Bitcoin On Watch

Of all the market moves on the back of the US election result earlier this week, the rally in Bitcoin is receiving the most attention. Crypto prices were seen rallying across October in line with a shift in voting sentiment which pointed to rising odds of Trump winning the election. This dynamic was premised on the view that a Trump presidency will herald a new golden era for crypto via an easier regulatory environment, greater access for institutional capital and a wider uptake in the mainstream US financial system, including the prospect of a US Strategic Bitcoin Reserve.

Lofty BTC Targets

On the back of Trump winning, and with news of a Republican clean sweep in Congress, BTC prices have rallied over 10%. Mainstream media is awash with analysts calling for $100k and beyond by year end while social media is filled with retail traders calling for even higher than that ($800k and $1 million are popular targets). So could we see such a rally develop near-term?

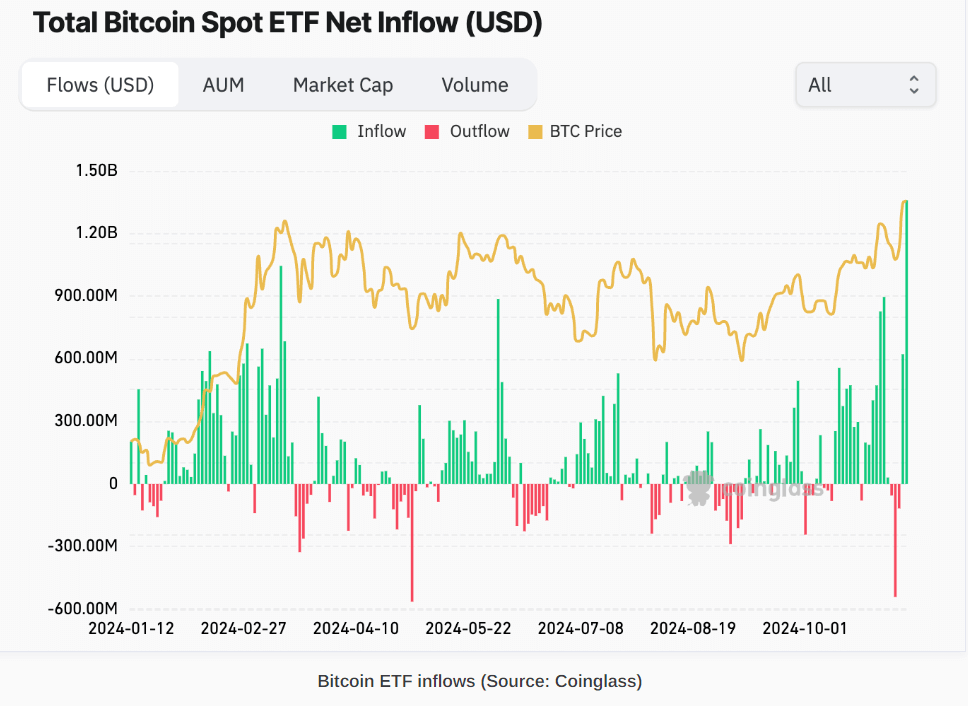

Institutional Flows

Institutional flows have become a solid sign post for BTC market moves since ETFs began trading earlier this year. Rising inflows have coincided with BTC rallies while rising outflows have come alongside price declines. This week, BTC ETFs have seen record inflows as institutional investors look to position for a Trump driven boom. However, the path to higher prices might not be so straight-forward and if we consider the below graphic produced by CoinGlass, charting ETF flows, we can see something interesting.

Inflection Points

Outsized inflows have tended to align with market tops while outsized outflows have tended to align with market bottoms. Given that yesterday saw the largest daily inflow on record, BTC prices could be due a correction lower near-term on the back of the recent rally we’ve seen before making any further push higher.

