surprising. One possible driver is that the USD weakness which ahs built up over the last month might struggle to continue near-term. Expectations around projected September easing from the Fed are mixed, with the risk that USD fails to weaken further unless we see the Fed cut by more than .25%.

US Government Selling

Another factor weighing on BTC here is the ongoing selling of seized crypto assets by the US government. Ongoing sale of seized Bitcoin linked to the FBI’s closure of dark web market ‘Silk Road’ has had a notable impact on BTC prices. With other governments, such as those in Germany, also engaged in the selling of seized crypto assets, BTC is currently dealing with a supply overhand which is keeping prices subdued for now.

Bullish Outlook Remains

Looking ahead, however, there is still scope for BTC to recover upside momentum. Once the current seized-asset sales have been concluded, BTC should return to typical macro drivers. Strong institutional demand linked to dovish Fed expectations should offer support as we move through September, particularly if the Fed cuts by a larger amount next month or is more dovish in its guidance.

Technical Views

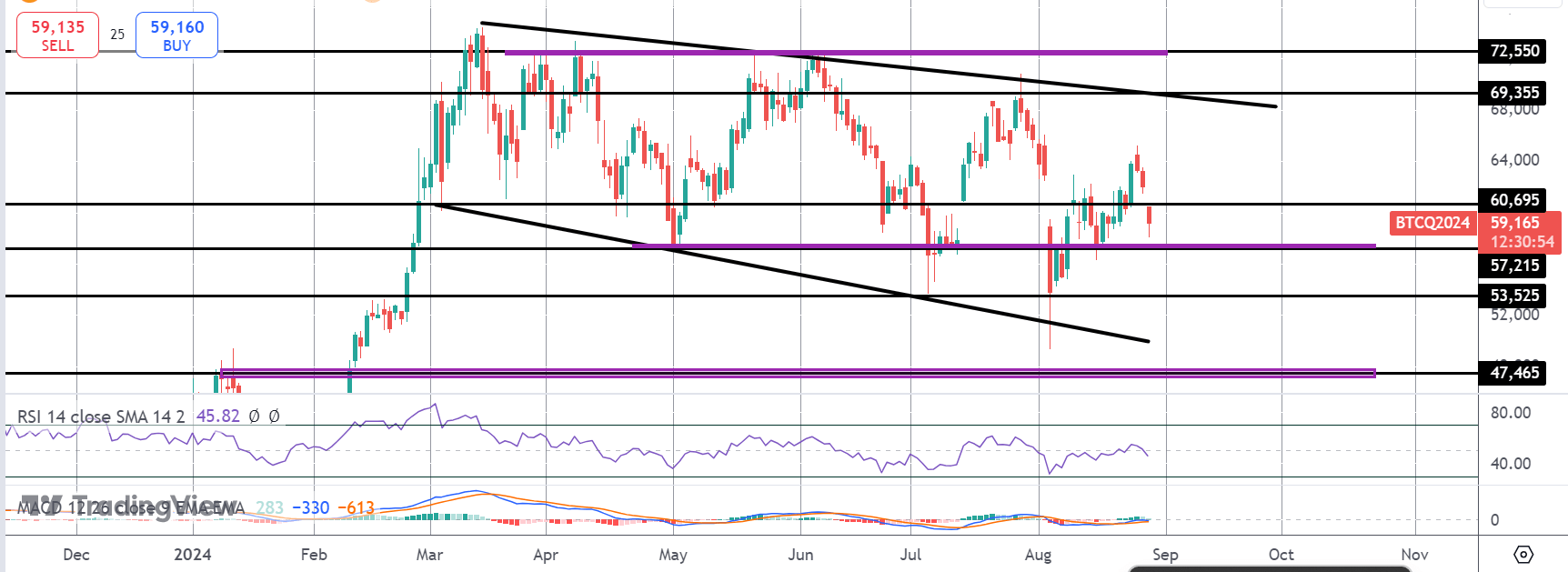

BTC

For now, price remains above the 57,215 level which has been an important pivot over the last year. While atop here, the focus is on a recovery and fresh push back towards the bear channel highs and the 69,355 level next. Below here, however, focus turns to 53,525 as next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.

-1724836256.jpg)