US Dollar Holds Steady Amid Key Economic Data and Interest Rate Speculation

As the US trading week kicks off after the Labor Day holiday, the US Dollar is showing signs of stability, holding its ground against a broad range of major currencies. The only exception is the Japanese Yen, against which the Greenback has slightly faltered.

A key event on today's economic calendar is the release of the Institute for Supply Management Manufacturing PMI for August. This report is closely watched by traders and analysts alike as it offers a snapshot of the health of the US manufacturing sector—a vital component of the overall economy.

Market participants are expecting a slight uptick in the PMI from 46.8 to 47.5, indicating that while the sector remains in contraction territory, there might be a marginal improvement. The Prices Paid component, which offers insights into inflationary pressures within the manufacturing sector, is anticipated to edge down slightly to 52.5 from 52.9.

These figures are particularly significant as they feed into broader economic narratives that could influence Federal Reserve decisions in the coming weeks.

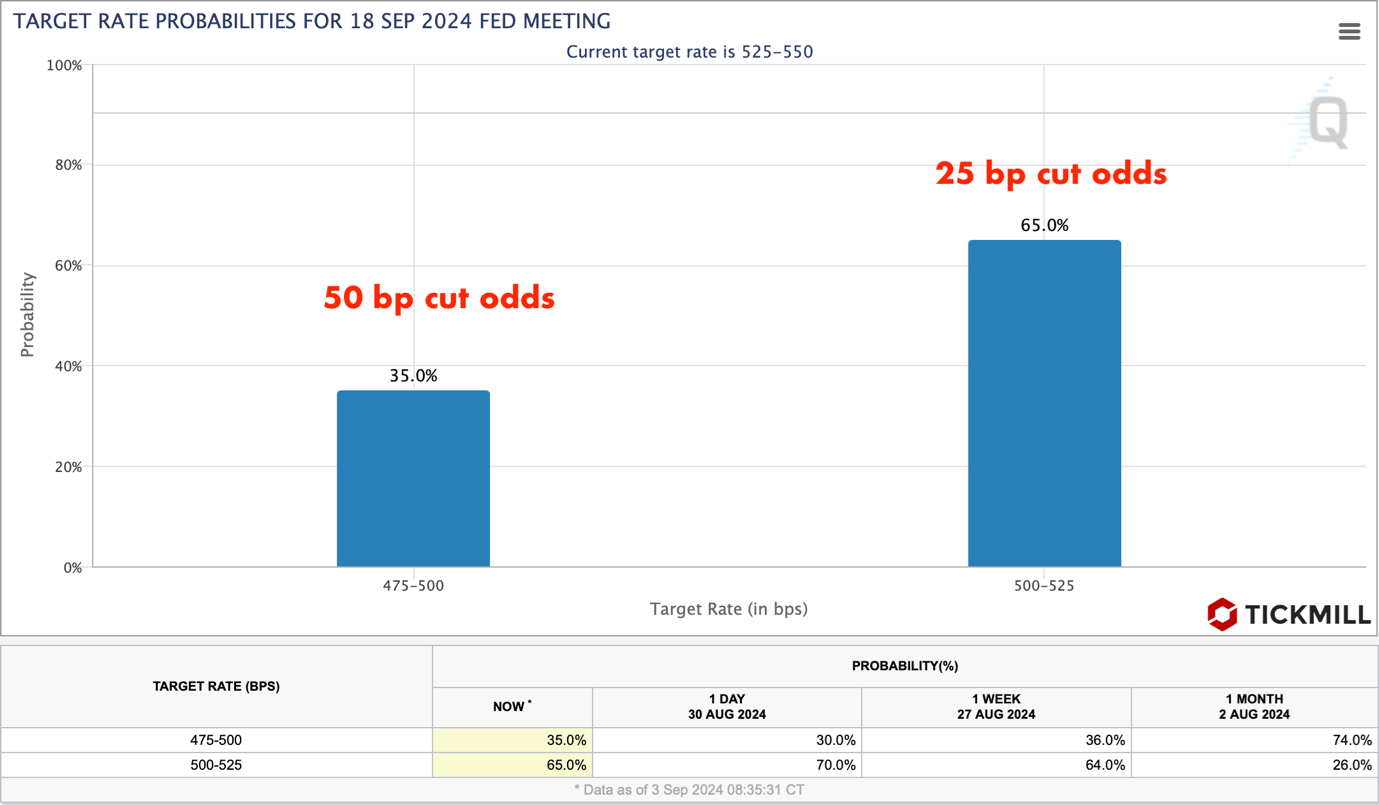

Interest rate speculation remains a dominant theme in the markets, with traders keenly pricing in potential moves by the Federal Reserve. Currently, US interest rate derivatives suggest a 65% probability of a 25 basis points cut in September, while a more aggressive 50 basis points cut is seen as less likely, with a 35% chance. This distribution of odds highlights a prevailing uncertainty in the market, with some room for expectations to shift towards a more dovish stance:

Looking ahead, market participants are also eyeing the November meeting, where there’s roughly a 50% chance of another 25 basis points cut, assuming the Fed opts for a moderate 25 basis points reduction this month.

Both US and European equities are under pressure, weighed down by concerns over global manufacturing health. This sentiment has been exacerbated by reports that Volkswagen is considering unprecedented factory closures in Germany—an alarming development that casts a shadow over the broader European economy.

The US Dollar Index, which tracks the performance of the Greenback against a basket of major currencies, is hovering near a two-week high. This resilience is partly driven by investor focus on the upcoming Nonfarm Payrolls data for August, set to be released on Friday:

The NFP report is a critical piece of the puzzle for traders as they assess the likelihood and magnitude of the Fed’s next rate cut. A strong labor market reading could sway the Fed towards a smaller, more cautious rate reduction, while a weaker-than-expected report might bolster the case for a more aggressive cut.

The British Pound is facing its own set of challenges, trading just above the key 1.3100 support level against the USD. Despite speculation that the Bank of England will likely pursue a more measured approach to rate cuts this year compared to other central banks, the Pound remains subdued.

The BoE’s cautious stance was echoed by Governor Andrew Bailey at the recent Jackson Hole Symposium, where he emphasized the need for gradual adjustments to avoid destabilizing the economy. As such, traders see little chance of a rate cut in September, with more attention being paid to the potential for a move in November.

Adding to the Pound’s struggles is the recent S&P Global/CIPS Manufacturing PMI, which showed an expansion in the UK manufacturing sector to a 26-month high in August. While this might typically be supportive for the currency, it has done little to lift the Pound amid broader market concerns.

Investors will be closely watching a speech by BoE policymaker Sarah Breeden later today for any fresh insights into the central bank's future policy direction.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.