Technical Views

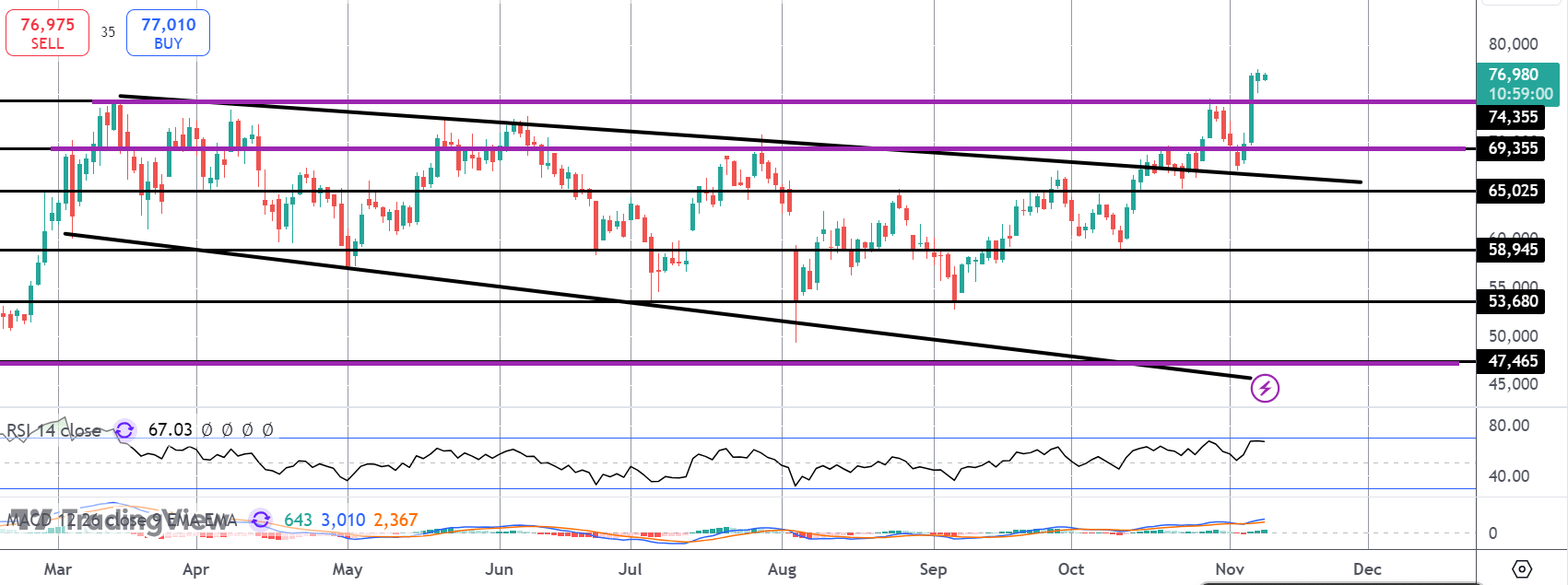

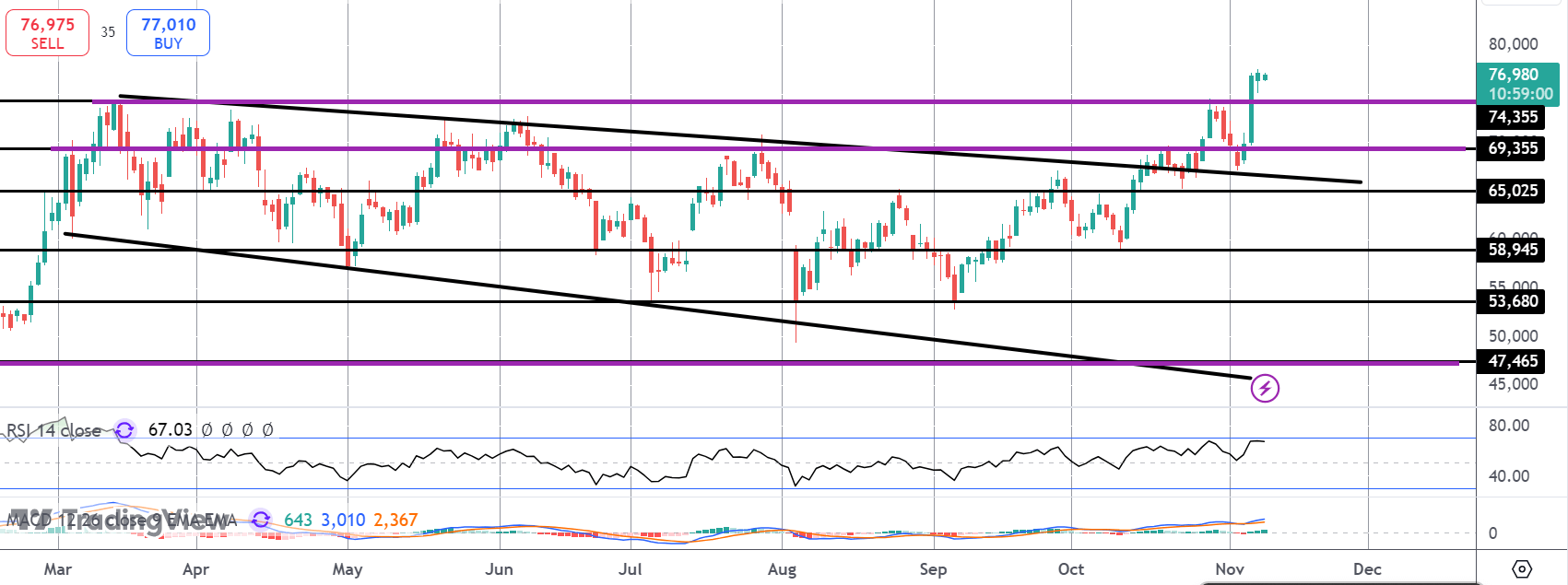

BTC

The rally in BTC has seen the market breaking out above the bear channel highs and above the 74,355 former ATH to trade to fresh ATH. While above the 69,355 level and the bear channel, focus is on a further push higher. Only a break back inside the channel will negate this view near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.