USDJPY Reverses Following NFP Spike

JPY Rallying

Following a spike higher yesterday as traders reacted to an upside surprise in the June NFPs, USDJPY is turning lower today. JPY is gaining ground amidst better safe-haven demand linked to rising uncertainty ahead of next week’s US tariff deadline. Trump is threatening to push ahead with a fresh rise in tariffs against several major trading partners, including Japan, unless deals are made in coming days. However, with no breakthrough yet in negotiations, the July 9th deadline looks set to be a day of big cross-market volatility which should feed into better support for JPY on continued safe-haven demand.

USD Outlook

The USD outlook looks more uncertain here. While Fed easing expectations have been pushed back in response to yesterday’s better jobs data, a return to tariffs is likely to see a return to the USD bear trend that we saw over the start over the start of the year. Fears for the health of the US economy and de-dollarisation present big risks for USD which could further reinforce the bearish USDJPY narrative. On the other hand, if we see any eleventh-hour deals being made ahead of the July 9th deadline, USDJPY could easily spike higher as USD rallies and safe-haven demand for JPY dissipates.

Technical Views

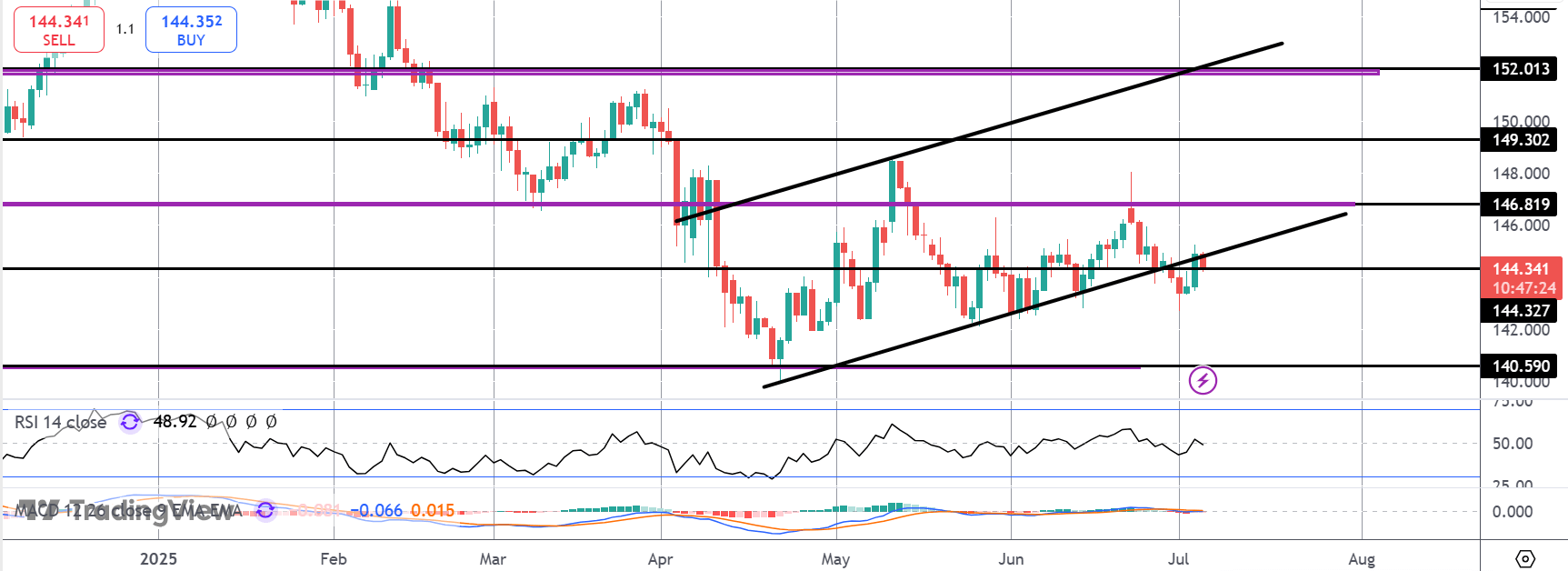

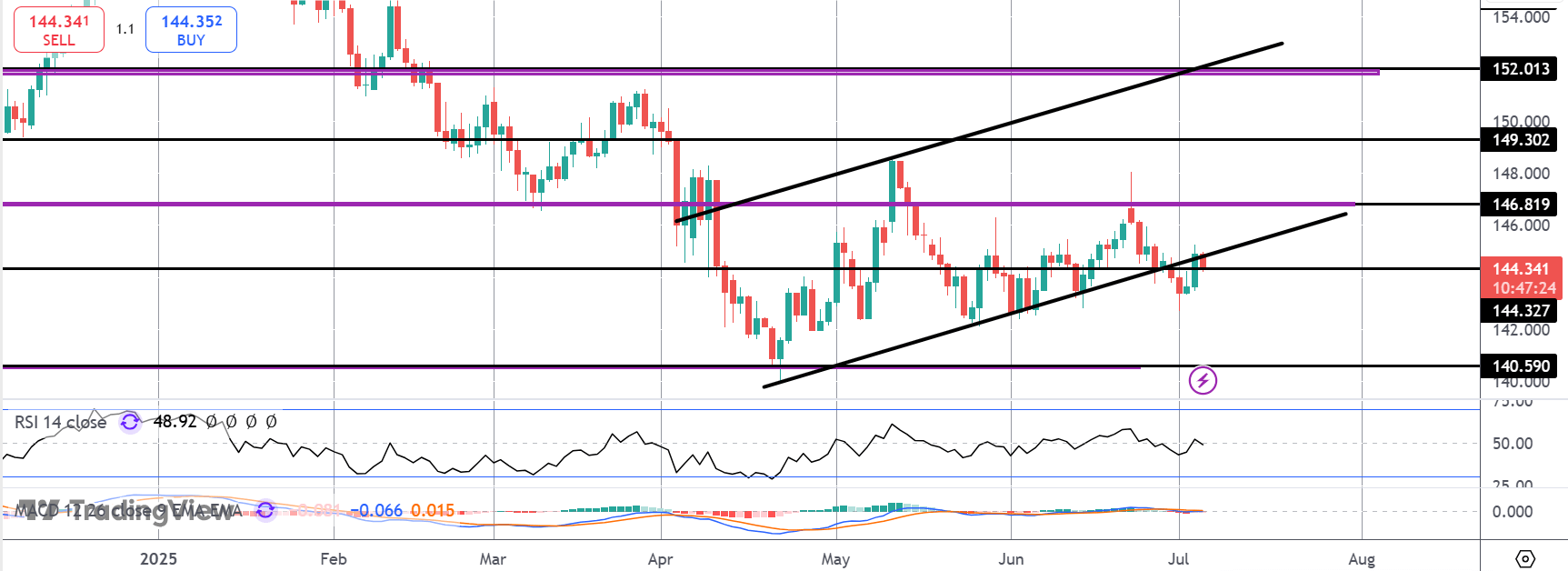

USDJPY

For now, USDJPY is stalled at the retest of the broken bull channel lows and the 144.32 level. If bulls can get back above here, focus will be on the 146.81 level next which opens the way to 149.30 above. To the downside, 140.59 will be the key support to watch if we turn lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.