US GDP Slides Following Powell Warning

GDP Undershoots

The US Dollar rout continues this week ahead of the all-important NFP release tomorrow. DXY took another leg lower as the prelim Q2 US GDP reading yesterday came in below expectations at 2.1% vs 2.4% prior and expected. This marks the latest in a string of tier-one data points to undershoot expectations and has seen traders pairing back their near-term Fed rate hike expectations. Pricing for the September meeting is showing around a 90% probability of rates being held unchanged.

Powell Cites Economic Uncertainty

Speaking last week, Fed’s Powell reaffirmed the bank’s message that its main priority is bringing inflation back down to its 2% target. However, the message was well balanced, and ultimately quite neutral with Powell warning that the bank would remain data dependent with its decisions, citing the need to stay agile with decision making due to economic uncertainty. Powell went on to say that there were signs that inflation was cooling but noted there was still a way to go.

NFP Up Next

On the back of these comments and recent data, focus now turns to tomorrow’s NFP release. Yesterday, the ADP number came in below expectations and if we see a similar outcome tomorrow, this should keep USD pressured lower on reduced Fed tightening expectations.

Technical Views

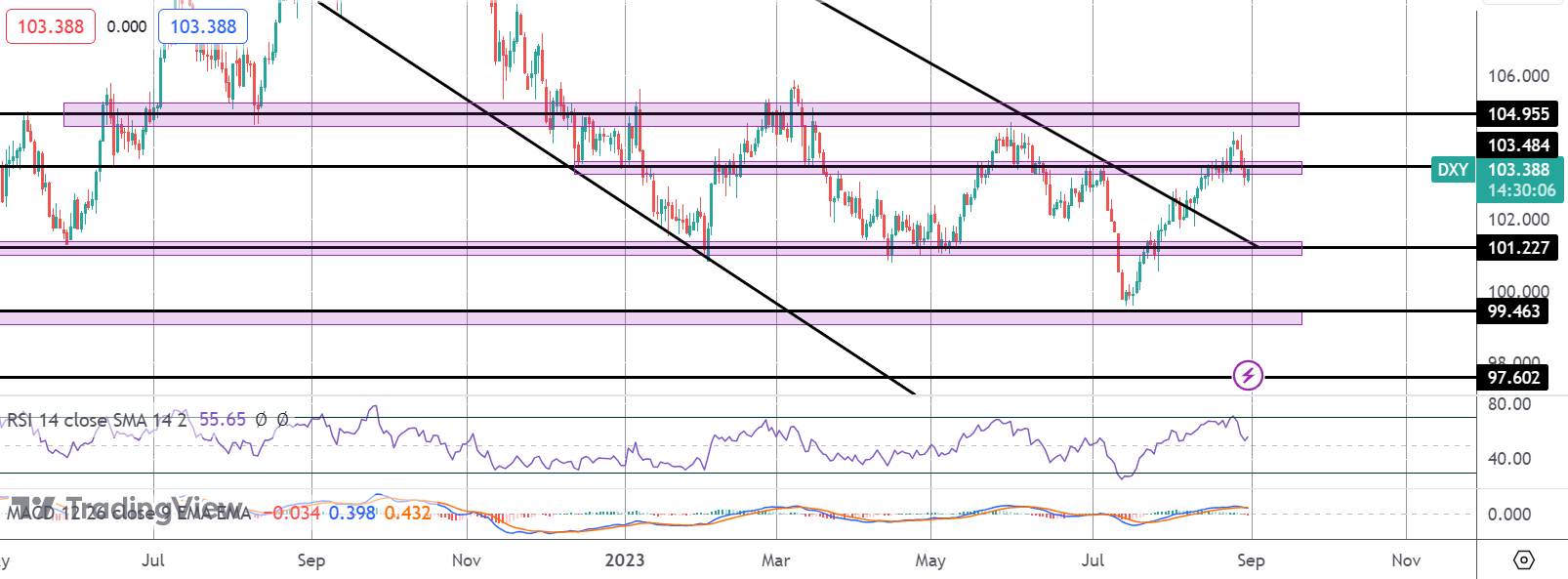

DXY

The rally in the Dollar Index has stalled for now ahead of the 104.95 level with the market since turning back under the 103.48 level. With momentum studies weakening, while below this level, there is room for a deeper correction towards the 101.22 level next where we also have the retest of the broken bear channel top.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.