USD Volatility Around Trump & Fed

DXY on Watch

The US Dollar is attempting to stabilise this week following a heavy fall on Friday in response to Fed chair Powell’s Jackson Hole speech. The DXY plunged lower as Powell gave a clear signal that a September rate cut is on the cards noting that risks to the jobs market were rising. However, amidst quiet trading yesterday the DXY was seen recovering with the index almost entirely reversing Friday’s losses. The rally was capped late yesterday however, in response to news of Trump firing Fed’s Cook on allegations of mortgage fraud. The move has once again raised fears over the Fed’s independence and the continued pressure Trump is putting on the back ahead of Powell ending his term there.

US Data on Watch

Looking ahead this week, there is plenty of incoming US data to watch with durable goods later today, prelim GDP and weekly jobless claims tomorrow, and core PCE on Friday. Given Powell’s comments on Friday and fresh data weakness should simply reinforce September easing expectations, leading USD lower near-term. On the other hand, any upside surprises in data will weaken that view, leading USD higher as traders scale back easing expectations. Ultimately, the upcoming August jobs report next Friday should prove the deciding data point for the Fed given the major adjustments made last time around.

Technical Views

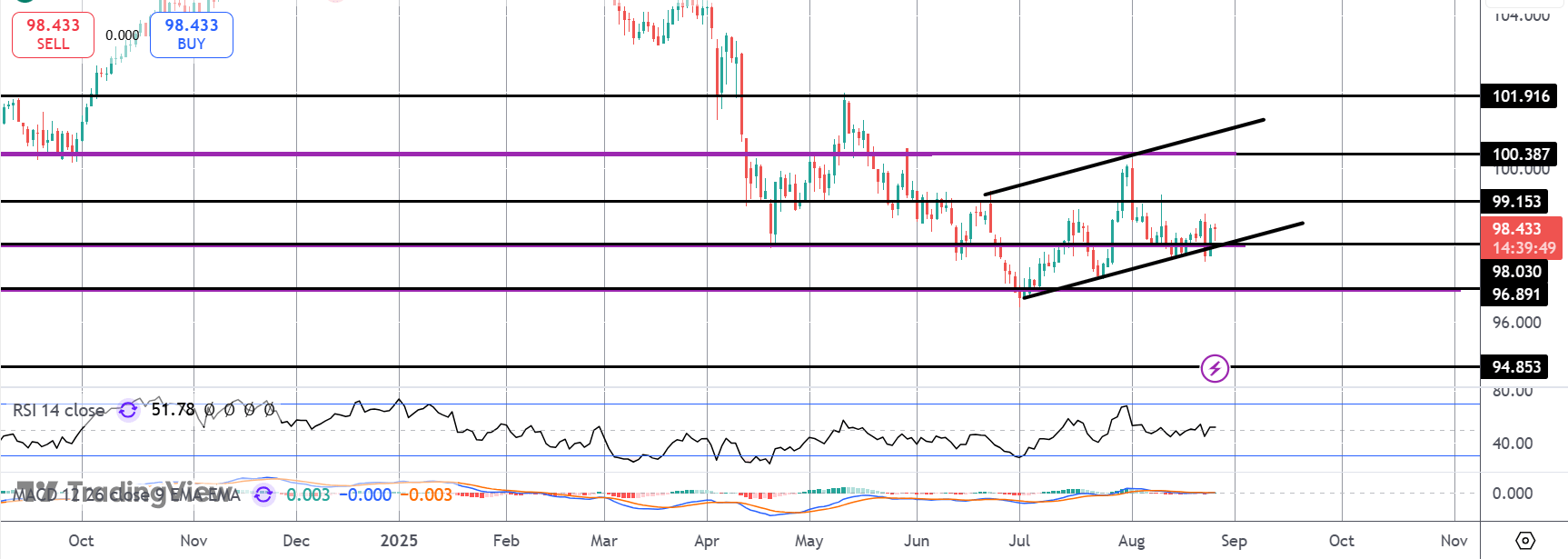

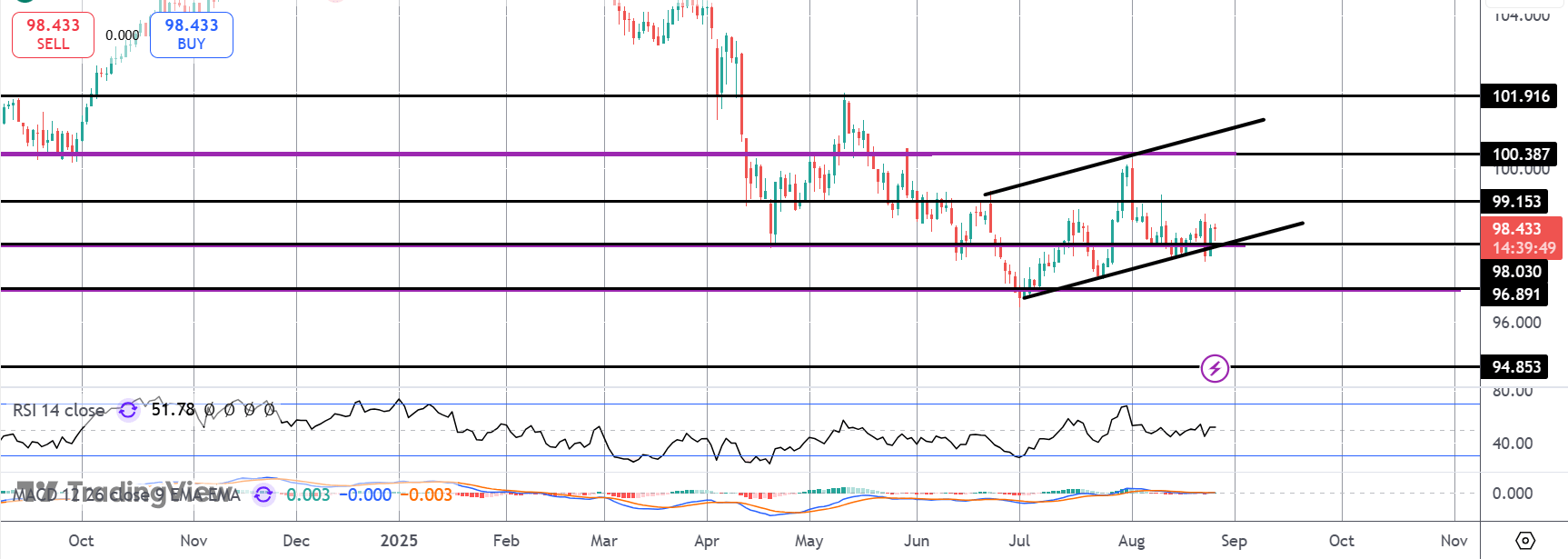

DXY

For now, DXY remains within the corrective bull channel (potential bear flag), underpinned by the channel lows and 98 level support. If we break lower, 96.89 and YTD lows will be the next support to watch ahead of the deeper level at 94.85. Topside, a break of 99.15 opens the way to a retest of the 100 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.