What Caused The Crash In The Dow?

Dow Sinks on Monday

US stock markets suffered record losses yesterday with the Dow Jones crashing by 1000 points as investor panic over US economic fears reached fever pitch. Weakness in Friday’s US jobs data has added to the growing view that the US economy is on the risk of a major downturn with big players accusing the Fed of being too slow to begin easing rates. Comments yesterday from Fed's Goolsbee saying the Fed would not react to one month of weak data were seen as further evidence of the Fed's disconnect.

Fed in Focus

The Fed has held off from cutting rates this year after first appearing to be poised for a Q1 cut. However, ongoing stickiness in inflation data and robust jobs readings saw the Fed holding rates steady through the summer even as other central banks began cutting. Recently, however, a stark drop in several key indicators suggests that US economic strength is on the turn with some banks now forecasting strong recession risks ahead of year end. For the Dow, weakness in the manufacturing sector in particular has become a major source of concern.

Market Mayhem

The impact on stock markets have been visceral with widespread losses across the board. The crash in Mega cap stocks yesterday added to investor panic seeing all eleven sectors of the S&P ending the day in the red. The focus now is firmly on the Fed and how it will react to the current market situation.

Bullish Opportunities

Indeed, despite the current sell off and near-term risks of further downside, there are bullish opportunities to be noted. With the Fed now expected to pursue a more aggressive easing path than previously expected, there is room for stocks to recover and rebound, particularly given the huge order-book clear-out we’ve seen in recent days. As such, incoming Fed commentary from various members this week will be closely watched, with any dovish signals likely to help stocks rebound.

