US Dollar: Trump & Powell in Focus

USD On Watch This Week

While there is little in the way of key data, this will be an important week for the US Dollar nonetheless. Later today, Zelensky will meet with Trump in Washington for a follow-up on Trump’s meeting with Putin over the weekend, aimed at delivering a peace deal between the two warring countries. Then, later in the week traders will turn their focus to the Fed’s Jackson Hole symposium, looking for greater clarity on the Fed’s outlook ahead of the September FOMC. Given the fluctuating probabilities we’ve seen in rates markets recently, the event will be closely watched and has the potential to cause plenty of volatility not just in USD but across asset classes.

Trump-Zelensky

Focus on Trump Zelensky first, the implications for USD are as follows: if talks go well today and it looks as though Zelensky is open to some for of compromise on surrendering land to Russia to secure peace, risk assets should move firmly higher with USD sold in this scenario. However, if Zelensky refuses any deal including surrendering land and it looks as though a deal won’t be forthcoming anytime soon, USD is vulnerable to a spike higher on revived safe-haven demand as risk assets recoil.

Jackson Hole

Looking ahead to Friday, traders will then be watching to see if Powell gives a clear signal in favour of a September cut. Though it’s likely still to early to confirm such a move, the significant shift in the labour market and the stalling of inflation should feed into a more dovish tone from Powell which should keep USD pressured near-term.

Technical Views

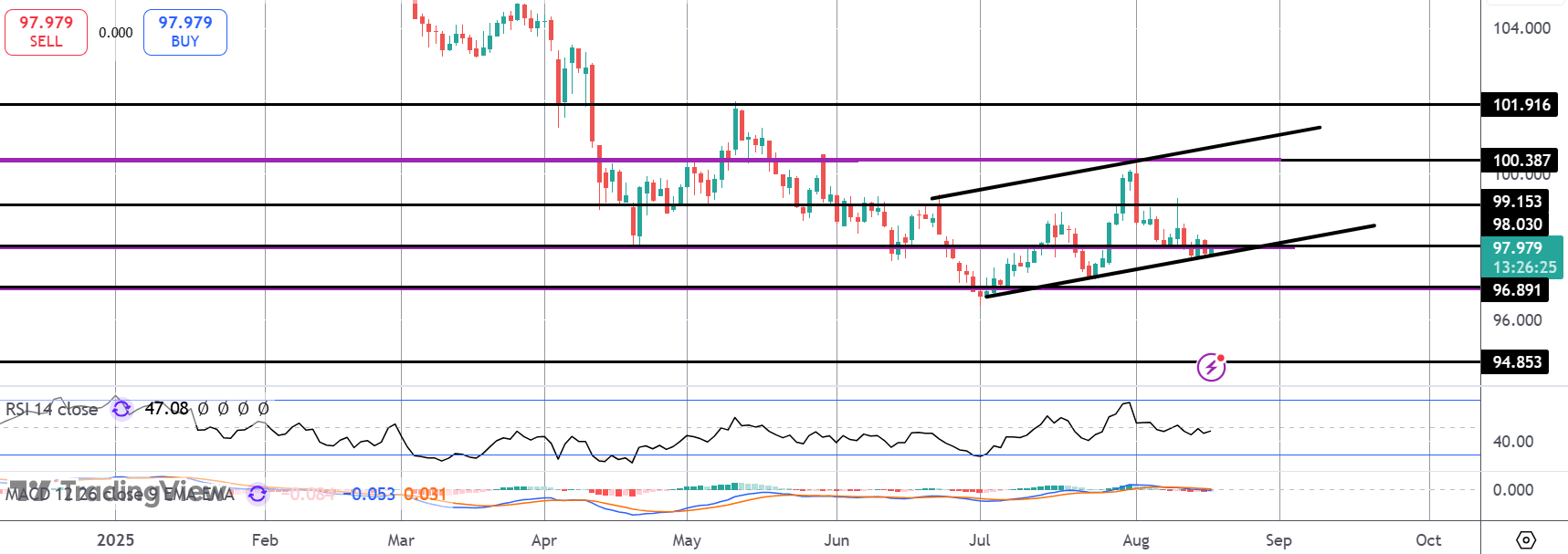

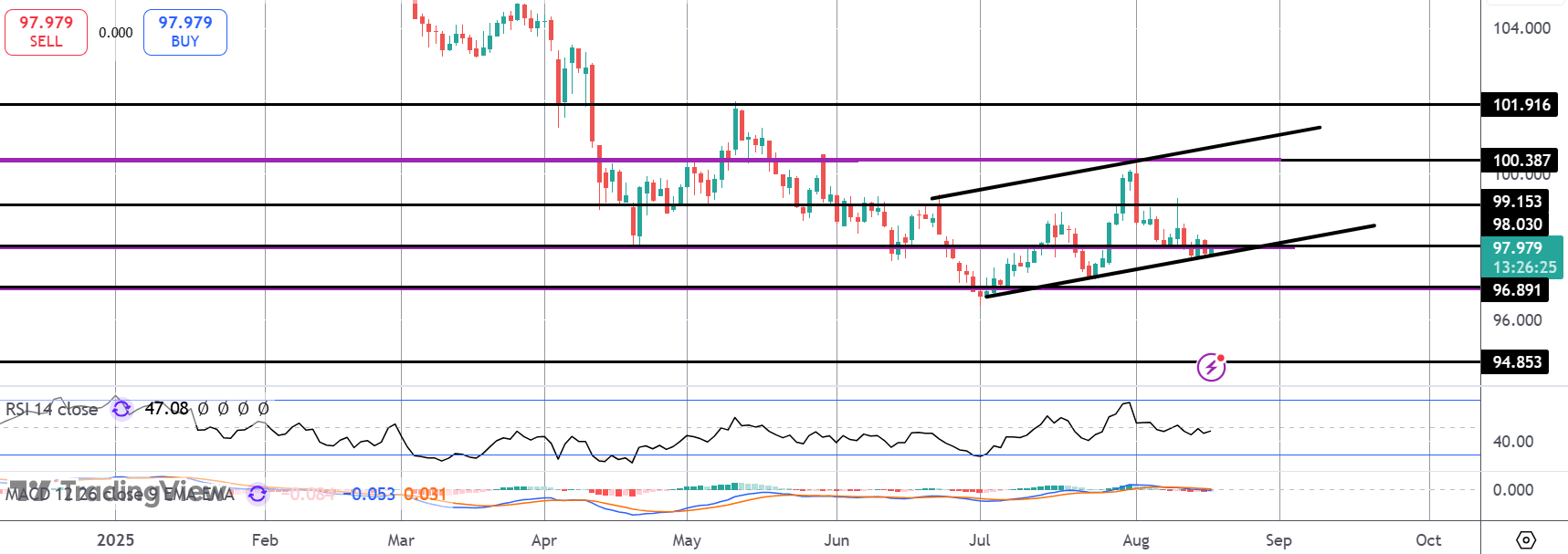

DXY

For now, the index remains in a bear flag formation, hugging the lower trend line. As such, risk are skewed towards a fresh breakdown with 96.89 (and the YTD lows) the next support to watch ahead of a deeper run down towards the 94.85 level, in line with bearish momentum studies signals.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.