What Happened to Dogecoin?

Downward Facing Dogecoin

Dogecoin, the original mem-coin which became the darling of the alt-coin world has fallen from grace recently. After a euphoric, almost 500% rally from summer 2024 lows to December highs, the coin once championed by Elon Musk has almost entirely reversed those gains over the last two months. Over the later stages of Trump’s presidential campaign, Dogecoin soared higher amidst the general bullish wave in crypto markets as traders looked to position for a continued bull run under Trump. His promises to be the world’s first crypto-president and champion cryptocurrencies saw investors piling into Dogecoin.

Trump Campaign Promises

Speculation reached fever pitch as it was announced that Elon Musk would head up a department aimed at reducing inefficient government spending, called D.O.G.E, featuring the Dogecoin dog as the logo. Musk’s ties to Dogecoin and the naming of the government department were seen by many as a wink and a nod for the cryptocurrency. When Trump spoke of his plans for a US strategic crypto reserve, many assumed Dogecoin would be included, driving the rally further.

Disappointment with Trump

Once Trump took office, however, crypto fever subsided. In his first weeks as president, his focus was on other, bigger policy items. With crypto clearly on the back burner for Trump, as well as chatter of tensions between Trump and Musk, crypto markets began reversing heavily lower with Dogecoin seeing massive capital outflows.

Huge Whale Buying Seen Into Lows

Now the market is at a crossroads, industry data points to huge accumulation by whales (accounts holding over 100 units of Doge) over the most recent part of the decline. With bigger accounts buying into the pullback, could the market be about to recover higher? There are plenty of factors which could feed into a fresh bull cycle for crypto markets such as fresh easing cycle from the Fed, an end to the Russia-Ukraine war and the potential for the first Dogecoin ETFs to be announce this year. As such, traders should monitor price action carefully in coming weeks for any signs of a bullish reversal.