Technical Views

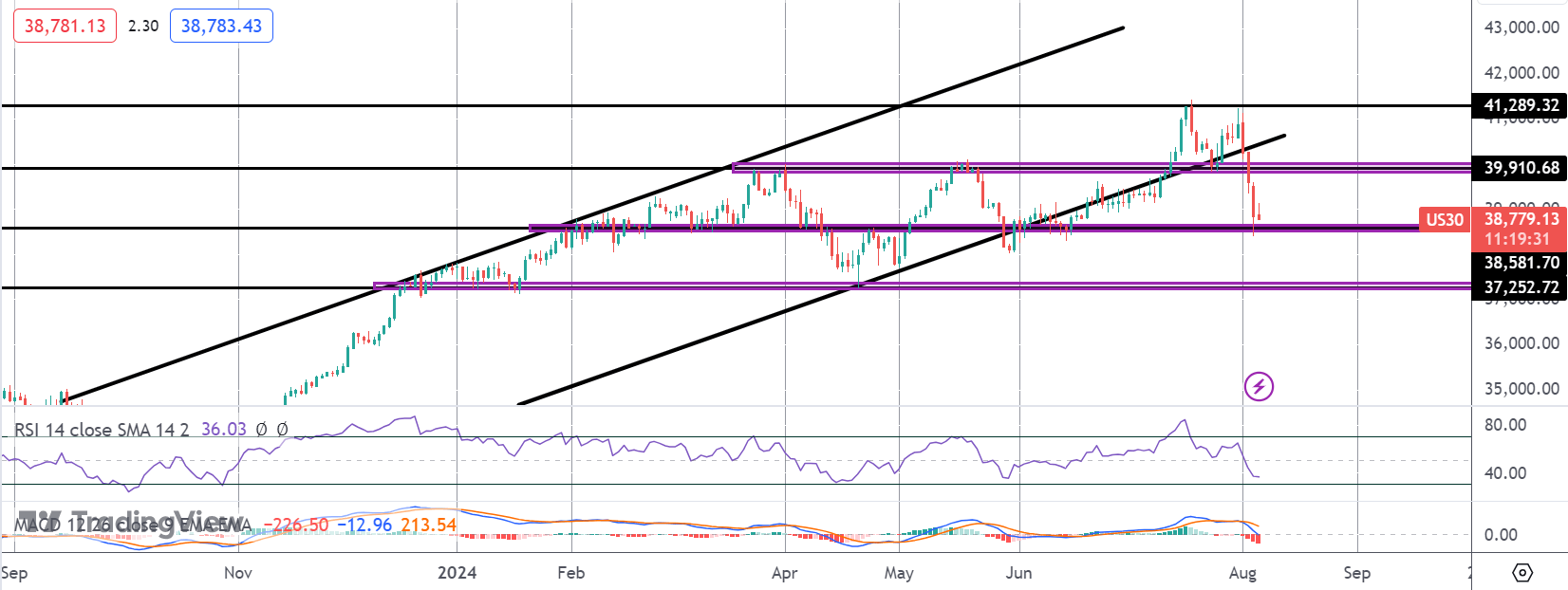

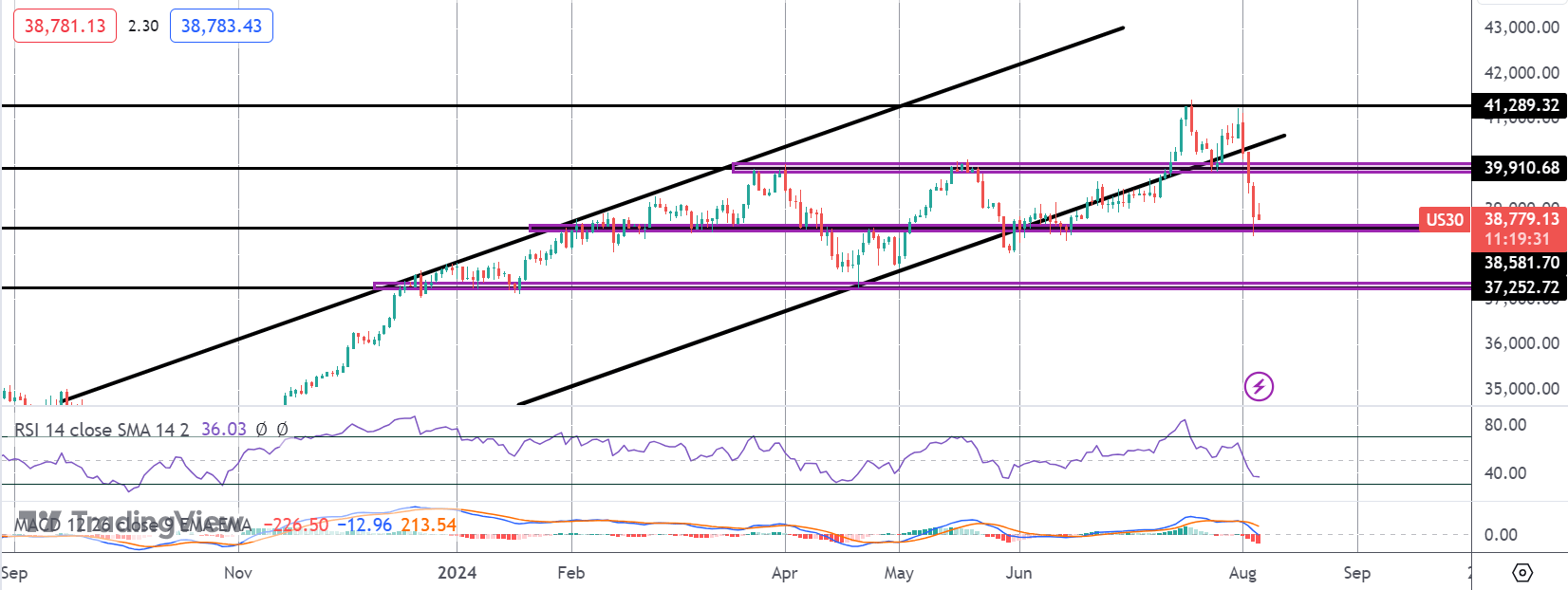

Dow Jones

The sell off in the Dow has seen the market breaking down heavily below the bull channel and below the 39.910.68 level. The index is currently testing support at 38,581.70 which is holding for now. While this level holds, focus is on a recovery higher. Below here, however, focus shifts to 37,252.72.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.