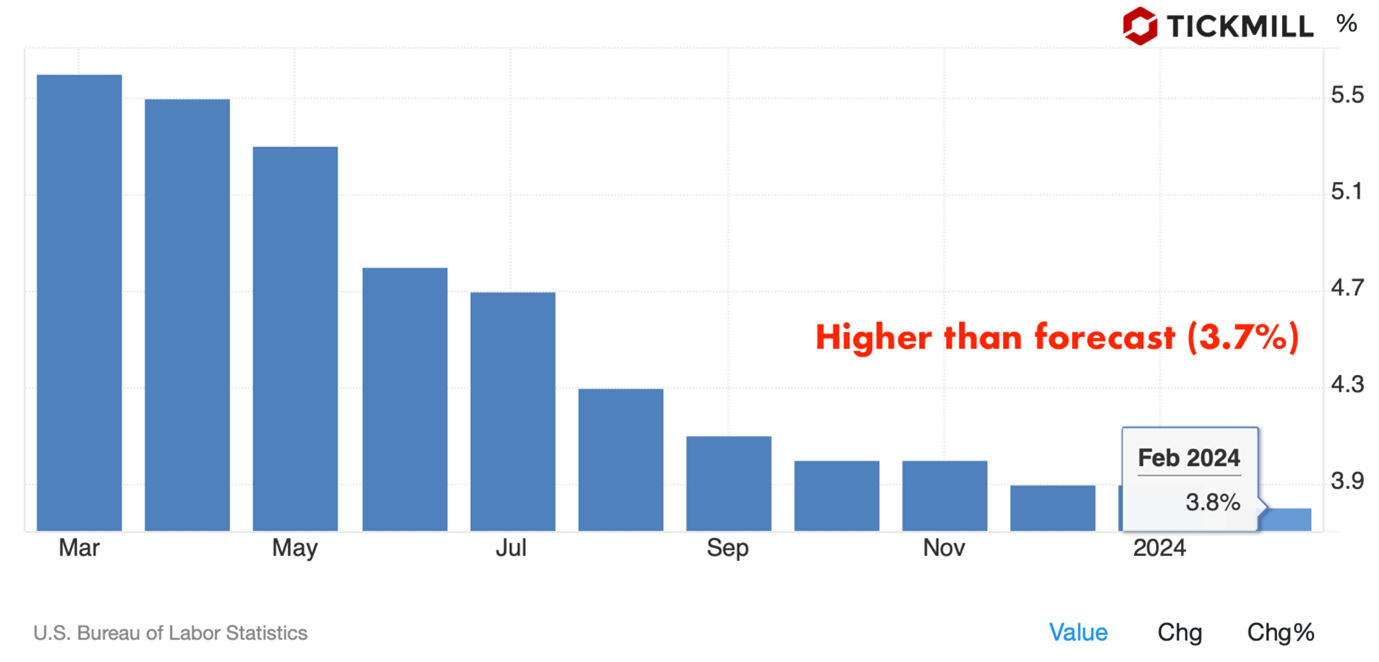

USD Trim Gains After CPI Upside Surprise; GBP Sees Downside Risk on Strong Technical Signals

The US Dollar is currently experiencing a downturn, unwinding gains fueled by the latest US Core CPI figures, which exceeded expectations. This unforeseen development has raised uncertainties regarding the Fed’s anticipated interest-rate adjustments. However, expectations about interest rate cuts from other central banks adjust too, limiting the positive impact of the CPI data on the USD:

Following the release of the CPI data, the USD initially surged, only to relinquish a portion of its gains as US equities rallied on Tuesday. However, the DXY US Dollar Index stood resilient on Wednesday, poised to maintain its position above 103.00, barring unforeseen disruptions during the US trading session.

Austrian Central Bank Governor Robert Holzmann's remarks further fueled the currency market's speculation, suggesting that if the ECB were to implement interest-rate cuts before the Fed, it could precipitate a risk of an over-devalued Euro, potentially reigniting inflationary pressures.

EURUSD prepares for a leap higher, which will likely prove to be a false breakout at the 1.10 level as the move will likely meet strong resistance due to the test of the major medium-term bearish channel:

Market sentiment surrounding the GBP has taken a positive turn in Wednesday's European session, bolstered by cautiously optimistic sentiments. The GBP/USD pair rebounded to 1.2800 levels following reports from the United Kingdom Office for National Statistics (ONS) indicating growth in monthly Gross Domestic Product (GDP), aligning with market expectations. However, the Industrial Production data for the same period fell short of consensus estimates.

The resilience showcased by the UK economy with a growth rate of 0.2% in January, following a technical recession in the latter half of 2023, signifies a shallow downturn and hints at improving economic prospects.

Looking ahead, the trajectory of the Pound Sterling will largely hinge on cues pertaining to the BoE interest-rate policy. Expectations for a potential rate cut by the BoE from August onward have heightened, propelled by cooling labor market conditions and subdued inflationary pressures.

Market indicators underscore this sentiment, with US bank Citi reporting a decline in consumer inflation expectations for the upcoming 12 months, dropping from 3.9% in January to 3.6% in February.

The technical picture of GBPUSD has barely changed from Tuesday as the price still appears to be gravitating towards a retest of recently broken resistance, which will also work as a support test of the medium-term support line:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.