US Stocks Cheer Trump

Stocks Rallying

US stock markets are rallying on Wednesday as traders digest the incoming results of the US elections. While an official result is yet to be confirmed, current voting results show a roughly 95% chance of Trump being declared winner. Additionally, the Republican party, which has already won the Senate, is in the lead to win The House too, securing a clean sweep for the party.

Trump Good for Growth

The reaction in stock markets today signals optimism over Trump’s growth-positive policies. The Republican candidate has pledged to slash taxes, reduce regulatory restrictions on businesses, increases spending and return to protectionist US trade policies. So far, it seems that investors are on side with a Trump presidency seeing the moves across the board today, banks, tech companies and US indices as a whole are all rallying across the board, despite a solid move higher in the US Dollar.

FOMC Next

Looking ahead, stocks look poised for further gains through the end of the week as traders turn their focus also to the FOMC tomorrow. The Fed is widely expected to cut rates by a further .25% with traders also looking for confirmation that further easing is coming. If seen, this should keep stocks supported near-term with markets set to get a further boost if a Red Sweep is declared.

Technical Views

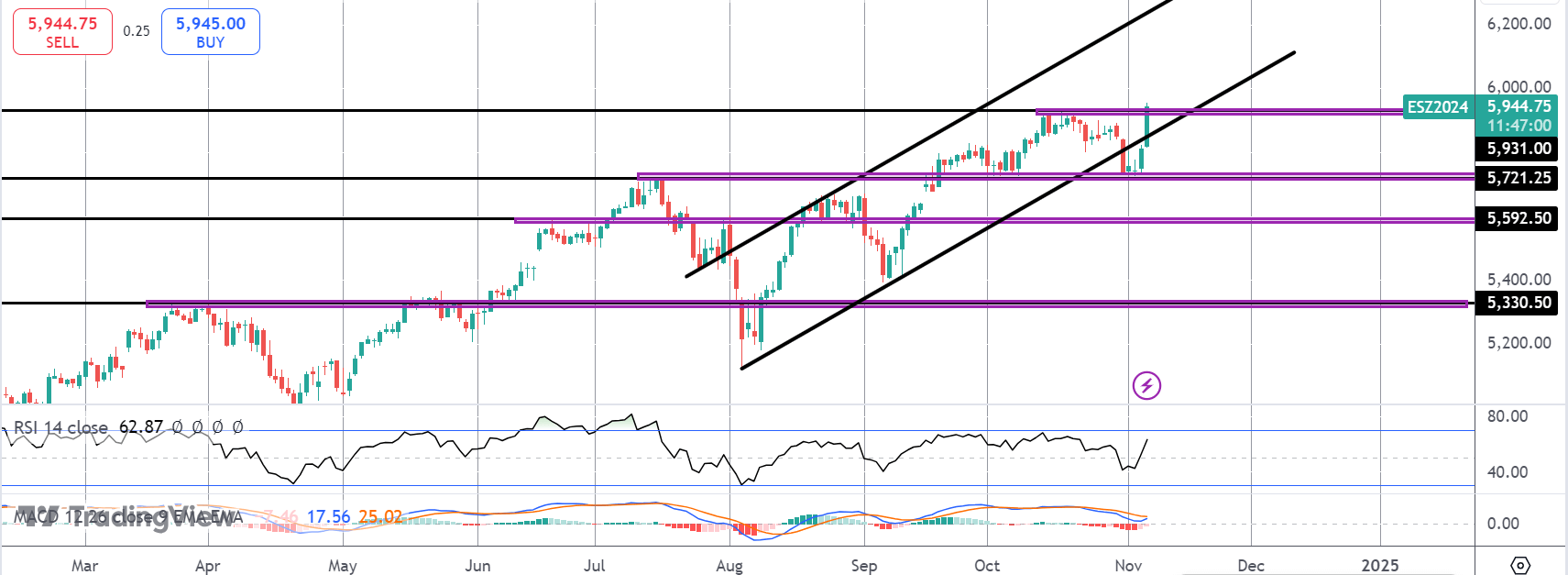

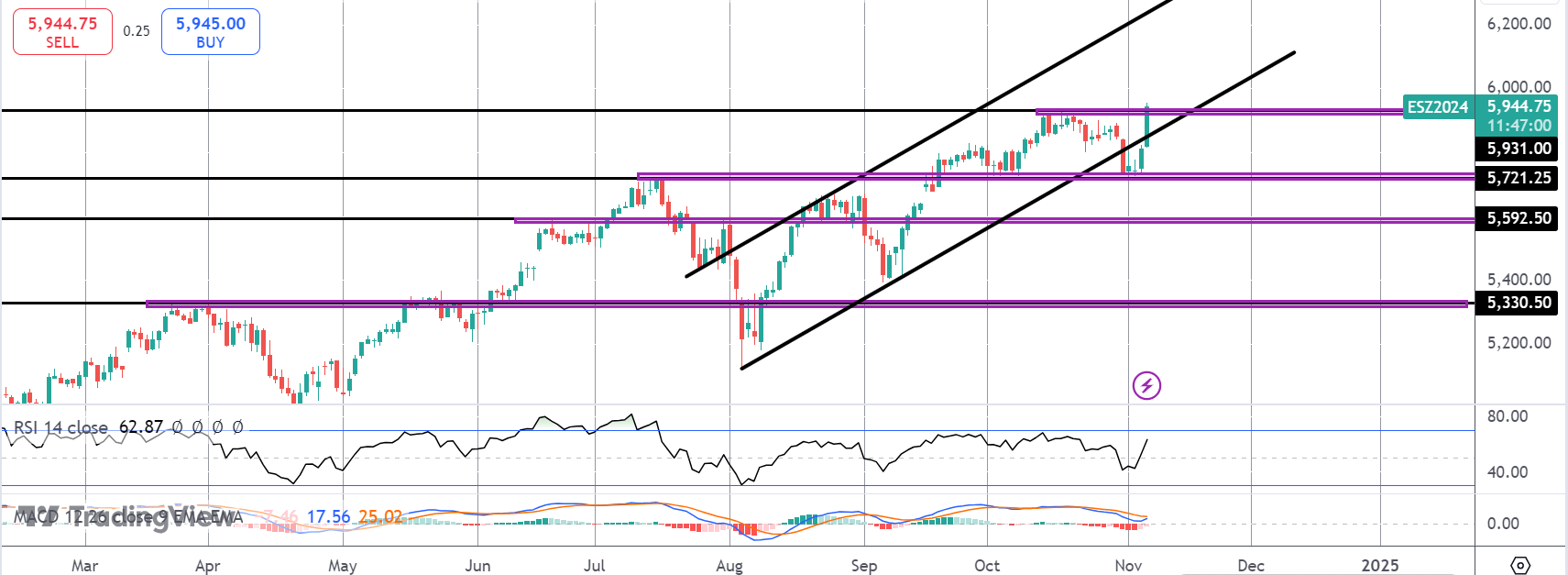

ES (S&P E-Mini Futures)

The rally off the 5,721 level has seen the market breaking back inside the bull channel with price now testing above the 5,931 level to print new highs. While 5,721 holds, the focus is on a continuation higher, supported by recovering momentum studies.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.