Technical Views

Dogecoin

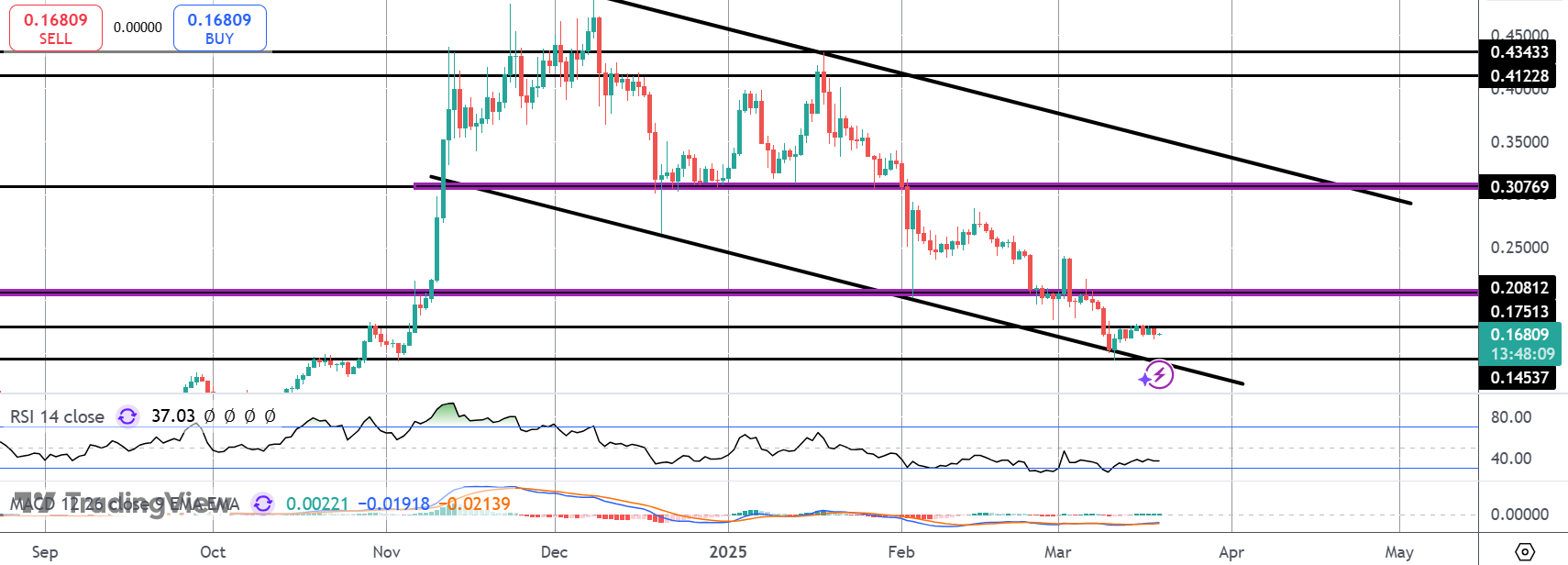

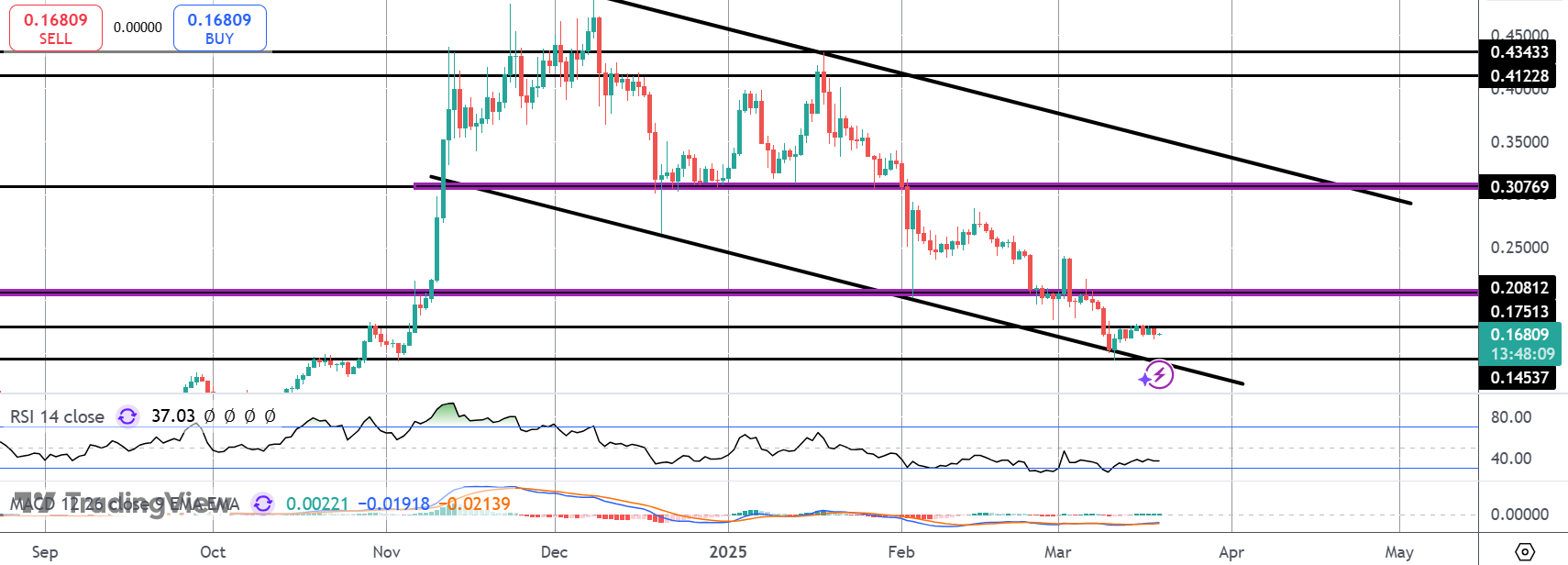

The sell off has stalled for now into the latest test of the bear channel lows and interim support level. While the bear channel holds, risks remain skewed towards further losses with .0924 the next key bear-target. Bulls need to get back above .2081 to alleviate bearish risks and turn the focus back to a recovery towards .3076 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.