USDJPY Rallying After JPY CPI Drop

Japanese Inflation Cools Again

USDJPY is rallying today helped by a stronger USD ahead of Fed chair Powell’s Jackson Hole speech later today rand weaker Japanese inflation data overnight. Japanese annualised core CPI fell to 3.1% last month from 3.3% prior. The data marks the lowest reading since November 2024 and was driven in part by the first drop in electricity prices since April. Japanese inflation has now fallen for six consecutive months, offering a firm pushback against calls for the BOJ to continue tightening rates. US treasury secretary Scott Bessent recently voiced his opinion that the Fed should be cutting rates more quickly and the BOJ should be hiking rates more quickly. However, the BOJ was qiuick to downplay any sense of pressure form these comments, reaffirming that it would remain cautious and data dependant.

Powell in Focus

Looking ahead today, USDJPY has the potential to push further higher if Powell disappoints doves and errs on the neutral side. Rate-cut expectations have been scaled back in recent days, reflected in the stronger USD. If Powell today focused on inflation uncertainty and refrains from giving a strong easing signal for next month, USDPY could e3nd the week sharply higher. However, if Powell does deliver a dovish message today, this should USDJPY reversing heavily as traders rebuild US rate-cut bets, driving USD lower.

Technical Views

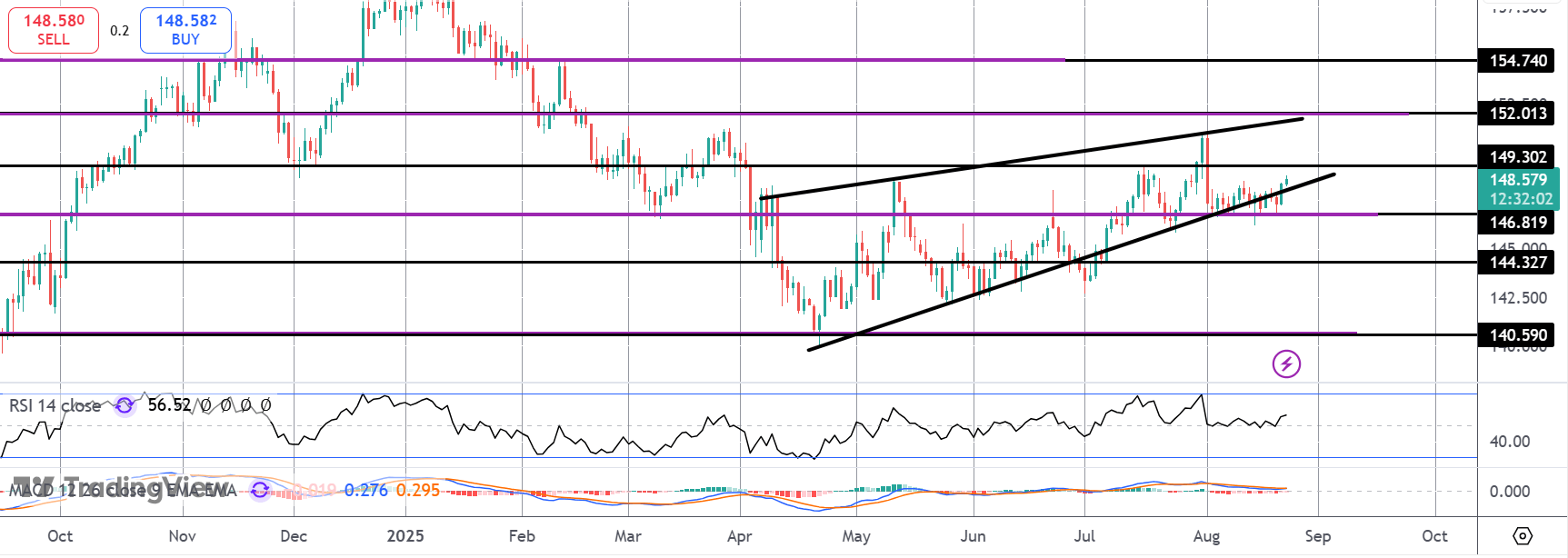

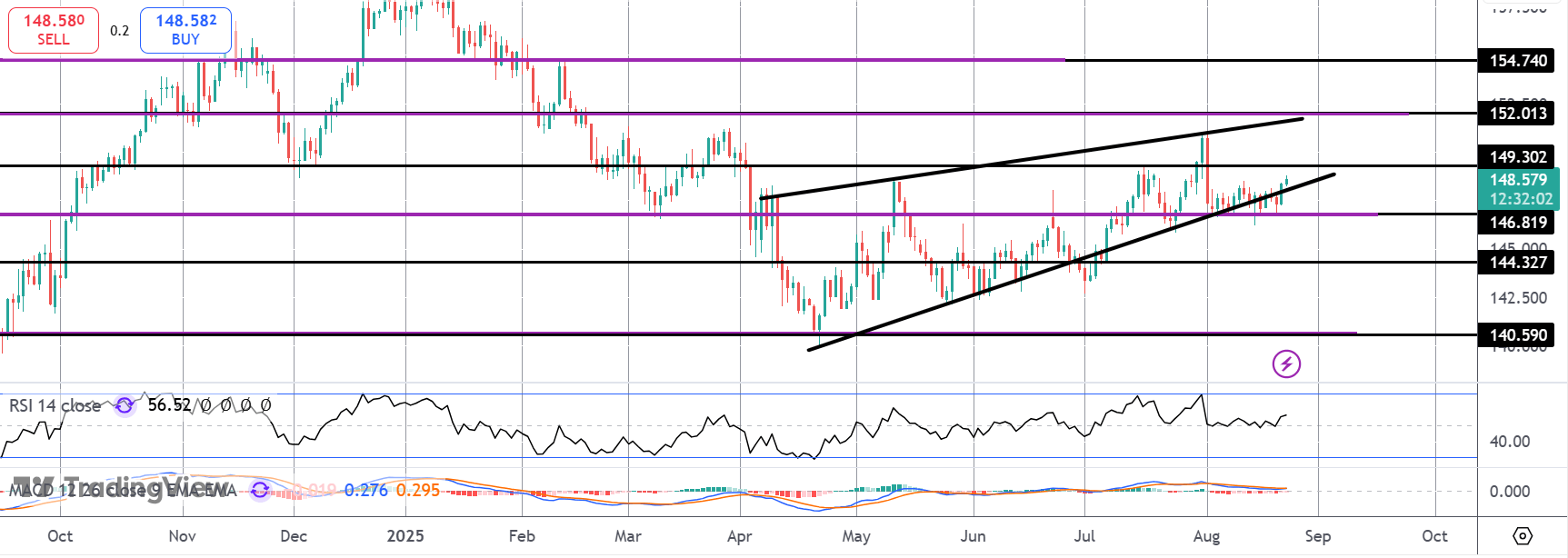

USDJPY

The pair has pushed back up into the rising wedge/bull channel formation following a lift off the 146.81 level support. 149.30 is the next resistance to watch with 152 sitting above if we break higher, in line with rising momentum studies readings. Should we reverse, however, any break of 146.81 will turn focus to 144.32 support next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.